Update on the restructuring process of the

Pierre & Vacances-Center Parcs Group

Regulatory News:

Pierre & Vacances-Center Parcs (Paris:VAC):

1. Strategic Plan ReInvention

On 18 May 2021, the Pierre & Vacances-Center Parcs Group

announced its strategic plan, ReInvention 2025, with the

ambition of becoming the leader and precursor of a new, reinvented

and value-creating local tourism, by:

- a radical modernization of its offer, 100%

experience-based, personalised and service-focused, supported by a

general premiumisation,

- a sustainable performance, with a selective and

responsible development, favouring alternative contracting methods

to leasing, and a more agile and efficient organization, with lower

structural costs.

In the context of the agreement related to the restructuring of

the Group concluded on 10 March 2022, Alcentra, Fidera and Atream

(the "Investors") confirmed that they share the strategic

orientations of ReInvention 2025, specifying that an additional

delay of up to 12 to 24 months in the achievement of the financial

objectives initially set (and slightly revised in fall 2021) could

not be excluded in consideration of the current health and

international context.

The update of the financial objectives of the Group’s plan

include this calendar shift, as well as the following main

elements:

- a more selective approach to development projects included in

the business plan and a postponement of certain programs (impact on

real estate and tourism margins);

- full consolidation of Villages Nature as of 15 December 2022

(previously 50%);

- higher raw material and energy costs, and wage inflation on

site (pressure on the labor market in certain sectors - especially

cleaning and catering);

- a more conservative approach to the evolution of average sales

prices and occupancy rates, and generally a more cautious approach

to objectives, particularly for the last two years of the plan for

which the predictive accuracy is more uncertain.

This update of the strategic orientations was agreed with the

Investors, it being recalled that the Group's business plan, which

involves an ambitious transformation project, is by its very nature

the subject of ongoing work.

Main objectives1 expressed according to operational

reporting2 (vs. revised objectives in fall 2021)

- Revenue from tourism activities: €1,620 million in 2023

(vs. €1,581 million) and €1,795 million in 2025 (vs. €1,805

million);

- Group adjusted EBITDA3: €105 million in 2023 (vs. €137

million) and €170 million in 2025 (vs. €268 million), mainly

generated by tourism activities;

- Group operating cash-flows4: €37 million generated in

2023 (vs. €33 million) and €65 million in 2025 (vs €156

million).

The Group also plans to finance €381 million in CAPEX over the

period 2022-2025 (vs. €375 million), in addition to nearly €290

million in investments financed by the owners of the Center Parcs

estates over the same period.

The business plan has also been forecasted until 2026, with

the final year's objectives as follows:

- revenue from tourism activities of €1,877 million;

- €187 million in Group adjusted EBITDA;

- €93 million in Group operating cash flows.

Finally, for the current fiscal year 2021/2022, the Group

expects:

- revenue from tourism activities above budget (growing by

nearly 7% over the revenue achieved in 2019);

- Group adjusted EBITDA also higher than budget, estimated at

€83 million excluding the benefit of non-recurring items (which

could amount to a positive total of more than €50 million,

including in particular the so-called "closure" aid received in

France, subsidies requested from the German federal government and

the impact of the agreements concluded with the Group's

lenders)

This adjusted EBITDA has been revised upwards compared with the

previous communication of 10 March 2022 (Group adjusted EBITDA then

expected to be €95 million, or €72 million excluding non-recurring

items).

- a cash position estimated to date at €438 million euros as of

30 September 2022, including the benefit of the aforementioned aid

and after completion of the Restructuring Operations. As a

reminder, the cash position as of 30 September 2022 mentioned in

the press release of 10 March 2022 was €390 million, before taking

into account the so-called "closure" aid received in France.

2. Update on the Group’s restructuring

process

In accordance with the announcements made in the press release

dated 10 March 2022, the Group is committed to completing the

preliminary transactions and lifting the conditions precedent to

the completion of the Restructuring Transactions.

