0001515156falseDecember 3100015151562024-01-312024-01-31

U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 31, 2024

ADVANCED EMISSIONS SOLUTIONS, INC.

(Name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-37822 | | 27-5472457 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

| | | | | | | | |

8051 E. Maplewood Avenue, Suite 210, Greenwood Village, CO | | 80111 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code: (720) 598-3500

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Class | | Trading Symbol | | Name of each exchange on which registered |

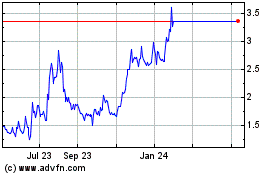

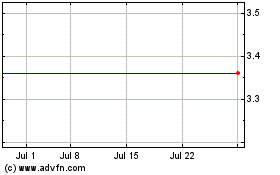

| Common stock, par value $0.001 per share | | ADES | | Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | | | | | | | |

| Emerging growth company | ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

| | | | | | | | |

| Item 5.03 | | Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

On January 31, 2024, Advanced Emissions Solutions, Inc. (the "Company") filed an amendment (the "Amendment") to its Second Amended and Restated Certificate of Incorporation to change the Company’s name to "Arq, Inc." (the "Name Change"), to be effective February 1, 2024. The Company also amended and restated its Bylaws solely to update the Company’s name to Arq, Inc., to be effective February 1, 2024.

In connection with the Name Change, the Company will begin trading on the Nasdaq Global Market under the new ticker symbol "ARQ". The new ticker symbol will become effective at the open of the market on February 1, 2024.

A copy of the Amendment, as filed with the Secretary of State of the State of Delaware on January 31, 2024, is attached as Exhibit 3.1 to this Current Report on Form 8-K and is incorporated herein by reference. A copy of the Company’s Amended and Restated Bylaws, as amended to reflect the Name Change, is attached as Exhibit 3.2 to this Current Report on Form 8-K and is incorporated herein by reference.

On January 31, 2024, the Company issued a press release announcing the Name Change. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

| | | | | | | | |

| Item 9.01 | | Financial Statements and Exhibits. |

| | |

| (d) | | Exhibits |

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: January 31, 2024

| | | | | |

| | Advanced Emissions Solutions, Inc. |

| | Registrant |

| | | | | |

| | /s/ Robert Rasmus |

| | Robert Rasmus |

| | Chief Executive Officer |

STATE OF DELAWARE

CERTIFICATE OF AMENDMENT

OF CERTIFICATE OF INCORPORATION

The corporation organized and existing under the General Corporation Law of the State of Delaware, hereby certifies as follows:

| | | | | | | | | | | | | | | | | |

| 1. | | The name of the corporation is | Advanced Emissions Solutions, Inc. |

| | | | | |

| | |

| 2. | | The Certificate of incorporation is hereby amended by changing the article |

| thereof numbered | 1 | | so that, as |

| amended, said article shall be and read as follows: |

| The name of the Corporation is Arq, Inc. | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| 3. | | That said amendment was duly adopted in accordance with the provisions of |

| Section 242 of the General Corporation Law of the State of Delaware |

| | | | | |

| 4. | | The effective date of this amendment shall be February 1, 2024. |

| | | | | |

| By: | /s/ Robert Rasmus |

| Authorized Officer |

| |

| Name: | Robert Rasmus, President |

| Print or Type |

AMENDED AND RESTATED BYLAWS OF ARQ, INC.

ARTICLE I

OFFICES

Section 1.01 Offices. Arq, Inc. (hereinafter called the “Corporation”) may have offices at such places, both within and without the State of Delaware, as the board of directors of the Corporation (the “Board of Directors”) from time to time shall determine or the business of the Corporation may require.

Section 1.02 Books and Records. Any records maintained by the Corporation in the regular course of its business, including its stock ledger, books of account and minute books, may be maintained on any information storage device or method so long as such records so kept can be converted into clearly legible paper form within a reasonable time. The Corporation shall so convert any records so kept upon the request of any person entitled to inspect such records pursuant to applicable law.

ARTICLE II

MEETINGS OF THE STOCKHOLDERS

Section 2.01 Place of Meetings. All meetings of the stockholders shall be held at such place, if any, either within or without the State of Delaware, as is designated from time to time by resolution of the Board of Directors and stated in the notice of meeting.

Section 2.02 Annual Meeting. The annual meeting of the stockholders for the election of directors and for the transaction of such other business as may properly come before the meeting shall be held at such date, time and place, if any, as are determined by the Board of Directors and stated in the notice of the meeting.

Section 2.03 Advance Notice of Stockholder Nominations and Proposals.

(a) Definitions.

“Affiliate or Associate” shall have the respective meanings ascribed to such terms in Rule 12b-2 of the General Rules and Regulations under the Securities Exchange Act of 1934, as in effect March 11, 2011.

“Exchange Act” means the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.

“Public Disclosure” or “Publicly Disclosed” means a disclosure made in a press release reported by the Dow Jones News Services, The Associated Press or a comparable national news service or in a document filed by the Corporation with the Securities and Exchange Commission pursuant to Section 13, 14 or 15(d) of the Exchange Act.

(b) Timely Notice. At a meeting of the stockholders, only such nominations of persons for the election of directors and such other business shall be conducted as have been properly brought before the meeting. To be properly brought before an annual meeting, nominations or such other business must be: (i) specified in the notice of meeting (or any supplement thereto) given by or at the direction of the board of directors or any committee thereof, (ii) otherwise properly brought before the meeting

by or at the direction of the board of directors or any committee thereof, or (iii) otherwise properly brought before an annual meeting by a stockholder who is a stockholder of record of the Corporation at the time such notice of meeting is delivered, who is entitled to vote at the meeting and who complies with the notice procedures set forth in this Section 2.03. In addition, any proposal of business (other than the nomination of persons for election to the board of directors, which shall be governed by Section 2.03(c) below) must be a proper matter for stockholder action. For business (including, but not limited to, director nominations) to be properly brought before an annual meeting by a stockholder, the stockholder or stockholders of record intending to propose the business (the “Proposing Stockholder”) must have given timely notice thereof pursuant to this Section 2.03(b) or Section 2.03(d) below, as applicable, in writing to the secretary of the Corporation even if such matter is already the subject of any notice to the stockholders or Public Disclosure from the board of directors. To be timely, a Proposing Stockholder’s notice must be delivered to or mailed and received at the principal executive offices of the Corporation in the case of an annual meeting of the stockholders, not less than one hundred twenty (120) calendar days in advance of the date specified in the Corporation’s proxy statement released to stockholders in connection with the previous year’s annual meeting of stockholders; provided, however, that if no annual meeting was held in the previous year or the date of the annual meeting has been changed by more than thirty (30) days from the date on which the previous year’s annual meeting was held, notice by the stockholder to be timely must be so received not later than the close of business on the later of one hundred twenty (120) calendar days in advance of such annual meeting or ten (10) calendar days following the date of Public Disclosure of the date of such meeting. In no event shall the Public Disclosure of an adjournment or postponement of an annual meeting commence a new notice time period (or extend any notice time period).

