UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d)

of the Securities

Exchange Act of 1934

Date of

Report (Date of earliest event reported): December 12, 2024

ACNB Corporation

(Exact name of Registrant

as specified in its charter)

| Pennsylvania |

|

1-35015 |

|

23-2233457 |

(State

or other

jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

| 16

Lincoln Square, Gettysburg,

PA |

|

17325 |

| (Address of principal executive offices) |

|

(Zip Code) |

717.334.3161

(Registrant’s

telephone number, including area code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions (see

General Instruction A.2. below):

| x | Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

Of Each Class |

Trading

Symbol(s) |

Name

Of Each Exchange On Which Registered |

| Common Stock, $2.50 par value per share |

ACNB |

The NASDAQ Stock Market, LLC |

Indicate by check mark whether the Registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging

growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

CURRENT REPORT ON FORM 8-K

As previously announced, on July 23, 2024, ACNB

Corporation (“ACNB”) and, its wholly-owned subsidiaries, ACNB Bank and ACNB South Acquisition Subsidiary, LLC (“Acquisition

Subsidiary”) and Traditions Bancorp, Inc. (“Traditions”) and Traditions Bank entered into an Agreement and Plan of Reorganization

(the “Agreement”) which provides that, subject to the terms and conditions set forth in the Agreement, Traditions will merge

with and into Acquisition Subsidiary with Acquisition Subsidiary surviving the merger. In addition, as soon as practicable after the merger

of Traditions with and into Acquisition Subsidiary, Traditions Bank will merge with and into ACNB Bank.

The transaction is described in the joint proxy

statement/prospectus, which forms a part of a registration statement on Form S-4 that was filed by ACNB with the Securities and Exchange

Commission (the “SEC”) on September 30, 2024, and amended on October 23, 2024 (the “joint proxy statement/prospectus”)

with respect to special meetings of ACNB and Traditions shareholders scheduled to be held on December 18, 2024, respectively. On or about

November 1, 2024, ACNB and Traditions mailed the joint proxy statement/prospectus to their respective shareholders. In connection with

the transaction, from October 9, 2024 to December 11, 2024, ACNB received five demand letters and Traditions received two demand letters

from purported ACNB and Traditions shareholders (collectively, the “Demand Letters”), alleging that the joint proxy statement/prospectus

fails to disclose material information regarding the transaction in violation of federal securities laws and seeking additional disclosures

in an amendment or supplement to the joint proxy statement/prospectus. It is possible that additional demand letters may be received arising

from the transaction between December 11, 2024 and the consummation of the transaction. Absent new or significantly different allegations,

ACNB and Traditions will not necessarily disclose such additional demand letters. ACNB and Traditions believe that the demands for supplemental

corrective and/or additional disclosure in the Demand Letters are entirely without merit and that no further disclosure is required by

applicable rule, statute, regulation or law beyond that already contained in the joint proxy statement/prospectus. However, in order to

avoid nuisance, cost, and distraction, and to avoid the risk that the Demand Letters and the demands therein may delay or otherwise adversely

affect the consummation of the transaction and to minimize the expense of defending any potential lawsuit that may arise as a result of

the Demand Letters, ACNB and Traditions have determined that they will voluntarily make certain additional disclosures (the “Supplemental

Disclosures”) to supplement the disclosures contained in the joint proxy statement/prospectus.

ACNB, the ACNB board of directors, Traditions,

and the Traditions board of directors deny any liability or wrongdoing in connection with the joint proxy statement/prospectus, and none

of the Supplemental Disclosures nor any other disclosure in this Current Report on Form 8-K should be construed as an admission of the

legal necessity or materiality under applicable laws of any Supplemental Disclosures. This decision to make the Supplemental Disclosures

will not affect the merger consideration to be paid in connection with the transaction or the timing of the special meetings of ACNB’s

shareholders and Traditions’ shareholders. The Supplemental Disclosures are included below and should be read in conjunction with

the joint proxy statement/prospectus.