To date, the Group confirms the following main elements:

- the capital reduction by way of a reduction in the par value of

the shares from €10 to €0.01 has been implemented by the Board of

Directors upon the authorization of the Annual General Meeting of

31 March 2022. The capital reduction should be realized in the next

few days. After such reduction, the number of outstanding shares,

i.e. 9,893,463, will remain unchanged, and the share capital will

be reduced to €98,934.63;

- the so-called "closure" aid to compensate for the uncovered

fixed costs of companies whose activity was particularly affected

by the covid-19 pandemic has been received in the amount of 24

million euros. As announced in the press release of 10 March 2022,

the Group will pay back a portion of this aid to certain individual

lessors, in accordance with the agreements concluded with them in

the context of the conciliation procedure initiated in 2021;

- discussions with the institutional lenders concerned are

continuing in the context of the completion of the Restructuring

Transactions;

- on 6 April 2022, the required application for approval by the

German Competition Authority under the applicable merger control

regulations was filed. The decision of the German Competition

Authority is expected in May 2022;

- the transactions relating to S.I.T.I., the Company's current

controlling shareholder, referred to in the press release dated 10

March 2022, were formalized by an agreement dated 11 March 2022,

under the terms of which the mandatory transfer by S.I.T.I. to

Alcentra and Fidera of all the preferential subscription rights

(DPS) to be received in the Right Issue (as this term is defined in

the press release dated 10 March 2022) was reaffirmed. In this

context, Alcentra and Fidera have granted a minimum price of €0.19

per preferential subscription right, offered to all Pierre &

Vacances SA’ shareholders within the framework of the liquidity

offer, the maximum price of €0.22 remaining unchanged.

The indicative date of 16 September 2022 announced in the press

release of 10 March remains the target date for the completion of

the Restructuring Transactions.

Forward-looking information

This press release contains prospective information relative to

the targets and strategy of the Pierre & Vacances Center Parcs

Group. Although Pierre & Vacances-Center Parcs’ management

considers that this prospective information is based on reasonable

estimates, forecasts and assumptions, it provides no guarantee as

to the future performance of the Pierre & Vacances-Center Parcs

Group. The actual results may be very different to these

prospective statements, due to a certain number of risks and

uncertainties, known or unknown at the present date, the majority

of which are out of the control of the Pierre & Vacances Center

Parcs Group, in particular risks related to the economic

environment and the health situation in which the Group is active,

delivery of the strategic plan and the risks described in the

documents registered by Pierre & Vacances Center Parcs with the

AMF, including those set out in section 2.2 of the Group’s

universal registration document registered with the AMF on 17 March

2022 under the number D.22-0119 (the “Universal Registration

Document”). Copies of the Universal Registration Document are

available free of charge at the Pierre & Vacances head office

and on the Pierre & Vacances and AMF websites

(www.groupepvcp.com).

1 The full financing of the strategic plan remains subject to

the completion of the restructuring transactions mentioned in the

press release dated 10 March 2022 (the “Restructuring

Transactions”). The objectives mentioned prevail over any

contrary objective previously communicated by the Group and assume

the financing by the real estate company to be formed by Atream of

the real estate projects planned over the duration of the business

plan. 2 In order to reflect the operational reality of the Group's

activities and the clarity of their performance, the Group's

financial communication, in line with operational reporting as

monitored by management, includes the results of joint ventures on

a proportional basis and does not include the application of IFRS

16. 3 Adjusted EBITDA = operating income before non-recurring items

(consolidated operating income before other non-recurring operating

income and expenses, excluding the impact of IFRS 11 and IFRS 16),

adjusted for provisions and net depreciations on fixed operating

assets. 4 Operating cash flow, after capex and before non-recurring

items and financing activities.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220421006219/en/

For further information:

Investor Relations and Strategic Operations Emeline Lauté

+33 (0) 1 58 21 54 76 info.fin@groupepvcp.com

Press Relations Valérie Lauthier +33 (0) 1 58 21 54 61

valerie.lauthier@groupepvcp.com

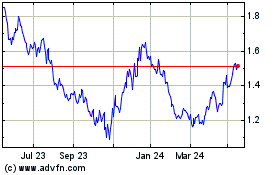

Pierre & Vacances (EU:VAC)

Historical Stock Chart

From Nov 2024 to Dec 2024

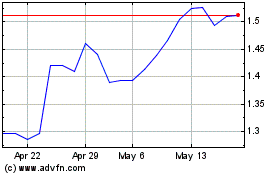

Pierre & Vacances (EU:VAC)

Historical Stock Chart

From Dec 2023 to Dec 2024