Advanced Energy Industries, Inc. (Nasdaq GM: AEIS) today

announced financial results for the first quarter ended March 31,

2011. The company posted first quarter sales of $137.7 million,

operating income of 17.7%, and earnings of $0.43 per diluted share

from continuing operations.

“Advanced Energy had another quarter of solid financial and

organizational performance. Our strategy to transition the company

to a diversified business model paid dividends this quarter as

increased shipments in our thin films business minimized the

seasonality of our renewables business,” said Dr. Hans Betz, chief

executive officer.

Total revenue of $137.7 million was split between Thin Films at

$100.1 million and $37.6 million in the Renewables Business Unit.

Thin films sales were primarily driven by strength in the

semiconductor market. Renewables sales were impacted by the North

American market first quarter seasonality, but delivered record

bookings of $65.5 million for the quarter.

“We are very excited about our announcement today that our

inverters have been chosen for two major Utility projects: a 150MW

project with Zachry in Arizona and a 35MW project in California

with Cupertino Electric, demonstrating the differentiated

reliability and efficiency of our inverters and the subsequent

impact on the levelized cost of energy. We are seeing a growing

number of larger, Utility scale projects as the solar market

continues its expansion,” said Dr. Hans Betz, chief executive

officer.

Operating income grew to $24.4 million or 17.7% of revenue, the

8th consecutive quarter of improved operating results. This

continued strength was the result of our aggressive management of

operating expenses as we continue to refine our strategic business

units. Net income from continuing operations was $18.8 million or

$0.43 per diluted share, compared to net income from continuing

operations of $19.7 million or $0.45 per diluted share in the

fourth quarter of 2010. This decline was due to an increase in the

company’s effective tax rate to 25% in the first quarter of 2011

from 19% in the fourth quarter of 2010.

Bookings for the first quarter were $184.0 million, compared to

$83.2 million in the first quarter of 2010.

Thin Films Business Unit

Thin Films business unit sales climbed to $100.1 million versus

$67.4 million in the same period of 2010, a 49% improvement year

over year. This growth reflects the continued strength in the

semiconductor industry and demonstrated our strength in advanced

power solutions for Etch and Deposition applications. We also

benefitted from another strong quarter in the solar panel and glass

market as we continue to leverage our leading position in

crystalline silicon processing equipment and strategic customer

relationships to address the current growth in China.

Renewables Business Unit

Renewables business unit sales were $37.6 million in the quarter

versus $2.3 million in the same period of 2010. This significant

year over year improvement reflects the acquisition of PV Powered

as well continued growth of the North American solar market. Our

focus on building a leading position in the strategic commercial

and Utility segments of the inverter market continued this quarter

with record bookings reflecting the many growth opportunities

ahead.

Second Quarter 2011 Guidance

The Company anticipates second quarter 2011 results from

continuing operations, to be within the following ranges:

- Sales of $148 million to $160

million

- Earnings per share of $0.36 to

$0.44

First Quarter 2011 Conference Call

Management will host a conference call tomorrow, Tuesday, May 3,

2011, at 8:30 a.m. Eastern Daylight Time to discuss Advanced

Energy's financial results. Domestic callers may access this

conference call by dialing (800) 299-6183. International callers

may access the call by dialing (617) 801-9173. Participants will

need to provide a conference pass code 79453281. For a replay of

this teleconference, please call (888) 286-8010 or (617) 801-6888,

and enter the pass code 79453281. The replay will be available for

two weeks following the conference call. A webcast will also be

available on the Investor Relations web page at

http://ir.advanced-energy.com.

About Advanced Energy

Advanced Energy (NASDAQ: AEIS - News) is a global leader in

innovative power and control technologies forthin-film

manufacturing and high-growth solar-power generation. Advanced

Energy is headquartered in Fort Collins, Colorado, with dedicated

support and service locations around the world. For more

information, go to www.advanced-energy.com.

Forward-Looking Language

The Company’s expectations with respect to guidance to financial

results for the second quarter ending June 30, 2011 and statements

that are not historical information are forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. Forward-looking

statements are subject to known and unknown risks and uncertainties

that could cause actual results to differ materially from those

expressed or implied by such statements. Such risks and

uncertainties include, but are not limited to: the effects of

global macroeconomic conditions upon demand for our products, the

volatility and cyclicality of the industries the company serves,

particularly the semiconductor industry, the continuation of RPS

(renewable portfolio standards), the timing and availability of

incentives and grant programs in the US and Europe related to the

renewable energy market, the timing of orders received from

customers, the company's ability to realize benefits from cost

improvement efforts, the ability to source materials and

manufacture products, and unanticipated changes to management's

estimates, reserves or allowances. These and other risks are

described in Advanced Energy's Form 10-K, Forms 10-Q and other

reports and statements filed with the Securities and Exchange

Commission. These reports and statements are available on the SEC's

website at www.sec.gov. Copies may also be obtained from Advanced

Energy's website at www.advancedenergy.com or by contacting

Advanced Energy's investor relations at 970-407-6555.