(c) Stockholder Nominations. For the nomination of any person or persons for election to the board of directors, a Proposing Stockholder’s notice to the secretary of the Corporation shall set forth (i) the name, age, business address and residence address of each nominee proposed in such notice, (ii) the principal occupation or employment of each such nominee, (iii) the number of shares of capital stock of the Corporation that are owned of record and beneficially by each such nominee (if any), (iv) such other information concerning each such nominee as would be required to be disclosed in a proxy statement soliciting proxies for the election of such nominee as a director in an election contest (even if an election contest is not involved) or that is otherwise required to be disclosed, under Section 14(a) of the Exchange Act and the rules and regulations promulgated thereunder, (v) the consent of the nominee to being named in the proxy statement as a nominee and to serving as a director if elected, and (vi) as to the Proposing Stockholder: (A) the name and address of the Proposing Stockholder as they appear on the Corporation’s books and of the beneficial owner, if any, on whose behalf the nomination is being made, (B) the class and number of shares of the Corporation that are owned by the Proposing Stockholder (beneficially and of record) and owned by the beneficial owner, if any, on whose behalf the nomination is being made, as of the date of the Proposing Stockholder’s notice, and a representation that the Proposing Stockholder will notify the Corporation in writing of the class and number of such shares owned of record and beneficially as of the record date for the meeting promptly following the later of the record date or the date notice of the record date is first Publicly Disclosed, (C) a description of any agreement, arrangement or understanding with respect to such nomination between or among the Proposing Stockholder and any of its Affiliates or Associates, and any others (including their names) acting in concert with any of the foregoing, and a representation that the Proposing Stockholder will notify the Corporation in writing of any such agreement, arrangement or

understanding in effect as of the record date for the meeting promptly following the later of the record date or the date notice of the record date is first Publicly Disclosed, (D) a description of any agreement, arrangement or understanding (including any derivative or short positions, profit interests, options, hedging transactions, and borrowed or loaned shares) that has been entered into as of the date of the Proposing Stockholder’s notice by, or on behalf of, the Proposing Stockholder or any of its Affiliates or Associates, the effect or intent of which is to mitigate loss to, manage risk or benefit of share price changes for, or increase or decrease the voting power of the Proposing Stockholder or any of its Affiliates or Associates with respect to shares of stock of the Corporation, and a representation that the Proposing Stockholder will notify the Corporation in writing of any such agreement, arrangement or understanding in effect as of the record date for the meeting promptly following the later of the record date or the date notice of the record date is first Publicly Disclosed, (E) a representation that the Proposing Stockholder is a holder of record of shares of the Corporation entitled to vote at the meeting and intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice, and (F) a representation whether the Proposing Stockholder intends to deliver a proxy statement and/or form of proxy to holders of at least the percentage of the Corporation’s outstanding capital stock required to approve the nomination and/or otherwise to solicit proxies from stockholders in support of the nomination. The Corporation may require any proposed nominee to furnish such other information as it may reasonably require to determine the eligibility of such proposed nominee to serve as an independent director of the Corporation or that could be material to a reasonable stockholder’s understanding of the qualifications and independence, or lack thereof, of such nominee.

(d) Other Stockholder Proposals. For all business other than director nominations, a Proposing Stockholder’s notice to the secretary of the Corporation shall set forth as to each matter the Proposing Stockholder proposes to bring before the annual meeting: (i) a brief description of the business desired to be brought before the annual meeting and the reasons for conducting such business at the annual meeting, (ii) any other information relating to such stockholder and beneficial owner, if any, on whose behalf the proposal is being made, required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for the proposal and pursuant to and in accordance with Section 14(a) of the Exchange Act and the rules and regulations promulgated thereunder and (iii) the information required by Section 2.03(c)(vi) above.

(e) Proxy Rules. The foregoing notice requirements of Sections 2.03(c) and 2.03(d) shall be deemed satisfied by a stockholder with respect to business or a nomination if the stockholder has notified the Corporation of his, her or its intention to present a proposal or make a nomination at an annual meeting in compliance with the applicable rules and regulations promulgated under Section 14(a) of the Exchange Act and such stockholder’s proposal or nomination has been included in a proxy statement that has been prepared by the Corporation to solicit proxies for such annual meeting.

(f) Special Meetings of Stockholders. Only such business shall be conducted at a special meeting of stockholders as has properly been brought before the meeting pursuant to the Corporation’s notice of meeting. Nominations of persons for election to the board of directors may be made at a special meeting of stockholders at which directors are to be elected pursuant to the Corporation’s notice of meeting (x) by or at the direction of the board of directors or any committee thereof (or stockholders pursuant to Section 2.04 hereof) or (y) provided that the board of directors (or stockholders pursuant to Section 2.04 hereof have determined that directors shall be elected at such

meeting, by any stockholder of the Corporation who is a stockholder of record at the time the notice provided for in this Section 2.03 is delivered to the secretary of the Corporation, who is entitled to vote at the meeting and upon such election and who complies with the notice procedures set forth in this Section 2.03. If the Corporation calls a special meeting of stockholders for the purpose of electing one or more directors to the board of directors, any such stockholder entitled to vote in such election of directors may nominate a person or persons (as the case may be) for election to such position(s) as specified in the Corporation’s notice of meeting, if the stockholder’s notice required by this Section 2.03 shall be delivered to the secretary at the principal executive offices of the Corporation not less than one hundred twenty (120) days prior to the special meeting at which such business will be considered or the tenth (10th) day following the date of Public Disclosure of the date of the special meeting and of the nominees proposed by the board of directors to be elected at such meeting. The foregoing notice requirements of this paragraph (f) of this Section 2.03 shall be deemed satisfied by a stockholder with respect to a nomination if the stockholder has notified the Corporation of his, her or its intention to present a nomination at such special meeting in compliance with Section 14(a) of the Exchange Act and the rules and regulations promulgated thereunder and such stockholder’s nomination has been included in a proxy statement that has been prepared by the Corporation to solicit proxies for such special meeting. In no event shall the Public Disclosure of an adjournment or postponement of a special meeting commence a new time period (or extend any notice time period).

(g) Effect of Noncompliance. Notwithstanding anything in these Bylaws to the contrary: (i) no nominations shall be made or business shall be conducted at any annual meeting except in accordance with the procedures set forth in this Section 2.03, and (ii) otherwise required by law, if a Proposing Stockholder intending to propose business or make nominations at an annual meeting pursuant to this Section 2.03 does not provide the information required under this Section 2.03 to the Corporation promptly following the later of the record date or the date notice of the record date is first Publicly Disclosed, or the Proposing Stockholder (or a qualified representative of the Proposing Stockholder) does not appear at the meeting to present the proposed business or nominations, such business or nominations shall not be considered, notwithstanding that proxies in respect of such business or nominations may have been received by the Corporation. The requirements of this Section 2.03 shall apply to any business or nominations to be brought before an annual meeting by a stockholder whether such business or nominations are to be included in the Corporation’s proxy statement pursuant to Rule 14a-8 or Rule 14a-11 of the Exchange Act or presented to stockholders by means of an independently financed proxy solicitation. The requirements of the Section 2.03 are included to provide the Corporation notice of a stockholder’s intention to bring business or nominations before an annual meeting and shall in no event be construed as imposing upon any stockholder the requirement to seek approval from the Corporation as a condition precedent to bringing any such business or make such nominations before an annual meeting.

