Form 8-K - Current report

December 19 2024 - 4:13PM

Edgar (US Regulatory)

false000071557900007155792024-12-182024-12-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

______________

Date of Report (Date of earliest event reported): December 18, 2024

ACNB Corporation

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Pennsylvania | | 1-35015 | | 23-2233457 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | |

16 Lincoln Square, Gettysburg, PA | | 17325 |

| (Address of principal executive offices) | | (Zip Code) |

| | | | | | | | |

| 717.334.3161 | |

| (Registrant’s telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions (see General Instruction A.2. below):

X Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title Of Each Class | Trading Symbol(s) | Name Of Each Exchange On Which Registered |

| Common Stock, $2.50 par value per share | ACNB | The NASDAQ Stock Market, LLC |

CURRENT REPORT ON FORM 8-K

ITEM 5.07 Submission of Matters to a Vote of Security Holders

On December 18, 2024, ACNB Corporation (“ACNB”) held a Special Meeting of Shareholders (the “Special Meeting”). A total of 8,577,773 shares of ACNB’s common stock were entitled to vote as of October 21, 2024, the record date for the Special Meeting. There were 5,525,489 shares present virtually or by proxy which constituted a quorum at the Special Meeting, at which the shareholders were asked to vote on three (3) proposals. Set forth below are the matters acted upon by the shareholders at the Special Meeting, and the final voting results of each such proposal.

Proposal No. 1 – Approval of Issuance of Shares of ACNB Common Stock

The shareholders voted to approve the issuance of shares of ACNB common stock in connection with the merger of Traditions Bancorp, Inc. with and into ACNB South Acquisition Subsidiary, LLC, a wholly-owned subsidiary of ACNB, as contemplated by the Agreement and Plan of Reorganization, dated as of July 23, 2024, by and among ACNB, ACNB South Acquisition Subsidiary, LLC, ACNB Bank, Traditions Bancorp, Inc. and Traditions Bank. The results of the vote were as follows:

| | | | | | | | |

| For | Against | Abstain |

| 5,459,384 | 56,484 | 9,621 |

Proposal No. 2 – Adjournment or Postponement of Special Meeting

The shareholders voted to approve the proposal to adjourn or postpone the Special Meeting of Shareholders, if more time is needed, to allow ACNB to solicit additional votes in favor of issuance of shares of ACNB common stock in connection with the merger. The results of the vote were as follows:

| | | | | | | | |

| For | Against | Abstain |

| 5,096,245 | 382,451 | 46,793 |

Proposal No. 3 – To Transact Such Other Business

The shareholders voted to approve the transaction of such other business as may properly come before the Special Meeting of Shareholders. The results of the vote were as follows:

| | | | | | | | |

| For | Against | Abstain |

| 2,838,615 | 2,634,517 | 52,357 |

Given that Proposal No. 1 was approved and the adjournment or postponement of the Special Meeting was not necessary, and there was no other business properly presented to the Special Meeting, ACNB did not take action on Proposals No. 2 and 3.

ITEM 8.01 Other Events

On December 19, 2024, the Registrant issued a press release announcing the results of the Special Meeting of Shareholders. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

ITEM 9.01 Financial Statements and Exhibits

(d) Exhibits.

Exhibit Number Description

104 Cover Page Interactive Data File (embedded within the Inline XBRL document).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Current Report on Form 8-K to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | |

| | | ACNB CORPORATION (Registrant) |

| | | |

| Dated: | December 19, 2024 | | /s/ Kevin J. Hayes |

| | | Kevin J. Hayes |

| | | Senior Vice President/ |

| | | General Counsel, Secretary & Chief Governance Officer |

FOR IMMEDIATE RELEASE Contact: Kevin J. Hayes SVP/General Counsel, Secretary, and Chief Governance Officer 717.339.5085 khayes@acnb.com ACNB CORPORATION AND TRADITIONS BANCORP, INC. ANNOUNCE RECEIPT OF SHAREHOLDER APPROVALS FOR ACQUISITION GETTYSBURG, PA, December 19, 2024 --- ACNB Corporation (NASDAQ: ACNB) (“ACNB”), the parent financial holding company of ACNB Bank, a Pennsylvania state-chartered, FDIC insured community bank headquartered in Gettysburg, PA and Traditions Bancorp, Inc. (OTC Pink: TRBK) (“Traditions”) and its wholly-owned subsidiary, Traditions Bank, headquartered in York, PA are pleased to announce the receipt of each of their respective shareholder approvals for ACNB’s proposed acquisition of Traditions. At a special meeting of shareholders held on December 18, 2024, ACNB shareholders approved the issuance of shares of ACNB common stock to Traditions shareholders as part of the acquisition pursuant to an Agreement and Plan of Reorganization dated July 23, 2024 (the “Agreement”). At a separate special meeting of shareholders held the same day, Traditions shareholders overwhelmingly approved and adopted the Agreement and the merger of Traditions with and into an acquisition subsidiary of ACNB Corporation, with the approval of 99.5% of the 85.1% of outstanding Traditions shares that were voted.". James P. Helt, President and CEO of ACNB Corporation commented, “We are thrilled to announce that our shareholders have approved our issuance of common stock for this momentous transaction, marking the beginning of an exciting new chapter for our company. This strategic acquisition will allow us to leverage our combined strengths, enhance innovation and deliver even greater value to our customers, shareholders, employees alike.”

