Academy Sports and Outdoors, Inc. (Nasdaq: ASO) ("Academy" or the

"Company") today announced its financial results for the fourth

quarter and fiscal year ended February 3, 2024. Fourth quarter and

fiscal year 2023 included 14 and 53 weeks respectively, compared to

13 and 52 weeks in fourth quarter and fiscal 2022.

"I am proud of the progress we have made and the

resiliency that the team has shown, as we have navigated through

many challenges over the past year. We have been working through a

choppy macro-economic backdrop while putting in place the building

blocks for our future," said Steve Lawrence, Chief Executive

Officer. "As we move into 2024 and beyond, we remain optimistic

about our long-term growth potential. We are the value leader in

our space, and we believe this positions us well to serve the

active young families who are our core customers. Customers have

shown a deep affinity for our brand, and we remain confident that

our model is both scalable and transportable. We remain committed

to our long-range plan goals and will continue to invest in our

future growth so that we can enable more customers to have fun out

there by shopping at Academy Sports + Outdoors."

|

Fourth Quarter Operating Results($ in millions, except per share

data) |

Quarter Ended |

|

Change |

|

February 3, 2024 |

|

January 28, 2023 |

|

% |

|

Net sales |

$ |

1,794.8 |

|

|

|

$ |

1,746.5 |

|

|

|

|

2.8 |

|

% |

| Comparable sales |

|

(3.6 |

) |

% |

|

|

(5.1 |

) |

% |

|

|

|

|

|

| Income before income tax |

$ |

211.3 |

|

|

|

$ |

206.1 |

|

|

|

|

2.5 |

|

% |

| Net income(1) |

$ |

168.2 |

|

|

|

$ |

157.7 |

|

|

|

|

6.7 |

|

% |

| Adjusted net income(2) |

$ |

168.2 |

|

|

|

$ |

163.5 |

|

|

|

|

2.9 |

|

% |

| Earnings per common share,

diluted |

$ |

2.21 |

|

|

|

$ |

1.97 |

|

|

|

|

12.2 |

|

% |

| Adjusted earnings per common

share, diluted(2) |

$ |

2.21 |

|

|

|

$ |

2.04 |

|

|

|

|

8.3 |

|

% |

|

Fiscal 2023 Operating Results($ in millions, except per share

data) |

Fiscal Year Ended |

|

Change |

|

February 3, 2024 |

|

January 28, 2023 |

|

% |

|

Net sales |

$ |

6,159.3 |

|

|

|

$ |

6,395.1 |

|

|

|

|

(3.7 |

) |

% |

| Comparable sales |

|

(6.5 |

) |

% |

|

|

(6.4 |

) |

% |

|

|

|

|

|

| Income before income tax |

$ |

663.2 |

|

|

|

$ |

818.3 |

|

|

|

|

(19.0 |

) |

% |

| Net income(1) |

$ |

519.2 |

|

|

|

$ |

628.0 |

|

|

|

|

(17.3 |

) |

% |

| Adjusted net income(2) |

$ |

539.5 |

|

|

|

$ |

645.8 |

|

|

|

|

(16.5 |

) |

% |

| Earnings per common share,

diluted |

$ |

6.70 |

|

|

|

$ |

7.49 |

|

|

|

|

(10.5 |

) |

% |

| Adjusted earnings per common

share, diluted(2) |

$ |

6.96 |

|

|

|

$ |

7.70 |

|

|

|

|

(9.6 |

) |

% |

(1) Includes a $15.9 million gain from a credit

card fee litigation settlement in the quarter and fiscal year ended

Feb. 3, 2024. The quarter and year ended Jan. 28, 2023 included a

$7.2 million gain from a business interruption insurance recovery

and a $3.7 million gain from the sale of a tariff relief litigation

claim.

(2) Adjusted net income and adjusted earnings

per common share, diluted are non-GAAP measures. See "Non-GAAP

Measures" and "Reconciliations of GAAP to Non-GAAP Financial

Measures" below for reconciliations of non-GAAP financial measures

to their most directly comparable GAAP financial measures.

