Naspers, Prosus Expect Fiscal Year 2021 EPS to Soar; Back Shareholder Exchange

June 10 2021 - 12:43PM

Dow Jones News

By Matteo Castia

Naspers Ltd. and subsidiary Prosus NV said Thursday that each

expect a sharp rise in earnings per share for fiscal 2021, and that

both recommend their shareholders proceed with the previously

announced voluntary share exchange offer between the two

companies.

Naspers--a South African newspaper publisher turned technology

giant and Africa's most valuable listed company--said it expects

earnings per share for the year ended March 31 to rise between 70%

and 77% year-on-year, or by 500 cents and 550 cents. EPS in fiscal

2020 came in at 718 cents.

"While navigating a global pandemic, the group benefited from

its global perspective and diversified operations and executed on

many key strategic initiatives that position it very well for

continued long-term growth and value creation," Naspers said.

Dutch internet conglomerate Prosus said in a separate release

that it expects EPS for the same period to rise between 92% and 99%

on the year, or by 216 cents and 232 cents. EPS in fiscal 2020 came

in at 235 cents.

Naspers and Prosus also said they deem the previously announced

voluntary share exchange offer to be in the best interest of both

companies' shareholders.

"It could provide significant value unlock for Prosus and

Naspers shareholders. It will increase the Prosus free float

materially, with expected growth in its overall trading liquidity,

market index weightings and positive trading dynamics," they

said.

On May 12, Naspers and Prosus said they were planning to launch

a voluntary offer under which Naspers shareholders would be

entitled to exchange ordinary shares for newly issued shares in

Prosus.

Write to Matteo Castia at matteo.castia@dowjones.com

(END) Dow Jones Newswires

June 10, 2021 12:29 ET (16:29 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

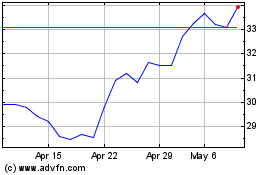

Prosus NV (EU:PRX)

Historical Stock Chart

From Oct 2024 to Nov 2024

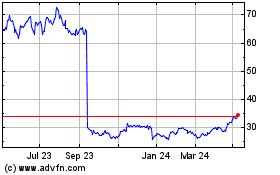

Prosus NV (EU:PRX)

Historical Stock Chart

From Nov 2023 to Nov 2024