VEON 1Q24 Trading Update: Accelerating USD Growth, Strong

Operational Execution

VEON 1Q24 Trading Update: Accelerating

USD Growth, Strong Operational

Execution

Amsterdam, 16 May 2024 07:00AM

CEST –

VEON Q1 2024 Highlights

- Q1 revenue of USD 942 million, +6.6% YoY (+11.6% YoY in local

currency) and EBITDA of USD 386 million, +0.2% YoY (+5.1% YoY in

local currency)

- Q1 capex of USD 125 million, +38.6% YoY, with LTM capex

intensity of 18.3%

- Total cash and cash equivalents of USD 632 million, with USD

261 million at HQ; and gross debt at USD 3.7 billion (decreased by

USD 2.0 billion YoY), with net debt excluding lease liabilities at

USD 2.0 billion; VEON repaid its Revolving Credit Facility

- Maintaining FY 2024 revenue growth guidance in local currency

of 16-18%, EBITDA growth guidance in local currency of 18-20%, and

capex intensity of 18-19%

- VEON management increases share ownership; announces its 2024

Annual General Meeting and Capital Markets Day

VEON Ltd. (NASDAQ: VEON, Euronext Amsterdam: VEON), a global

digital operator that provides converged connectivity and online

services, announces selected financial and operating results for

the first quarter ended 31 March 2024.

In 1Q24, VEON continued to report growth in revenues in reported

currency terms with double digit local currency top-line growth.

Total revenues reached USD 942 million, an increase of 6.6% YoY in

reported currency (+11.6% YoY in local currency). Service revenues

amounted to USD 903 million, an increase of 5.5% YoY in reported

currency (+10.4% YoY in local currency), and EBITDA of USD 386

million represented a 0.2% YoY increase in reported currency terms

(+5.1% YoY in local currency). Capex in 1Q24 was USD 125 million,

an increase of 38.6% YoY, and reported capex intensity for the last

twelve months was 18.3% (-2.0p.p. YoY). Total cash and cash

equivalents as of 31 March 2024 amounted to USD 632 million with

USD 261 million held at the headquarters (“HQ”) level.

For FY 2024, VEON maintains its full-year guidance for revenue

of 16%-18% and EBITDA of 18%-20% growth in local currency supported

by execution of its digital operator strategy, and for Group capex

intensity of 18%-19%.

Commenting on the results, Kaan Terzioğlu said:

“I am pleased to see balanced organic performance in all our

markets, reflecting our ability to serve our customers in both

consumer and business segments with digital solutions in finance,

entertainment, healthcare, education and enterprise

services.

Our operating companies successfully leverage our customer

acquisition and engagement capabilities as well as our distribution

power to meet the growing demand for digitalization in our markets,

where we served a total of 111 million monthly active users across

our digital services in March 2024.

I am excited to see the continuation of our growth trend as we

deepen our customer engagement through high-quality digital

experiences, which are now being strengthened with new technologies

including artificial intelligence. We look forward to updating our

investors on our upcoming Capital Markets Day on June 6th,

2024.”

Additional information

View the full 1Q24 trading update View 1Q24

trading update presentationView 1Q24 factbook

About VEON

VEON is a digital operator that provides

converged connectivity and digital services to nearly 160 million

customers. Operating across six countries that are home to

more than 7% of the world’s population, VEON is transforming lives

through technology-driven services that empower individuals and

drive economic growth. Headquartered in Amsterdam, VEON is listed

on NASDAQ and Euronext. For more information,

visit: https://www.veon.com.

Notice to readers: financial information

presented

VEON's results and other financial information

presented in this document are, unless otherwise stated, prepared

in accordance with International Financial Reporting Standards

("IFRS") based on internal management reporting, are the

responsibility of management, and have not been externally audited,

reviewed, or verified. As such, you should not place undue reliance

on this information. This information may not be indicative of the

actual results for any future period.

Notice to readers: impact of the war in

Ukraine

The ongoing war between Russia and Ukraine and

the sanctions imposed by the United States, member states of the

European Union, the European Union itself, the United Kingdom,

Ukraine and certain other nations, counter-sanctions by Russia and

other legal and regulatory responses, as well as responses by our

service providers, partners, suppliers and other counterparties,

and the other indirect and direct consequences of the war have

impacted and, if the war, sanctions and such responses and other

consequences continue or escalate, may significantly impact our

results and aspects of our operations in Ukraine, and may

significantly affect our results and aspects of our operations in

the other countries in which we operate. We are closely monitoring

events in Russia and Ukraine, as well as the possibility of the

imposition of further sanctions in connection with the ongoing war

between Russia and Ukraine and any resulting further rise in

tensions between Russia and the United States, the United Kingdom

and/or the European Union.

Our operations in Ukraine continue to be

affected by the war. We are doing everything we can to protect the

safety of our employees, while continuing to ensure the

uninterrupted operation of our communications, financial and

digital services.

Disclaimer

VEON's results and other financial information

presented in this document are, unless otherwise stated, prepared

in accordance with International Financial Reporting Standards

("IFRS") and have not been externally reviewed and audited. The

financial information included in this document is preliminary and

is based on a number of assumptions that are subject to inherent

uncertainties and subject to change. The financial information

presented herein is based on internal management accounts, is the

responsibility of management and is subject to financial closing

procedures which have not yet been completed and has not been

audited, reviewed or verified. Certain amounts and percentages that

appear in this document have been subject to rounding adjustments.

