StateHouse Holdings Inc. (“StateHouse” or the “Company”) (CSE:

STHZ) (OTCQB: STHZF), a California-focused, vertically integrated

cannabis company, today announced its financial results for the

three-month period ended March 31, 2024 (“Q1 2024”), and the

three-month (“Q4 2023”) and twelve-month (“FY 2023”) periods ended

December 31, 2023, as well as provided additional business updates.

The unaudited condensed interim consolidated financial statements

for Q1 2024, as well as the corresponding management’s discussion

and analysis and the audited consolidated financial statements for

FY 2023, as well as the corresponding management’s discussion and

analysis, are available for download from the Company’s investor

website, statehouseholdings.com, and on the Company’s SEDAR

profile. The delay in filing arose as a result of the Company’s

prior auditor unexpectedly discontinuing certain services to

publicly traded companies and the subsequent engagement and

onboarding of a new auditor, which involved the extensive review of

prior financials, acquisitions and tax returns dating back to 2019

that has now been completed. Unless otherwise indicated, all dollar

amounts in this press release are denominated in U.S. currency.

Q1 2024

Financial Highlights

- Q1 2024 net

revenues were $25.4 million, compared with $24.7

million in Q1 2023.

- Retail revenues were $12.0

million representing 47.1% of total sales for Q1 2024, compared to

$14.4 million or 47.2 of total sales in Q1 2023.

- Branded wholesale manufacturing

revenues were $11.5 million, representing 45.2% of total sales for

Q1 2024, compared to $9.4 million or 38.3% of total sales in Q1

2023.

- Cultivation revenues were $2.0

million, representing 7.7% of total sales for Q1 2024, compared to

$0.8 million or 3.2% of total sales in Q1 2023.

- Gross profit before adjustments for

biological assets1 was $11.8 million in Q1 2024, compared with

$10.9 million in Q1 2023.

- Consolidated gross margins improved

to 46.5% in Q1 20241, compared to 44.3% for Q1 2023.

- Adjusted

EBITDA1 improved to $0.8 million in Q1 2024 compared with Adjusted

EBITDA1 loss of $2.4 million in Q1 2023.

Q4 2023

Financial Highlights

- Q4 2023 net

revenues were $25.1 million, compared with $25.5

million in Q4 2022.

- Retail revenues were $13.0

million representing 51.8% of total sales for Q4 2023, compared to

$16.4 million or 64.3% of total sales in Q4 2022.

- Branded wholesale manufacturing

revenues were $11.7 million, representing 46.5% of total sales for

Q4 2023, compared to $8.6 million or 33.7% of total sales in Q4

2022.

- Cultivation revenues were $0.4

million, representing 1.5% of total sales for Q4 2023, compared to

$0.5 million or 1.9% of total sales in Q4 2022.

- Gross profit before adjustments for

biological assets1 was $10.4 million in Q4 2023, compared with

$10.8 million in Q4 2022.

- Consolidated

gross margins1 declined to 41.6% in Q4 2023, compared to 42.4% for

Q4 2022.

FY 2023

Financial Highlights

- FY 2023 net

revenues were $101.0 million, compared with $108.2

million in FY 2022.

- Retail revenues were $53.6

million representing 53.0% of total sales for FY 2023, compared to

$63.0 million or 58.2% of total sales in FY 2022.

- Branded wholesale manufacturing

revenues were $44.0 million, representing 42.5% of total sales for

FY 2023, compared to $40.7 million or 37.6% of total sales in FY

2022.

- Cultivation revenues were $2.9

million, representing 3.5% of total sales for FY 2023, compared to

$4.6 million or 4.2% of total sales in FY 2022.

- Gross profit before adjustments for

biological assets1 was $45.1 million in FY 2023, compared with

$42.1 million in FY 2022.

- Consolidated

gross margins1 improved to 44.9% in FY 2023, compared to 36.2% for

FY 2022.

Management

Commentary

“The team at

StateHouse has focused on improving margins and reducing our

operating expenses to generate cash. Our adjusted EBITDA was

positive in Q1 2024 and has improved further in Q2, despite the

overall California market’s decline,” said Ed Schmults, Chief

Executive Officer of StateHouse. “As an organization we are focused

on enhancing our customer experience across both our stores and

products, while improving the quality and speed of our operations

to lower costs. These efforts are having the desired impacts and

have kept our gross margin steady at 46.5% in Q1 2024 while

maintaining strong revenue of $25 million.”

