Aeterna Zentaris Inc. (NASDAQ: AEZS) (TSX: AEZS) (“Aeterna” or the

“Company”), a specialty biopharmaceutical company commercializing

and developing therapeutics and diagnostic tests, today reported

its financial and operating results for the second quarter ended

June 30, 2020.

The Company also provided an update on its

clinical program to expand the use of macimorelin for the diagnosis

of childhood-onset growth hormone deficiency (“CGHD”), an area of

significant unmet need, and its plans to expand macimorelin for the

diagnosis of adult growth hormone deficiency (“AGHD”) in Europe and

other key markets.

“We are pleased with the progress we have made

over the last quarter across our business, despite the challenges

of the COVID-19 pandemic. The health and safety of our team remains

a top priority and as such, we continue to actively take steps to

ensure the highest level of safety for our employees. We are

incredibly grateful for their dedication and maintaining operations

amidst navigating these unprecedented times. I am happy to report

that we have been fortunate enough to not have experienced any

significant delays or impacts to our operations to date from the

pandemic,” commented Dr. Klaus Paulini, Chief Executive Officer of

Aeterna.

“We have continued advancing the development of

macimorelin for CGHD, which we believe represents a significant

opportunity for the Company and, if approved, has the potential to

significantly increase the available patient population for

macimorelin. Additionally, the EMA accepted our modification to the

Pediatric Investigation Plan (“PIP”), which streamlined our

clinical efforts, allowing the P02 Study protocol to comply with

requirements from both the EMA and FDA,” added Dr. Paulini.

Recent Highlights

- Successfully raised a total of $19

million, including a registered direct offering priced

at-the-market under Nasdaq rules for gross proceeds of $7.0 million

and a public offering for gross proceeds of $12 million to the

Company;

- Regained compliance with minimum

stockholders’ equity requirement for continued listing on

Nasdaq;

- Announced that the abstract on

study results of the Company’s first pediatric study on macimorelin

has been selected for presentation at the 22nd European Congress of

Endocrinology (e-ECE 2020) being held September 5-9, 2020;

- Executed on expanding intellectual

property portfolio for macimorelin with the filing of two

additional patent applications;

- Entered into an exclusive

distribution and related quality agreement with Megapharm Ltd., a

leading Israel-based biopharmaceutical company, for the

commercialization of macimorelin in Israel and the Palestinian

Authority;

- Received European Medicines Agency

(“EMA”) acceptance of modification request of the Company’s PIP for

macimorelin as originally approved in March 2017, which covered the

conduct of two pediatric studies and defined relevant key elements

in the outline of these studies; and

- Achieved positive results for the

pediatric dose-escalation study, Study P01, of

macimorelin, indicating favorable safety and

tolerability data for the use in childhood-onset growth hormone

deficiency testing.

Dr. Paulini concluded, “On the commercial side

we continue to work diligently to expand macimorelin for AGHD in

key global markets around the world. Our distribution agreement

with Megapharm was an important milestone for the Company to

address the interesting market opportunity in Israel and the

Palestine Authority. In Europe, we are encouraged by our ongoing

partnership talks and hope to communicate more about those in the

near-term. Beyond macimorelin, we are actively seeking

opportunities to re-establish a development pipeline and look

forward to providing more updates as they become available.”

Macimorelin Clinical Program

Update

The Company’s lead product, macimorelin, is the

only United States Food and Drug Administration (“FDA”) approved

oral drug indicated for the diagnosis of AGHD and is currently

marketed in the United States (“U.S.”) under the tradename

Macrilen™, by Novo Nordisk. Aeterna is currently developing

macimorelin for the diagnosis of CGHD, an area of significant unmet

need, in collaboration with Novo Nordisk.

Upcoming Anticipated Program

Milestones

- Commence CGHD safety and efficacy study, Study P02

(multi-national, including U.S.); and

- Advance business development efforts to secure a marketing

partner for macimorelin for the diagnosis of AGHD in Europe and

other key markets.

Financings Completed After June 30,

2020

On July 7, 2020, the Company closed a public

offering of 26,666,666 units at a price to the public of $0.45 per

unit, for gross proceeds of $12 million, before deducting placement

agent fees and other offering expenses payable by the Company,

estimated at $1.5 million. Each unit contained one common share (or

common share equivalent in lieu thereof) and one investor share

purchase warrant to purchase one common share. In total, 26,666,666

common shares, 26,666,666 investor share purchase warrants at an

exercise price of $0.45 per share expiring July 7, 2025 and

1,866,667 placement agent warrants with an exercise price of

$0.5625 per share, expiring July 1, 2025 were issued.

