Current Report Filing (8-k)

September 16 2015 - 4:27PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________

FORM 8-K

________________________________________________

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 15, 2015

________________________________________________

Advanced Energy Industries, Inc.

(Exact name of registrant as specified in its charter)

________________________________________________

|

| | | | |

Delaware | | 000-26966 | | 84-0846841 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

|

| | | | | |

1625 Sharp Point Drive, Fort Collins, Colorado | | 80525 | |

(Address of principal executive offices) | | (Zip Code) | |

|

| | | |

(970) 221-4670 |

(Registrant's telephone number, including area code) |

| | | |

Not applicable |

(Former name or former address, if changed since last report) |

________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

On September 16, 2015, Advanced Energy Industries, Inc. (the “Company”) announced its capital deployment strategy and that its Board of Directors has authorized the Company to repurchase up to $150 million of its common stock over the next 30 months. Purchases under the program may be made from time-to-time in the public or private markets, through block trades, Rule 10b5-1 trading plans or other available means and may include the use of derivative contracts and structured and accelerated share repurchase agreements. There is no minimum number of shares to be repurchased under the program, and the program may be suspended or discontinued at any time. A copy of the press release announcing the capital deployment strategy and share repurchase program is provided as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

|

| | |

(d) | Exhibits |

| | |

99.1 | | Press release dated September 16, 2015 by Advanced Energy Industries, Inc., announcing “Advanced Energy Unveils Capital Deployment Strategy and Announces $150 Million Share Repurchase Program.” |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| | | |

| | /s/ Thomas Liguori |

Date: September 16, 2015 | | Thomas Liguori |

| | Executive Vice President and Chief Financial Officer |

EXHIBIT INDEX

|

| | |

Exhibit Number | | Description |

99.1 | | Press release dated September 16, 2015 by Advanced Energy Industries, Inc., announcing “Advanced Energy Unveils Capital Deployment Strategy and Announces $150 Million Share Repurchase Program.” |

Financial News Release

|

| | | |

CONTACTS: | | | |

Tom Liguori, EVP & CFO | | Annie Leschin | |

Advanced Energy Industries, Inc. | | Advanced Energy Industries, Inc. | |

970.407.6570 | | 970.407.6555 | |

tom.liguori@aei.com | | ir@aei.com | |

|

|

ADVANCED ENERGY UNVEILS CAPITAL DEPLOYMENT STRATEGY AND ANNOUNCES $150 MILLION SHARE REPURCHASE PROGRAM |

Fort Collins, Colo., September 16, 2015 - Advanced Energy Industries, Inc. (Nasdaq: AEIS) today announced a formalized capital deployment strategy. Over the past several quarters, Advanced Energy has embarked on a strategic transformation to build a strong model around its core precision power business. An integral part of this model is the company’s strong cash generating capabilities and current balance sheet. In keeping with the company’s overall objectives, the capital deployment strategy is centered on increasing shareholder value by investing in long-term growth opportunities and making distributions to shareholders.

Advanced Energy’s capital deployment strategy encompasses the following:

| |

1) | organic investments to grow its market leadership in semiconductor applications, expand into industrial markets and increase its geographic presence; |

| |

2) | acquisitions to increase the company’s total addressable market with a particular focus on industrial products and applications; |

| |

3) | share repurchases to meaningfully reduce share count over time; and |

| |

4) | a more flexible capital structure that may include debt instruments to fund key investments. |

Overall, the company aspires to deploy approximately 70% of its future free cash flow to organic investments and acquisitions and 30% to share repurchases.

“Today’s announcement is a key component in our broader strategy to effectively deploy our cash,” said Yuval Wasserman, President and CEO of Advanced Energy. “Our differentiated business model continues to drive significant profitability and cash flow generation, allowing us the flexibility to pursue organic and inorganic initiatives to grow and diversify revenue, add to earnings per share growth and enhance capital returns. This

program reaffirms our confidence in the long-term opportunity for AE and our ability to provide the best return to our shareholders.”

The company also announced today that its Board of Directors has authorized it to repurchase up to $150 million of its common stock over the next 30 months. Purchases under the program may be made from time-to-time in the public or private markets, through block trades, Rule 10b5-1 trading plans or other available means and may include the use of derivative contracts and structured and accelerated share repurchase agreements. There is no minimum number of shares to be repurchased under the program, and it may be suspended or discontinued at any time. As of June 30, 2015, the company had approximately $183 million in cash and marketable securities and approximately 41 million common shares outstanding.

About Advanced Energy

Advanced Energy (Nasdaq: AEIS) is a global leader in innovative power and control technologies for high-growth, precision power solutions for thin films processes and industrial applications. Advanced Energy is headquartered in Fort Collins, Colorado, with dedicated support and service locations around the world. For more information, go to www.advanced-energy.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Words such as “may” and “anticipate(s)” and similar expressions are intended to identify forward-looking statements, which generally are not historical in nature. These statements include, but are not limited to, future use of cash and our ability to meet expectations regarding implementation of our capital deployment plan, including repurchase of our shares of common stock. These forward-looking statements are based on Advanced Energy's current assumptions, expectations and beliefs and involve substantial risks and uncertainties that may cause results, performance or achievement to materially differ from those expressed or implied by these forward-looking statements. There can be no assurances regarding when or if the contemplated transactions described in this press release will occur. These risks and uncertainties include, but are not limited to, the market price of the company's common stock, regulatory and legal requirements,

contractual requirements, the fact that there is no minimum number of shares that may be repurchased under the stock repurchase program, that the company may discontinue the repurchase program at any time, the company’s future profitability, the availability of cash, prevailing general economic and stock market conditions, the impact of volatility and cyclicality on the company’s business and the industries we serve and other market factors. Additional factors and risks are described in Advanced Energy's Form 10-K, Forms 10-Q and other reports and statements filed with the Securities and Exchange Commission. These reports and statements are available on the SEC's website at www.sec.gov. Copies may also be obtained from Advanced Energy's website at www.advancedenergy.com or by contacting Advanced Energy's investor relations at 970-407-6555. Forward-looking statements are made and based on information available to the company on the date of this press release. The company assumes no obligation to update the information in this press release.

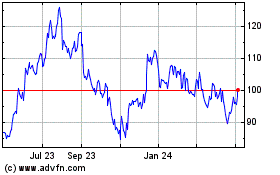

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Jun 2024 to Jul 2024

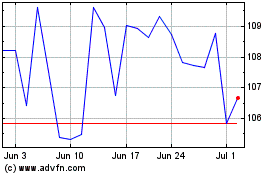

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Jul 2023 to Jul 2024