U.S. Dollar Trades Lower On Trump Worries

May 18 2017 - 5:14AM

RTTF2

The U.S. dollar traded lower against its most major counterparts

in the European session on Thursday, as mounting political turmoil

in Washington stoked worries over the future of U.S. President

Donald Trump and his stimulus measures.

News of Trump's request to drop an investigation into Russian

ties with Washington raised speculation he had meddled with the FBI

investigation, with a Democratic lawmaker calling for his

impeachment.

The Trump administration appointed former FBI Director Robert

Mueller as a special counsel to oversee the federal investigation

into Russia's involvement in the U.S. presidential election last

year.

With fears mounting over the future of Trump's presidency,

traders doubt about the implementation of agenda of tax cuts and

deregulation.

In economic front, data from the Labor Department showed that

U.S. unemployment benefits dropped unexpectedly in the week ended

May 13.

The report said initial jobless claims edged down to 232,000, a

decrease of 4,000 from the previous week's unrevised level of

236,000. Economists had expected jobless claims to rise to

240,000.

The greenback rebounded modestly against its major rivals in the

Asian session.

The greenback slid to near an 8-month low of 1.3048 against the

pound, and held steady thereafter. The pair finished yesterday's

trading at 1.2970.

Figures from the Office for National Statistics showed that UK

retail sales recovered at a faster than expected pace in April.

Retail sales volume including auto fuel grew 2.3 percent

month-on-month, reversing a 1.4 percent drop in March.

The greenback fell to 0.9764 against the Swiss franc, a level

unseen since November 2016. The greenback is seen finding support

around the 0.96 mark.

Swiss National Bank Chairman Thomas Jordan said that the Swiss

franc remains clearly overvalued despite the positive results from

the ultra-loose monetary policy that includes negative interest

rates and currency market interventions by the central bank.

While the currency remains significantly overvalued, the

expansive monetary policy has been able to stem further

appreciation, especially during times of high uncertainty following

the 'Bexit' vote in the UK and ahead of the presidential election

in France, Jordan said in an interview to the Swiss newspaper

Corriere Del Ticino.

The greenback weakened to more than a 3-week low of 110.24

against the yen and traded sideways in subsequent deals. The pair

was valued at 110.80 when it closed Wednesday's deals.

Preliminary data from the Cabinet Office showed that Japan's

gross domestic product gained 0.5 percent on quarter in the first

three months of 2017.

That was in line with expectations and up from 0.3 percent in

the previous three months.

On the flip side, the greenback reversed from an early more than

6-month low of 1.1172 against the euro and edged up to 1.1108. If

the greenback extends rise, 1.10 is likely seen as its next

resistance level.

U.S. leading indicators for April are slated for release

shortly.

The European Central Bank President Mario Draghi speaks at the

Tel Aviv University in Tel Aviv, Israel, at 1:00 pm ET.

Cleveland Fed President Loretta Mester speaks on economy and

monetary policy before the Economic Club of Minnesota at 1:15 pm

ET.

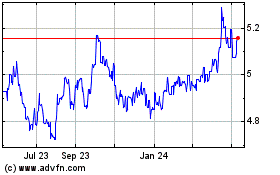

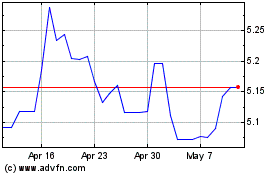

US Dollar vs BRL (FX:USDBRL)

Forex Chart

From Feb 2025 to Mar 2025

US Dollar vs BRL (FX:USDBRL)

Forex Chart

From Mar 2024 to Mar 2025