Note: Fourth quarter and fiscal year 2023

included 14 and 53 weeks respectively, compared to 13 and 52 weeks

in fourth quarter and fiscal 2022.

|

Balance Sheet ($ in millions) |

As of |

|

Change |

|

February 3, 2024 |

|

|

January 28, 2023 |

|

|

% |

|

Cash and cash equivalents |

$ |

347.9 |

|

|

$ |

337.1 |

|

|

|

3.2 |

|

% |

| Merchandise inventories,

net |

$ |

1,194.2 |

|

|

$ |

1,283.5 |

|

|

|

(7.0 |

) |

% |

| Long-term debt, net |

$ |

484.6 |

|

|

$ |

584.5 |

|

|

|

(17.1 |

) |

% |

|

Capital Allocation ($ in millions) |

Fiscal Year Ended |

|

Change |

|

February 3, 2024 |

|

January 28, 2023 |

|

% |

|

Share repurchases |

$ |

204.2 |

|

|

$ |

489.5 |

|

|

|

(58.3 |

) |

% |

| Dividends paid |

$ |

27.2 |

|

|

$ |

24.6 |

|

|

|

10.6 |

|

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Subsequent to the end of fiscal 2023, on March

7, 2024, Academy announced its Board of Directors declared a

quarterly cash dividend with respect to the quarter ended February

3, 2024, of $0.11 per share of common stock. This is a 22% increase

from the previous dividend payment. The dividend is payable on

April 18, 2024, to stockholders of record as of the close of

business on March 26, 2024. In addition, on March 8, 2024, the

Company amended and extended its $1.0 billion ABL credit facility

through March 8, 2029.

New Store OpeningsAcademy

opened seven new stores during the fourth quarter for a total of 14

stores in 2023. In 2024, the company plans on opening 15-17 new

stores.

2024 Outlook“In 2023, topline

sales did not meet our expectations, but we were pleased with the

Q4 trajectory change. For the third consecutive year, we achieved

double digit operating margins and a gross margin rate above 34%,

underscoring the structural changes Academy has made to improve

margins. The Company also delivered stakeholder value by purchasing

$204 million of stock, paying $27 million in dividends and reducing

its debt by $103 million," stated Carl Ford, Executive Vice

President and Chief Financial Officer. "In 2024, we are focused on

our long-range strategy of growing the Company by opening new

stores, growing omnichannel sales, customer data acquisition and

utilization, and improving our supply chain. Utilizing our strong

balance sheet, we will invest in each of these strategic areas

while we navigate the current consumer landscape because we believe

that these initiatives will drive our long-term success."

Academy is providing the following initial

guidance for fiscal 2024 (year ending February 1, 2025). This

guidance takes into account various factors, both internal and

external, such as the expected benefits of the Company's growth

initiatives, current consumer demand, the competitive environment

as well as the potential impacts from inflation and other economic

risks. The earnings per share estimate does not include any

potential future share repurchases and uses a tax rate of 22.0% to

23.0%.

|

|

Fiscal 2024 Guidance |

|

|

|

change (at midpoint) |

|

(in millions, except per share amounts) |

Low end |

|

High end |

|

2023 Actuals(2) |

|

vs. 2023 |

|

Net sales |

$ |

6,070 |

|

|

|

$ |

6,350 |

|

|

|

$ |

6,159 |

|

|

|

|

0.8 |

|

% |

| Sales

Growth |

|

(1.5 |

) |

% |

|

|

+3.0 |

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comparable sales |

|

(4.0 |

) |

% |

|

|

1.0 |

|

% |

|

|

(6.5 |

) |

% |

|

|

+500 bps |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross

margin rate |

|

34.3 |

|

% |

|

|

34.7 |

|

% |

|

|

34.3 |

|

% |

|

|

+20 bps |

|

|

|

|

|

|

|

|

|

|

| Net

income |

$ |

455 |

|

|

|

$ |

530 |

|

|

|

$ |

519 |

|

|

|

|

(5.2 |

) |

% |

|

|

|

|

|

|

|

|

|

|

| Earnings

per common share, diluted |

$ |

5.90 |

|

|

|

$ |

6.90 |

|

|

|

$ |

6.70 |

|

|

|

|

(4.5 |

) |

% |

|

|

|

|

|

|

|

|

|

|

| Diluted

weighted average common shares |

|

~77 |

|

|

|

|

~77 |

|

|

|

|

77.5 |

|

|

|

|

(0.6 |

) |

% |

|

|

|

|

|

|

|

| Capital

Expenditures |

$ |

225 |

|

|

|

$ |

275 |

|

|

|

$ |

208 |

|

|

|

|

20.2 |

|

% |

|

|

|

|

|

|

|

| Adjusted

free cash flow(1) |

$ |

290 |

|

|

|

$ |

375 |

|

|

|

$ |

330 |

|

|

|

|

0.8 |

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Adjusted free cash flow is a non-GAAP

measure. We have not reconciled it to the most comparable GAAP

measure because it is not possible to do so

without unreasonable efforts given the uncertainty and

potential variability of reconciling items, which are dependent on

future events and often outside of management’s control and

which could be significant. Because such items cannot be reasonably

predicted with the level of precision required, we are unable to

provide an estimate of the most closely comparable GAAP

measure at this time.