Section 2.04 Special Meetings. Special meetings of stockholders for any purpose or purposes may be called pursuant to a resolution approved by the Board of Directors or by the holders of shares entitled to cast not less than twenty percent (20%) of the votes at the meeting, and shall be held at such place, on such date, and at such time as the Board of Directors shall fix. The only business that may be conducted at a special meeting shall be the matter or matters set forth in the notice of such meeting. If a special meeting is properly called by any person or persons other than the Board of Directors, the request shall be in writing, specifying the general nature of the business proposed to be transacted in compliance with the same advance notice requirements of Section 2.03(c) and 2.03(d), and shall be

delivered personally or sent by certified or registered mail, return receipt requested, or by telegraphic or other facsimile transmission to the secretary of the Corporation. No business may be transacted at such special meeting otherwise than specified in such notice. The Board of Directors shall determine the time and place of such special meeting, which shall be held not less than thirty-five (35) nor more than one hundred twenty (120) days after the date of the receipt of the request. Upon determination of the time and place of the meeting, the secretary shall cause notice to be given to the stockholders entitled to vote, in accordance with the provisions of Section 2.07 of these Bylaws. Nothing contained in this Section 2.04 shall be construed as limiting, fixing, or affecting the time when a meeting of stockholders called by action of the Board of Directors may be held.

Section 2.05 Adjournments. Any meeting of the stockholders, annual or special, may be adjourned from time to time to reconvene at the same or some other place, if any, and notice need not be given of any such adjourned meeting if the time and place, if any, thereof are announced at the meeting at which the adjournment is taken. At the adjourned meeting, the Corporation may transact any business that may have been transacted at the original meeting. If the adjournment is for more than 30 days, a notice of the adjourned meeting shall be given to each stockholder of record entitled to vote at the meeting. If after the adjournment a new record date is fixed for stockholders entitled to vote at the adjourned meeting, the Board of Directors shall fix a new record date for notice of the adjourned meeting and shall give notice of the adjourned meeting to each stockholder of record entitled to vote at the meeting as of the record date for notice of such adjourned meeting.

Section 2.06 Notice of Meetings. Notice of the place, if any, date, hour, the record date for determining the stockholders entitled to vote at the meeting (if such date is different from the record date for stockholders entitled to notice of the meeting) and means of remote communication, if any, of every meeting of stockholders shall be given by the Corporation not less than ten days nor more than 60 days before such meeting (unless a different time is specified by law) to every stockholder entitled to vote at the meeting as of the record date for determining the stockholders entitled to notice of the meeting. Notices of special meetings shall also specify the purpose or purposes for which the meeting has been called. Except as otherwise provided herein or permitted by applicable law, notice to stockholders shall be in writing and delivered personally or mailed to the stockholders at their addresses appearing on the books of the Corporation. Without limiting the manner by which notice otherwise may be given effectively to stockholders, notice of meetings may be given to stockholders by means of electronic transmission in accordance with applicable law. Notice of any meeting need not be given to any stockholder who, either before or after the meeting, submits a waiver of notice or attends such meeting, except when the stockholder attends for the express purpose of objecting, at the beginning of the meeting, to the transaction of any business because the meeting is not lawfully called or convened. Any stockholder so waiving notice of such meeting shall be bound by the proceedings of any such meeting in all respects as if due notice thereof had been given.

Section 2.07 List of Stockholders. The officer of the Corporation who has charge of the stock ledger shall prepare a complete list of the stockholders entitled to vote at any meeting of stockholders (provided, however, if the record date for determining the stockholders entitled to vote is less than ten days before the date of the meeting, the list shall reflect the stockholders entitled to vote as of the tenth day before the meeting date), arranged in alphabetical order, and showing the address of each stockholder and the number of shares of each class of capital stock of the Corporation registered in the name of each stockholder at least ten days before any meeting of the stockholders. Such list shall be

open to the examination of any stockholder, for any purpose germane to the meeting, during ordinary business hours, at the principal place of business of the Corporation. If the meeting is to be held at a place, the list shall also be produced and kept at the time and place of the meeting the whole time thereof and may be inspected by any stockholder who is present. If the meeting is held solely by means of remote communication, the list shall also be open for inspection by any stockholder during the whole time of the meeting as provided by applicable law. Except as provided by applicable law, the stock ledger of the Corporation shall be the only evidence as to who are the stockholders entitled to examine the stock ledger and the list of stockholders or to vote in person or by proxy at any meeting of stockholders.

Section 2.08 Quorum. Unless otherwise required by law, the Certificate of Incorporation of the Corporation (the “Certificate of Incorporation”) or these bylaws, at each meeting of the stockholders, one-third of the voting power of the outstanding shares of the Corporation entitled to vote at the meeting, present in person or represented by proxy, shall constitute a quorum. If, however, such quorum is not present or represented at any meeting of the stockholders, the stockholders entitled to vote thereat, present in person or represented by proxy, shall have the power to adjourn the meeting from time to time, in the manner provided in Section 2.05, until a quorum is present or represented. A quorum, once established, shall not be broken by the subsequent withdrawal of enough votes to leave less than a quorum. At any such adjourned meeting at which there is a quorum, any business may be transacted that may have been transacted at the meeting originally called.

Section 2.09 Conduct of Meetings. The Board of Directors of the Corporation may adopt by resolution such rules and regulations for the conduct of the meeting of the stockholders as it deems appropriate. At every meeting of stockholders, the president or in his or her absence or inability to act, the secretary or, in his or her absence or inability to act, the person whom the president appoints, shall act as chairman of, and preside at, the meeting. The secretary or, in his or her absence or inability to act, the person whom the chairman of the meeting appoints secretary of the meeting, shall act as secretary of the meeting and keep the minutes thereof. Except to the extent inconsistent with such rules and regulations as adopted by the Board of Directors, the chairman of any meeting of the stockholders has the right and authority to prescribe such rules, regulations and procedures and to do all such acts as, in the judgment of such chairman, are appropriate for the proper conduct of the meeting. Such rules, regulations or procedures, whether adopted by the Board of Directors or prescribed by the chairman of the meeting, may include, without limitation, the following: (a) the establishment of an agenda or order of business for the meeting; (b) the determination of when the polls open and close for any given matter to be voted on at the meeting; (c) rules and procedures for maintaining order at the meeting and the safety of those present; limitations on attendance at or participation in the meeting to stockholders of record of the Corporation, their duly authorized and constituted proxies or such other persons as the chairman of the meeting determines; (e) restrictions on entry to the meeting after the time fixed for the commencement thereof; and (f) limitations on the time allotted to questions or comments by participants.

