Canadian Dollar Drops As Oil Prices Dip

July 26 2024 - 8:45AM

RTTF2

The Canadian dollar weakened against its major counterparts in

the New York session on Friday, as oil edged lower on China demand

concerns.

Oil prices came under pressure due to concerns about a slowdown

in Chinese growth and expectations of a ceasefire deal for the Gaza

war and related violence in the Middle East.

Data released earlier this week showed China's apparent oil

demand fell 8.1 percent to 13.66 million barrels per day in June,

prompting concerns about consumption.

Elsewhere, United States Vice President Kamala Harris and the

presumptive Democratic nominee after President Joe Biden's decision

to end his re-election campaign has pledged not to stay "silent"

about suffering in Gaza, raising hopes of an end to the war.

Speaking to reporters after a meeting with Israeli Prime

Minister Benjamin Netanyahu in Washington on Thursday, Harris said

that her commitment to Israel's existence and security was

"unwavering", but that "far too many" innocent civilians had been

killed in the war.

Harris said that she had urged Netanyahu to agree to a

U.S.-backed ceasefire proposal that would ease the suffering of

Palestinian civilians.

The loonie fell to 1.3849 against the greenback and 0.9079

against the aussie, off its early highs of 1.3807 and 0.9034,

respectively. The loonie is likely to challenge support around 1.39

against the greenback and 0.93 against the aussie.

The loonie touched more than an 8-month low of 1.5035 against

the euro. The loonie is seen finding support around the 1.52

level.

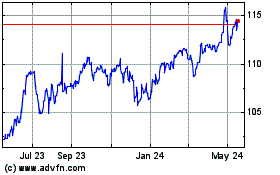

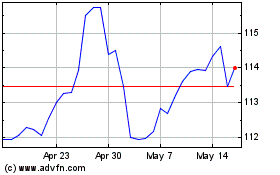

Against the yen, the loonie edged down to 110.73, from an early

2-day high of 111.98. The currency is poised to challenge support

around the 106.00 level.

CAD vs Yen (FX:CADJPY)

Forex Chart

From Oct 2024 to Nov 2024

CAD vs Yen (FX:CADJPY)

Forex Chart

From Nov 2023 to Nov 2024