(2) Fiscal 2023 net sales include approximately

$73 million from having a 53rd week, which is approximately a 1%

impact on 2024 sales growth.

Conference Call Info

Academy will host a conference call today at

10:00 a.m. Eastern Time to discuss its financial results. The call

will be webcast at investors.academy.com. The following information

is provided for those who would like to participate in the

conference call:

| |

U.S.

callers |

1-877-407-3982 |

| |

International callers |

1-201-493-6780 |

| |

Passcode |

13744704 |

| |

|

|

A replay of the conference call will be

available for approximately 30 days on the Company's website.

About Academy Sports +

Outdoors

Academy is a leading full-line sporting goods

and outdoor recreation retailer in the United States. Originally

founded in 1938 as a family business in Texas, Academy has grown to

282 stores across 18 states. Academy’s mission is to provide “Fun

for All” and Academy fulfills this mission with a localized

merchandising strategy and value proposition that strongly connects

with a broad range of consumers. Academy’s product assortment

focuses on key categories of outdoor, apparel, footwear and sports

& recreation through both leading national brands and a

portfolio of private label brands.

Non-GAAP Measures

Adjusted EBITDA, Adjusted EBIT, Adjusted Net

Income, Adjusted Earnings per Common Share, and Adjusted Free Cash

Flow have been presented in this press release as supplemental

measures of financial performance that are not required by, or

presented in accordance with, generally accepted accounting

principles (“GAAP”). The Company believes that the presentation of

these non-GAAP measures is useful to investors as it provides

additional information on comparisons between periods by excluding

certain items that affect overall comparability. The Company uses

these non-GAAP financial measures for business planning purposes,

to consider underlying trends of its business, and in measuring its

performance relative to others in the market, and believes

presenting these measures also provides information to investors

and others for understanding and evaluating trends in the Company’s

operating results or measuring performance in the same manner as

the Company’s management. Non-GAAP financial measures should be

considered in addition to, and not as an alternative for, the

Company’s reported results prepared in accordance with GAAP. The

calculation of these non-GAAP financial measures may differ from

similar measures reported by other companies and may not be

comparable to other similarly titled measures. For additional

information on these non-GAAP financial measures, please see our

Annual Report for the fiscal year ended February 3, 2024 (the

"Annual Report"), which may be updated from time to time in our

periodic filings with the Securities and Exchange Commission (the

"SEC"), which are accessible on the SEC's website at

www.sec.gov.

See “Reconciliations of GAAP to Non-GAAP Financial Measures”

below for reconciliations of non-GAAP financial measures used in

this press release (other than Adjusted free cash flow) to their

most directly comparable GAAP financial measures.

Forward Looking Statements

This press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. These forward-looking statements are based on

Academy’s current expectations and are not guarantees of future

performance. Forward-looking statements may incorporate words such

as “believe,” “expect,” “forward,” “ahead,” “opportunities,”

“plans,” “priorities,” “goals,” “future,” “short/long term,”

“will,” “should,” or the negative version of these words or other

comparable words. The forward-looking statements include, among

other things, statements regarding the Company’s future

performance, financial condition, and capital deployment, including

intent, ability, payment, extent, and timing of capital

expenditures, debt repayment, dividends, share repurchases,

interest savings, and execution of the capital allocation plan,

each of which is subject to various risks, assumptions, or changes

in circumstances that are difficult to predict or quantify. Actual

results may differ materially from these expectations due to

changes in global, regional, or local economic, business,

competitive, market, regulatory and other factors that could affect

overall consumer spending or our industry, including the possible

effects of ongoing macroeconomic challenges, inflation and

increases in interest rates, or changes to the financial health of

our customers, many of which are beyond Academy's control. These

and other important factors that could cause actual results to

differ materially from those in the forward-looking statements are

set forth in Academy's filings with the SEC, including the Annual

Report, under the caption "Risk Factors," as may be updated from

time to time in our periodic filings with the SEC. Any

forward-looking statement in this press release speaks only as of

the date of this release. Academy undertakes no obligation to

publicly update or review any forward-looking statement, whether as

a result of new information, future developments or otherwise,

except as may be required by any applicable securities laws.

