Yen Rises After BoJ Governor Ueda Comments

November 20 2024 - 11:45PM

RTTF2

The Japanese yen strengthened against other major currencies in

the late Asian session on Thursday, after the Bank of Japan (BoJ)

indicated that the bank is prepared to raise rates once more, if

the economy and prices move in line with its forecast.

Speaking at the Paris Europlace Financial Forum in Tokyo, BoJ

Governor Kazuo Ueda said the central bank will reach a decision

"meeting by meeting" on the basis of information that becomes

available.

"There's still a month to go" until the BOJ's next meeting in

December, Ueda said. "Vast amount of data and information will

become available between now and then," he said.

Markets now sees the possibility of a rate hike next month.

Today's comments came after those made on Monday that highlighted

Japan's efforts in achieving wages-driven inflation.

Moreover, traders remain cautious and are reluctant to make more

significant moves as they kept an eye on the escalating tensions

between Ukraine and Russia. The People's Bank of China holding

rates steady and the uncertainty about the U.S. Fed's interest rate

moves also rendered the mood cautious.

In the Asian trading today, the yen rose to 2-day highs of

162.86 against the euro, 195.44 against the pound, 175.03 against

the Swiss franc and 90.65 against the NZ dollar, from early lows of

163.78, 196.56, 175.81 and 91.33, respectively. The yen may test

resistance around 161.00 against the euro, 193.00 against the

pound, 173.00 against the franc and 89.00 against the kiwi.

Against the U.S., the Australia and the Canadian dollars, the

yen edged up to 154.56, 100.66 and 110.67 from early lows of

155.30, 101.14 and 111.19, respectively. If the yen extends its

uptrend, it is likely to find resistance around 153.00 against the

greenback, 99.00 against the aussie and 109.00 against the

loonie.

Looking ahead, the Confederation of British Industry is slated

to release Industrial Trends survey results for November at 6:00 am

ET in the European session. The order book balance is forecast to

rise to -25 percent from -27 percent in October.

In the New York session, Canada PPI and raw materials price

index, both for October, U.S. weekly jobless claims data, Eurozone

flash consumer confidence for November, U.S. existing home sales

data and U.S. Consumer Board's leading index, both for October, are

slated for release.

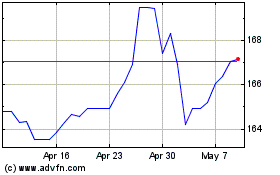

Euro vs Yen (FX:EURJPY)

Forex Chart

From Oct 2024 to Nov 2024

Euro vs Yen (FX:EURJPY)

Forex Chart

From Nov 2023 to Nov 2024