Additionally, on August 3, 2020, the Company

announced that it had entered into a securities purchase agreement

with several institutional investors in the United States providing

for the sale and issuance of 12,427,876 common shares at a purchase

price of $0.56325 per common share in a registered direct offering

priced at-the-market under Nasdaq rules for gross proceeds of

approximately $7.0 million, closing on August 5, 2020.

Concurrently, the Company also issued to the purchasers

unregistered warrants to purchase up to an aggregate of 9,320,907

common shares. The warrants are exercisable for a period of five

and one-half years, exercisable immediately following the issuance

date and have an exercise price of $0.47 per common share. In

addition, the Company has issued unregistered warrants to the

placement agent to purchase up to an aggregate of 869,952 common

shares, with an exercise price of $0.7040625 per share and an

expiration date of August 3, 2025.

On August 4, 2020, prior to closing the recently

announced financing, the Company had approximately $17 million cash

and cash equivalents. Based on current expectations, management

believes it has sufficient capital to fund operations through

2023.

Summary of Second Quarter 2020 Financial

Results

All amounts are in U.S. dollars

For the three-month period ended June 30, 2020,

the Company reported a consolidated net loss of $3.5 million, or

$0.15 loss per common share (basic), as compared with a

consolidated net income of $0.2 million, or $0.01 income per common

share (basic) for the three-month period ended June 30, 2019. The

$3.7 million decline in net results is primarily from a change in

fair value of warrant liability of $6.1 million partially offset by

a reduction of $2.3 million in operating expenses.

Revenues

- The Company reported total revenue

for the three-month period ended June 30, 2020 of $0.07 million as

compared with $0.2 million for the same period in 2019,

representing a decrease of $0.13 million. The 2020 revenue was

comprised of $0.01 million in royalty revenue (2019 - $0.01

million), $nil in product sales of Macrilen™ (macimorelin) to Novo

(2019 - $0.13 million), $0.04 million in supply chain revenue (2019

- $0.04 million) and $0.02 million in licensing revenue (2019 –

$0.02 million).

Operating Expenses

- The Company reported total

operating expenses for the three-month period ended June 30, 2020

was $1.5 million as compared with $3.8 million for the same period

in 2019, representing a decrease of $2.3 million. This decrease

arises primarily from a $0.8 million decline in general and

administrative expenses, a $0.8 million decline in restructuring

costs, a $0.4 million decline in research and development costs,

and a $0.3 million decline in selling expenses. The impact of our

June 2019 restructuring in our German subsidiary, namely payroll

and share based compensation costs, is a key influence in the

declines in general and administrative expenses, selling and

research and development expenses.

- The further impact on the decline

in research and development costs is attributed to the different

phases of activity of Study P01. In the first half of 2019, study

activities included study start with document development,

medication manufacturing, study feasibility testing at different

sites and clinical trial applications in Hungary, Poland, Belarus,

Russia, Ukraine and Serbia, while in 2020, all sites had completed

their enrollment and clinical activities.

Net Finance (Costs) Income

- The Company reported net finance

costs for the three-month period ended June 30, 2020 was $2.0

million as compared with a net finance income of $3.9 million for

the same period in 2019, representing a decrease of $5.9 million.

This is primarily due to a $6.1 million change in fair value of

warrant liability offset by $0.2 million from changes in currency

exchange rates. Effective June 16, 2020, the Company registered the

common shares underlying the 2,608,696 investor warrants and

243,478 placement agent warrants issued on February 21, 2020 and

the 3,325,000 investor warrants issued on September 20, 2019 by way

of a registration statement which removed the cashless exercise

option for registered warrants.

Consolidated Financial Statements and

Management’s Discussion and Analysis

For reference, the Management’s Discussion and

Analysis of Financial Condition and Results of Operations for the

second quarter of 2020, as well as the Company’s audited

consolidated financial statements as of June 30, 2020, will be

available at www.zentaris.com in the Investors section or at the

Company’s profile at www.sedar.com and www.sec.gov.