|

Investor Contact |

|

Media

Contact |

| Matt Hodges |

|

Elise Hasbrook |

| VP, Investor Relations |

|

VP, Communications |

| 281-646-5362 |

|

281-944-6041 |

| Matt.hodges@academy.com |

|

Elise.hasbrook@academy.com |

|

ACADEMY SPORTS AND OUTDOORS,

INC.CONSOLIDATED STATEMENTS OF

INCOME(Unaudited)(Amounts in

thousands, except per share data) |

| |

|

| |

Fiscal Quarter Ended |

| |

February 3, 2024 |

|

Percentage of Sales(1) |

|

January 28, 2023 |

|

Percentage of Sales(1) |

|

Net sales |

$ |

1,794,828 |

|

|

|

|

100.0 |

|

% |

|

$ |

1,746,503 |

|

|

|

|

100.0 |

|

% |

| Cost of goods sold |

|

1,197,819 |

|

|

|

|

66.7 |

|

% |

|

|

1,173,959 |

|

|

|

|

67.2 |

|

% |

|

Gross margin |

|

597,009 |

|

|

|

|

33.3 |

|

% |

|

|

572,544 |

|

|

|

|

32.8 |

|

% |

| Selling, general and

administrative expenses |

|

393,044 |

|

|

|

|

21.9 |

|

% |

|

|

367,744 |

|

|

|

|

21.1 |

|

% |

|

Operating income |

|

203,965 |

|

|

|

|

11.4 |

|

% |

|

|

204,800 |

|

|

|

|

11.7 |

|

% |

| Interest expense, net |

|

12,578 |

|

|

|

|

0.7 |

|

% |

|

|

12,201 |

|

|

|

|

0.7 |

|

% |

| Loss on early retirement of

debt |

|

1,525 |

|

|

|

|

0.1 |

|

% |

|

|

1,963 |

|

|

|

|

0.1 |

|

% |

| Other (income), net |

|

(21,395 |

) |

|

|

|

(1.2 |

) |

% |

|

|

(15,499 |

) |

|

|

|

(0.9 |

) |

% |

|

Income before income taxes |

|

211,257 |

|

|

|

|

11.8 |

|

% |

|

|

206,135 |

|

|

|

|

11.8 |

|

% |

| Income tax expense |

|

43,090 |

|

|

|

|

2.4 |

|

% |

|

|

48,482 |

|

|

|

|

2.8 |

|

% |

|

Net income |

$ |

168,167 |

|

|

|

|

9.4 |

|

% |

|

$ |

157,653 |

|

|

|

|

9.0 |

|

% |

| |

|

|

|

|

|

|

|

| Earnings Per Common

Share: |

|

|

|

|

|

|

|

|

Basic |

$ |

2.27 |

|

|

|

|

|

$ |

2.03 |

|

|

|

|

|

Diluted |

$ |

2.21 |

|

|

|

|

|

$ |

1.97 |

|

|

|

|

| |

|

|

|

|

|

|

|

| Weighted Average Common Shares

Outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

74,219 |

|

|

|

|

|

|

77,657 |

|

|

|

|

|

Diluted |

|

76,035 |

|

|

|

|

|

|

80,074 |

|

|

|

|

(1) Column may not add due to rounding

|

ACADEMY SPORTS AND OUTDOORS,

INC.CONSOLIDATED STATEMENTS OF

INCOME(Amounts in thousands, except per share

data) |

| |

| |

Fiscal Year Ended |

| |

February 3, 2024 |

|

Percentage of Sales(1) |

|

January 28, 2023 |

|

Percentage of Sales(1) |

|

Net sales |

$ |

6,159,291 |

|

|

|

|

100.0 |

|

% |

|

$ |

6,395,073 |

|

|

|

|

100.0 |

|

% |

| Cost of goods sold |

|

4,049,080 |

|

|

|

|

65.7 |

|

% |

|

|

4,182,571 |

|

|

|

|

65.4 |

|

% |

|

Gross margin |

|

2,110,211 |

|

|

|

|

34.3 |

|

% |

|

|

2,212,502 |

|

|

|

|

34.6 |

|

% |

| Selling, general and

administrative expenses |

|

1,432,356 |

|

|

|

|

23.3 |

|

% |

|

|

1,365,953 |

|

|

|

|

21.4 |

|

% |

|

Operating income |

|

677,855 |

|

|

|

|

11.0 |

|

% |

|

|

846,549 |

|

|

|

|

13.2 |

|

% |

| Interest expense, net |

|

46,051 |

|

|

|

|

0.7 |

|

% |

|

|

46,441 |

|

|

|

|

0.7 |

|

% |

