- Revenue of $128.5 million

- Results include a restructuring charge of $3.1

million

- Cash increased to $155 million

Advanced Energy Industries, Inc. (Nasdaq:AEIS) today announced

financial results for the third quarter ended September 30, 2011.

The company posted third quarter sales of $128.5 million, operating

income of 8.3% of sales and diluted earnings per share from

continuing operations of $0.16. On a non-GAAP basis, income

generated from operations was 10.7% of sales and earnings from our

continuing operations on a per share basis were $0.21. The non-GAAP

measures exclude the impact of the previously-announced $3.1

million restructuring charge recorded in the third quarter. A

reconciliation of non-GAAP income from operations and per share

earnings is provided in the tables.

"Tenuous macroeconomic conditions coupled with continuing

declines in capital equipment spending pressured our Thin Films

business this quarter. We continue to see revenue growth in our

Solar Energy business as orders increased and the deployment of our

previously announced utility scale projects continued," said Garry

Rogerson, chief executive officer. "By taking pro-active measures

to re-align our resources and cost structure, Advanced Energy will

be better positioned to make strategic investments that we expect

will extend our leadership and improve profitability in the future.

During the quarter, cash increased by $9 million as working capital

declined during the quarter."

Thin Films Business

Unit

Thin Films business unit sales were $76.8 million versus $103.6

million in the third quarter of 2010. On a sequential basis, Thin

Films sales declined 21.1% from $97.3 million in the second quarter

of 2011. Industry conditions across most of the company's thin

films end markets weakened this quarter. Semiconductor equipment

sales slowed as manufacturers limited purchases due to low fab

utilization rates. The thin film renewables market continued to

experience panel overcapacity and pricing pressure, while the flat

panel display market is undergoing a pause in investment as

capacity comes on line.

Solar Energy Business Unit

Solar Energy business unit sales were $51.7 million in the

quarter versus $37.4 million in the same period of 2010. On a

sequential basis, Solar Energy sales increased 26.7% from $40.8

million in the second quarter of 2011. Despite the solar panel

industry's struggle with significant oversupply and ongoing price

declines, inverter sales grew once again this quarter due to

utility-scale shipments from large projects wins announced earlier

this year.

Income from Continuing Operations

Income from continuing operations was $7.2 million or $0.16 per

diluted share, compared to income from continuing operations of

$17.6 million or $0.40 per diluted share in the same period last

year. Income from continuing operations was $13.5 million or $0.31

in the second quarter of 2011. On a non-GAAP basis, excluding the

impact of the restructuring charge, continuing operations generated

income for the quarter of $9.3 million or $0.21 per share.

Restructuring Charge

The restructuring charge incurred in the quarter related to the

restructuring plan that was announced on September 28, 2011. Under

the first phase of the plan, Advanced Energy will align its

engineering resources with the geographic footprint of its customer

base. By localizing R&D within the major geographies it serves,

the company will improve its time to market and distance to key

customers, creating a more highly-focused and responsive

development team. The company will also transition the manufacture

of certain solar inverter subcomponents to its Shenzhen factory.

This will lower product costs for its Solar Energy business

worldwide and enable regional fulfillment for complete products in

the growing Asian market. The anticipated savings from the

restructuring are approximately $6 million annually for the first

phase.

The second phase will be implemented over the next 12 to 18

months as the company reduces its cost structure, closes facilities

and relocates certain functions to different regions worldwide. As

a result, the company anticipates further charges in the amount of

$8 to $12 million, principally for space consolidation, and another

$1 million in additional severance costs over this timeframe. Once

complete, these two phases of the restructuring plan, along with

other cost savings initiatives and margin improvements, are

expected to deliver annual savings of approximately $16 to $20

million.

Fourth Quarter 2011 Guidance

The Company anticipates fourth quarter 2011 results from

continuing operations, to be within the following ranges:

- Sales of $105 million to $120 million

- Non-GAAP earnings per share of approximately breakeven

Third Quarter 2011 Conference Call

Management will host a conference call tomorrow, Wednesday,

November 2, 2011, at 8:30 a.m. Eastern Daylight Time to discuss

Advanced Energy's financial results. Domestic callers may access

this conference call by dialing 800-706-7748. International callers

may access the call by dialing 617-614-3473. Participants will need

to provide a conference pass code 72488976. For a replay of this

teleconference, please call 888-286-8010 or 617-801-6888, and enter

the pass code 48571613. The replay will be available for two weeks

following the conference call. A webcast will also be available on

the Investor Relations web page at

http://ir.advanced-energy.com.