Mr. Schmults added,

“Our efforts are not only improving our financial results but also

helping to advance our market presence. We’ve climbed from the 8th

largest California cannabis brand operator in 2023 to the 4th in

2024, driven by our commitment to bringing the products and brands

customers want to market. Over the past 12 months we introduced 23

new products as well as 40 in-house developed strain formulations,

driving new product sales to approximately 15% of total sales in

2024. We are extremely proud to have won gold and silver awards at

the California State Fair for our potency and terpene profile for

the third consecutive year.”

Mr. Schmults

concluded, “Our influence in California continues to grow as we set

new benchmarks for success and drive innovation across the market.

In 2023, we established a strong foundation, and in 2024, we're

witnessing the positive benefits of these strategic advancements

towards achieving our goals. Thanks to these efforts and our

incredibly popular brands and products we have solidified our

foothold in California's dynamic cannabis industry and are

well-positioned ahead of potential future market expansion.”

Brands and

Products Highlights

- Introduced 23 new

products across 7 brands, along with over 40 new in-house developed

strain formulations over the last twelve months. New products

account for approximately 15% of the Company’s YTD sales in

2024.

- Achieved broad and significant

market share gains with the Company now ranking as the 4th largest

operator of cannabis brands in California based on units sold

year-to-date and 6th largest based on dollars spent year-to-date

(per BDSA) compared with the 8th and 10th in 2023, respectively.

- Dime Bag is the 2nd most popular flower brand based on units

and the 5th most popular flower brand based on dollars spent in

California for year-to-date up from 11th and 16th in 2023 during

the same period, respectively (per BDSA).

- Urbn Leaf Flower, only available

through the Company’s owned retail platform, is the 35th ranked

flower brand in California year-to-date (per BDSA).

- Launched a new farm product

offering in 2024 for young plant sales, comprised of cuttings,

clones and teens. This newest channel has performed exceptionally

well in sales to date, as the Company is currently the only

at-scale producer of unrooted cuttings in California.

- For the third

consecutive year, the Company won both gold and silver awards at

the California State Fair for potency and terpene profile, bringing

the total to 10 awards over the past three years by

StateHouse.

Operations

Update

Total revenue in Q1

2024 was $25.4 million, sequentially inline with the previous

quarter, despite the ongoing competition, price compression, and

overall market declines. The Company has continued to generate

strong gross profit before biological asset adjustments1 with a

gross profit of $11.8 million or 46.5% of total revenue.

Retail operations have

consistently improved in 2024 through a combination of targeted

promotions, effective product merchandising strategies and

excellent staff. As a result, average daily returning customer

traffic has increased 18% in the first half of 2024 compared to

2023. Total new customer traffic has also improved 9% in the first

half of 2024 compared with the same period in 2023. The Company’s

retail team has achieved significant results in the digital

landscape, with online sales increasing 17% in the first half of

2024 compared with 2023, and transactions increasing 58% over the

first half of 2024 compared to 2023. The Company’s loyalty program,

STASH, had 312,860 members as of July 7, 2024. Additionally, Buy

Online, Pickup in Store (“BOPIS”) sales have more than doubled in

the first half of 2024 compared with 2023. The Company’s sales team

has updated and enhanced multiple product lines to improve visual

merchandising. The most impactful has been the roll out of the new

Dime Bag Cartridge and All-In-One hardware in Q1 2024. The

Company’s Dime Bag All-In-Ones are the top selling vape product

line in its owned retail platform.

The Company’s

manufacturing operations have added automation and efficiencies to

lower operating costs and improve product quality. Automation

processes for flower bagging have resulted in a 70% increase in

daily capacity for flower packing while reducing direct labor by

50%, an automated pre-roll machine has reduced direct labor by 25%

and a new edibles sugar tumbler and mold extractor has reduced

direct labor by 54%. Overall, as a result of these implementations

there has been a headcount reduction of 37%, which represents

direct labor savings of approximately $70,000 per week.

Additionally, the Company has closed a warehouse location to drive

additional cost savings per month.

Cultivation

infrastructure improvements continue to deliver results, with an

18% increase in pounds of flower produced year-to-date compared

with the same period in 2023, largely driven by the installation of

supplemental CO2 in all the Company’s flowering ranges in Q1 2024.

Productivity enhancements, improved crop training, and bulking

protocols before flowering has enabled the Company to achieve this

improved yield with a 10% reduction in the total number of plants

harvested. This has resulted in successfully reducing the Company’s

total direct cost per pound by 13.7% year-to-date compared to 2023.

The Company is further exploring additional innovation at its

cultivation operations, including trialing various form factors,

spectra, and intensities of inter-canopy and beneath canopy

lighting. These trials indicate that with additional improvements

to the Company’s lighting approach there is the potential to

further increase yields.