Section 2.10 Voting; Proxies. Unless otherwise required by law or the Certificate of Incorporation, the contested election of any director and proposals so designated by the directors shall be decided by a plurality of the votes cast at a meeting of the stockholders by the holders of stock entitled to vote in the election. Unless otherwise required by law, the Certificate of Incorporation or these bylaws, any matter, other than the contested election of a director and proposals designated by

the directors as being subject to a plurality vote, brought before any meeting of stockholders shall be approved if the votes cast favoring the matter exceed the votes cast opposing the matter at a meeting of the stockholders by the holders of stock entitled to vote thereon. A contested election of a director is one in which (i) a Proposing Stockholder has met the requirements of Sections 2.03(b) and (c) hereof for the nomination of a person for election to the Board of Directors, (ii) the Corporation has determined that such director nominee is eligible to serve as an independent director of the Corporation and (iii) prior to the date that notice of the respective meeting of stockholders is given, the Board of Directors has not made a determination that the director election is not contested. Each stockholder entitled to vote at a meeting of stockholders or to express consent to corporate action in writing without a meeting may authorize another person or persons to act for such stockholder by proxy, but no such proxy shall be voted or acted upon after three years from its date, unless the proxy provides for a longer period. A proxy shall be irrevocable if it states that it is irrevocable and if, and only as long as, it is coupled with an interest sufficient in law to support an irrevocable power. A stockholder may revoke any proxy that is not irrevocable by attending the meeting and voting in person or by delivering to the secretary of the Corporation a revocation of the proxy or a new proxy bearing a later date. Voting at meetings of stockholders need not be by written ballot.

Section 2.11 Inspectors at Meetings of Stockholders. The Board of Directors, in advance of any meeting of stockholders, may, and shall if required by law, appoint one or more inspectors, who may be employees of the Corporation, to act at the meeting or any postponement or adjournment thereof and make a written report thereof. The Board of Directors may designate one or more persons as alternate inspectors to replace any inspector who fails to act. If no inspector or alternate is able to act at a meeting, the person presiding at the meeting shall appoint one or more inspectors to act at the meeting. Each inspector, before entering upon the discharge of his or her duties, shall take and sign an oath faithfully to execute the duties of inspector with strict impartiality and according to the best of his or her ability. The inspectors shall (a) ascertain the number of shares outstanding and the voting power of each, (b) determine the shares represented at the meeting, the existence of a quorum and the validity of proxies and ballots, (c) count all votes and ballots, (d) determine and retain for a reasonable period a record of the disposition of any challenges made to any determination by the inspectors and (e) certify their determination of the number of shares represented at the meeting and their count of all votes and ballots. The inspectors may appoint or retain other persons or entities to assist the inspectors in the performance of their duties. Unless otherwise provided by the Board of Directors, the date and time of the opening and the closing of the polls for each matter upon which the stockholders will vote at a meeting shall be determined by the person presiding at the meeting and shall be announced at the meeting. No ballot, proxies, votes or any revocation thereof or change thereto, shall be accepted by the inspectors after the closing of the polls unless the Court of Chancery of the State of Delaware upon application by a stockholder determines otherwise. In determining the validity and counting of proxies and ballots cast at any meeting of stockholders, the inspectors may consider such information as is permitted by applicable law. No person who is a candidate for office at an election may serve as an inspector at such election.

Section 2.12 Written Consent of Stockholders Without a Meeting. Any action to be taken at any annual or special meeting of stockholders may be taken without a meeting, without prior notice and without a vote, if a consent or consents in writing, setting forth the action to be so taken, are signed by all of the holders of outstanding stock entitled to vote with respect to the subject matter thereof and delivered (by hand or by certified or registered mail, return receipt requested) to the

Corporation by delivery to its registered office in the State of Delaware, its principal place of business or an officer or agent of the Corporation having custody of the books in which proceedings of meetings of stockholders are recorded. Every written consent shall bear the date of signature of each stockholder, and no written consent shall be effective to take the corporate action referred to therein unless, within 60 days of the earliest dated consent delivered in the manner required by this Section 2.12, written consents signed by all of the holders of outstanding stock entitled to vote with respect to the subject matter thereof are delivered to the Corporation as aforesaid.

Section 2.13 Fixing the Record Date.

(a) In order that the Corporation may determine the stockholders entitled to notice of or to vote at any meeting of stockholders or any adjournment or postponement thereof, the Board of Directors may fix a record date, which record date shall not precede the date upon which the resolution fixing the record date is adopted by the Board of Directors, and which record date shall not be more than 60 nor less than ten days before the date of such meeting. If the Board of Directors so fixes a date, such date shall also be the record date for determining the stockholders entitled to vote at such meeting unless the Board of Directors determines, at the time it fixes such record date, that a later date on or before the date of the meeting shall be the date for making such determination. If no record date is fixed by the Board of Directors, the record date for determining stockholders entitled to notice of or to vote at a meeting of stockholders shall be at the close of business on the day next preceding the day on which notice is given, or, if notice is waived, at the close of business on the day next preceding the day on which the meeting is held. A determination of stockholders of record entitled to notice of or to vote at a meeting of stockholders shall apply to any adjournment or postponement of the meeting; provided, however, that the Board of Directors may fix a new record date for the determination of stockholders entitled to vote at the adjourned or postponed meeting and in such case shall also fix as the record date for stockholders entitled to notice of such adjourned or postponed meeting the same or an earlier date as that fixed for the determination of stockholders entitled to vote therewith at the adjourned or postponed meeting.

(b) In order that the Corporation may determine the stockholders entitled to express consent to corporate action in writing without a meeting, the Board of Directors may fix a record date, which record date shall not precede the date upon which the resolution fixing the record date is adopted by the Board of Directors, and which record date shall not be more than ten days after the date upon which the resolution fixing the record date is adopted by the Board of Directors. If no record date has been fixed by the Board of Directors, the record date for determining stockholders entitled to express consent to corporate action in writing without a meeting: (i) when no prior action by the Board of Directors is required by law, the record date for such purpose shall be the first date on which a signed written consent setting forth the action taken or proposed to be taken is delivered to the Corporation by delivery to its registered office in the State of Delaware, its principal place of business, or an officer or agent of the Corporation having custody of the book in which proceedings of meetings of stockholders are recorded and (ii) if prior action by the Board of Directors is required by law, the record date for such purpose shall be at the close of business on the day on which the Board of Directors adopts the resolution taking such prior action. Delivery shall be by hand or by certified or registered mail, return receipt requested.

(c) In order that the Corporation may determine the stockholders entitled to receive payment of any dividend or other distribution or allotment of any rights or the stockholders entitled to exercise any

rights in respect of any change, conversion or exchange of stock, or for the purpose of any other lawful action, the Board of Directors may fix a record date, which record date shall not precede the date upon which the resolution fixing the record date is adopted, and which record date shall be not more than 60 days prior to such action. If no record date is fixed, the record date for determining stockholders for any such purpose shall be at the close of business on the day on which the Board of Directors adopts the resolution relating thereto.

ARTICLE III

BOARD OF DIRECTORS

Section 3.01 General Powers. The business and affairs of the Corporation shall be managed by or under the direction of the Board of Directors. The Board of Directors may adopt such rules and procedures, not inconsistent with the Certificate of Incorporation, these bylaws or applicable law, as it may deem proper for the conduct of its meetings and the management of the Corporation.

Section 3.02 Number; Term of Office. The Board of Directors shall consist of no less than one or more than fifteen members, the number thereof to be determined from time to time by resolution of the Board of Directors. Each director shall hold office until a successor is duly elected and qualified or until the director’s earlier death, resignation, disqualification or removal.

