Yen Strengthens On Worries Over Coronavirus Outbreak In China

January 20 2020 - 8:31PM

RTTF2

The Japanese yen drifted higher against its major counterparts

in the Asian session on Tuesday amid safe-haven appeal, as an

outbreak of a new coronavirus in China raised the threat of

contagion during the Lunar New Year holiday.

Most Asian shares declined after Chinese government had

confirmed the fourth death from the illness.

The outbreak of the disease raised fears of spreading faster

during the peak travel season, developing economic risk to the

Asia-Pacific region.

The Bank of Japan maintained its monetary policy but upgraded

its growth outlook.

The Policy Board of the BoJ voted 7-2 to retain the interest

rate at -0.1 percent on current accounts that financial

institutions maintain at the central bank.

The bank maintained it yield target for 10-year Japanese

government bonds at around zero percent.

Further, the bank will purchase JGBs in a flexible manner so

that their outstanding amount will increase at an annual pace of

about JPY 80 trillion.

The yen showed mixed trading against its major opponents on

Monday. While it rose against the pound and the franc, it held

steady against the greenback and the euro.

The yen advanced to a 5-day high of 109.90 against the

greenback, from a low of 110.22 seen at 7:45 pm ET. The yen is

poised to challenge resistance around the 108.00 mark.

The Japanese currency appreciated to an 8-day high of 121.90

against the euro, after falling to 122.27 at 7:45 pm ET. Next key

resistance for the yen is likely seen around the 119.00 level.

The yen climbed to a 6-day high of 113.56 against the franc,

following a decline to 113.80 at 5:45 pm ET. The yen is seen

finding resistance around the 111.00 mark.

Rebounding from a low of 143.35 hit at 5:00 pm ET, the yen

gained to 142.86 against the pound. The yen is likely to face

resistance around the 140.00 region, if it gains again.

The yen strengthened to near a 2-week high of 75.32 against the

aussie, 6-day highs of 72.49 against the kiwi and 84.14 against the

loonie, off its previous lows of 75.81, 72.85 and 84.46,

respectively. The next possible resistance for the yen is seen

around 73.00 against the aussie, 71.00 against the kiwi and 82.00

against the loonie.

Looking ahead, U.K. claimant count rate for December and ILO

jobless rate for three months ended November and German ZEW

economic sentiment index for January are due in the European

session.

Canada manufacturing sales for November are scheduled for

release in the New York session.

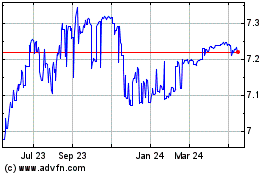

US Dollar vs CNY (FX:USDCNY)

Forex Chart

From Oct 2024 to Nov 2024

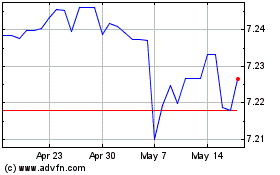

US Dollar vs CNY (FX:USDCNY)

Forex Chart

From Nov 2023 to Nov 2024