About Advanced Energy

Advanced Energy is a global leader in innovative power and

control technologies for high-growth, thin-films manufacturing and

solar-power generation. Founded in 1981, Advanced Energy is

headquartered in Fort Collins, Colorado, with dedicated support and

service locations around the world. For more information, go to

www.advanced-energy.com.

This release includes non-GAAP operating, net income and

earnings per share data. These non-GAAP measures are not in

accordance with, or an alternative for, generally accepted

accounting principles and may be different from non-GAAP measures

used by other companies. In addition, these non-GAAP measures are

not based on any comprehensive set of accounting rules or

principles. Advanced Energy believes that these non-GAAP measures

provide useful information to management and investors regarding

financial and business trends relating to its financial condition

and results of operations. Additionally, the Company believes that

these non-GAAP measures, in combination with its financial results

calculated in accordance with GAAP, provides investors with

additional perspective. The Company further believes that the items

excluded from certain non-GAAP measures do not accurately reflect

the underlying performance of its continuing operations for the

period in which they are incurred, even though some of these

excluded items may be incurred and reflected in the Company's GAAP

financial results in the foreseeable future. The use of non-GAAP

measures have limitations in that they do not reflect all of the

amounts associated with its results of operations as determined in

accordance with GAAP and these measures should only be used to

evaluate the company's results of operations in conjunction with

the corresponding GAAP measures.

For additional information on the items excluded from one or

more of its non-GAAP financial measures, refer to the Form 8-K

regarding this release furnished today to the Securities and

Exchange Commission.

Forward-Looking Language

The Company's expectations with respect to guidance to financial

results for the fourth quarter ending December 31, 2011 and

statements that are not historical information are forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934.

Forward-looking statements are subject to known and unknown risks

and uncertainties that could cause actual results to differ

materially from those expressed or implied by such statements. Such

risks and uncertainties include, but are not limited to: the

effects of global macroeconomic conditions upon demand for our

products, the volatility and cyclicality of the industries the

company serves, particularly the semiconductor industry, the

continuation of RPS (renewable portfolio standards), the timing and

availability of incentives and grant programs in the US and Europe

related to the renewable energy market, renewable energy project

delays resulting from solar panel price declines and increased

competition in the solar inverter equipment market, the timing of

orders received from customers, the company's ability to realize

benefits from cost improvement efforts and any restructuring plans;

the ability to source materials and manufacture products, and

unanticipated changes to management's estimates, reserves or

allowances. These and other risks are described in Advanced

Energy's Form 10-K, Forms 10-Q and other reports and statements

filed with the Securities and Exchange Commission.

These reports and statements are available on the SEC's website at

www.sec.gov. Copies may also be obtained from Advanced Energy's

website at www.advancedenergy.com or by contacting Advanced

Energy's investor relations at 970-407-6555. Forward-looking

statements are made and based on information available to the

company on the date of this press release. The company assumes no

obligation to update the information in this press release.

