Pound Falls Amid BoE Rate Cut Speculation

July 29 2024 - 2:30AM

RTTF2

The British pound weakened against other major currencies in the

European session on Monday, as traders speculate the Bank of

England is likely to cut its interest rates at the monetary policy

meeting later in the week.

The Bank of England will announce its decision at the monetary

policy meeting, due on Thursday. The BoE is expected to cut its

interest rate by 25 basis points to 5.00 percent.

Signs of escalating tensions in the Middle East offset hopes for

more interest rate cuts from the Federal Reserve this year, also

weighed on the investor sentiment.

The Middle East braced for a potential flare-up in violence

after Israeli authorities said a rocket from Lebanon struck a

soccer field in the Israeli-controlled Golan Heights, killing 12

children and teens in what the military called the deadliest attack

on civilians since Oct. 7.

Investors also awaited the release of mega-cap U.S. tech

earnings and central bank policy meetings in the United States and

Japan this week for directional cues.

In economic news, data from the Bank of England showed that U.K.

mortgage approvals remained almost stable in June despite an

increase in the mortgage rate, reflecting the strength in the

housing market. Net mortgage approvals for house purchases, an

indicator of future borrowing, totalled 59,976 in June compared to

60,134 in May. The figure was almost in line with the forecast of

60,000.

Mortgage debt increased to GBP 2.7 billion in June from GBP 1.3

billion in May, while it was forecast to fall to GBP 1.2 billion.

Gross lending fell to GBP 20.8 billion from GBP 22.6 billion a

month ago.

The British sterling traded higher against its major rivals in

the Asian session today.

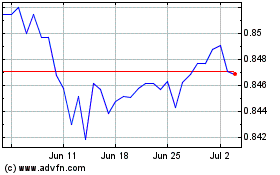

In the European trading now, the pound fell to nearly a 4-week

low of 0.8461 against the euro and a 4-day low of 196.88 against

the yen, from early highs of 0.8431 and 198.62, respectively. If

the pound extends its downtrend, it is likely to find support

around 0.85 against the euro and 195.00 against the yen.

Against the U.S. dollar, the pound slipped to nearly a 3-week

low of 1.2807 from an early 4-day high of 1.2889. On the downside,

1.26 is seen as the next support level for the pound.

Moving away from an early 4-day high of 1.1385 against the Swiss

franc, the pound edged down to 1.1334. The pound may test support

near the 1.12 region.

Looking ahead, U.S. Dallas Fed manufacturing index for July is

due to be released in the New York session.

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Oct 2024 to Nov 2024

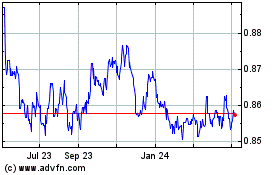

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Nov 2023 to Nov 2024