Financial results and analyses are also

available on the Company’s website (statehouseholdings.com).

Board Update

The Company is also

announcing that Kevin K. Albert has been appointed as a director of

the Board effective immediately following the filing of the

Corporation’s 2023 annual financial statements and Q1 2024 interim

financial statements. Mr. Albert will serve on the Audit Committee

and Special Committee of the Board.

“I am thrilled to

announce the addition of Kevin to our Board,” said Felicia Snyder,

Chair of the Board. “He brings a wealth of cannabis industry

expertise alongside a successful track record in M&A. His

significant experience and insight will be invaluable as we

strengthen our balance sheet, accelerate our market position in

California and expand our reach.”

Previously Mr. Albert

served on the Board of Directors of Harborside from November 2020

through April 2022, stepping down when the merger of Harborside,

LoudPack, and Urbn Leaf were completed, and StateHouse was formed.

Mr. Albert previously worked in the investment banking division of

Merrill Lynch & Co. from 1981 to 2005, where he was responsible

for its private capital raising business. From 2005 to 2010 Mr.

Albert was a co-founder of Elevation Partners, a private equity

firm that concentrated on consumer technology investments. From

2010 thru 2019 he was a Senior Partner of Pantheon Ventures LLC a

global private equity firm that invested across industries,

geographies and managers. Mr. Albert currently sits on the board of

Slang Worldwide Inc. (CSE:SLNG) and Achari Venture Holding Corp. I

(OTC: AVHI). Mr. Albert has a BA and an MBA from the University of

California, Los Angeles.

The Company further

announced that it has engaged Roger Jenkins as a consultant to the

Special Committee to assist with the development and implementation

of a comprehensive strategy to strengthen its balance sheet and

assist management in its negotiation with lenders to restructure

the company’s debt.

Ms. Snyder continued,

“Roger has a renowned background in finance and M&A and, as an

original investor in Harborside, a unique understanding of our

assets and strengths. We look forward to Roger being hands-on as we

implement strategies to further accelerate the optimization our

operations to achieve greater financial resilience and position

STHZ for future growth.”

Notes:

(1) This is a non-IFRS

reporting measure. For a reconciliation of this to the nearest IFRS

measure, see “Use of Non-IFRS Measures” and “Non-IFRS Measures” in

the Company’s management discussion and analysis for the three and

twelve months ended December 31, 2023, and for the three months

ended March 31, 2024. See “Non-IFRS Measures, Reconciliation and

Discussion”.

About StateHouse Holdings

Inc.

StateHouse, a vertically integrated enterprise

with cannabis licenses covering retail, major brands, distribution,

cultivation, nursery, and manufacturing, is one of the oldest and

most respected cannabis companies in California. Founded in 2006,

its predecessor company Harborside was awarded one of the first six

medical cannabis licenses granted in the United States. Today, the

Company operates 11 dispensaries covering Northern and Southern

California, an integrated cultivation facility in Salinas and

manufacturing in Greenfield, California. StateHouse is a leading

brand house in California by market share, with a diversified

product across multiple brands, form factors, and price points.

StateHouse sells its six popular house brands to over 700 retailers

across California including Kingpen, Dime Bag, Loudpack, Fuzzies,

Sublime, Urbn Leaf and Smokiez line of products. StateHouse is a

publicly listed company, currently trading on the Canadian

Securities Exchange ("CSE") under the ticker symbol "STHZ" and the

OTCQB under the ticker symbol "STHZF". The Company continues to

play an instrumental role in making cannabis safe and accessible to

a broad and diverse community of California and Oregon

consumers.

Cautionary Note Regarding

Forward-Looking Information

This news release contains "forward-looking

information" and "forward-looking statements'' (collectively,

"forward-looking statements") within the meaning of the applicable

Canadian and United States securities legislation. To the extent

any forward-looking information in this news release constitutes

"financial outlooks" or "future-oriented financial information"

within the meaning of applicable Canadian securities laws, the

reader is cautioned not to place undue reliance on such

information. All statements, other than statements of historical

fact, are forward-looking statements and are based on expectations,

estimates, and projections as at the date of this news release. Any

statement that involves discussions with respect to predictions,

expectations, beliefs, plans, projections, objectives, assumptions,

future events or performance (often but not always using phrases

such as "expects'', or "does not expect", "is expected",

"anticipates" or "does not anticipate", "plans", "budget",

"scheduled", "forecasts", "estimates", "believes" or "intends" or

variations of such words and phrases or stating that certain

actions, events or results "may" or "could", "would", "might" or

"will" be taken to occur or be achieved) are not statements of

historical fact and may be forward-looking statements. In this news

release, forward-looking statements include, among other things,

statements relating to potential future growth, future financial

performance including but not limited to the company’s sale of

various non-core assets, enhanced output for cultivation and

manufacturing, expanding managed services offerings, reduction of

operating expenses, future infrastructure investments, increased

cannabis yields and potency, the company’s ability to increase the

sale of in-house branded products, new product sales targets, and

future financings.