| Loss on early retirement of

debt |

|

1,525 |

|

|

|

|

0.0 |

|

% |

|

|

1,963 |

|

|

|

|

0.0 |

|

% |

| Other (income), net |

|

(32,877 |

) |

|

|

|

(0.5 |

) |

% |

|

|

(20,175 |

) |

|

|

|

(0.3 |

) |

% |

|

Income before income taxes |

|

663,156 |

|

|

|

|

10.8 |

|

% |

|

|

818,320 |

|

|

|

|

12.8 |

|

% |

| Income tax expense |

|

143,966 |

|

|

|

|

2.3 |

|

% |

|

|

190,319 |

|

|

|

|

3.0 |

|

% |

|

Net income |

$ |

519,190 |

|

|

|

|

8.4 |

|

% |

|

$ |

628,001 |

|

|

|

|

9.8 |

|

% |

| |

|

|

|

|

|

|

|

| Earnings Per Common

Share: |

|

|

|

|

|

|

|

|

Basic |

$ |

6.89 |

|

|

|

|

|

$ |

7.70 |

|

|

|

|

|

Diluted |

$ |

6.70 |

|

|

|

|

|

$ |

7.49 |

|

|

|

|

| |

|

|

|

|

|

|

|

| Weighted Average Common Shares

Outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

75,389 |

|

|

|

|

|

|

81,590 |

|

|

|

|

|

Diluted |

|

77,469 |

|

|

|

|

|

|

83,895 |

|

|

|

|

(1) Column may not add due to rounding

|

ACADEMY SPORTS AND OUTDOORS,

INC.CONSOLIDATED BALANCE

SHEETS(Dollar amounts in thousands, except per

share data) |

| |

| |

February 3, 2024 |

|

January 28, 2023 |

|

ASSETS |

|

|

|

| CURRENT

ASSETS: |

|

|

|

|

Cash and cash equivalents |

$ |

347,920 |

|

|

|

$ |

337,145 |

|

|

|

Accounts receivable - less allowance for doubtful accounts of

$2,217 and $2,004, respectively |

|

19,371 |

|

|

|

|

16,503 |

|

|

|

Merchandise inventories, net |

|

1,194,159 |

|

|

|

|

1,283,517 |

|

|

|

Prepaid expenses and other current assets |

|

83,450 |

|

|

|

|

47,747 |

|

|

|

Assets held for sale |

|

— |

|

|

|

|

1,763 |

|

|

|

Total current assets |

|

1,644,900 |

|

|

|

|

1,686,675 |

|

|

| |

|

|

|

| PROPERTY AND

EQUIPMENT, NET |

|

445,209 |

|

|

|

|

351,424 |

|

|

| RIGHT-OF-USE

ASSETS |

|

1,111,237 |

|

|

|

|

1,100,085 |

|

|

| TRADE

NAME |

|

578,236 |

|

|

|

|

577,716 |

|

|

| GOODWILL |

|

861,920 |

|

|

|

|

861,920 |

|

|

| OTHER NONCURRENT

ASSETS |

|

35,211 |

|

|

|

|

17,619 |

|

|

|

Total assets |

$ |

4,676,713 |

|

|

|

$ |

4,595,439 |

|

|

| |

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

| CURRENT

LIABILITIES: |

|

|

|

|

Accounts payable |

$ |

541,077 |

|

|

|

$ |

686,472 |

|

|

|

Accrued expenses and other current liabilities |

|

217,932 |

|

|

|

|

240,169 |

|

|

|

Current lease liabilities |

|

117,849 |

|

|

|

|

109,075 |

|

|

|

Current maturities of long-term debt |

|

3,000 |

|

|

|

|

3,000 |

|

|

|

Total current liabilities |

|

879,858 |

|

|

|

|

1,038,716 |

|

|

| |

|

|

|

| LONG-TERM DEBT,

NET |

|

484,551 |

|

|

|

|

584,456 |

|

|

| LONG-TERM LEASE

LIABILITIES |

|

1,091,294 |

|

|

|

|

1,072,192 |

|

|

| DEFERRED TAX

LIABILITIES, NET |

|

254,796 |

|

|

|

|

259,043 |

|

|

| OTHER LONG-TERM

LIABILITIES |

|

11,564 |

|

|

|

|

12,726 |

|

|

|

Total liabilities |

|

2,722,063 |

|

|

|

|

2,967,133 |

|

|

| |

|

|

|

| COMMITMENTS AND

CONTINGENCIES |

|

|

|

| |

|

|

|

| STOCKHOLDERS'

