Yen Declines As Intervention Risk Rises; BoJ Meeting In Focus

April 25 2024 - 12:23AM

RTTF2

The Japanese yen weakened against other major currencies in the

Asian session on Thursday, as market speculate the Japanese

authorities is likely to intervene the foreign exchange market to

prop up the yen ahead of the BOJ policy meeting.

The Bank of Japan (BOJ) will start its two-day rate-setting

meeting later in the day. The central bank is expected to leave its

benchmark interest rate unchanged.

Traders also await the U.S. Fed meeting on April 30 to May 1,

with the central bank widely expected to keep rates unchanged.

In economic news, data from the Cabinet Office showed that the

Japan's leading index improved to the highest level in

one-and-a-half years as initially estimated in February. The

leading index, which measures future economic activity, rose to

111.8 in February from 109.5 in the previous month. That was in

line with the flash data published on April 5.

Meanwhile, the coincident index, measures the current economic

situation, dropped to 111.6 from 112.3 a month ago. In the initial

estimate, the score was 110.9.

The safe-haven yen traded lower against its major rivals on

Wednesday. In the Asian trading today, the yen declined to a

34-year low of 155.75 against the U.S. dollar, a 16-year low of

166.80 against the euro and a 9-year low of 194.25 against the

pound, from yesterday's closing quotes of 155.34, 166.17 and

193.57, respectively. If the yen extends its downtrend, it is

likely to find support around 157.00 against the greenback, 168.00

against the euro and 196.00 against the pound.

The yen dropped to a 6-day low of 170.39 against the Swiss

franc, from yesterday's closing value of 169.71. On the downside,

172.00 is seen as the next support level for the yen.

Against Australia, the New Zealand and the Canadian dollars, the

yen slipped to nearly a 10-year low of 101.41, nearly a 2-month low

of 92.56 and a 17-year low of 113.78 from Wednesday's closing

quotes of 100.92, 92.19 and 113.33, respectively. The yen is likely

to find support around 102.00 against the aussie, 93.00 against the

kiwi and 114.00 against the loonie.

Looking ahead, U.K. Confederation of British Industry is set to

release Distributive Trades survey results for April at 6:00 am ET

in the European session.

In the New York session, U.S. weekly jobless claims, core PCE

prices and GDPP data for the first quarter, wholesale inventories

for March, pending home sales for March and U.S. Fed Bank of Kansas

manufacturing index for March are slated for release.

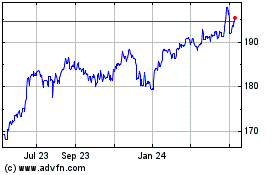

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Oct 2024 to Nov 2024

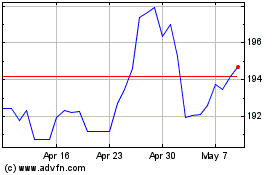

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Nov 2023 to Nov 2024