Supplemental Disclosures to the Joint Proxy

Statement/Prospectus

The disclosure in the joint proxy statement/prospectus

under the heading “Proposal 1: The Issuance of Shares of ACNB Common Stock and the Merger – Background of the Merger”

is hereby supplemented by expanding the existing disclosure regarding the engagement of Piper Sandler & Co. by inserting the following

sentence after seventh full paragraph on page 55 of the joint proxy statement/prospectus:

Pursuant to the engagement agreement with Piper

Sandler, ACNB agreed to pay Piper Sandler an advisory fee equal to $725,000, $100,000 of which became payable upon the execution of the

reorganization agreement and the balance of which is contingent upon the consummation of the merger. If Piper Sandler is asked by ACNB

to render a fairness opinion in connection with the merger, ACNB shall pay Piper Sandler a fee in an amount equal to $250,000 payable

at the time such fairness opinion is rendered. Piper Sandler has not been asked and will not be asked to render a fairness opinion in

connection with the merger. ACNB also agreed to reimburse Piper Sandler for reasonable out-of-pocket expenses and disbursements incurred

in connection with its engagement up to a maximum of $15,000 and to indemnify Piper Sandler against certain liabilities relating to or

arising out of Piper Sandler 's engagement or Piper Sandler 's role in connection therewith.

Piper Sandler did not provide any investment banking services to Traditions

during the two years prior to announcement of the merger for which compensation was received or was intended to be received as a result

of the relationship between Piper Sandler, on the one hand, and Traditions, on the other hand. Except as already disclosed in this joint

proxy statement/prospectus, Piper Sandler did not provide any other investment banking services to ACNB during the two years prior to

announcement of the merger for which compensation was received or was intended to be received as a result of the relationship between

Piper Sandler, on the one hand, and ACNB, on the other hand. Piper Sandler may provide investment banking services to ACNB in the future,

although there is currently no agreement to do so. In addition, in the ordinary course of Piper Sandler’s business as a broker-dealer,

Piper Sandler may purchase securities from and sell securities to ACNB and Traditions. Piper Sandler may also actively trade the equity

and debt securities of ACNB and Traditions for its own account and for the accounts of Piper Sandler’s customers.

The disclosure in the joint proxy statement/prospectus

under the heading “Proposal 1: The Issuance of Shares of ACNB Common Stock and the Merger – Certain Unaudited Prospective

Financial Information” is hereby amended by adding the following paragraphs after the second full paragraph on page 62 of the joint

proxy statement/prospectus and replacing it with the following:

Prospective Financial Information Regarding Traditions and Combined

Company Pro Forma Projections

The following tables present select unaudited financial

forecasts for Traditions and pro forma financial forecasts for the combined company following the merger for the fiscal years ended December

31, 2024 through December 31, 2029 prepared by ACNB with the assistance of Hovde and considered by Hovde for the purpose of preparing

its fairness opinion to ACNB’s board of directors as described in this joint proxy statement/prospectus.

Financial Forecast for Traditions

| | |

6 Months Ended | | |

Full Year Projections Ended | |

| | |

To Year End | | |

| | |

| | |

| | |

| | |

| |

| | |

12/31/2024 | | |

12/31/2025 | | |

12/31/2026 | | |

12/31/2027 | | |

12/31/2028 | | |

12/31/2029 | |

| Net Income ($000s) | |

$ | 2,217 | | |

$ | 5,670 | | |

$ | 5,954 | | |

$ | 6,251 | | |

$ | 6,564 | | |

$ | 6,892 | |

| Earnings Per Share | |

$ | 0.81 | | |

$ | 2.06 | | |

$ | 2.16 | | |

$ | 2.27 | | |

$ | 2.38 | | |

$ | 2.50 | |

| Tangible Assets ($000s) | |

$ | 849,145 | | |

$ | 893,466 | | |

$ | 939,995 | | |

$ | 988,845 | | |

$ | 1,040,134 | | |

$ | 1,093,988 | |

Pro Forma Financial Forecast for Combined Company

| | |

6

Months Ended | | |

Full Year Projections Ended | |

| | |

To Year End | | |

| | |

| | |

| | |

| | |

| |

| | |

12/31/2024 | | |

12/31/2025 | | |

12/31/2026 | | |

12/31/2027 | | |

12/31/2028 | | |

12/31/2029 | |

| Net Income ($000s) | |

| | | |

$ | 44,971 | | |

$ | 47,309 | | |

$ | 46,700 | | |

$ | 47,411 | | |

$ | 48,019 | |

| Earnings Per Share | |

| | | |

$ | 4.27 | | |

$ | 4.49 | | |

$ | 4.44 | | |

$ | 4.50 | | |

$ | 4.56 | |

| Tangible Assets ($000s) | |

$ | 3,259,589 | | |

$ | 3,378,469 | | |

$ | 3,501,688 | | |

$ | 3,626,375 | | |

$ | 3,753,933 | | |

$ | 3,884,343 | |

The disclosure in the joint proxy statement/prospectus

under the heading “Proposal 1: The Issuance of Shares of ACNB Common Stock and the Merger – Opinion of ACNB’s Financial