EQUITY: |

|

|

|

|

Preferred stock, $0.01 par value, authorized 50,000,000 shares;

none issued and outstanding |

|

— |

|

|

|

|

— |

|

|

|

Common stock, $0.01 par value, authorized 300,000,000 shares;

74,349,927 and 76,711,720 issued and outstanding as of February 3,

2024 and January 28, 2023, respectively |

|

743 |

|

|

|

|

767 |

|

|

|

Additional paid-in capital |

|

242,098 |

|

|

|

|

216,209 |

|

|

|

Retained earnings |

|

1,711,809 |

|

|

|

|

1,411,330 |

|

|

|

Stockholders' equity |

|

1,954,650 |

|

|

|

|

1,628,306 |

|

|

|

Total liabilities and stockholders' equity |

$ |

4,676,713 |

|

|

|

$ |

4,595,439 |

|

|

|

ACADEMY SPORTS AND OUTDOORS,

INC.CONSOLIDATED STATEMENTS OF CASH

FLOWS(Amounts in thousands) |

| |

| |

Fiscal Year Ended |

| |

February 3, 2024 |

|

January 28, 2023 |

| CASH FLOWS FROM OPERATING

ACTIVITIES: |

|

|

|

|

Net income |

$ |

519,190 |

|

|

|

$ |

628,001 |

|

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

Depreciation and amortization |

|

110,936 |

|

|

|

|

106,762 |

|

|

|

Non-cash lease expense |

|

16,723 |

|

|

|

|

(16 |

) |

|

|

Equity compensation |

|

24,377 |

|

|

|

|

21,175 |

|

|

|

Amortization of deferred loan, terminated interest rate swaps and

other costs |

|

2,739 |

|

|

|

|

3,054 |

|

|

|

Deferred income taxes |

|

(4,247 |

) |

|

|

|

41,831 |

|

|

|

Non-cash loss on early retirement of debt |

|

1,525 |

|

|

|

|

1,963 |

|

|

|

Gain on disposal of property and equipment |

|

(388 |

) |

|

|

|

— |

|

|

|

Changes in assets and liabilities: |

|

|

|

|

Accounts receivable, net |

|

(2,868 |

) |

|

|

|

3,215 |

|

|

|

Merchandise inventories, net |

|

89,358 |

|

|

|

|

(111,709 |

) |

|

|

Prepaid expenses and other current assets |

|

(50,225 |

) |

|

|

|

(11,287 |

) |

|

|

Other noncurrent assets |

|

(18,761 |

) |

|

|

|

(14,088 |

) |

|

|

Accounts payable |

|

(142,346 |

) |

|

|

|

(55,400 |

) |

|

|

Accrued expenses and other current liabilities |

|

(26,712 |

) |

|

|

|

(58,395 |

) |

|

|

Income taxes payable |

|

17,640 |

|

|

|

|

(3,407 |

) |

|

|

Other long-term liabilities |

|

(1,162 |

) |

|

|

|

306 |

|

|

|

Net cash provided by operating activities |

|

535,779 |

|

|

|

|

552,005 |

|

|

| |

|

|

|

| CASH FLOWS FROM INVESTING

ACTIVITIES: |

|

|

|

|

Capital expenditures |

|

(207,770 |

) |

|

|

|

(108,304 |

) |

|

|

Purchases of intangible assets |

|

(520 |

) |

|

|

|

(502 |

) |

|

|

Proceeds from the sale of property and equipment |

|

2,151 |

|

|

|

|

— |

|

|

|

Net cash used in investing activities |

|

(206,139 |

) |

|

|

|

(108,806 |

) |

|

| |

|

|

|

| CASH FLOWS FROM FINANCING

ACTIVITIES: |

|

|

|

|

Repayment of Term Loan |

|

(103,000 |

) |

|

|

|

(103,000 |

) |

|

|

Proceeds from exercise of stock options |

|

16,636 |

|

|

|

|

21,249 |

|

|

|

Proceeds from issuance of common stock under employee stock

purchase program |

|

5,484 |

|

|

|

|

5,043 |

|

|

|

Taxes paid related to net share settlement of equity awards |

|

(7,971 |

) |

|

|

|

(1,236 |

) |

|

|

Repurchase of common stock for retirement |

|

(202,796 |

) |

|

|

|

(489,475 |

) |

|

|

Dividends paid |

|

(27,218 |

) |

|

|

|

(24,633 |

) |

|

|

Net cash used in financing activities |

|

(318,865 |

) |

|

|

|

(592,052 |

) |

|

| |

|

|

|

| NET INCREASE (DECREASE) IN

CASH AND CASH EQUIVALENTS |

|

10,775 |

|

|

|

|