About Aeterna Zentaris Inc.

Aeterna Zentaris Inc. is a specialty

biopharmaceutical company commercializing and developing

therapeutics and diagnostic tests. The Company’s lead product,

Macrilen™ (macimorelin), is the first and only U.S. FDA and

European Commission approved oral test indicated for the diagnosis

of adult growth hormone deficiency (AGHD). Macrilen™ is currently

marketed in the United States through a license agreement with Novo

Nordisk and Aeterna Zentaris receives double-digit royalties on

sales. Aeterna Zentaris owns all rights to macimorelin outside of

the U.S. and Canada.

Aeterna Zentaris is also leveraging the clinical

success and compelling safety profile of macimorelin to develop it

for the diagnosis of child-onset growth hormone deficiency (CGHD),

an area of significant unmet need.

The Company is actively pursuing business

development opportunities for the commercialization of macimorelin

in Europe and the rest of the world, in addition to other

non-strategic assets to monetize their value. For more information,

please visit www.zentaris.com and connect with the Company on

Twitter, LinkedIn and Facebook.

Condensed Consolidated Statements of Comprehensive

(Loss) Income(in thousands, except share and per

share data) (unaudited)

| |

|

Three months

ended |

|

Six months

ended |

| |

|

June 30 |

|

June 30 |

| |

|

2020 |

|

|

2019 |

|

|

2020 |

|

|

2019 |

|

| |

|

$ |

|

$ |

|

$ |

|

$ |

| Revenues |

|

|

|

|

|

|

|

|

| Royalty income |

|

10 |

|

|

8 |

|

|

24 |

|

|

21 |

|

| Product sales |

|

— |

|

|

129 |

|

|

1,016 |

|

|

129 |

|

| Supply chain |

|

40 |

|

|

39 |

|

|

81 |

|

|

45 |

|

| Licensing revenue |

|

18 |

|

|

18 |

|

|

37 |

|

|

36 |

|

| Total revenues |

|

68 |

|

|

194 |

|

|

1,158 |

|

|

231 |

|

| Operating expenses |

|

|

|

|

|

|

|

|

| Cost of sales |

|

12 |

|

|

101 |

|

|

874 |

|

|

101 |

|

| Research and development costs |

|

189 |

|

|

571 |

|

|

508 |

|

|

1,099 |

|

| General and administrative expenses |

|

1,141 |

|

|

1,923 |

|

|

2,265 |

|

|

3,560 |

|

| Selling expenses |

|

199 |

|

|

495 |

|

|

447 |

|

|

799 |

|

| Restructuring costs |

|

— |

|

|

773 |

|

|

— |

|

|

773 |

|

| Impairment of right of use asset |

|

— |

|

|

64 |

|

|

— |

|

|

401 |

|

| Gain on modification of building lease |

|

(34 |

) |

|

— |

|

|

(219 |

) |

|

— |

|

| Impairment of prepaid asset |

|

— |

|

|

— |

|

|

— |

|

|

169 |

|

| Total operating expenses |

|

1,507 |

|

|

3,927 |

|

|

3,875 |

|

|

6,902 |

|

| Loss from operations |

|

(1,439 |

) |

|

(3,733 |

) |

|

(2,717 |

) |

|

(6,671 |

) |

| Gain (loss) due to changes in foreign currency exchange

rates |

|

130 |

|

|

(6 |

) |

|

26 |

|

|

58 |

|

| (Loss) gain on change in fair value of warrant liability |

|

(2,139 |

) |

|

3,926 |

|

|

331 |

|

|

1,865 |

|

| Other finance (costs) income |

|

(2 |

) |

|

19 |

|

|

(311 |

) |

|

43 |

|

| Net finance income (costs) |

|

(2,011 |

) |

|

3,939 |

|

|

46 |

|

|

1,966 |

|

| Net (loss) income |

|

(3,450 |

) |

|

206 |

|

|

(2,671 |

) |

|

(4,705 |

) |

| Other comprehensive (loss): |

|

|

|

|

|

|

|

|

| Items that may be reclassified subsequently to

profit or loss: |

|

|

|

|

|

|

| Foreign currency translation adjustments |

|

(209 |

) |

|

(110 |

) |

|

1 |

|

|

(26 |

) |

| Items that will not be reclassified to profit or

loss: |

|

|

|

|

|

|

|

| Actuarial (loss) on defined benefit plans |