These forward-looking statements are based on

reasonable assumptions and estimates of management of the Company

at the time such statements were made. Actual future results may

differ materially as forward-looking statements involve known and

unknown risks, uncertainties, and other factors which may cause the

actual results, performance, or achievements of the Company to

materially differ from any future results, performance, or

achievements expressed or implied by such forward-looking

statements. Such factors, among other things, include: fluctuations

in general macroeconomic conditions; fluctuations in securities

markets; expectations regarding the size of the cannabis markets

where the Company operates; changing consumer habits; the ability

of the Company to successfully achieve its business objectives;

plans for expansion and acquisitions; political and social

uncertainties; inability to obtain adequate insurance to cover

risks and hazards; employee relations; the presence of laws and

regulations that may impose restrictions on cultivation,

production, distribution, and sale of cannabis and cannabis-related

products in the markets where the Company operates; and the risk

factors set out in the Company's management's discussion and

analysis for the year ended December 31, 2023 and the Company's

listing statement dated May 30, 2019, which are available under the

Company's profile on www.sedarplus.ca. Although the forward-looking

statements contained in this news release are based upon what

management of the Company believes, or believed at the time, to be

reasonable assumptions, the Company cannot assure shareholders that

actual results will be consistent with such forward-looking

statements, as there may be other factors that cause results not to

be as anticipated, estimated or intended. Readers should not place

undue reliance on the forward-looking statements and information

contained in this news release. The Company assumes no obligation

to update the forward-looking statements of beliefs, opinions,

projections, or other factors, should they change, except as

required by law.

The Company, through several of its

subsidiaries, is directly involved in the manufacture, possession,

use, sale, and distribution of cannabis in the recreational and

medicinal cannabis marketplace in the United States. Local state

laws where the Company operates permit such activities however,

investors should note that there are significant legal restrictions

and regulations that govern the cannabis industry in the United

States. Cannabis remains a Schedule I drug under the United States

Controlled Substances Act, making it illegal under federal law in

the United States to, among other things, cultivate, distribute, or

possess cannabis in the United States. Financial transactions

involving proceeds generated by, or intended to promote,

cannabis-related business activities in the United States may form

the basis for prosecution under applicable United States federal

money laundering legislation.

While the approach to enforcement of such laws

by the federal government in the United States has trended toward

non-enforcement against individuals and businesses that comply with

recreational and medicinal cannabis programs in states where such

programs are legal, strict compliance with state laws with respect

to cannabis will neither absolve the Company of liability under

United States federal law, nor will it provide a defense to any

federal proceeding which may be brought against the Company. The

enforcement of federal laws in the United States is a significant

risk to the business of the Company and any proceedings brought

against the Company thereunder may adversely affect the Company's

operations and financial performance.

This news release does not constitute an offer

to sell, or a solicitation of an offer to buy, any securities in

the United States. The Company's securities have not been and will

not be registered under the United States Securities Act of 1933,

as amended (the "U.S. Securities Act") or any state securities laws

and may not be offered or sold within the United States or to U.S.

Persons unless registered under the U.S. Securities Act and

applicable state securities laws or an exemption from such

registration is available.

The CSE has neither approved nor disapproved the

contents of this news release. Neither the CSE nor its Market

Regulator (as that term is defined in the policies of the CSE)

accepts responsibility for the adequacy or accuracy of this

release.

For the latest news, activities, and media

coverage, please visit https://www.statehouseholdings.com,

https://shopharborside.com and https://urbnleaf.com and

connect with us on LinkedIn and Twitter.

For further information:

StateHouse Holdings Inc.,

Ed Schmults, CEO,

800-892-4209

Investor Contact:

MATTIO Communications

Rob Kelly

statehouse@mattio.com

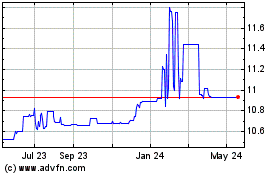

Achari Ventures Holdings... (NASDAQ:AVHI)

Historical Stock Chart

From Oct 2024 to Nov 2024

Achari Ventures Holdings... (NASDAQ:AVHI)

Historical Stock Chart

From Nov 2023 to Nov 2024