(148,853 |

) |

|

| CASH AND CASH EQUIVALENTS AT

BEGINNING OF PERIOD |

|

337,145 |

|

|

|

|

485,998 |

|

|

| CASH AND CASH EQUIVALENTS AT

END OF PERIOD |

$ |

347,920 |

|

|

|

$ |

337,145 |

|

|

|

ACADEMY SPORTS AND OUTDOORS,

INC.RECONCILIATIONS OF NON-GAAP TO GAAP FINANCIAL

MEASURES(Unaudited)(Dollar

amounts in thousands) |

|

|

Adjusted EBITDA and Adjusted

EBIT

We define “Adjusted EBITDA” as net income (loss)

before interest expense, net, income tax expense and depreciation,

and amortization, and impairment, and other adjustments included in

the table below. We define “Adjusted EBIT” as Adjusted EBITDA less

depreciation and amortization. We describe these adjustments

reconciling net income (loss) to Adjusted EBITDA and Adjusted EBIT

in the following table.

| |

Fiscal Quarter Ended |

|

Fiscal Year Ended |

| |

February 3, 2024 |

|

January 28, 2023 |

|

February 3, 2024 |

|

January 28, 2023 |

|

Net income (a) |

$ |

168,167 |

|

|

|

$ |

157,653 |

|

|

|

$ |

519,190 |

|

|

|

$ |

628,001 |

|

|

| Interest expense,

net |

|

12,578 |

|

|

|

|

12,201 |

|

|

|

|

46,051 |

|

|

|

|

46,441 |

|

|

| Income tax

expense |

|

43,090 |

|

|

|

|

48,482 |

|

|

|

|

143,966 |

|

|

|

|

190,319 |

|

|

| Depreciation and

amortization |

|

31,542 |

|

|

|

|

27,910 |

|

|

|

|

110,936 |

|

|

|

|

106,762 |

|

|

| Equity

compensation (b) |

|

(1,751 |

) |

|

|

|

5,689 |

|

|

|

|

24,377 |

|

|

|

|

21,175 |

|

|

| Loss on early

retirement of debt |

|

1,525 |

|

|

|

|

1,963 |

|

|

|

|

1,525 |

|

|

|

|

1,963 |

|

|

|

Adjusted EBITDA |

$ |

255,151 |

|

|

|

$ |

253,898 |

|

|

|

$ |

846,045 |

|

|

|

$ |

994,661 |

|

|

| Less: Depreciation

and amortization |

|

(31,542 |

) |

|

|

|

(27,910 |

) |

|

|

|

(110,936 |

) |

|

|

|

(106,762 |

) |

|

|

Adjusted EBIT |

$ |

223,609 |

|

|

|

$ |

225,988 |

|

|

|

$ |

735,109 |

|

|

|

$ |

887,899 |

|

|

| |

|

|

| (a) Net income

for the fourth quarter and year ended February 3, 2024, includes a

$15.9 million net gain relative to a credit card fee litigation

settlement which occurred in the fourth quarter of 2023. Net income

for the fourth quarter and year ended January 28, 2023, included a

$7.2 million gain from a business interruption insurance recovery

and a $3.7 million gain from the sale of a tariff relief litigation

claim, both of which occurred in the fourth quarter of 2022. All of

these items are included in their respective years within Other

(income), net on the Consolidated Statements of Income in our

Annual Report. |

| (b) Represents

non-cash charges related to equity based compensation, which vary

from period to period depending on certain factors such as the

timing and valuation of awards, achievement of performance targets

and equity award forfeitures. |

Adjusted Net Income and Adjusted

Earnings Per Common Share

We define “Adjusted Net Income (Loss)” as net

income (loss), plus other adjustments included in the table below,

less the tax effect of these adjustments. We define “Adjusted

Earnings per Common Share, Basic” as Adjusted Net Income divided by

the basic weighted average common shares outstanding during the

period and “Adjusted Earnings per Common Share, Diluted” as

Adjusted Net Income divided by the diluted weighted average common

shares outstanding during the period. We describe these adjustments

reconciling net income (loss) to Adjusted Net Income (Loss) and

Adjusted Earnings Per Share in the following table.