Advisor” is hereby amended by deleting the second full paragraph on page 67 of the joint proxy statement/prospectus and replacing

it with the following:

ACNB engaged Hovde on June 24, 2024 to issue an

opinion to ACNB's board of directors in connection with the proposed merger. Pursuant to ACNB's engagement agreement with Hovde, Hovde

received from ACNB an opinion fee of $250,000 upon the delivery of the opinion to ACNB. Additionally, ACNB has agreed to reimburse Hovde

for certain of its reasonable out-of-pocket expenses and has agreed to indemnify Hovde and its affiliates for certain liabilities that

may arise out of Hovde's engagement. Other than the compensation described above, Hovde will receive no additional compensation in connection

with the merger including compensation that is contingent upon consummation of the merger.

The disclosure in the joint proxy statement/prospectus

under the heading “Proposal 1: The Issuance of Shares of ACNB Common Stock and the Merger – Opinion of ACNB’s Financial

Advisor – Comparable Public Companies Analyses” is hereby amended by deleting the list of Traditions Peer Group following

the first paragraph of this subsection on page 71 of the joint proxy statement/prospectus and replacing it with the following:

| | |

Price / TBV(1) (%) | | |

Price /

LTM(2) EPS

(x) | | |

Price /

LQA(3) EPS

(x) | | |

Core Deposit

Premium

(%) | |

| Solvay Bank Corp | |

| 77.8 | | |

| 11.0 | | |

| 9.48 | | |

| -2.04 | |

| Community Heritage Financial, Inc. | |

| 73.9 | | |

| 12.2 | | |

| 9.38 | | |

| -2.28 | |

| Dimeco, Inc. | |

| 92.6 | | |

| 8.59 | | |

| 9.72 | | |

| -1.12 | |

| JBT Bancorp, Inc. | |

| 71.4 | | |

| 7.88 | | |

| 11.3 | | |

| -3.90 | |

| Ballston Spa Bancorp, Inc. | |

| 68.1 | | |

| 8.74 | | |

| 8.18 | | |

| -2.75 | |

| 1st Colonial Bancorp, Inc. | |

| 108.9 | | |

| 10.3 | | |

| 12.5 | | |

| 1.00 | |

| Farmers and Merchants Bancshares, Inc. | |

| 101.5 | | |

| 8.15 | | |

| 9.62 | | |

| 0.14 | |

| National Capital Bancorp, Inc. | |

| 96.9 | | |

| 11.4 | | |

| 11.2 | | |

| -0.34 | |

| Harford Bank | |

| 81.0 | | |

| 7.59 | | |

| 7.71 | | |

| -2.49 | |

| First Resource Bancorp, Inc. | |

| 84.1 | | |

| 6.65 | | |

| 7.50 | | |

| -1.84 | |

| Mifflinburg Bancorp, Inc. | |

| 66.9 | | |

| 8.93 | | |

| 6.85 | | |

| -4.63 | |

| (1) | Tangible book value (TBV) |

| (2) | Last twelve months (LTM) |

| (3) | Last quarter annualized (LQA) |

The disclosure in the joint proxy statement/prospectus

under the heading “Proposal 1: The Issuance of Shares of ACNB Common Stock and the Merger – Opinion of ACNB’s Financial

Advisor – Comparable Public Companies Analyses” is hereby amended by deleting the list of ACNB Peer Group following the first

full paragraph on page 72 of the joint proxy statement/prospectus and replacing it with the following:

| | |

Price / TBV

(%) | | |

Price / LTM

EPS (x) | | |

Price / 2024E

EPS (x) | | |

Price / 2025E

EPS (x) | | |

Core Deposit

Premium

(%) | |

| Citizens Financial Services, Inc. | |

| 123.3 | | |

| 13.8 | | |

| 9.26 | | |

| 7.84 | | |

| 2.17 | |

| LINKBANCORP, Inc. | |

| 142.6 | | |

| NM | | |

| 9.77 | | |

| 8.59 | | |

| 4.20 | |

| Unity Bancorp, Inc. | |

| 130.0 | | |

| 9.04 | | |

| 9.18 | | |

| 8.06 | | |

| 4.70 | |

| Citizens & Northern Corporation | |

| 143.7 | | |

| 12.7 | | |

| 12.0 | | |

| 10.8 | | |

| 5.02 | |

| Fidelity D & D Bancorp, Inc. | |

| 185.5 | | |

| 19.5 | | |

| -- | | |

| -- | | |

| 7.20 | |

| Orange County Bancorp, Inc. | |

| 202.6 | | |

| 9.21 | | |

| 10.8 | | |

| 10.3 | | |

| 7.85 | |

| Capital Bancorp, Inc. | |

| 125.5 | | |

| 10.0 | | |

| 9.81 | | |

| 7.73 | | |

| 3.77 | |

| Norwood Financial Corp. | |

| 147.2 | | |

| 14.4 | | |

| -- | | |

| -- | | |

| 5.48 | |

| ESSA Bancorp, Inc. | |

| 95.2 | | |

| 10.6 | | |

| 10.9 | | |

| 10.2 | | |

| -0.82 | |

| Parke Bancorp, Inc. | |

| 75.4 | | |

| 9.41 | | |

| -- | | |

| -- | | |

| -6.13 | |

The disclosure in the joint proxy statement/prospectus

under the heading “Proposal 1: The Issuance of Shares of ACNB Common Stock and the Merger – Opinion of ACNB’s Financial

Advisor – Comparable Precedent Transactions Analyses” is hereby amended by deleting the lists of transactions following the

first full paragraph on page 73 of the joint proxy statement/prospectus and replacing it with the following:

Comparable Precedent Transactions Analyses

– Regional Group

| Buyer / Target | |

Closing Date | |

Deal Value

($MM) | |

Price /

Tangible

Book (%) | |

Core Deposit

Premium

(%) | |

Price / LTM

EPS (x) | |

Market

Premium

(%) | |

| NexTier Incorporated/Mars Bancorp, Inc. | |

2/16/2024 | |

32.0 | |

128.4 | |

1.7 | |

20.2 | |

53.3 | |

| Summit Financial Group/PBS Holding Corp. | |

4/1/2023 | |

52.8 | |

135.0 | |

3.2 | |

12.1 | |

34.8 | |

| Citizens Financial Services, Inc./HV Bancorp, Inc. | |

6/16/2023 | |

67.5 | |

155.0 | |

5.7 | |

21.8 | |

42.6 | |

| First Commonwealth Financial Corporation/Centric Financial Corporation | |

1/31/2023 | |

137.5 | |

131.5 | |

4.8 | |

14.8 | |

42.5 | |

| Farmers National Banc Corp/Emclaire Financial Corp | |

1/1/2023 | |

106.8 | |

142.1 | |

4.1 | |

10.4 | |

29.7 | |

| Fulton Financial Corporation/Prudential Bancorp, Inc. | |

7/1/2022 | |

138.3 | |

103.9 | |

1.7 | |

17.9 | |

21.1 | |

| Community Bank System, Inc./Elmira Savings Bank | |

5/13/2022 | |

82.8 | |

160.7 | |

7.0 | |

15.0 | |

73.2 | |

| Mid Penn Bancorp, Inc./Riverview Financial Corporation | |

11/30/2021 | |

124.8 | |

121.0 | |

2.3 | |

12.2 | |

11.6 | |

| Shore Bancshares, Inc./Severn Bancorp, Inc. | |

10/31/2021 | |

146.2 | |

133.7 | |

5.5 | |

21.7 | |

39.5 | |

| Dollar Mutual Bancorp/Standard AVB Financial Corp | |

5/28/2021 | |

161.3 | |

133.4 | |

6.8 | |

22.5 | |

75.9 | |

Comparable Precedent Transactions Analyses

– Nationwide Group

| Buyer / Target | |

Closing Date | |

Deal Value

($MM) | |

Price /

Tangible

Book (%) | |

Core Deposit

Premium (%) | |

Price / LTM

EPS (x) | |

Market

Premium (%) | |

| CBC Bancorp/Bay Community Bancorp | |

11/1/2024 | |

126.1 | |

157.9 | |

9.8 | |

15.4 | |

83.0 | |

| Alerus Financial Corporation/HMN Financial, Inc. | |

10/9/2024 | |

115.5 | |

106.8 | |

0.8 | |

20.1 | |

32.6 | |

| Business First Bancshares, Inc./Oakwood Bancshares, Inc. | |

10/1/2024 | |

87.6 | |

121.2 | |

3.1 | |

19.8 | |

NA | |

| Dogwood State Bank/Community First Bancorporation | |

8/1/2024 | |

57.9 | |

110.0 | |

1.2 | |

13.7 | |

46.7 | |

| Glacier Bancorp, Inc./Community Financial Group, Inc. (Spokane, WA) | |

1/31/2024 | |

80.6 | |

164.9 | |

5.6 | |

10.7 | |

147.6 | |

| Summit Financial Group, Inc./PSB Holding Corp. | |

4/1/2023 | |

52.8 | |

135.0 | |

3.2 | |

12.1 | |

34.8 | |

| Citizens Financial Services, Inc./HV Bancorp, Inc. | |

6/16/2023 | |

67.5 | |

155.0 | |

5.7 | |

21.8 | |

42.6 | |

| Southern Missouri Bancorp, Inc./Citizens Bancshares Co. | |

1/20/2023 | |

150.1 | |

163.6 | |

7.1 | |

29.5 | |

NA | |

| First Commonwealth Financial Corporation/Centric Financial Corporation | |

1/31/2023 | |

137.5 | |

131.5 | |

4.8 | |

14.8 | |

42.5 | |

| CrossFirst Bankshares, Inc./Farmers & Stockmens Bank | |

11/22/2022 | |

75.0 | |

165.4 | |

6.0 | |

26.5 | |

NA | |

| Seacoast Banking Corporation of Florida/Apollo Bancshares, Inc./Apollo Bank | |

10/7/2022 | |

168.3 | |

194.7 | |

9.7 | |

20.0 | |

NA | |

| Farmers National Banc Corp./Emclaire Financial Corp | |

1/1/2023 | |

106.8 | |

142.1 | |

4.1 | |

10.4 | |

29.7 | |

| BAWAG Group AG/Peak Bancorp Inc. | |

11/30/2023 | |

64.4 | |

151.1 | |

4.9 | |

11.2 | |

52.9 | |

| Bank First Corporation/Denmark Bancshares, Inc. | |

8/12/2022 | |

118.0 | |

170.5 | |

8.8 | |

18.1 | |

56.9 | |

The disclosure in the joint proxy statement/prospectus

under the heading “Proposal 1: The Issuance of Shares of ACNB Common Stock and the Merger – Opinion of ACNB’s Financial

Advisor – Discount Cash Flow Analyses – Traditions Dividend Discount Analysis” is hereby amended by deleting the first

two paragraphs of this subsection starting on page 74 of the joint proxy statement/prospectus and replacing them with the following paragraphs:

Traditions Dividend

Discount Analyses. Hovde performed two discounted cash flow analyses to estimate a range of implied values per share for Traditions

based upon the discounted net present value of the projected after-tax free cash flows for Traditions. The first discounted cash flow

analysis was performed based upon Traditions operating on a standalone basis. The second discounted cash flow analysis took into account

transaction synergies related to the proposed merger, including, without limitation, cost savings, related expenses and other adjustments

provided by ACNB management. Hovde utilized net income and balance sheet projections for Traditions that were based on guidance from ACNB

management for a forward looking five and a half year period and which formed the basis for the discounted cash flow analyses. The resulting

projections estimated Traditions' standalone net income for the analysis to be $2.2 million for the second half of 2024, $5.7 million

for 2025, $6.0 million for 2026, $6.3 million for 2027, $6.6 million for 2028 and $6.9 million for 2029. Traditions' standalone total

assets were projected based upon an annual growth rate of 5% per guidance provided by ACNB management. Traditions’ standalone

earnings were projected based on ACNB management estimates through 2024 and 5% annual growth thereafter (2024

estimated net income of $5.4 million). For the standalone analysis and transaction synergies analysis, Hovde assumed Traditions’

minimum tangible common equity/tangible assets threshold of 8.00%, pre-tax cost of cash of 5.00% and marginal tax rate of 22.7%. For the

transaction synergies analysis, Hovde also assumed 35% cost savings (phased in 75% in 2025 and 100% thereafter), $14.8 million of after-tax

merger charges and a $2.7 million after-tax net credit mark.

To determine the net present values of Traditions

based on the projections utilized for the standalone analysis and the transaction synergies analysis, utilizing industry norms, Hovde

projected the amount of after-tax free cash flow for Traditions assuming annual dividend payments for excess capital above a tangible

common equity to tangible assets ratio of 8.00% from December 2024 to December 2029. Hovde also applied a terminal value to Traditions'

adjusted net income in 2029 assuming a three-point range of price-to-earnings multiples from 8.0x to 10.0x. The range of terminal values

of Traditions in the standalone analysis was $52.3 million to $65.4 million (with a midpoint of $58.9 million) based on adjusted net income

of $6.5 million. The range of terminal values of Traditions in the transaction synergies analysis was $113.7 million to $142.2 million