Section 3.03 Newly Created Directorships and Vacancies. Any newly created directorships resulting from an increase in the authorized number of directors and any vacancies occurring in the Board of Directors, may be filled by the affirmative votes of a majority of the remaining members of the Board of Directors, although less than a quorum. A director so elected shall hold office until the earlier of the expiration of the term of office of the director whom he or she has replaced, a successor is duly elected and qualified or the earlier of such director’s death, resignation or removal. If the votes cast opposing the election of an incumbent director nominee in an uncontested election of a director exceed the votes cast favoring such election at a meeting of the Corporation’s stockholders, the majority of the disinterested independent members of the Board of Directors may (a) request such director nominee to immediately tender his or her resignation as a director of the Corporation, (b) reduce the size of the Board of Directors upon the occurrence of the resulting vacancy and (c) take any other action regarding the resulting vacancy as such independent directors deem necessary or appropriate.

Section 3.04 Resignation. Any director may resign at any time by notice given in writing or by electronic transmission to the Corporation. Such resignation shall take effect at the date of receipt of such notice by the Corporation or at such later time as is therein specified.

Section 3.05 Regular Meetings. Regular meetings of the Board of Directors may be held without notice at such times and at such places as may be determined from time to time by the Board of Directors or its chairman.

Section 3.06 Special Meetings. Special meetings of the Board of Directors may be held at such times and at such places as may be determined by the chairman or the president on at least 24 hours notice to each director given by one of the means specified in Section 3.09 hereof other than by mail or on at least three days notice if given by mail. Special meetings shall be called by the chairman or the president in like manner and on like notice on the written request of any two or more directors.

Section 3.07 Telephone Meetings. Board of Directors or Board of Directors committee meetings may be held by means of telephone conference or other communications equipment by means of which all persons participating in the meeting can hear each other and be heard. Participation by a director in a meeting pursuant to this Section 3.07 shall constitute presence in person at such meeting.

Section 3.08 Adjourned Meetings. A majority of the directors present at any meeting of the Board of Directors, including an adjourned meeting, whether or not a quorum is present, may adjourn and reconvene such meeting to another time and place. At least 24 hours notice of any adjourned or postponed meeting of the Board of Directors shall be given to each director whether or not present at the time of the adjournment or postponement, if such notice shall be given by one of the means specified in Section 3.09 hereof other than by mail, or at least three days notice if by mail. Any business may be transacted at an adjourned meeting that could have been transacted at the meeting as originally called.

Section 3.09 Notices. Subject to Section 3.06 and Section 3.10 hereof, whenever notice is required to be given to any director by applicable law, the Certificate of Incorporation or these bylaws, such notice shall be deemed given effectively if given in person or by telephone, mail addressed to such director at such director’s address as it appears on the records of the Corporation, facsimile, email or by other means of electronic transmission.

Section 3.10 Waiver of Notice. Whenever the giving of any notice to directors is required by applicable law, the Certificate of Incorporation or these bylaws, a waiver thereof, given by the director entitled to the notice, whether before or after such notice is required, shall be deemed equivalent to notice. Attendance by a director at a meeting shall constitute a waiver of notice of such meeting except when the director attends a meeting for the express purpose of objecting, at the beginning of the meeting, to the transaction of any business on the ground that the meeting was not lawfully called or convened. Neither the business to be transacted at, nor the purpose of, any regular or special Board of Directors or committee meeting need be specified in any waiver of notice.

Section 3.11 Organization. At each meeting of the Board of Directors, the chairman or, in his or her absence, another director selected by the Board of Directors shall preside. The secretary or a person designated by secretary shall act as secretary at each meeting of the Board of Directors. If the secretary is absent from any meeting of the Board of Directors, an assistant secretary shall perform the duties of secretary at such meeting; and in the absence from any such meeting of the secretary and all assistant secretaries, the person presiding at the meeting may appoint any person to act as secretary of the meeting.

Section 3.12 Quorum of Directors. The presence of a majority of the Board of Directors shall be necessary and sufficient to constitute a quorum for the transaction of business at any meeting of the Board of Directors.

Section 3.13 Action by Majority Vote. Except as otherwise expressly required by these bylaws, the Certificate of Incorporation or by applicable law, the vote of a majority of the directors present at a meeting at which a quorum is present shall be the act of the Board of Directors.

Section 3.14 Action Without Meeting. Unless otherwise restricted by the Certificate of Incorporation or these bylaws, any action required or permitted to be taken at any meeting of the Board of Directors or of any committee thereof may be taken without a meeting if all directors or

members of such committee, as the case may be, consent thereto in writing or by electronic transmission, and the writings or electronic transmissions are filed with the minutes of proceedings of the Board of Directors or committee in accordance with applicable law.

Section 3.15 Committees of the Board of Directors. The Board of Directors may designate one or more committees, each committee to consist of one or more of the directors of the Corporation. The Board of Directors may designate one or more directors as alternate members of any committee, who may replace any absent or disqualified member at any meeting of such committee. If a member of a committee is absent from any meeting, or disqualified from voting thereat, the remaining member or members present at the meeting and not disqualified from voting, whether or not such member or members constitute a quorum, may, by a unanimous vote, appoint another member of the Board of Directors to act at the meeting in the place of any such absent or disqualified member. Any such committee, to the extent permitted by applicable law, shall have and may exercise all the powers and authority of the Board of Directors in the management of the business and affairs of the Corporation and may authorize the seal of the Corporation to be affixed to all papers that may require it to the extent so authorized by the Board of Directors. Unless the Board of Directors provides otherwise, at all meetings of such committee, a majority of the then authorized members of the committee shall constitute a quorum for the transaction of business, and the vote of a majority of the members of the committee present at any meeting at which there is a quorum shall be the act of the committee. Each committee shall keep regular minutes of its meetings. Unless the Board of Directors provides otherwise, each committee designated by the Board of Directors may make, alter and repeal rules and procedures for the conduct of its business. In the absence of such rules and procedures each committee shall conduct its business in the same manner as the Board of Directors conducts its business pursuant to this Article III.

ARTICLE IV

OFFICERS

Section 4.01 Positions and Election. The officers of the Corporation shall be elected by the Board of Directors and shall include a president, a treasurer and a secretary. The Board of Directors, in its discretion, may also elect a chairman (who must be a director), one or more vice chairmen (who must be directors) and one or more vice presidents, assistant treasurers, assistant secretaries and other officers. Any individual may be elected to, and may hold, more than one office of the Corporation.

Section 4.02 Term. Each officer of the Corporation shall hold office until such officer’s successor is elected and qualifies or until such officer’s earlier death, resignation or removal. Any officer elected or appointed by the Board of Directors may be removed by the Board of Directors at any time with or without cause by the majority vote of the members of the Board of Directors then in office. The removal of an officer shall be without prejudice to his or her contract rights, if any. The election or appointment of an officer does not of itself create contract rights. Any officer of the Corporation may resign at any time by giving written notice of his or her resignation to the president or the secretary. Any such resignation shall take effect at the time specified therein or, if the time when it becomes effective is not specified therein, immediately upon its receipt. Unless otherwise specified therein, the acceptance of such resignation is not necessary to make it effective. If any vacancy occurs among the officers, the Board of Directors shall, if required by law, or may appoint a person to fill the position for the unexpired portion of the term.