| |

Fiscal Quarter Ended |

|

Fiscal Year Ended |

| |

February 3, 2024 |

|

January 28, 2023 |

|

February 3, 2024 |

|

January 28, 2023 |

|

Net income (a) |

$ |

168,167 |

|

|

|

$ |

157,653 |

|

|

|

$ |

519,190 |

|

|

|

$ |

628,001 |

|

|

| Equity compensation (b) |

|

(1,751 |

) |

|

|

|

5,689 |

|

|

|

|

24,377 |

|

|

|

|

21,175 |

|

|

| Loss on early retirement of

debt, net |

|

1,525 |

|

|

|

|

1,963 |

|

|

|

|

1,525 |

|

|

|

|

1,963 |

|

|

| Tax effects of these

adjustments (c) |

|

288 |

|

|

|

|

(1,789 |

) |

|

|

|

(5,621 |

) |

|

|

|

(5,382 |

) |

|

|

Adjusted Net Income |

|

168,229 |

|

|

|

|

163,516 |

|

|

|

|

539,471 |

|

|

|

|

645,757 |

|

|

| |

|

|

|

|

|

|

|

| Earnings per common share |

|

|

|

|

|

|

|

|

Basic |

$ |

2.27 |

|

|

|

$ |

2.03 |

|

|

|

$ |

6.89 |

|

|

|

$ |

7.70 |

|

|

|

Diluted |

$ |

2.21 |

|

|

|

$ |

1.97 |

|

|

|

$ |

6.70 |

|

|

|

$ |

7.49 |

|

|

| Adjusted Earnings per

Share |

|

|

|

|

|

|

|

|

Basic |

$ |

2.27 |

|

|

|

$ |

2.11 |

|

|

|

$ |

7.16 |

|

|

|

$ |

7.91 |

|

|

|

Diluted |

$ |

2.21 |

|

|

|

$ |

2.04 |

|

|

|

$ |

6.96 |

|

|

|

$ |

7.70 |

|

|

| Weighted average common shares

outstanding |

|

|

|

|

|

|

|

|

Basic |

|

74,219 |

|

|

|

|

77,657 |

|

|

|

|

75,389 |

|

|

|

|

81,590 |

|

|

|

Diluted |

|

76,035 |

|

|

|

|

80,074 |

|

|

|

|

77,469 |

|

|

|

|

83,895 |

|

|

| |

|

|

|

|

|

|

|

| (a) Net income

for the fourth quarter and year ended February 3, 2024, includes a

$15.9 million net gain relative to a credit card fee litigation

settlement which occurred in the fourth quarter of 2023. Net income

for the fourth quarter and year ended January 28, 2023, included a

$7.2 million gain from a business interruption insurance recovery

and a $3.7 million gain from the sale of a tariff relief litigation

claim, both of which occurred in the fourth quarter of 2022. All of

these items are included in their respective years within Other

(income), net on the Consolidated Statements of Income in our

Annual Report. |

| (b) Represents

non-cash charges related to equity based compensation, which vary

from period to period depending on certain factors such as the

timing and valuation of awards, achievement of performance targets

and equity award forfeitures. |

| (c) Represents

the tax effect of the total adjustments made to arrive at Adjusted

Net Income at our historical tax rate. |

Adjusted Free Cash Flow

We define “Adjusted Free Cash Flow” as net cash

provided by (used in) operating activities less net cash provided

by (used in) investing activities. We describe these adjustments

reconciling net cash provided by operating activities to Adjusted

Free Cash Flow in the following table.

| |

Fiscal Quarter Ended |

|

Fiscal Year Ended |

| |

February 3, 2024 |

|

January 28, 2023 |

|

February 3, 2024 |

|

January 28, 2023 |

|

Net cash provided by operating activities |

$ |

234,737 |

|

|

|

$ |

242,836 |

|

|

|

$ |

535,779 |

|

|

|

$ |

552,005 |

|

|

| Net cash used in investing

activities |

|

(55,948 |

) |

|

|

|

(28,995 |

) |

|

|

|

(206,139 |

) |

|

|

|

(108,806 |

) |

|

|

Adjusted Free Cash Flow |

$ |

178,789 |

|

|

|

$ |

213,841 |

|

|

|

$ |

329,640 |

|

|

|

$ |

443,199 |

|

|

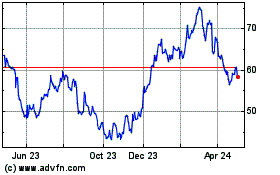

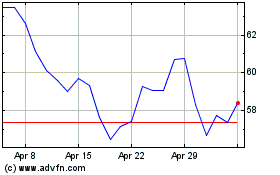

Academy Sports and Outdo... (NASDAQ:ASO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Academy Sports and Outdo... (NASDAQ:ASO)

Historical Stock Chart

From Nov 2023 to Nov 2024