Aclaris Therapeutics Reports First Quarter 2024 Financial Results and Provides a Corporate Update

May 07 2024 - 4:01PM

Aclaris Therapeutics, Inc. (NASDAQ: ACRS), a clinical-stage

biopharmaceutical company focused on developing novel drug

candidates for immuno-inflammatory diseases, today announced its

financial results for the first quarter of 2024 and provided a

corporate update.

“We are pleased to announce that following a

review of the potential development pathways for ATI-2138, our

investigational ITK/JAK3 compound with best-in-class potential, we

have decided to progress ATI-2138 into a proof-of-concept Phase 2a

trial in patients with moderate to severe atopic dermatitis,”

stated Dr. Neal Walker, co-founder and Interim Chief Executive

Officer & President of Aclaris. “Across all of our programs, we

remain focused on executing a capital efficient strategy to advance

novel immuno-inflammatory therapies.”

Research and Development

Highlights:

- ITK Inhibitor

Programs

- ATI-2138, an

investigational oral covalent ITK/JAK3 inhibitor

- Aclaris plans to progress ATI-2138

into a Phase 2a trial in subjects with moderate to severe atopic

dermatitis.

- In September 2023, Aclaris reported

positive results from its Phase 1 multiple ascending dose (MAD)

trial of ATI-2138.

- ITK Selective

Compound

- Aclaris is progressing to

development candidate selection a second generation ITK selective

inhibitor for autoimmune indications.

- Lepzacitinib

(ATI-1777), an investigational topical “soft” JAK

1/3 inhibitor

- In January 2024, Aclaris reported

positive top-line results from its Phase 2b trial in atopic

dermatitis (AD).

- Aclaris is currently seeking a

global development and commercialization partner for this program

(excluding Greater China). As previously announced, in 2022 Aclaris

granted Pediatrix Therapeutics exclusive rights to develop and

commercialize lepzacitinib in Greater China.

- Zunsemetinib

(ATI-450), an investigational oral small molecule MK2

inhibitor

- Aclaris plans to support Washington

University in St. Louis in its investigator-initiated Phase 1b/2

trials of zunsemetinib as a potential treatment for pancreatic

cancer and metastatic breast cancer. Aclaris expects these trials

to be primarily funded by grants awarded to Washington

University.

Financial Highlights:

Liquidity and Capital

Resources

As of March 31, 2024, Aclaris had aggregate cash, cash

equivalents and marketable securities of $161.4 million compared to

$181.9 million as of December 31, 2023. A majority of cash

expenditures in the first quarter of 2024 were related to payments

associated with exit activities, including the wind down of

discontinued R&D programs and the previously announced

reduction in force. Aclaris anticipates payments associated with

these activities to be substantially completed by the second

quarter of 2024. As a result, Aclaris expects significantly lower

quarterly cash expenditures in future quarters, without giving

effect to any potential business development activities resulting

from its ongoing strategic review of its business.

Financial Results

First Quarter 2024

- Net loss was $16.9 million for the first quarter of 2024

compared to $28.2 million for the first quarter of 2023.

- Total revenue was $2.4 million for the first quarter of 2024

compared to $2.5 million for the first quarter of 2023. The

decrease was primarily driven by lower contract research revenue

during the three months ended March 31, 2024.

- Research and development (R&D) expenses were $9.8 million

for the quarter ended March 31, 2024 compared to $22.6 million for

the prior year period.

- The $12.8 million decrease was primarily the result of lower:

- Zunsemetinib development expenses associated with clinical

activities for a Phase 2a trial for hidradenitis suppurativa, a

Phase 2b trial for rheumatoid arthritis, and drug candidate

manufacturing costs.

- Costs associated with lepzacitinib preclinical development

activities and a Phase 2b clinical trial for AD.

- ATI-2138 development expenses, including costs associated with

a Phase 1 MAD trial and other preclinical activities.

- Compensation-related expenses due to a decrease in headcount

and higher forfeiture credits.