Section 4.03 The President. The president shall have general supervision over the business of the Corporation and other duties incident to the office of president, and any other duties as may be from time to time assigned to the president by the Board of Directors and subject to the control of the Board of Directors in each case.

Section 4.04 Vice Presidents. Each vice president shall have such powers and perform such duties as may be assigned to him or her from time to time by the chairman of the Board of Directors or the president.

Section 4.05 The Secretary. The secretary, or a person appointed by the secretary, president or Board of Directors, shall attend all sessions of the Board of Directors and all meetings of the stockholders and record all votes and the minutes of all proceedings in a book to be kept for that purpose, and shall perform like duties for committees when required. He or she shall give, or cause to be given, notice of all meetings of the stockholders and meetings of the Board of Directors, and shall perform such other duties as may be prescribed by the Board of Directors or the president. The secretary shall keep in safe custody the seal of the Corporation and shall see that it is affixed to all documents, the execution of which, on behalf of the Corporation, under its seal, is necessary or proper, and when so affixed may attest the same.

Section 4.06 The Treasurer. The treasurer shall have the custody of the corporate funds and securities, except as otherwise provided by the Board of Directors, and shall cause to be kept full and accurate accounts of receipts and disbursements in books belonging to the Corporation and shall deposit all moneys and other valuable effects in the name and to the credit of the Corporation in such depositories as may be designated by the Board of Directors. The treasurer shall disburse the funds of the Corporation as may be ordered by the Board of Directors, taking proper vouchers for such disbursements, and shall render to the president and the directors, at the regular meetings of the Board of Directors, or whenever they may require it, an account of all his or her or her transactions as treasurer and of the financial condition of the Corporation.

Section 4.07 Duties of Officers May be Delegated. In the case of the absence of any officer, or for any other reason that the Board of Directors may deem sufficient, the president or the Board of Directors may delegate for the time being the powers or duties of such officer to any other officer, director or person.

ARTICLE V

STOCK CERTIFICATES AND THEIR TRANSFER

Section 5.01 Certificates Representing Shares. The shares of stock of the Corporation shall be represented by certificates unless the Board of Directors provides by resolution or resolutions that some or all of any class or series shall be uncertificated shares that may be evidenced by a book-entry system maintained by the registrar of such stock. If shares are represented by certificates, such certificates shall be in the form approved by the Board of Directors. The certificates representing shares of stock of each class shall be signed by, or in the name of, the Corporation by the chairman, any vice chairman, the president or any vice president, and by the secretary, any assistant secretary, the treasurer or any assistant treasurer. Any or all such signatures may be facsimiles. Although any officer, transfer agent or registrar whose manual or facsimile signature is affixed to such a certificate ceases to be such officer, transfer agent or registrar before such certificate has been issued, it may nevertheless

be issued by the Corporation with the same effect as if such officer, transfer agent or registrar were still such at the date of its issue.

Section 5.02 Transfers of Stock. Stock of the Corporation shall be transferable in the manner prescribed by law and in these bylaws. Transfers of stock shall be made on the books of the Corporation only by the person named as the holder thereof on the stock records of the Corporation, by such person’s attorney lawfully constituted in writing, and in the case of shares represented by a certificate upon the surrender of the certificate thereof, which shall be cancelled before a new certificate or uncertificated shares may be issued. No transfer of stock shall be valid as against the Corporation for any purpose until it has been entered in the stock records of the Corporation by an entry showing from and to whom such stock was transferred. To the extent designated by the president or any vice president or the treasurer of the Corporation, the Corporation may recognize the transfer of fractional uncertificated shares, but shall not otherwise be required to recognize the transfer of fractional shares.

Section 5.03 Transfer Agents and Registrars. The Board of Directors may appoint, or authorize any officer or officers to appoint, one or more transfer agents and one or more registrars.

Section 5.04 Lost, Stolen or Destroyed Certificates. The Board of Directors may direct a new certificate or uncertificated shares to be issued in place of any certificate theretofore issued by the Corporation alleged to have been lost, stolen or destroyed upon the making of an affidavit of that fact by the person claiming the certificate of stock to be lost, stolen or destroyed. When authorizing such issue of a new certificate or uncertificated shares, the Board of Directors may, in its discretion and as a condition precedent to the issuance thereof, require the owner of such lost, stolen or destroyed certificate, or the owner’s legal representative to give the Corporation a bond sufficient to indemnify it against any claim that may be made against the Corporation with respect to the certificate alleged to have been lost, stolen or destroyed or the issuance of such new certificate or uncertificated shares.

ARTICLE VI

GENERAL PROVISIONS

Section 6.01 Seal. The seal of the Corporation shall be in such form as is approved by the Board of Directors. The seal may be used by causing it or a facsimile thereof to be impressed or affixed or reproduced or otherwise, as may be prescribed by law or custom or by the Board of Directors.

Section 6.02 Fiscal Year. The fiscal year of the Corporation shall be determined by the Board of Directors.

Section 6.03 Checks, Notes, Drafts, Etc. All checks, notes, drafts or other orders for the payment of money of the Corporation shall be signed, endorsed or accepted in the name of the Corporation by such officer, officers, person or persons as from time to time may be designated by the Board of Directors or by an officer or officers authorized by the Board of Directors to make such designation.

Section 6.04 Dividends. Subject to applicable law and the Certificate of Incorporation, dividends upon the shares of capital stock of the Corporation may be declared by the Board of Directors at any regular or special meeting of the Board of Directors. Dividends may be paid in cash,

in property or in shares of stock of the Corporation, unless otherwise provided by applicable law or the Certificate of Incorporation.

Section 6.05 Conflict with Applicable Law or Certificate of Incorporation. These bylaws are adopted subject to any applicable law and the Certificate of Incorporation. Whenever these bylaws may conflict with any applicable law or the Certificate of Incorporation, such conflict shall be resolved in favor of such law or the Certificate of Incorporation.

ARTICLE VII

INDEMNIFICATION

Section 7.01 Power to Indemnify in Actions, Suits or Proceedings Other Than Those by or in the Right of the Corporation. Subject to Section 7.03, the Corporation shall indemnify, to the fullest extent permitted by applicable law, any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of the Corporation), by reason of the fact that such person is or was a director or officer of the Corporation, or is or was a director or officer of the Corporation serving at the request of the Corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by such person in connection with such action, suit or proceeding if such person acted in good faith and in a manner such person reasonably believed to be in or not opposed to the best interests of the Corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe such person’s conduct was unlawful. The termination of any action, suit or proceeding by judgment, order, settlement, conviction, or upon a plea of nolo contendere or its equivalent, shall not, of itself, create a presumption that the person did not act in good faith and in a manner which such person reasonably believed to be in or not opposed to the best interests of the Corporation, and, with respect to any criminal action or proceeding, had reasonable cause to believe that such person’s conduct was unlawful.