(with a midpoint of $128.0 million) based on adjusted net income of $14.2 million. Hovde also utilized the following projections:

| (dollars in thousands) | |

12/31/2024 | | |

12/31/2025 | | |

12/31/2026 | | |

12/31/2027 | | |

12/31/2028 | | |

12/31/2019 | |

| Standalone: After-Tax Free Cash Flow Available for Dividends | |

$ | 427 | | |

$ | 2,108 | | |

$ | 2,133 | | |

$ | 2,163 | | |

$ | 2,197 | | |

$ | 2,235 | |

| Transaction Synergies: After-Tax Free Cash Flow Available for Dividends | |

($ | 2,079 | ) | |

$ | 6,889 | | |

$ | 8,785 | | |

$ | 9,139 | | |

$ | 9,514 | | |

$ | 9,910 | |

For the standalone analysis, the present values of the after-tax cash

flows and terminal value of Traditions was then calculated assuming a range of discount rates between 12.65% and 14.65%, with a midpoint

of 13.65%. For the analysis with transaction synergies, the same calculations were performed utilizing a range of discount rates between

9.95% and 11.95%, with a midpoint of 10.95%. These discount rate ranges were chosen to reflect different assumptions regarding the required

rates of return of holders or prospective holders of Traditions' common stock (standalone analysis) and ACNB's common stock (transaction

synergies analysis). In each case, the range of discount rates utilized the build-up method to determine such required rates of return

and was based upon the risk-free interest rate, an equity risk premium, an industry risk premium and a size premium which resulted in

the aforementioned midpoints of the respective ranges. For the standalone discount rate, Hovde utilized the following information sourced

from Kroll Cost of Capital Navigator: risk free rate of 3.50%, equity risk premium of 5.00%, industry risk premium of 0.45%, and size

premium (based on market value) of 4.70%, with the sum of these inputs resulting in the discount rate of 13.65% that was utilized as the

midpoint of a range of discount rates from 12.65% to 14.65%. For the synergies discount rate, Hovde utilized the following information

sourced from Kroll Cost of Capital Navigator: risk free rate of 3.50%, equity risk premium of 5.00%, industry risk premium of 0.45%, and

size premium (based on market value) of 1.99%, with the sum of these inputs resulting in a discount rate of 10.94%, which was rounded

to 10.95% and utilized as the midpoint of a range of discount rates from 9.95% to 11.95%.

The disclosure in the joint proxy statement/prospectus

under the heading “Proposal 1: The Issuance of Shares of ACNB Common Stock and the Merger – Opinion of ACNB’s Financial

Advisor – Discount Cash Flow Analyses – ACNB Dividend Discount Analysis” is hereby amended by deleting the last two

paragraphs on page 75 of the joint proxy statement/prospectus and replacing them with the following paragraphs:

ACNB Dividend Discount

Analyses. Hovde performed two discounted cash flow analyses to estimate a range of implied values per share for ACNB based upon the

discounted net present value of the projected after-tax free cash flows for ACNB. The first discounted cash flow analysis was performed

based upon ACNB operating on a standalone basis. The second discounted cash flow analysis took into account transaction synergies related

to the proposed merger, including, without limitation, cost savings, related expenses and other adjustments provided by ACNB management.

Hovde utilized median consensus research analyst estimates sourced from S&P Capital IQ Pro for ACNB's net income projections for 2024

of $31.8 million and 2025 of $28.2 million. Based on guidance provided by ACNB management, Hovde utilized an annual growth rate of 5%

to project ACNB's 2026 to 2029 net income and an annual growth rate of 3% to project ACNB's total assets for the forward looking five

and a half year period which formed the basis for the discounted cash flow analyses. The resulting projections estimated ACNB's standalone

net income for the analysis to be $13.8 million for the second half of 2024, $28.2 million for 2025, $29.7 million for 2026, $31.1 million

for 2027, $32.7 million for 2028 and $34.3 million for 2029. For the standalone analysis and transaction synergies analysis, Hovde assumed

a minimum tangible common equity/tangible assets threshold of 8.00%, pre-tax cost of cash of 5.00% and

marginal tax rate of 22.7%. For the transaction synergies analysis, Hovde combined the projections from the TRBK standalone analysis and

the ACNB standalone analysis, and made for pro forma adjustments based on assumptions related to the proposed merger, including, without

limitation, 35% cost savings (phased in 75% in 2025 and 100% thereafter), $14.8 million of after-tax merger charges, and purchase accounting

and other adjustments, each of which were provided by, or developed based on guidance from, ACNB management and its advisers.