- General and administrative (G&A) expenses were $6.8 million

for the quarter ended March 31, 2024 compared to $8.8 million for

the prior year period. The decrease was primarily due to a

reduction in compensation-related expenses due to lower headcount

and higher forfeiture credits.

- Licensing expenses were $1.0 million for the quarter ended

March 31, 2024 compared to $1.1 million for the prior year period.

The decrease was due to the achievement of a commercial milestone

during the three months ended March 31, 2023, offset by an increase

in royalties earned under the Lilly license agreement.

- Revaluation of contingent consideration resulted in a $2.8

million loss for the quarter ended March 31, 2024 compared to a

gain of $0.8 million for the prior year period.

Conference Call and Webcast

As previously disclosed on April 30, 2024,

management will host a conference call and webcast, with an

accompanying slide presentation, at 5:00 PM ET today to provide a

corporate update. To access the live webcast of the call and the

accompanying slide presentation, please visit the “Events” page of

the “Investors” section of Aclaris’ website, www.aclaristx.com. The

webcast will be archived for at least 30 days on the Aclaris

website.

About Aclaris Therapeutics,

Inc.

Aclaris Therapeutics, Inc. is a clinical-stage

biopharmaceutical company developing a pipeline of novel drug

candidates to address the needs of patients with

immuno-inflammatory diseases who lack satisfactory treatment

options. The company has a multi-stage portfolio of drug candidates

powered by a robust R&D engine exploring protein kinase

regulation. For additional information, please visit

www.aclaristx.com.

Cautionary Note Regarding

Forward-Looking Statements

Any statements contained in this press release

that do not describe historical facts may constitute

forward-looking statements as that term is defined in the Private

Securities Litigation Reform Act of 1995. These statements may be

identified by words such as “anticipate,” “believe,” “expect,”

“intend,” “may,” “plan,” “potential,” “will,” and similar

expressions, and are based on Aclaris’ current beliefs and

expectations. These forward-looking statements include expectations

regarding its plans for its development programs, including its

plans to seek a development and commercialization partner for

lepzacitinib, the clinical development of ATI-2138, and its plan to

support Washington University in St. Louis in its

investigator-initiated Phase 1b/2 trials of zunsemetinib, as well

as Aclaris’ expectations regarding the wind down of discontinued

R&D programs and costs associated with its recent reduction in

force and the associated impact on anticipated cash burn, and its

strategic review of its business. These statements involve risks

and uncertainties that could cause actual results to differ

materially from those reflected in such statements. Risks and

uncertainties that may cause actual results to differ materially

include uncertainties inherent in the conduct of clinical trials,

Aclaris’ reliance on third parties over which it may not always

have full control, Aclaris’ ability to enter into strategic

partnerships on commercially reasonable terms, the uncertainty

regarding the macroeconomic environment and other risks and

uncertainties that are described in the Risk Factors section of

Aclaris’ Annual Report on Form 10-K for the year ended December 31,

2023, and other filings Aclaris makes with the U.S. Securities and

Exchange Commission from time to time. These documents are

available under the “SEC Filings” page of the “Investors” section

of Aclaris’ website at www.aclaristx.com. Any forward-looking

statements speak only as of the date of this press release and are

based on information available to Aclaris as of the date of this

release, and Aclaris assumes no obligation to, and does not intend

to, update any forward-looking statements, whether as a result of

new information, future events or otherwise.