|

(1,418 |

) |

|

(756 |

) |

|

(30 |

) |

|

(1,491 |

) |

| Comprehensive (loss) |

|

(5,077 |

) |

|

(660 |

) |

|

(2,700 |

) |

|

(6,222 |

) |

| Net (loss) income per share [basic and

diluted] |

(0.15 |

) |

|

0.01 |

|

|

(0.12 |

) |

|

(0.28 |

) |

| Weighted average number of shares

outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

23,515,579 |

|

|

16,622,415 |

|

|

22,519,497 |

|

|

16,532,090 |

|

|

Diluted |

|

23,515,579 |

|

|

17,260,016 |

|

|

22,519,497 |

|

|

16,532,090 |

|

Condensed Consolidated Interim Statements of Financial

Position

| |

|

As at June 30, 2020 |

|

As at December 31, 2019 |

|

|

| (in thousands) |

(Unaudited) |

|

|

|

| |

|

$ |

|

$ |

|

|

|

Cash and cash equivalents |

|

6,743 |

|

7,838 |

|

|

|

|

Trade and other receivables and other current assets |

|

1,937 |

|

1,869 |

|

|

|

|

Inventory |

|

375 |

|

1,203 |

|

|

|

|

Restricted cash equivalents |

|

313 |

|

364 |

|

|

|

|

Property, plant and equipment |

|

25 |

|

35 |

|

|

|

|

Right of use assets |

|

190 |

|

582 |

|

|

|

|

Other non-current assets |

|

8,086 |

|

8,090 |

|

|

|

|

Total assets |

|

17,669 |

|

19,981 |

|

|

|

|

Payables and accrued liabilities and income taxes payable |

|

1,697 |

|

3,596 |

|

|

|

|

Current portion of provision for restructuring and other costs |

|

107 |

|

418 |

|

|

|

|

Current portion of deferred revenues |

|

596 |

|

991 |

|

|

|

|

Lease liabilities |

|

222 |

|

903 |

|

|

|

|

Warrant liability |

|

12 |

|

2,255 |

|

|

|

|

Non-financial non-current liabilities (1) |

|

14,104 |

|

14,281 |

|

|

|

|

Total liabilities |

|

16,738 |

|

22,444 |

|

|

|

|

Shareholders' equity (deficiency) |

|

931 |

|

(2,463 |

) |

|

|

|

Total liabilities and shareholders' equity

(deficiency) |

|

17,699 |

|

19,981 |

|

|

|

| |

|

_________________________

(1) Comprised mainly of employee future

benefits, provisions for restructuring and other costs and

non-current portion of deferred revenues.

COVID-19 In 2020, the COVID-19

pandemic began causing significant financial market declines and

social dislocation. The situation is dynamic with various cities

and countries around the world responding in different ways to

address the outbreak. The spread of COVID-19 may impact the

Company’s operations, including the potential interruption of our

clinical trial activities and the Company’s supply chain, or that

of the Company’s licensee. For example, the COVID-19 outbreak may

delay enrollment in the Company’s clinical trials due to

prioritization of hospital resources toward the outbreak, and some

patients may be unwilling to be enrolled in the Company’s trials or

be unable to comply with clinical trial protocols if quarantines

impede patient movement or interrupt healthcare services, which

would delay the Company’s ability to conduct clinical trials or

release clinical trial results and could delay the Company’s

ability to obtain regulatory approval and commercialize the

Company’s product candidates. The pandemic may also impact the

ability of the Company’s suppliers to deliver components or raw

materials on a timely basis or at all. In addition, hospitals may

reduce staffing and reduce or postpone certain treatments in

response to the spread of an infectious disease. The Company’s

licensee may be impacted due to significant delays of diagnostic

activities in the U.S. To date, the Company has not experienced

significant business disruption from COVID-19.

