Statement of Changes in Beneficial Ownership (4)

February 18 2021 - 5:59PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

STUELPNAGEL JOHN R |

2. Issuer Name and Ticker or Trading Symbol

10x Genomics, Inc.

[

TXG

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director _____ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

|

|

(Last)

(First)

(Middle)

C/O 10X GENOMICS, INC., 6230 STONERIDGE MALL ROAD |

3. Date of Earliest Transaction

(MM/DD/YYYY)

2/16/2021 |

|

(Street)

PLEASANTON, CA 94588

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Class A Common Stock | 2/16/2021 | | S(1) | | 400 | D | $189.5061 (2) | 465591 | D | |

| Class A Common Stock | 2/16/2021 | | S(1) | | 1400 | D | $190.4158 (3) | 464191 | D | |

| Class A Common Stock | 2/16/2021 | | S(1) | | 2683 | D | $191.6289 (4) | 461508 | D | |

| Class A Common Stock | 2/16/2021 | | S(1) | | 451 | D | $192.6131 (5) | 461057 | D | |

| Class A Common Stock | 2/16/2021 | | S(1) | | 600 | D | $194.60 (6) | 460457 | D | |

| Class A Common Stock | 2/16/2021 | | S(1) | | 800 | D | $195.4314 (7) | 459657 | D | |

| Class A Common Stock | 2/16/2021 | | S(1) | | 633 | D | $197.3609 (8) | 459024 | D | |

| Class A Common Stock | 2/16/2021 | | S(1) | | 233 | D | $198.0797 (9) | 458791 | D | |

| Class A Common Stock | 2/16/2021 | | S(1) | | 300 | D | $199.7833 (10) | 458491 | D | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Explanation of Responses: |

| (1) | The sales reported on this Form 4 were effected pursuant to a Rule 10b5-1 trading plan entered into by the Reporting Person. |

| (2) | This transaction was executed in multiple trades at prices ranging from $188.99 to $189.91. The price reported above reflects the weighted average sale price. The Reporting Person undertakes to provide upon request by the staff of the Securities and Exchange Commission, the Issuer, or a security holder of the Issuer, full information regarding the number of shares sold at each separate sale price. |

| (3) | This transaction was executed in multiple trades at prices ranging from $190.05 to $190.76. The price reported above reflects the weighted average sale price. The Reporting Person undertakes to provide upon request by the staff of the Securities and Exchange Commission, the Issuer, or a security holder of the Issuer, full information regarding the number of shares sold at each separate sale price. |

| (4) | This transaction was executed in multiple trades at prices ranging from $191.11 to $192.09. The price reported above reflects the weighted average sale price. The Reporting Person undertakes to provide upon request by the staff of the Securities and Exchange Commission, the Issuer, or a security holder of the Issuer, full information regarding the number of shares sold at each separate sale price. |

| (5) | This transaction was executed in multiple trades at prices ranging from $192.18 to $192.95. The price reported above reflects the weighted average sale price. The Reporting Person undertakes to provide upon request by the staff of the Securities and Exchange Commission, the Issuer, or a security holder of the Issuer, full information regarding the number of shares sold at each separate sale price. |

| (6) | This transaction was executed in multiple trades at prices ranging from $194.15 to $195.09. The price reported above reflects the weighted average sale price. The Reporting Person undertakes to provide upon request by the staff of the Securities and Exchange Commission, the Issuer, or a security holder of the Issuer, full information regarding the number of shares sold at each separate sale price. |

| (7) | This transaction was executed in multiple trades at prices ranging from $195.24 to $195.56. The price reported above reflects the weighted average sale price. The Reporting Person undertakes to provide upon request by the staff of the Securities and Exchange Commission, the Issuer, or a security holder of the Issuer, full information regarding the number of shares sold at each separate sale price. |

| (8) | This transaction was executed in multiple trades at prices ranging from $196.86 to $197.74. The price reported above reflects the weighted average sale price. The Reporting Person undertakes to provide upon request by the staff of the Securities and Exchange Commission, the Issuer, or a security holder of the Issuer, full information regarding the number of shares sold at each separate sale price. |

| (9) | This transaction was executed in multiple trades at prices ranging from $197.89 to $198.26. The price reported above reflects the weighted average sale price. The Reporting Person undertakes to provide upon request by the staff of the Securities and Exchange Commission, the Issuer, or a security holder of the Issuer, full information regarding the number of shares sold at each separate sale price. |

| (10) | This transaction was executed in multiple trades at prices ranging from $199.46 to $200.00. The price reported above reflects the weighted average sale price. The Reporting Person undertakes to provide upon request by the staff of the Securities and Exchange Commission, the Issuer, or a security holder of the Issuer, full information regarding the number of shares sold at each separate sale price. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

STUELPNAGEL JOHN R

C/O 10X GENOMICS, INC.

6230 STONERIDGE MALL ROAD

PLEASANTON, CA 94588 | X |

|

|

|

Signatures

|

| /s/ Eric S. Whitaker, as Attorney-in-Fact | | 2/18/2021 |

| **Signature of Reporting Person | Date |

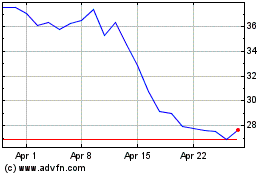

10x Genomics (NASDAQ:TXG)

Historical Stock Chart

From Jun 2024 to Jul 2024

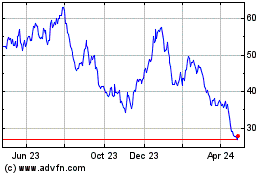

10x Genomics (NASDAQ:TXG)

Historical Stock Chart

From Jul 2023 to Jul 2024