|

|

|

Aclaris Therapeutics, Inc.Condensed Consolidated

Statements of Operations(unaudited, in thousands, except share and

per share data) |

|

|

|

|

|

Three Months Ended |

|

|

|

March 31, |

|

|

|

2024 |

|

|

2023 |

|

|

Revenues: |

|

|

|

|

|

|

|

Contract research |

|

$ |

657 |

|

|

$ |

889 |

|

|

Licensing |

|

|

1,741 |

|

|

|

1,639 |

|

| Total

revenue |

|

|

2,398 |

|

|

|

2,528 |

|

|

|

|

|

|

|

|

|

| Costs

and expenses: |

|

|

|

|

|

|

|

Cost of revenue (1) |

|

|

809 |

|

|

|

808 |

|

|

Research and development (1) |

|

|

9,845 |

|

|

|

22,587 |

|

|

General and administrative (1) |

|

|

6,844 |

|

|

|

8,790 |

|

|

Licensing |

|

|

1,031 |

|

|

|

1,061 |

|

|

Revaluation of contingent consideration |

|

|

2,800 |

|

|

|

(800 |

) |

| Total

costs and expenses |

|

|

21,329 |

|

|

|

32,446 |

|

| Loss

from operations |

|

|

(18,931 |

) |

|

|

(29,918 |

) |

|

Other income, net |

|

|

1,990 |

|

|

|

1,758 |

|

| Net

loss |

|

$ |

(16,941 |

) |

|

$ |

(28,160 |

) |

| Net loss

per share, basic and diluted |

|

$ |

(0.24 |

) |

|

$ |

(0.42 |

) |

| Weighted

average common shares outstanding, basic and diluted |

|

|

71,074,858 |

|

|

|

66,872,778 |

|

|

|

|

|

|

|

|

|

|

(1) Amounts include stock-based compensation expense as

follows: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of

revenue |

|

$ |

252 |

|

|

$ |

299 |

|

| Research

and development |

|

|

(29 |

) |

|

|

2,602 |

|

| General

and administrative |

|

|

1,866 |

|

|

|

3,905 |

|

| Total

stock-based compensation expense |

|

$ |

2,089 |

|

|

$ |

6,806 |

|

|

|

|

Aclaris Therapeutics, Inc.Selected Consolidated

Balance Sheet Data(unaudited, in thousands, except share data) |

|

|

| |

|

March 31, 2024 |

|

December 31, 2023 |

|

|

|

|

|

|

|

|

|

|

| Cash,

cash equivalents and marketable securities |

|

$ |

161,365 |

|

|

$ |

181,877 |

|

| Total

assets |

|

$ |

174,065 |

|

|

$ |

197,405 |

|

| Total

current liabilities |

|

$ |

20,080 |

|

|

$ |

30,952 |

|

| Total

liabilities |

|

$ |

32,051 |

|

|

$ |

40,226 |

|

| Total

stockholders' equity |

|

$ |

142,014 |

|

|

$ |

157,179 |

|

| Common

stock outstanding |

|

|

71,248,017 |

|

|

|

70,894,889 |

|

|

|

|

Aclaris Therapeutics, Inc.Selected Consolidated

Cash Flow Data(unaudited, in thousands) |

|

|

| |

|

March 31, 2024 |

|

March 31, 2023 |

| |

|

|

|

|

|

|

|

Net loss |

|

$ |

(16,941 |

) |

|

$ |

(28,160 |

) |

|

Depreciation and amortization |

|

|

243 |

|

|

|

198 |

|

|

Stock-based compensation expense |

|

|

2,089 |

|

|

|

6,806 |

|

|

Revaluation of contingent consideration |

|

|

2,800 |

|

|

|

(800 |

) |

| Changes

in operating assets and liabilities |

|

|

(9,006 |

) |

|

|

(4,397 |

) |

| Net cash

used in operating activities |

|

$ |

(20,815 |

) |

|

$ |

(26,353 |

) |

Aclaris Therapeutics Contact:

investors@aclaristx.com

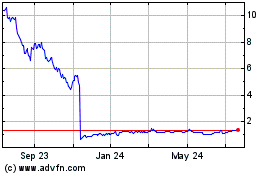

Aclaris Therapeutics (NASDAQ:ACRS)

Historical Stock Chart

From Oct 2024 to Nov 2024

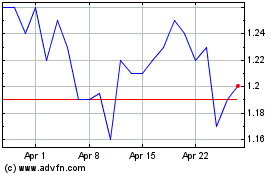

Aclaris Therapeutics (NASDAQ:ACRS)

Historical Stock Chart

From Nov 2023 to Nov 2024