Forward-Looking Statements

This press release contains forward-looking

statements (as defined by applicable securities legislation) made

pursuant to the safe-harbor provision of the U.S. Securities

Litigation Reform Act of 1995, which reflect our current

expectations regarding future events. Forward-looking statements

include those relating to the Company obtaining approval of

macimorelin for CGHD and the resulting potential to significantly

increase the available patient population for macimorelin, the

Company’s ability to expand macimorelin for AGHD in key global

markets around the world, including its ability to secure a

marketing partner for macimorelin for the diagnosis of AGHD in

Europe and pursue market opportunities in Israel and the Palestine

Authority, the commencement of the CGHD safety and efficacy study

and the impact of COVID-19 on the Company’s operations, including

regarding the potential interruption of the Company’s clinical

trial activities and the Company’s supply chain, or that of the

Company’s licensee, as well as the impact COVID-19 may have on

hospital staffing and treatments, the Company’s ability to fund

operations through 2023, and may include, but are not limited to

statements preceded by, followed by, or that include the words

"will," "expects," "believes," "intends," "would," "could," "may,"

"anticipates," and similar terms that relate to future events,

performance, or our results. Forward-looking statements involve

known and unknown risks and uncertainties, including those

discussed in this press release and in our Annual Report on Form

20-F, under the caption "Key Information - Risk Factors" filed with

the relevant Canadian securities regulatory authorities in lieu of

an annual information form and with the U.S. Securities and

Exchange Commission. Known and unknown risks and uncertainties

could cause our actual results to differ materially from those in

forward-looking statements. Such risks and uncertainties include,

among others, our ability to raise capital and obtain financing to

continue our currently planned operations, our ability to continue

to list our Common Shares on the NASDAQ, our ability to continue as

a going concern is dependent, in part, on our ability to transfer

cash from Aeterna Zentaris GmbH to Aeterna Zentaris and the U.S.

subsidiary and secure additional financing, our now heavy

dependence on the success of Macrilen™ (macimorelin) and related

out-licensing arrangements and the continued availability of funds

and resources to successfully commercialize the product, including

our heavy reliance on the success of the License Agreement with

Novo, the global instability due to the global pandemic of

COVID-19, and its unknown potential effect on our planned

operations, including studies, our ability to enter into

out-licensing, development, manufacturing, marketing and

distribution agreements with other pharmaceutical companies and

keep such agreements in effect, our reliance on third parties for

the manufacturing and commercialization of Macrilen™ (macimorelin),

potential disputes with third parties, leading to delays in or

termination of the manufacturing, development, out-licensing or

commercialization of our product candidates, or resulting in

significant litigation or arbitration, uncertainties related to the

regulatory process, unforeseen global instability, including the

instability due to the global pandemic of the novel coronavirus,

our ability to efficiently commercialize or out-license Macrilen™

(macimorelin), our reliance on the success of the pediatric

clinical trial in the European Union (“E.U.”) and U.S. for

Macrilen™ (macimorelin), the degree of market acceptance of

Macrilen™ (macimorelin), our ability to obtain necessary approvals

from the relevant regulatory authorities to enable us to use the

desired brand names for our product, our ability to successfully

negotiate pricing and reimbursement in key markets in the E.U. for

Macrilen™ (macimorelin), any evaluation of potential strategic

alternatives to maximize potential future growth and shareholder

value may not result in any such alternative being pursued, and

even if pursued, may not result in the anticipated benefits, our

ability to take advantage of business opportunities in the

pharmaceutical industry, our ability to protect our intellectual

property, and the potential of liability arising from shareholder

lawsuits and general changes in economic conditions. Investors

should consult our quarterly and annual filings with the Canadian

and U.S. securities commissions for additional information on risks

and uncertainties. Given these uncertainties and risk factors,

readers are cautioned not to place undue reliance on these

forward-looking statements. We disclaim any obligation to update

any such factors or to publicly announce any revisions to any of

the forward-looking statements contained herein to reflect future

results, events or developments, unless required to do so by a

governmental authority or applicable law.

Investor Contact:

Jenene Thomas JTC Team T (US): +1 (833) 475-8247 E:

aezs@jtcir.com

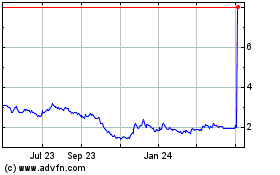

Aeterna Zentaris (NASDAQ:AEZS)

Historical Stock Chart

From Oct 2024 to Nov 2024

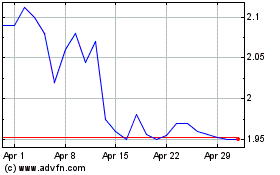

Aeterna Zentaris (NASDAQ:AEZS)

Historical Stock Chart

From Nov 2023 to Nov 2024