Antipodean Currencies Fall Amid Risk Aversion, China Rate Cut

July 22 2024 - 12:15AM

RTTF2

The Antipodean currencies such as the Australia and the New

Zealand dollars weakened against their major currencies in the

Asian session on Monday, as Asian stocks fell amid uncertainties

about the outcome of the upcoming U.S. presidential election and a

surprise rate cut by China's central bank also weighed on the

currencies.

Investors remain concerned about the effects of the widespread

Microsoft outage that hit services from airlines, banks and

financial services worldwide. The deepening Sino-U.S. trade

tensions and rising concerns about the outlook for China's growth

also hurt market sentiment.

The operations of major banks, media outlets, hospitals and

airlines worldwide were affected due to the widespread outage,

which was purportedly caused by an update by cybersecurity firm

CrowdStrike (CRWD).

"The underlying cause has been fixed, however, residual impact

is continuing to affect some Microsoft 365 apps and services. We're

conducting additional mitigations to provide relief," Microsoft

said on X.

U.S. President Joe Biden has decided to end his reelection

campaign and endorse U.S. Vice President Kamala Harris to run

against former President Donald Trump.

China lowered its short-term policy rate as well as benchmark

lending rates, in order to prop up growth. The People's Bank of

China cut the interest rate on seven-day reverse repos to 1.7

percent from 1.8 percent.

After cutting seven-day reverse repo rate, the central bank

lowered the one-year loan prime rate to 3.35 percent from 3.45

percent.

Similarly, the five-year LPR, the benchmark for mortgage rates,

was trimmed to 3.85 percent from 3.95 percent. The five-year LPR

was last lowered by 5 basis points in February.

Weakness across most sectors led by mining and energy stocks

amid tumbling commodity prices, also led to the downturn of the

antipodean currencies.

Crude oil prices fell to a four-week low amid concerns about the

outlook for demand from China and on renewed hopes of a ceasefire

in Gaza, while a firm dollar also weighed on oil prices. West Texas

Intermediate Crude oil futures for August sank $2.69 or 3.25

percent at $80.13 a barrel, the lowest settlement since June

17.

In the Asian trading today, the Australian dollar fell to nearly

a 1-1/2-month low of 1.6341 against the euro and more than a

1-month low of 104.17 against the yen, from last week's closing

quotes of 1.6273 and 105.23, respectively. If the aussie extends

its downtrend, it is likely to find support around 1.64 against the

euro and 103.00 against the yen.

Against the U.S. and the Canadian dollars, the aussie slipped to

near 3-week lows of 0.6661 and 0.9149 from Friday's closing quotes

of 0.6682 and 0.9176, respectively. The aussie may test support

near 0.65 against the greenback and 0.90 against the loonie.

The aussie edged down to 1.1102 against the NZ dollar, from last

week's closing value of 1.1118. The AUD/NZD pair may test support

near the 1.10 region.

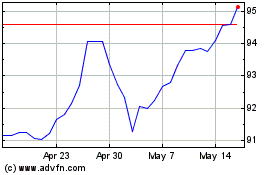

The NZ dollar fell to a 2-1/2-month low of 0.5991 against the

U.S. dollar and more than a 2-month low of 93.79 against the yen,

from Friday's closing quotes of 0.6009 and 94.64, respectively. If

the kiwi extends its downtrend, it is likely to find support around

0.58 against the greenback and 92.00 against the yen.

Against the euro, the kiwi dropped to an 8-month low of 1.8171

from last week's closing value of 1.8098. The EUR/NZD pair may test

support near the 1.82 region.

Looking ahead, U.S. Chicago Fed National Activity Index for June

is due to be released at 8:30 am ET in the New York session.

NZD vs Yen (FX:NZDJPY)

Forex Chart

From Oct 2024 to Nov 2024

NZD vs Yen (FX:NZDJPY)

Forex Chart

From Nov 2023 to Nov 2024