As a result, certain numerical figures shown as totals, including

those in the tables, may not be an exact arithmetic aggregation of

the figures that precede or follow them. Although we believe the

information to be reasonable, actual results may vary from the

information contained above and such variations could be material.

As such, you should not place undue reliance on this information.

This information may not be indicative of the actual results for

the current period or any future period.

This document contains “forward-looking

statements”, as the phrase is defined in Section 27A of the U.S.

Securities Act of 1933, as amended, and Section 21E of the U.S.

Securities Exchange Act of 1934, as amended. These forward-looking

statements may be identified by words such as “may,” “might,”

“will,” “could,” “would,” “should,” “expect,” “plan,” “anticipate,”

“intend,” “seek,” “believe,” “estimate,” “predict,” “potential,”

“continue,” “contemplate,” “possible” and other similar words.

Forward-looking statements include statements relating to, among

other things, VEON’s plans to implement its strategic priorities,

including operating model and development plans; anticipated

performance, including VEON’s ability to generate sufficient cash

flow; VEON’s assessment of the impact of the war in Ukraine,

including related sanctions and counter-sanctions, on its current

and future operations and financial condition; future market

developments and trends; operational and network development and

network investment, including expectations regarding the roll-out

and benefits of 3G/4G/LTE networks, as applicable; spectrum

acquisitions and renewals; the effect of the acquisition of

additional spectrum on customer experience; VEON’s ability to

realize the acquisition and disposition of any of its businesses

and assets and to execute its strategic transactions in the

timeframes anticipated, or at all; VEON’s ability to realize

financial improvements, including an expected reduction of net

pro-forma leverage ratio following the successful completion of

certain dispositions and acquisitions; our dividends; and VEON’s

ability to realize its targets and commercial initiatives in its

various countries of operation.

The forward-looking statements included in this

document are based on management’s best assessment of VEON’s

strategic and financial position and of future market conditions,

trends and other potential developments. These discussions involve

risks and uncertainties. The actual outcome may differ materially

from these statements as a result of, among other things: further

escalation in the war in Ukraine, including further sanctions and

counter-sanctions and any related involuntary deconsolidation of

our Ukrainian operations; demand for and market acceptance of

VEON’s products and services; our plans regarding our dividend

payments and policies, as well as our ability to receive dividends,

distributions, loans, transfers or other payments or guarantees

from our subsidiaries; continued volatility in the economies in

VEON’s markets; governmental regulation of the telecommunications

industries; general political uncertainties in VEON’s markets;

government investigations or other regulatory actions; litigation

or disputes with third parties or regulatory authorities or other

negative developments regarding such parties; the impact of export

controls and laws affecting trade and investment on our and

important third-party suppliers' ability to procure goods, software

or technology necessary for the services we provide to our

customers; risks associated with our material weakness in internal

control over financial reporting; risks associated with data

protection or cyber security, other risks beyond the parties’

control or a failure to meet expectations regarding various

strategic priorities, the effect of foreign currency fluctuations,

increased competition in the markets in which VEON operates and the

effect of consumer taxes on the purchasing activities of consumers

of VEON’s services.

Certain other factors that could cause actual

results to differ materially from those discussed in any

forward-looking statements include the risk factors described in

VEON’s Annual Report on Form 20-F for the year ended 31 December

2022 filed with the U.S. Securities and Exchange Commission (the

“SEC”) on 24 July 2023 and other public filings made from time to

time by VEON with the SEC. Other unknown or unpredictable factors

also could harm our future results. New risk factors and

uncertainties emerge from time to time and it is not possible for

our management to predict all risk factors and uncertainties, nor

can we assess the impact of all factors on our business or the

extent to which any factor, or combination of factors, may cause

actual results to differ materially from those contained in any

forward-looking statements. Under no circumstances should the

inclusion of such forward-looking statements in this document be

regarded as a representation or warranty by us or any other person

with respect to the achievement of results set out in such

statements or that the underlying assumptions used will in fact be

the case. Therefore, you are cautioned not to place undue reliance

on these forward-looking statements. The forward-looking statements

speak only as of the date hereof. We cannot assure you that any

projected results or events will be achieved. Except to the extent

required by law, we disclaim any obligation to update or revise any

of these forward-looking statements, whether as a result of new

information, future events or otherwise, after the date on which

the statements are made, or to reflect the occurrence of

unanticipated events.

Furthermore, elements of this document contain

or may contain, “inside information” as defined under the Market

Abuse Regulation (EU) No. 596/2014.

Contact Information

VEONInvestor RelationsFaisal

Ghoriir@veon.com

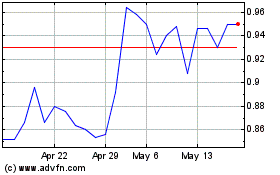

VEON (EU:VEON)

Historical Stock Chart

From Nov 2024 to Dec 2024

VEON (EU:VEON)

Historical Stock Chart

From Dec 2023 to Dec 2024