Australian Dollar Rises After Strong Australia CPI Data

August 27 2024 - 11:21PM

RTTF2

The Australian dollar strengthened against other major

currencies in the Asian session on Wednesday, after data showed

that Australia's monthly consumer price index rose more than

expected in July.

Data from the Australian Bureau of Statistics or ABS showed that

the Australia's monthly Consumer Price Index or CPI rose 3.5

percent in the year to July, compared to a 3.8 percent increase

seen in June. Economists expected the consumer price index to

increase 3.4 percent in July.

The inflation data spurred speculation among the traders for

further interest-rate hikes from the Reserve Bank of Australia

(RBA), also fueled the strength of Australian dollar.

Traders remain cautious and await the release of key U.S.

inflation report later in the week, which could impact expectations

for how quickly the U.S. Fed will cuts interest rates.

In other economic news, data from the Australian Bureau of

Statistics showed that the value of total construction work done in

Australia was up a seasonally adjusted0.1 percent on quarter in the

second quarter of 2024, standing at A$64.932 billion. That missed

expectations for a gain of 0.8 percent following the 2.9 percent

contraction in the three months prior.

On a yearly basis, overall construction work rose 1.5

percent.

In the Asian trading today, the Australian dollar rose to more

than a 1-month high of 1.6408 against the euro, from yesterday's

closing value of 1.6464. The aussie may test resistance around the

1.59 region.

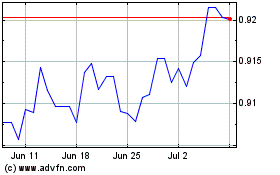

Against the U.S. and the Canadian dollars, the aussie advanced

to nearly an 8-month high of 0.6813 and a 2-day high of 0.9159 from

Tuesday's closing quotes of 0.6792 and 0.9128, respectively. If the

aussie extends its uptrend, it is likely to find resistance around

0.69 against the greenback and 0.93 against the loonie.

Against the yen and the NZ dollar, the aussie edged up to 98.25

and 1.0911 from yesterday's closing quotes of 97.77 and 1.0860,

respectively. The next possible upside target of the aussie is

found around 104.00 against the yen and 1.11 against the kiwi.

Looking ahead, the European Central Bank is slated to release

monetary aggregates for July at 4:00 am ET in the European

session.

In the New York session, U.S. MBA weekly mortgage approvals data

and U.S. EIA weekly crude oil data are slated for release.

AUD vs CAD (FX:AUDCAD)

Forex Chart

From Jul 2024 to Aug 2024

AUD vs CAD (FX:AUDCAD)

Forex Chart

From Aug 2023 to Aug 2024