To determine the net present values of ACNB based

on the projections utilized for the standalone analysis and the transaction synergies analysis, utilizing industry norms, Hovde projected

the amount of after-tax free cash flow for ACNB assuming annual dividend payments for excess capital above a tangible common equity to

tangible assets ratio of 8.00% from December 2024 to December 2029. Hovde also applied a terminal value to ACNB' adjusted net income in

2029 assuming a three-point range of price-to-earnings multiples from 10.0x to 12.0x. The range of terminal values of ACNB in the standalone

analysis was $291.0 million to $349.2 million (with a midpoint of $320.1 million) based on adjusted net income of $29.1 million. The range

of terminal values of ACNB in the transaction synergies analysis was $416.7 million to $500.0 million (with a midpoint of $458.3 million)

based on adjusted net income of $41.7 million. Hovde also utilized the following projections:

| (dollars in thousands) | |

12/31/2024 | | |

12/31/2025 | | |

12/31/2026 | | |

12/31/2027 | | |

12/31/2028 | | |

12/31/2019 | |

| Standalone: After-Tax Free Cash Flow Available for Dividends | |

$ | 50,040 | | |

$ | 20,862 | | |

$ | 21,128 | | |

$ | 21,409 | | |

$ | 21,743 | | |

$ | 22,277 | |

| Transaction Synergies: After-Tax Free Cash Flow Available for Dividends | |

$ | 14,472 | | |

$ | 39,112 | | |

$ | 39,171 | | |

$ | 36,474 | | |

$ | 35,090 | | |

$ | 33,804 | |

For both analyses, the present values of the after-tax cash flows and

terminal value of ACNB was then calculated assuming a range of discount rates between 9.95% and 11.95%, with a midpoint of 10.95%. This

discount rate range was chosen to reflect different assumptions regarding the required rates of return of holders or prospective holders

of ACNB's common stock. The range of discount rates utilized the build-up method to determine such required rate of return based upon

the risk-free interest rate, an equity risk premium, an industry risk premium and a size premium which resulted in the aforementioned

midpoint of the range. For both analyses, Hovde utilized the following information sourced from Kroll Cost of Capital Navigator: risk

free rate of 3.50%, equity risk premium of 5.00%, industry risk premium of 0.45%, and size premium (based on market value) of 1.99%, with

the sum of these inputs resulting in a discount rate of 10.94%, which was rounded to 10.95% and utilized as the midpoint of a range of

discount rates from 9.95% to 11.95%.

The disclosure in the joint proxy statement/prospectus

under the heading “Proposal 1: The Issuance of Shares of ACNB Common Stock and the Merger – Opinion of ACNB’s Financial

Advisor – Pro Forma Impact Analyses” is hereby amended by deleting the first paragraph under this subheading on page 77 of

the joint proxy statement/prospectus and replacing it with the following paragraph:

For informational purposes only, Hovde performed

a pro forma financial impact analysis that combined projected balance sheet and estimated earnings per share information of ACNB and Traditions

over the projection period of years ended December 31, 2024 through 2029. Using (i) closing balance sheet estimates as of December 31,

2024 for each of ACNB and Traditions; (ii) financial forecasts and projections for each of ACNB and Traditions for the years ending December

31, 2024 through 2029; and (iii) pro forma assumptions (including, without limitation, the cost savings expected to result from the merger,

related expenses as well as purchase accounting and other adjustments), each of which were provided by, or developed based on guidance

from, ACNB management and its advisers. Hovde analyzed the estimated financial impact of the merger on certain projected financial results

for the combined pro forma company. This analysis indicated that, based on pro forma shares of common stock projected to be outstanding

after the merger of 10,529,704, the merger (i) could be 9% dilutive to ACNB's estimated tangible book value per share at estimated closing

of December 31, 2024 becoming accretive by 2027 with an estimated tangible book value payback period of 2.1 years and (ii) could be immediately

accretive by 29% to ACNB's estimated earnings per share. For all of the above analyses, the actual results achieved by the pro forma company

following the merger may vary from the projected results, and the variations may be material.