| ADVANCED ENERGY INDUSTRIES,

INC. |

|

|

|

|

|

| CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (UNAUDITED) |

|

|

|

| (in thousands, except per share

data) |

|

|

|

|

|

| |

|

|

|

|

|

| |

Three Months

Ended |

Nine Months

Ended |

| |

September

30, |

June 30, |

September

30, |

| |

2011 |

2010 |

2011 |

2011 |

2010 |

| |

|

|

|

|

|

| SALES |

$ 128,498 |

$ 140,966 |

$ 138,154 |

$ 404,304 |

$ 310,760 |

| COST OF SALES |

79,651 |

80,276 |

82,777 |

238,035 |

176,304 |

| GROSS PROFIT |

48,847 |

60,690 |

55,377 |

166,269 |

134,456 |

| |

38.0% |

43.1% |

40.1% |

41.1% |

43.3% |

| OPERATING EXPENSES: |

|

|

|

|

|

| Research and development |

17,592 |

16,672 |

17,137 |

50,591 |

41,329 |

| Selling, general and administrative |

16,473 |

20,545 |

20,001 |

57,379 |

49,955 |

| Restructuring charges |

3,119 |

|

|

3,119 |

|

| Amortization of intangible assets |

989 |

1,177 |

921 |

2,831 |

1,945 |

| Total operating expenses |

38,173 |

38,394 |

38,059 |

113,920 |

93,229 |

| |

|

|

|

|

|

| Operating income |

10,674 |

22,296 |

17,318 |

52,349 |

41,227 |

| |

|

|

|

|

|

| Other income (loss), net |

(259) |

1,224 |

92 |

496 |

1,828 |

| Income from continuing operations before

income taxes |

10,415 |

23,520 |

17,410 |

52,845 |

43,055 |

| Provision for income taxes |

3,244 |

5,964 |

3,898 |

13,396 |

9,192 |

| INCOME FROM CONTINUING OPERATIONS, NET OF

INCOME TAXES |

7,171 |

17,556 |

13,512 |

39,449 |

33,863 |

| |

|

|

|

|

|

| Income (loss) from discontinued operations,

net of income taxes |

(579) |

2,392 |

74 |

(365) |

5,921 |

| |

|

|

|

|

|

| NET INCOME |

$ 6,592 |

$ 19,948 |

$ 13,586 |

$ 39,084 |

$ 39,784 |

| |

|

|

|

|

|

| Basic weighted-average common shares

outstanding |

43,535 |

43,254 |

43,571 |

43,515 |

42,711 |

| Diluted weighted-average common shares

outstanding |

43,819 |

43,849 |

44,187 |

44,056 |

43,293 |

| |

|

|

|

|

|

| EARNINGS PER SHARE: |

|

|

|

|

|

| CONTINUING OPERATIONS: |

|

|

|

|

|

| BASIC EARNINGS PER SHARE |

$ 0.16 |

$ 0.41 |

$ 0.31 |

$ 0.91 |

$ 0.79 |

| DILUTED EARNINGS PER SHARE |

$ 0.16 |

$ 0.40 |

$ 0.31 |

$ 0.90 |

$ 0.78 |

| |

|

|

|

|

|

| DISCONTINUED OPERATIONS |

|

|

|

|

|

| BASIC EARNINGS PER SHARE |

$ (0.01) |

$ 0.06 |

$ 0.00 |

$ (0.01) |

$ 0.14 |

| DILUTED EARNINGS PER SHARE |

$ (0.01) |

$ 0.05 |

$ 0.00 |

$ (0.01) |

$ 0.14 |

| |

|

|

|

|

|

| NET INCOME: |

|

|

|

|

|

| BASIC EARNINGS PER

SHARE |

$ 0.15 |

$ 0.46 |

$ 0.31 |

$ 0.90 |

$ 0.93 |

| DILUTED EARNINGS PER

SHARE |

$ 0.15 |

$ 0.45 |

$ 0.31 |

$ 0.89 |

$ 0.92 |

| |

|

|

|

|

|

| |

|

|

| ADVANCED ENERGY INDUSTRIES,

INC. |

|

|

| CONDENSED CONSOLIDATED BALANCE

SHEETS |

|

|

| (in thousands) |

|

|

| |

|

|

| |

September

30, |

December

31, |

| |

2011 |

2010 |

| ASSETS |

UNAUDITED |

AUDITED |

| |

|

|

| Current assets: |

|

|

| Cash and cash equivalents |

$ 132,253 |

$ 130,914 |

| Marketable securities |

22,669 |

9,640 |

| Accounts receivable, net |

132,048 |

119,893 |

| Inventories, net |

92,822 |

77,593 |

| Deferred income taxes |

7,689 |

7,510 |

| Income taxes receivable |

6,570 |

6,061 |

| Other current assets |

12,393 |

10,156 |

| Total current assets |

406,444 |

361,767 |

| |

|

|

