Current Report Filing (8-k)

June 26 2023 - 9:01AM

Edgar (US Regulatory)

false000106930800010693082023-06-222023-06-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): June 22, 2023

ACER THERAPEUTICS INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware |

|

001-33004 |

|

32-0426967 |

(State or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

One Gateway Center, Suite 356

300 Washington Street Newton, Massachusetts |

|

02458 |

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (844) 902-6100 |

N/A |

(Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

|

|

Securities registered pursuant to Section 12(b) of the Act: |

Title of Each Class |

Trading Symbol |

Name of Each Exchange on Which Registered |

Common Stock, $0.0001 par value per share |

ACER |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On June 22, 2023, Acer Therapeutics Inc. (the “Company”) received $1,000,000 in funding in exchange for the issuance of an unsecured, subordinated promissory note for that principal amount (the “Promissory Note”) to Christopher Schelling, the Company’s Chief Executive Officer and Founder, a member of the Company’s Board of Directors, and the beneficial owner of more than 10% of the Company’s outstanding common stock. Pursuant to the Promissory Note, the principal amount will accrue interest at a rate of six percent (6%) per annum, and all principal and accrued interest will be due and payable on August 21, 2023 (the “Maturity Date”); provided, however, that the repayment obligation of the Company under the Promissory Note is expressly subordinated to the Company’s obligations under its outstanding secured debt. If the Promissory Note is not paid in full on or before the Maturity Date, the unpaid balance will thereafter accrue interest at a rate of ten percent (10%) per annum.

The Promissory Note is filed as Exhibit 10.1 to this Current Report on Form 8-K. The foregoing summary of the terms of the Promissory Note does not purport to be complete and is subject to, and qualified in its entirety by, the Promissory Note which is incorporated herein by reference.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information included under Item 1.01 of this Current Report on Form 8-K is incorporated by reference herein.

Item 7.01. Regulation FD Disclosure.

The Company has updated its Corporate Presentation that will be available on the Investor Relations page of the Company’s website at https://acertx.com/investor-relations and will be used at investor and other meetings. A copy of the updated Corporate Presentation is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference. The Company does not undertake to update this presentation.

The information in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed to be filed for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933 or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 8.01. Other Events.

The proceeds to the Company from the Promissory Note, together with the Company’s existing cash and cash equivalents, are expected to be sufficient to fund the Company’s anticipated operating and capital requirements into early in the third quarter of 2023.

On June 26, 2023, Acer Therapeutics Inc. issued a press release entitled “Acer Therapeutics Receives $1 Million Capital Infusion from Chief Executive Officer and Founder,” a copy of which is attached as Exhibit 99.2 hereto and is incorporated herein by reference.

Forward-Looking Statements

This Current Report on Form 8-K contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical facts, included in this Current Report are forward-looking statements. Such statements include statements regarding the sufficiency and duration of the Company’s cash and cash equivalents. Such statements are based on the current expectations of the Company’s management and involve risks and uncertainties. Actual results and performance could differ materially from those projected in the forward-looking statements as a result of many factors, including without limitation, risks and uncertainties associated with the ability to project future cash utilization and reserves needed for contingent future liabilities and business operations, the availability of sufficient resources to fund the Company’s various product candidate development programs and to meet the Company’s business objectives and operational requirements, and the risks and uncertainties set forth in the Company’s filings with the Securities and Exchange Commission, including the Company’s Quarterly Reports on Form 10-Q and Annual Report on Form 10-K. Forward-looking statements speak only as of the date hereof, and the Company disclaims any obligation to update any forward-looking statements, unless otherwise required by law. Interested parties should review additional disclosures the Company makes in its filings with the Securities and Exchange Commission, including the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10‑Q. These documents may be accessed for no charge at http://www.sec.gov.

2

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

3

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

Dated: June 26, 2023 |

ACER THERAPEUTICS INC. |

|

|

|

|

|

|

By: |

/s/ Harry S. Palmin |

|

|

|

Harry S. Palmin |

|

|

|

Chief Financial Officer |

|

4

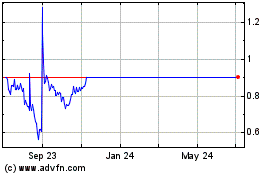

Acer Therapeutics (NASDAQ:ACER)

Historical Stock Chart

From Nov 2024 to Dec 2024

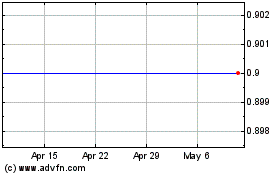

Acer Therapeutics (NASDAQ:ACER)

Historical Stock Chart

From Dec 2023 to Dec 2024