Section 7.02 Power to Indemnify in Actions, Suit or Proceedings By or in the Right of the Corporation. Subject to Section 7.03, the Corporation shall indemnify, to the fullest extent permitted by applicable law, any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action or suit by or in the right of the Corporation to procure a judgment in its favor by reason of the fact that such person is or was a director or officer of the Corporation, or is or was a director or officer of the Corporation serving at the request of the Corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses (including attorneys’ fees) actually and reasonably incurred by such person in connection with the defense or settlement of such action or suit if such person acted in good faith and in a manner such person reasonably believed to be in or not opposed to the best interests of the Corporation; except that no indemnification shall be made in respect of any claim, issue or matter as to which such person shall have been adjudged to be liable to the Corporation unless and only to the extent that the Court of Chancery of the State of Delaware or the court in which such action or suit was brought shall determine upon application that, despite the adjudication of liability but in view of all the circumstances of the case, such person is fairly and reasonably entitled to indemnity for such expenses which the Court of Chancery or such other court shall deem proper.

Section 7.03 Authorization of Indemnification. Any indemnification under this Article VII (unless ordered by a court) shall be made by the Corporation only as authorized in the specific case upon a determination that indemnification of the present or former director or officer is proper in the circumstances because such person has met the applicable standard of conduct set forth in Section 7.01 or Section 7.02, as the case may be. Such determination shall be made, with respect to a person who is a director or officer at the time of such determination, (i) by a majority vote of the directors who are not parties to such action, suit or proceeding, even though less than a quorum, or (ii) by a committee of such directors designated by a majority vote of such directors, even though less than a quorum, or (iii) if there are no such directors, or if such directors so direct, by independent legal counsel in a written opinion, or (iv) by the stockholders. Such determination shall be made, with respect to former directors and officers, by any person or persons having the authority to act on the matter on behalf of the Corporation. To the extent, however, that a present or former director or officer of the Corporation has been successful on the merits or otherwise in defense of any action, suit or proceeding described above, or in defense of any claim, issue or matter therein, such person shall be indemnified against expenses (including attorneys’ fees) actually and reasonably incurred by such person in connection therewith, without the necessity of authorization in the specific case.

Section 7.04 Good Faith Defined. For purposes of any determination under Section 7.03, a person shall be deemed to have acted in good faith and in a manner such person reasonably believed to be in or not opposed to the best interests of the Corporation, or, with respect to any criminal action or proceeding, to have had no reasonable cause to believe such person’s conduct was unlawful, if such person’s action is based on the records or books of account of the Corporation or another enterprise, or on information supplied to such person by the officers of the Corporation or another enterprise in the course of their duties, or on the advice of legal counsel for the Corporation or another enterprise or on information or records given or reports made to the Corporation or another enterprise by an independent certified public accountant or by an appraiser or other expert selected with reasonable care by the Corporation or another enterprise. The provisions of this Section 7.04 shall not be deemed to be exclusive or to limit in any way the circumstances in which a person may be deemed to have met the applicable standard of conduct set forth in Section 7.01 or Section 7.02, as the case may be.

Section 7.05 Indemnification by a Court. Notwithstanding any contrary determination in the specific case under Section 7.03, and notwithstanding the absence of any determination thereunder, any director or officer may apply to the Court of Chancery of the State of Delaware or any other court of competent jurisdiction in the State of Delaware for indemnification (following the final disposition of such action, suit or proceeding) to the extent otherwise permissible under Section 7.01 or Section 7.02 or for advancement of expenses to the extent otherwise permissible under Section 7.06. The basis of such indemnification by a court shall be a determination by such court that indemnification of the director or officer is proper in the circumstances because such person has met the applicable standard of conduct set forth in Section 7.01 or Section 7.02, as the case may be. Neither a contrary determination in the specific case under Section 7.03 nor the absence of any determination thereunder shall be a defense to such application or create a presumption that the director or officer seeking indemnification has not met any applicable standard of conduct. Notice of any application for indemnification or advancement of expenses pursuant to this Section 7.05 shall be given to the Corporation promptly upon the filing of such application. If successful, in whole or in part, the director or officer seeking indemnification or advancement of expenses shall also be entitled to be paid the expense of prosecuting such application to the fullest extent permitted by applicable law.

Section 7.06 Expenses Payable in Advance. Expenses (including attorneys’ fees) incurred by a director or officer in defending any civil, criminal, administrative or investigative action, suit or proceeding shall, to the fullest extent not prohibited by applicable law, be paid by the Corporation in advance of the final disposition of such action, suit or proceeding upon receipt of an undertaking by or on behalf of such director or officer to repay such amount if it shall ultimately be determined that such person is not entitled to be indemnified by the Corporation as authorized in this Article VII. Such expenses (including attorneys’ fees) incurred by former directors and officers or other employees and agents may be so paid upon such terms and conditions, if any, as the Corporation deems appropriate.

Section 7.07 Nonexclusively of Indemnification and Advancement of Expenses. The indemnification and advancement of expenses provided by, or granted pursuant to, this Article VII shall not be deemed exclusive of any other rights to which those seeking indemnification or advancement of expenses may be entitled under the certificate of incorporation, these by-laws, agreement, vote of stockholders or disinterested directors or otherwise, both as to action in such person’s official capacity and as to action in another capacity while holding such office, it being the policy of the Corporation that indemnification of the persons specified in Section 7.01 and Section 7.02 shall be made to the fullest extent permitted by law. The provisions of this Article VII shall not be deemed to preclude the indemnification of any person who is not specified in Section 7.01 or Section 7.02 but whom the Corporation has the power or obligation to indemnify under the provisions of the General Corporation Law of the State of Delaware, or otherwise.

Section 7.08 Insurance. The Corporation may purchase and maintain insurance on behalf of any person who is or was a director or officer of the Corporation, or is or was a director or officer of the Corporation serving at the request of the Corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against any liability asserted against such person and incurred by such person in any such capacity, or arising out of such person’s status as such, whether or not the Corporation would have the power or the obligation to indemnify such person against such liability under the provisions of this Article VII.

Section 7.09 Certain Definitions. For purposes of this Article VII, references to “the Corporation” shall include, in addition to the resulting corporation, any constituent corporation (including any constituent of a constituent) absorbed in a consolidation or merger which, if its separate existence had continued, would have had power and authority to indemnify its directors or officers, so that any person who is or was a director or officer of such constituent corporation, or is or was a director or officer of such constituent corporation serving at the request of such constituent corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, shall stand in the same position under the provisions of this Article VII with respect to the resulting or surviving corporation as such person would have with respect to such constituent corporation if its separate existence had continued. The term “another enterprise” as used in this Article VII shall mean any other corporation or any partnership, joint venture, trust, employee benefit plan or other enterprise of which such person is or was serving at the request of the Corporation as a director, officer, employee or agent. For purposes of this Article VII, references to “fines” shall include any excise taxes assessed on a person with respect to an employee benefit plan; and references to “serving at the request of the Corporation” shall include any service as a director or officer of the Corporation which imposes duties on, or involves services by, such director or officer with respect to an employee benefit plan, its participants or beneficiaries; and a person who acted in good faith and in

a manner such person reasonably believed to be in the interest of the participants and beneficiaries of an employee benefit plan shall be deemed to have acted in a manner “not opposed to the best interests of the Corporation” as referred to in this Article VII.

Section 7.10 Survival of Indemnification and Advancement of Expenses. The indemnification and advancement of expenses provided by, or granted pursuant to, this Article VII shall, unless otherwise provided when authorized or ratified, continue as to a person who has ceased to be a director or officer and shall inure to the benefit of the heirs, executors and administrators of such a person.