| Property and equipment, net |

40,837 |

34,569 |

| |

|

|

| Deposits and other |

8,868 |

8,874 |

| Goodwill and intangibles, net |

92,105 |

96,781 |

| Deferred income tax assets, net |

5,176 |

3,166 |

| Total assets |

$ 553,430 |

$ 505,157 |

| |

|

|

| LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

| |

|

|

| Current liabilities: |

|

|

| Accounts payable |

$ 50,559 |

$ 56,185 |

| Other accrued expenses |

45,999 |

46,140 |

| Total current liabilities |

96,558 |

102,325 |

| |

|

|

| Long-term liabilities |

31,775 |

28,864 |

| |

|

|

| Total liabilities |

128,333 |

131,189 |

| |

|

|

| Stockholders' equity |

425,097 |

373,968 |

| Total liabilities and stockholders'

equity |

$ 553,430 |

$ 505,157 |

| |

|

|

| ADVANCED ENERGY INDUSTRIES,

INC. |

|

|

|

|

|

| SEGMENT INFORMATION

(UNAUDITED) |

|

|

|

|

|

| (in thousands) |

|

|

|

|

|

| |

|

|

|

|

|

| |

Three Months

Ended |

Nine Months

Ended |

| |

September

30, |

June 30, |

September

30, |

| |

2011 |

2010 |

2011 |

2011 |

2010 |

| SALES: |

|

|

|

|

|

| Thin Films |

$ 76,764 |

$ 103,616 |

$ 97,331 |

$ 274,194 |

$ 256,736 |

| Solar Energy |

51,734 |

37,350 |

40,823 |

130,110 |

54,024 |

| Total Sales |

128,498 |

140,966 |

138,154 |

404,304 |

310,760 |

| |

|

|

|

|

|

| |

|

|

|

|

|

| OPERATING INCOME: |

|

|

|

|

|

| Thin Films |

$ 16,015 |

|

$ 20,042 |

$ 60,881 |

|

| Solar Energy |

1,259 |

|

321 |

4,092 |

|

| Total segment operating income |

17,274 |

|

20,363 |

64,973 |

|

| Corporate expenses |

(6,600) |

|

(3,045) |

(12,624) |

|

| Other income, net |

(259) |

|

92 |

496 |

|

| Income from continuing operations before

income taxes |

$ 10,415 |

|

$ 17,410 |

$ 52,845 |

|

| |

|

|

|

|

|

| |

|

| ADVANCED ENERGY INDUSTRIES,

INC. |

|

| SELECTED OTHER DATA

(UNAUDITED) |

|

| (in thousands) |

|

| |

|

| Reconciliation of Non-GAAP measure -

income from operations without restructuring charge |

Three Months

Ended |

| |

September 30, |

| |

2011 |

| |

|

| Operating Income, as reported |

$ 10,674 |

| Add back: |

|

| Restructuring charge |

3,119 |

| Income from operations without resturcturing

charge |

$ 13,793 |

| |

|

| |

|

| Reconciliation of Non-GAAP measure -

income without restructuring charge |

Three Months

Ended |

| |

September 30, |

| |

2011 |

| |

|

| Income from continuing operations, net of

tax, as reported |

$ 7,171 |

| Add back: |

|

| Restructuring charge, net of tax

benefit |

2,136 |

| Income without restructuring charge |

$ 9,307 |

| |

|

| |

|

| |

|

| Reconciliation of Non-GAAP measure -

per share earnings from continuing operations without restructuring

charge |

Three Months

Ended |

| |

September 30, |

| |

2011 |

| |

|

| Diluted earnings per share from continuing

operations, as reported |

$ 0.16 |

| Add back: |

|

| per share impact of restructuring charge,

net of tax benefit |

0.05 |

| Per share earnings from continuing operations

without restructuring charge |

$ 0.21 |

| |

|

CONTACT: Danny Herron

Advanced Energy Industries, Inc.

970.407.6570

danny.herron@aei.com

Annie Leschin/Vanessa Lehr

Advanced Energy Industries, Inc.

970.407.6555

ir@aei.com

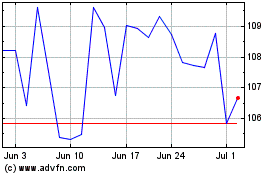

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Jul 2023 to Jul 2024