Forward-looking statements are made and based on information

available to the company on the date of this press release. The

company assumes no obligation to update the information in this

press release.

ADVANCED ENERGY INDUSTRIES,

INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

(in thousands, except per share data)

Three Months Ended March 31, December

31, 2011 2010 2010 SALES $ 137,652

$ 69,687 $

148,653

COST OF SALES 75,607 40,480

83,910 GROSS PROFIT 62,045 29,207 64,743 45.1 % 41.9 % 43.6

% OPERATING EXPENSES: Research and development 15,862 11,142 15,275

Selling, general and administrative 20,905 12,229 24,586

Amortization of intangible assets 921 -

920 Total operating expenses 37,688

23,371 40,781 INCOME FROM

OPERATIONS 24,357 5,836 23,962 Other income, net 663

385 392 Income from continuing

operations before income taxes 25,020 6,221 24,354 Provision for

income taxes 6,254 1,371 4,624

INCOME FROM CONTINUING OPERATIONS 18,766 4,850 19,730

Gain on sale of discontinued operations, net of tax - - 12,531

Results from discontinued operations, net of tax 140

1,367 (853 ) INCOME FROM DISCONTINUED

OPERATIONS, NET OF INCOME TAXES 140 1,367

11,678

NET INCOME $ 18,906

$ 6,217 $ 31,408 Basic weighted-average

common shares outstanding 43,440 42,074 43,315 Diluted

weighted-average common shares outstanding 44,133 42,680 43,796

EARNINGS PER SHARE: CONTINUING OPERATIONS: BASIC

EARNINGS PER SHARE $ 0.43 $ 0.12 $ 0.46 DILUTED EARNINGS PER SHARE

$ 0.43 $ 0.11 $ 0.45 DISCONTINUED OPERATIONS BASIC EARNINGS

PER SHARE $ 0.00 $ 0.03 $ 0.27 DILUTED EARNINGS PER SHARE $ 0.00 $

0.03 $ 0.27

NET INCOME: BASIC EARNINGS PER

SHARE $ 0.44 $ 0.15 $

0.73 DILUTED EARNINGS PER SHARE $ 0.43

$ 0.15 $ 0.72 ADVANCED

ENERGY INDUSTRIES, INC. CONDENSED CONSOLIDATED BALANCE

SHEETS (in thousands) March

31, December 31, 2011 2010 ASSETS

Current assets: Cash and cash equivalents $ 132,418 $ 130,914

Marketable securities 7,620 9,640 Accounts receivable, net 121,236

119,893 Inventories, net 90,109 77,593 Deferred income taxes 7,689

7,510 Income taxes receivable 9,435 6,061 Other current assets

9,179 10,156 Total current assets 377,686 361,767

Property and equipment, net 36,210 34,569 Deposits

and other 8,874 8,874 Goodwill and intangibles, net 95,860 96,781

Deferred income tax assets, net 3,166 3,166 Total

assets $ 521,796 $ 505,157 LIABILITIES AND STOCKHOLDERS'

EQUITY Current liabilities: Accounts payable $ 51,974 $

56,185 Other accrued expenses 43,005 46,140 Total

current liabilities 94,979 102,325 Long-term liabilities

29,959

28,864 Total liabilities

124,938

131,189 Stockholders' equity 396,858 373,968

Total liabilities and stockholders' equity $

521,796

$ 505,157

ADVANCED ENERGY INDUSTRIES, INC.

SEGMENT INFORMATION (in thousands)

Three Months Ended March 31,

December 31, 2011 2010 2010

SALES: Thin Films $ 100,099 $ 67,423 $ 96,960 Renewables

37,553 2,264 51,693 Total Sales

137,652 69,687 148,653

OPERATING INCOME: Thin Films $ 24,824 Renewables

2,512 Total segment operating income 27,336 Corporate

expenses (2,979 ) Other income, net 663 Income from

continuing operations before income taxes $ 25,020

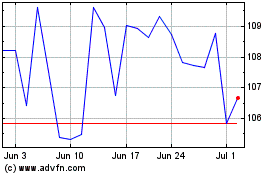

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Jun 2024 to Jul 2024

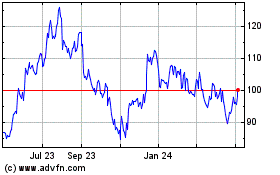

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Jul 2023 to Jul 2024