Adamas One Announces Closing of Initial Public Offering

December 14 2022 - 6:13PM

Adamas One Corp. (NasdaqCM: JEWL) (“Adamas One” or the

“Company”), The Original Lab-Grown Diamond Company ™, a high-tech

company that leverages proprietary technology to produce

high-quality, single-crystal, Lab-Grown Diamonds for jewelry and

diamond materials for industrial uses, today announced the closing

of its underwritten initial public offering of 2,450,000 shares of

common stock at the public offering price of $4.50 per share for

gross proceeds of $11,025,000, before underwriting discounts and

commissions and offering expenses. In addition, the Company has

granted the underwriters a 45-day option to purchase up to an

additional 367,500 shares of its common stock.

The shares began trading on The Nasdaq Capital

Market on December 9, 2022 under the ticker symbol "JEWL."

The Company intends to use the net proceeds of

this offering primarily for general corporate purposes, including

working capital, R&D, and operating expenses, which may include

debt repayment and capital expenditures.

Advisor Details

Alexander Capital, L.P. acted as sole

book-running manager for the offering. Greenberg Traurig, LLP and

Lucosky Brookman LLP served as co-counsel to Adamas. Carmel,

Milazzo & Feil LLP served as counsel to the underwriters.

The securities described above are being offered

by Adamas pursuant to a registration statement on Form S-1 (File

No. 333-265344) that was filed with and declared effective by the

U.S. Securities and Exchange Commission on November 14, 2022. The

offering is being made only by means of a prospectus forming a part

of the effective registration statement. A copy of the final

prospectus related to the offering may be obtained from Alexander

Capital, LP, 17 State Street 5th Floor, New York, NY 10004,

Attention: Equity Capital Markets, or by calling (212) 687-5650 or

emailing info@alexandercapitallp.com or by logging on to the SEC’s

website at www.sec.gov.

This press release does not constitute an offer

to sell or the solicitation of an offer to buy these securities,

and shall not constitute an offer, solicitation or sale in any

state or jurisdiction in which such offer, solicitation or sale

would be unlawful prior to registration or qualification under the

securities laws of that state or jurisdiction. Any offers,

solicitations or offers to buy, or any sales of securities will be

made in accordance with the registration requirements of the

Securities Act of 1933, as amended.

About Adamas One CorpAdamas is

a development stage lab-grown diamond manufacturer with nominal

revenues to date that produces near flawless single-crystal

diamonds for gemstone and industrial applications in its facilities

in Greenville, South Carolina. The Company holds 36 patents and

uses its proprietary chemical vapor deposition (CVD) to grow

gem-sized and smaller diamond crystals. Adamas One™ lab-grown

diamonds have the same physical, chemical and optical properties as

mined diamonds. The Company’s controlled manufacturing processes

enables it to produce very high-quality, high-purity,

single-crystal colorless, near colorless and fancy colored Type IIA

diamonds to suit a variety of industrial and gemstone applications.

The Company intends to market and sell its diamonds into the

wholesale jewelry and industrial markets. For more information,

visit www.adamasone.com.

Forward-Looking StatementsThis

press release includes statements that may be deemed to be

“forward-looking statements” under federal securities laws, and we

intend that such forward-looking statements be subject to the

safe-harbor created thereby. To the extent that the information

presented in this press release discusses financial projections,

information, or expectations about our business plans, results of

operations, products or markets, or otherwise makes statements

about future events, such statements are forward-looking. Such

forward-looking statements can be identified by the use of words

such as “should”, “may,” “intends,” “anticipates,” “believes,”

“estimates,” “projects,” “forecasts,” “expects,” “plans,” and

“proposes.” Specific forward-looking statements in this press

release include, among others, statements regarding the intended

use of the net proceeds of the offering. Although we believe that

the expectations reflected in these forward-looking statements are

based on reasonable assumptions, there are a number of risks and

uncertainties that could cause actual results to differ materially

from such forward-looking statements. You are urged to carefully

review and consider any cautionary statements and other

disclosures, including the statements made under the heading “Risk

Factors” and elsewhere in documents that we file from time to time

with the Securities and Exchange Commission. Forward-looking

statements speak only as of the date of the document in which they

are contained, and Adamas One Corp does not undertake any duty to

update any forward-looking statements except as may be required by

law. References and links to websites have been provided as a

convenience, and the information contained on such websites is not

incorporated by reference into this press release.

For more information contact:

Investor RelationsCORE IRScott Arnold, Managing

Partner(516) 222-2560ir@adamasone.com

Media RelationsJules Abraham(917) 885-7378

Source: Adamas One Corp

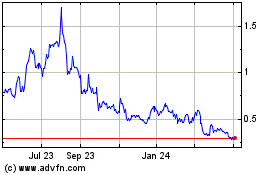

Adamas One (NASDAQ:JEWL)

Historical Stock Chart

From Oct 2024 to Nov 2024

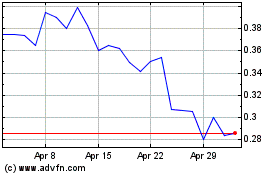

Adamas One (NASDAQ:JEWL)

Historical Stock Chart

From Nov 2023 to Nov 2024