UPDATE: Economic Fears Hit Adecco As Market Momentum Slows

August 10 2011 - 5:43AM

Dow Jones News

Adecco SA (ADEN.VX) Wednesday was hit by investor fears that the

ongoing financial crisis could soon hurt job markets in

industrialized economies as it warned of slowing business in July,

even as the world's largest staffing company posted a 45% jump in

second-quarter net profit.

The investor skepticism pushed Adecco's shares almost 7% lower

in early trade, against the overall positive trend in Switzerland.

At 0847 GMT, the shares were down 4.8% at 36.8 Swiss francs, adding

to the stock's 36.8% drop this year.

The Zurich-based company said net profit for the three months to

end-June rose to EUR141 million from EUR97 million, beating analyst

forecasts of EUR125 million as Adecco registered double-digit

growth in the U.S. and France, its two major markets.

Sales were also above expectations, rising 11% to EUR5.17

billion from EUR4.65 billion, as demand in the automotive sector in

Italy and Germany also helped boost revenue and as business in

emerging market continued to thrive.

But analysts and investors said the growth rates weren't enough

to disperse concerns over Adecco's ability to protect itself

against cooling economies in Europe and the U.S. as the financial

crisis is expected to hurt consumer demand and curb economic

growth.

Furthermore, job markets in countries such as the U.S., Spain

and the U.K., although they have improved from recession lows, are

still weak. And concerns are rising that any new jobs generated

will be in emerging markets, where Adecco's market presence is

still comparatively small and where profit margins are lower.

"In this market environment, the sales rise was too little to

impress," said Robert Scholl, asset manager at the 8.5 billion

Swiss francs ($11.6 billion) pension fund Aargauische

Pensionskasse. "And fears are that the industrial and automotive

sector in Europe and the U.S. could soon be hurt again if the

global economy cools off and Europe and the U.S. fall into

recession," Scholl said.

Chief Executive Patrick De Maeseneire tried to disperse some of

these fears, saying "there are no warning signals that clients are

reducing the number of temporary staff." While he said that

business was "a touch lower" in July, he also cautioned that it was

important how the market will develop after the holidays in

September.

De Maeseneire's outlook comments failed to imbue investor trust

as the market is aware that Adecco's ability to read market trends

is limited. The company is only able to predict developments about

one month ahead.

During the last crisis, Adecco, which leads the market ahead of

competitors such as U.S.-based Manpower Inc (MAN) and Randstad

Holding NV (RAND.AE), lost around 30% of revenue and had to launch

a hefty cost cutting program to protect profit margins and keep

losses in check.

Its attempt to place more professional staffers such as lawyers

and IT specialists helped it keep up margins and Chief Financial

Officer Dominik de Daniel said Adecco was confident the demand for

highly specialized staff will continue to perform well.

-By Goran Mijuk, Dow Jones Newswires, +41 43 443 80 47;

goran.mijuk@dowjones.com

(John Revill in Zurich contributed to this article.)

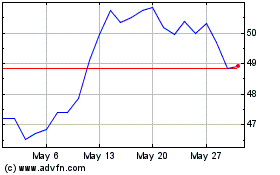

Randstad NV (EU:RAND)

Historical Stock Chart

From Aug 2024 to Sep 2024

Randstad NV (EU:RAND)

Historical Stock Chart

From Sep 2023 to Sep 2024