U.S. Dollar Climbs As Jobless Claims Fall, PCE Inflation Rises

April 25 2024 - 8:45AM

RTTF2

The U.S. dollar appreciated against its major counterparts in

the New York session on Thursday, as GDP data showed a hot

inflation reading for the first quarter and initial jobless claims

fell to a two-month low last week, dashing hopes of a rate cut

before September.

Data from the Commerce Department showed that U.S. economy grew

much less than expected in the first quarter of 2024.

Gross domestic product increased by 1.6 percent in the first

quarter after surging by 3.4 percent in the fourth quarter of 2023.

Economists had expected GDP to jump by 2.5 percent.

On the inflation front, the Commerce Department said the

personal consumption expenditures price index surged 3.4 percent in

the first quarter after advancing by 1.8 percent in the fourth

quarter.

Excluding food and energy prices, the PCE price index spiked 3.7

percent in the first quarter after jumping by 2.0 percent in the

fourth quarter.

Data from the Labor Department showed that initial jobless

claims fell to 207,000, a decrease of 5,000 from the previous

week's unrevised level of 212,000. The dip surprised economists,

who had expected jobless claims to inch up to 214,000.

With the unexpected decline, jobless claims dropped to their

lowest level since hitting 200,000 in the week ended February

17th.

The greenback touched 155.74 against the yen, its highest level

since 1990. Against the loonie, it climbed to a 3-day high of

1.3731. The greenback is poised to challenge resistance around

160.00 against the yen and 1.39 against the loonie.

The greenback jumped to a 6-1/2-month high of 0.9156 against the

franc. If the currency rises further, it may find resistance around

the 0.93 level.

The greenback recovered to 1.0678 against the euro and 1.2457

against the pound, from an early 2-week low of 1.0740 and near a

2-week low of 1.2525, respectively. The greenback is likely to find

resistance around 1.05 against the euro and 1.22 against the

pound.

The greenback moved up to 0.6485 against the aussie and 0.5920

against the kiwi, off its early nearly 2-week lows of 0.6538 and

0.5969, respectively. The greenback is seen finding resistance

around 0.63 against the aussie and 0.58 against the kiwi.

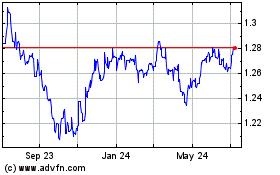

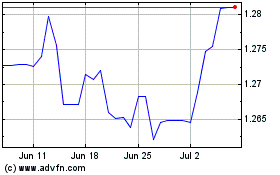

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From Sep 2024 to Oct 2024

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From Oct 2023 to Oct 2024