Caution Regarding Forward-Looking Statements

The information presented herein contains forward-looking

statements. These forward-looking statements include, but are not limited to, statements about (i) the benefits of the proposed merger

between ACNB and Traditions, (ii) ACNB’s and Traditions’ plans, obligations, expectations and intentions and (iii) other statements

presented herein that are not historical facts. Words such as “anticipates,” “believes,” “intends,”

“should,” “expects,” “will,” and variations of similar expressions are intended to identify forward-looking

statements. These statements are based on the beliefs of the respective managements of ACNB and Traditions as to the expected outcome

of future events and are not guarantees of future performance. These statements involve certain risks, uncertainties and assumptions that

are difficult to predict with regard to timing, extent, and degree of occurrence. Results and outcomes may differ materially from what

may be expressed or forecasted in forward-looking statements. Factors that could cause results and outcomes to differ materially include,

among others, the ability to obtain required regulatory and shareholder approvals and meet other closing conditions to the transaction;

the ability to complete the merger as expected and within the expected timeframe; disruptions to customer and employee relationships and

business operations caused by the merger; the ability to implement integration plans associated with the transaction, which integration

may be more difficult, time-consuming or costly than expected; the ability to achieve the cost savings and synergies contemplated by the

merger within the expected timeframe, or at all; changes in local and national economies, or market conditions; changes in interest rates;

regulations and accounting principles; changes in policies or guidelines; loan demand and asset quality, including real estate values

and collateral values; deposit flow; the impact of competition from traditional or new sources; and the other factors detailed in ACNB’s

publicly filed documents, including its Annual Report on Form 10-K for the year ended December 31, 2023, Quarterly Reports on Form 10-Q

for the quarters ended March 31, 2024, June 30, 2024 and September 30, 2024, and its other filings with the SEC. The forward-looking statements

only speak as of the date hereof. ACNB and Traditions assume no obligation to revise, update, or clarify forward-looking statements to

reflect events or conditions after the date of this report.

No Offer or Solicitation

The information presented herein does not constitute

an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be

any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification

under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements

of Section 10 of the Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

Additional Information about the Merger and

Where to Find It

In connection with the proposed merger, ACNB filed

with the SEC a registration statement on Form S-4 (File No. 333-282412) with respect to the offering of ACNB common stock as the merger

consideration under the Securities Act of 1933, as amended, which includes a joint proxy statement of Traditions and ACNB and a prospectus

of ACNB. A definitive joint proxy statement/prospectus was sent to the shareholders of Traditions and ACNB seeking the required shareholder

approvals on or about November 1, 2024. Before making any voting or investment decision, investors and security holders are urged to

read the registration statement and joint proxy statement/prospectus and other relevant documents filed or to be filed with the SEC because

they will contain important information about ACNB, Traditions, and the proposed merger.

Investors and security holders are able to obtain

free copies of these documents, and any other documents, through the website maintained by the SEC at http://www.sec.gov, or by accessing

ACNB’s website at www.acnb.com under the “Investor Relations” link and then under the heading “SEC Filings.”

Investors and security holders may also obtain free copies of these documents by directing a request by mail or telephone to ACNB Corporation

at 16 Lincoln Square, Gettysburg, PA 17325 or (717) 334-3161, or by directing a request by mail or telephone to Traditions Bancorp, Inc.

at 226 Pauline Drive, P.O. Box 3658, York, PA 17402 or (717) 747-2600.

Participants in the Solicitation

ACNB, Traditions, and their respective directors

and executive officers may be deemed to be participants in the solicitation of proxies from the shareholders of Traditions and ACNB in

connection with the merger. Information about ACNB’s directors and executive officers is included in the proxy statement for its

2024 annual meeting of ACNB’s shareholders, which was filed with the SEC on April 2, 2024. Information about the directors and executive

officers of Traditions and their ownership of Traditions common stock may be obtained by reading the joint proxy statement/prospectus

regarding the merger and other relevant materials filed with the SEC. Additional information regarding the interests of these participants

and other persons who may be deemed participants in the merger may be obtained by reading the joint proxy statement/prospectus regarding

the merger and other relevant materials filed with the SEC. Free copies of these documents may be obtained as described above.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this Current Report on Form 8-K to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

ACNB CORPORATION |

| |

(Registrant) |

| |

|

| Dated: December 12, 2024 |

/s/ Kevin J. Hayes |

| |

Kevin J. Hayes Senior Vice President/ |

| |

General Counsel, Secretary & Chief Governance Officer |

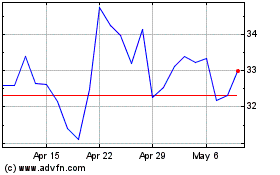

ACNB (NASDAQ:ACNB)

Historical Stock Chart

From Nov 2024 to Dec 2024

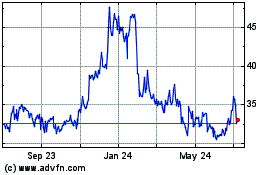

ACNB (NASDAQ:ACNB)

Historical Stock Chart

From Dec 2023 to Dec 2024