Section 7.11 Limitation on Indemnification. Notwithstanding anything contained in this Article VII to the contrary, except for proceedings to enforce rights to indemnification and to advancement of expenses (which shall be governed by Section 7.05), the Corporation shall not be obligated to indemnify any director or officer (or his or her heirs, executors or personal or legal representatives) or advance expenses in connection with a proceeding (or part thereof) initiated by such person unless such proceeding (or part thereof) was authorized or consented to by the Board of Directors.

Section 7.12 Indemnification of Employees and Agents. The Corporation may, to the extent authorized from time to time by the Board of Directors, provide rights to indemnification and to the advancement of expenses to employees and agents of the Corporation similar to those conferred in this Article VII to directors and officers of the Corporation.

Section 7.13 Other Sources. The Corporation’s obligation, if any, to indemnify or to advance expenses to any director or officer who was or is serving at its request as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise shall be reduced by any amount such director of officer may collect as indemnification or advancement of expenses from such other corporation, partnership, joint venture, trust or other enterprise.

Section 7.14 Amendment or Repeal. Any right to indemnification or to advancement of expenses of any director or officer arising hereunder shall not be eliminated or impaired by an amendment to or repeal of these by-laws after the occurrence of the act or omission that is the subject of the action, suit or proceeding for which indemnification or advancement of expenses is sought.

ARTICLE VIII

AMENDMENTS

These bylaws may be amended, altered, changed, adopted and repealed or new bylaws adopted by the Board of Directors. The stockholders may make additional bylaws and may alter and repeal any bylaws whether such bylaws were originally adopted by them or otherwise only to the extent required or permitted by the Corporations’ Certificate of Incorporation.

CONFORMED COPY OF THE AMENDED AND RESTATED BYLAWS OF ADVANCED EMISSIONS SOLUTIONSARQ, INC., AS AMENDED

ARTICLE I

OFFICES

Section 1.01 Offices. Advanced Emissions SolutionsArq, Inc. (hereinafter called the “Corporation”) may have offices at such places, both within and without the State of Delaware, as the board of directors of the Corporation (the “Board of Directors”) from time to time shall determine or the business of the Corporation may require.

Section 1.02 Books and Records. Any records maintained by the Corporation in the regular course of its business, including its stock ledger, books of account and minute books, may be maintained on any information storage device or method so long as such records so kept can be converted into clearly legible paper form within a reasonable time. The Corporation shall so convert any records so kept upon the request of any person entitled to inspect such records pursuant to applicable law.

ARTICLE II

MEETINGS OF THE STOCKHOLDERS

Section 2.01 Place of Meetings. All meetings of the stockholders shall be held at such place, if any, either within or without the State of Delaware, as is designated from time to time by resolution of the Board of Directors and stated in the notice of meeting.

Section 2.02 Annual Meeting. The annual meeting of the stockholders for the election of directors and for the transaction of such other business as may properly come before the meeting shall be held at such date, time and place, if any, as are determined by the Board of Directors and stated in the notice of the meeting.

Section 2.03 Advance Notice of Stockholder Nominations and Proposals.

(a) Definitions.

“Affiliate or Associate” shall have the respective meanings ascribed to such terms in Rule 12b-2 of the General Rules and Regulations under the Securities Exchange Act of 1934, as in effect March 11, 2011.

“Exchange Act” means the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.

“Public Disclosure” or “Publicly Disclosed” means a disclosure made in a press release reported by the Dow Jones News Services, The Associated Press or a comparable national news service or in a document filed by the Corporation with the Securities and Exchange Commission pursuant to Section 13, 14 or 15(d) of the Exchange Act.

(b) Timely Notice. At a meeting of the stockholders, only such nominations of persons for the election of directors and such other business shall be conducted as have been properly brought before the meeting. To be properly brought before an annual meeting, nominations or such other business must be: (i) specified in the notice of meeting (or any supplement thereto) given by or at the direction

of the board of directors or any committee thereof, (ii) otherwise properly brought before the meeting by or at the direction of the board of directors or any committee thereof, or (iii) otherwise properly brought before an annual meeting by a stockholder who is a stockholder of record of the Corporation at the time such notice of meeting is delivered, who is entitled to vote at the meeting and who complies with the notice procedures set forth in this Section 2.03. In addition, any proposal of business (other than the nomination of persons for election to the board of directors, which shall be governed by Section 2.03(c) below) must be a proper matter for stockholder action. For business (including, but not limited to, director nominations) to be properly brought before an annual meeting by a stockholder, the stockholder or stockholders of record intending to propose the business (the “Proposing Stockholder”) must have given timely notice thereof pursuant to this Section 2.03(b) or Section 2.03(d) below, as applicable, in writing to the secretary of the Corporation even if such matter is already the subject of any notice to the stockholders or Public Disclosure from the board of directors. To be timely, a Proposing Stockholder’s notice must be delivered to or mailed and received at the principal executive offices of the Corporation in the case of an annual meeting of the stockholders, not less than one hundred twenty (120) calendar days in advance of the date specified in the Corporation’s proxy statement released to stockholders in connection with the previous year’s annual meeting of stockholders; provided, however, that if no annual meeting was held in the previous year or the date of the annual meeting has been changed by more than thirty (30) days from the date on which the previous year’s annual meeting was held, notice by the stockholder to be timely must be so received not later than the close of business on the later of one hundred twenty (120) calendar days in advance of such annual meeting or ten (10) calendar days following the date of Public Disclosure of the date of such meeting. In no event shall the Public Disclosure of an adjournment or postponement of an annual meeting commence a new notice time period (or extend any notice time period).

(c) Stockholder Nominations. For the nomination of any person or persons for election to the board of directors, a Proposing Stockholder’s notice to the secretary of the Corporation shall set forth (i) the name, age, business address and residence address of each nominee proposed in such notice, (ii) the principal occupation or employment of each such nominee, (iii) the number of shares of capital stock of the Corporation that are owned of record and beneficially by each such nominee (if any), (iv) such other information concerning each such nominee as would be required to be disclosed in a proxy statement soliciting proxies for the election of such nominee as a director in an election contest (even if an election contest is not involved) or that is otherwise required to be disclosed, under Section 14(a) of the Exchange Act and the rules and regulations promulgated thereunder, (v) the consent of the nominee to being named in the proxy statement as a nominee and to serving as a director if elected, and (vi) as to the Proposing Stockholder: (A) the name and address of the Proposing Stockholder as they appear on the Corporation’s books and of the beneficial owner, if any, on whose behalf the nomination is being made, (B) the class and number of shares of the Corporation that are owned by the Proposing Stockholder (beneficially and of record) and owned by the beneficial owner, if any, on whose behalf the nomination is being made, as of the date of the Proposing Stockholder’s notice, and a representation that the Proposing Stockholder will notify the Corporation in writing of the class and number of such shares owned of record and beneficially as of the record date for the meeting promptly following the later of the record date or the date notice of the record date is first Publicly Disclosed, (C) a description of any agreement, arrangement or understanding with respect to such nomination between or among the Proposing Stockholder and any of its Affiliates or Associates, and any others (including their names) acting in concert with any of the foregoing, and a representation that the