ACNB CORPORATION Press Release/ACNB Corporation Receives Shareholder Approval to Acquire Traditions Bancorp, Inc. December 19, 2024 Page 2 of 3 Eugene J. Draganosky, Chair of the Board & Chief Executive Officer of Traditions commented, “Today’s approval by our shareholders underscores the confidence they have in the long-term potential of this partnership. Together, we are building a stronger, more resilient community bank poised to lead in a rapidly evolving industry. We are excited about the future and the opportunities this transaction will create.” The acquisition and related transactions with the companies’ banking subsidiaries are expected to close with an effective date of February 1, 2025, subject to fulfilment of other customary closing conditions. # # # About ACNB Corporation ACNB Corporation, headquartered in Gettysburg, PA, is the independent $2.42 billion financial holding company for the wholly-owned subsidiaries of ACNB Bank, Gettysburg, PA, and ACNB Insurance Services, Inc., Westminster, MD. Originally founded in 1857, ACNB Bank serves its marketplace with banking and wealth management services, including trust and retail brokerage, via a network of 27 community banking offices and two loan offices located in the Pennsylvania counties of Adams, Cumberland, Franklin, Lancaster and York and the Maryland counties of Baltimore, Carroll and Frederick. ACNB Insurance Services, Inc. is a full-service insurance agency with licenses in 46 states. The agency offers a broad range of property, casualty, health, life and disability insurance serving personal and commercial clients through office locations in Westminster and Jarrettsville, MD, and Gettysburg, PA. About Traditions Bancorp, Inc. Traditions Bancorp, Inc. is the holding company for Traditions Bank, a PA state-chartered community bank with its Administrative Headquarters located at 226 Pauline Drive in York, PA. As of September 30, 2024, assets stood at $859 million. Following a strong set of Core Values, Traditions Bank is committed to providing creative solutions and personalized experiences that foster successful business and personal relationships. With six retail branches in York County, two retail branches in Lancaster County, and a loan production office in Cumberland County, plus extensive technology-based delivery channels, Traditions Bank offers exquisite customer service in the areas of Personal Banking, Commercial Banking, and Residential Mortgage Services. Caution Regarding Forward-Looking Statements The information presented herein may contain forward-looking statements. These forward-looking statements include, but are not limited to, statements about (i) the benefits of the proposed merger between ACNB and Traditions, (ii) ACNB’s and Traditions’s plans, obligations, expectations and intentions, and

ACNB CORPORATION Press Release/ACNB Corporation Receives Shareholder Approval to Acquire Traditions Bancorp, Inc. December 19, 2024 Page 3 of 3 (iii) other statements presented herein that are not historical facts. Words such as “anticipates”, “believes”, “intends”, “should”, “expects”, “will” and variations of similar expressions are intended to identify forward- looking statements. These statements are based on the beliefs of the respective managements of ACNB and Traditions as to the expected outcome of future events and are not guarantees of future performance. These statements involve certain risks, uncertainties and assumptions that are difficult to predict with regard to timing, extent, and degree of occurrence. Results and outcomes may differ materially from what may be expressed or forecasted in forward-looking statements. Factors that could cause results and outcomes to differ materially include, among others, the ability to obtain required Traditions and ACNB shareholder approvals and meet other closing conditions to the transaction; the ability to complete the merger as expected and within the expected timeframe; disruptions to customer and employee relationships and business operations caused by the merger; the ability to implement integration plans associated with the transaction, which integration may be more difficult, time-consuming or costly than expected; the ability to achieve the cost savings and synergies contemplated by the merger within the expected timeframe, or at all; changes in local and national economies, or market conditions; changes in interest rates; regulations and accounting principles; changes in policies or guidelines; loan demand and asset quality, including real estate values and collateral values; deposit flow; the impact of competition from traditional or new sources; and, the other factors detailed in ACNB’s publicly-filed documents, including its Annual Report on Form 10-K for the year ended December 31, 2023, Quarterly Reports on Form 10-Q for the quarters ended March 31, 2024, June 30, 2024 and September 30, 2024, and its other filings with the SEC. The forward-looking statements only speak as of the date hereof. ACNB and Traditions assume no obligation to revise, update or clarify forward-looking statements to reflect events or conditions after the date of this press release. ACNB #2024-19 December 19, 2024

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

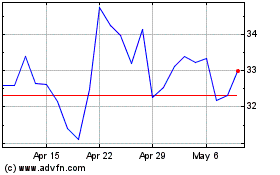

ACNB (NASDAQ:ACNB)

Historical Stock Chart

From Nov 2024 to Dec 2024

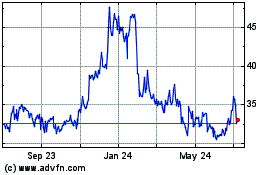

ACNB (NASDAQ:ACNB)

Historical Stock Chart

From Dec 2023 to Dec 2024