A worsening skills shortage coupled with recovering economies

will drive growth this year for staffing company ManpowerGroup

(MAN), Chief Executive Jeff Joerres said Wednesday.

Even big countries like India and China are facing acute

shortages of skilled staff while lingering uncertainty in developed

countries would boost demand for temporary workers, Joerres told

Dow Jones Newswires in an interview.

"Almost two years into the recovery and we are still seeing

shocks, either what is really happening in China, or concerns about

the U.S. housing market or debt in Europe," he said.

"Companies are feeling that their businesses are becoming

healthier, but there never seems to be enough daylight or enough

margin for them to hire the people they need."

Amid the uncertainty, companies are placing more value on

flexibility in hiring staff, while increasing global competition

between companies made them more sensitive to downturns in

particular regions, he said.

Joerres said the global skills shortage applied particularly to

technical areas, like specialized trades, but also sales staff.

"There is still unemployment, but companies are having a

difficult time finding the people they need to fill their

positions.

"As the world is becoming more technical, the sales staff are

having to become more technical, too," Joerres said.

The shortage also applied to laborers, especially in developing

markets.

"You cannot just throw people at production to get more output,"

Joerres said. "With the use of (computer numerical control, or CNC)

machines, for example, it is more difficult to find the right

people."

ManpowerGroup's sixth annual talent shortage survey, to be

published Thursday, will show that persistent talent shortages

across many geographies and industry sectors are frustrating

employers who struggle to find qualified talent amid an oversupply

of available workers.

Although European countries aren't yet feeling such an acute

impact of talent shortages, the U.S. has seen a considerable uptick

in the number of employers who can't find the talent they need,

Joerres said.

India now has the second-highest problem with skilled labor

shortages. "The number of companies in India reporting difficulty

filling vacancies is second only to Japan," Joerres said.

"India is a big place with lots of people but there's a shortage

of assurance engineers, people who can read blueprints, designers

and (computer-aided design, or CAD) designers."

Manpower, based in Milwaukee, is looking to expand its

operations in emerging markets that make up around 15% of its

sales, which reached $5.07 billion in the first quarter of

2011.

The company has joint ventures in China, and was expanding into

the west of the country away from the highly developed coastal

strip.

In April, Manpower acquired a 74% stake in Web Development Co.

Ltd., which provides IT services and professional staffing in

India.

Manpower would continue to look at takeover targets, with

acquisitions in the $50 million to $500 million price range,

Joerres added.

It would look at speciality firms, working in the high end in

accounting, IT and engineering, but also general staffing

companies.

Meanwhile, he expected the higher margin professional business

would continue to grow, because many companies were taking on

smaller and more one-off projects, which made them reluctant to

recruit permanent staff.

Like rival staffing companies Adecco SA (ADEN.VX) and Randstad

Holding NV (RAND.AE), Manpower has enjoyed a strong start to

2011.

Last month, it reported its first-quarter profit rose to $35.7

million from $2.8 million a year earlier and said it expected its

second-quarter earnings per share to rise to a range of 74 cents to

82 cents from 43 cents in the first three months.

According to a calculation by Dow Jones Newswires, this would

give Manpower second-quarter earnings of $61 million to $68

million.

"We have had a strong first quarter and we increased our

estimates for the second quarter," said Joerres.

"With GDP growth, we see a good solid growth in the second

quarter."

-By John Revill, Dow Jones Newswires; +41 43 443 8042;

john.revill@dowjones.com

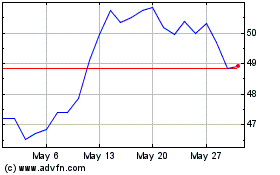

Randstad NV (EU:RAND)

Historical Stock Chart

From Jun 2024 to Jul 2024

Randstad NV (EU:RAND)

Historical Stock Chart

From Jul 2023 to Jul 2024