Correction: 2019 results: confirmation of McPhy’s industrial

scaling up

Final version : failure to comply with footnote 8

2019 results: confirmation of McPhy’s industrial scaling

up

- Strong revenue growth of 43% to €11.4 million in 2019, driven

by excellent sales momentum over the year with orders booked in

France and Europe

- Acceleration of the Group's development, preparing the

industrialization phase

- Strengthening of the financial structure with a cash position

of €13 million at end-2019, notably following the success of the

capital increase of almost €7 million carried out in November

2019

- Confirmation of medium-term growth prospects with McPhy’s

industrial scaling up

La Motte-Fanjas (France), March 10, 2020

– 5:45 pm CET – McPhy (Euronext Paris Compartment C: MCPHY,

FR0011742329), a specialist in hydrogen production and

distribution equipment, today announces its annual results for the

year to December 31, 2019, as approved by its Board of

Directors.

Laurent Carme, Chief Executive Officer

of McPhy, states: “Within a promising and high-potential

market context, McPhy has been able to continue its ramping up and

the consolidation of its technological leadership on its key

markets.

Thanks to excellent commercial activity

throughout the year, our revenue increased by 43% to €11.4 million

in 2019. This buoyant growth, combined with good control over our

operating costs, has enabled us to improve our results.

Following this rich and promising year, we are

more ready than ever to continue seizing new opportunities, and

more particularly projects on an industrial scale in order to

sustainably support the necessary transition to a low-carbon,

secure and competitive economy.”

Simplified income statement

| (€

millions) |

2019 |

2018 |

Change |

|

Revenue |

11.4 |

8.0 |

+43% |

| Other operating

income |

4.5 |

1.1 |

+296% |

| Income from ordinary

activities |

15.9 |

9.1 |

+75% |

| Purchases

consumed |

(6.1) |

(4.6) |

+35% |

|

Personnel costs |

(7.1) |

(6.1) |

+17% |

|

External costs |

(6.1) |

(5.7) |

+7% |

|

Depreciation, amortization and provisions |

(2.6) |

(2.1) |

+23% |

| Recurring operating

profit/loss |

(6.0) |

(9.4) |

+36% |

| Other operating income and

expenses |

(0.1) |

(0.0) |

- |

| Operating

profit/loss |

(6.1) |

(9.4) |

+35% |

|

Financial result |

(0.1) |

(0.0) |

- |

| Income tax |

(0.1) |

(0.1) |

- |

| Net profit/loss |

(6.3) |

(9.5) |

+34% |

Strong revenue growth and improved result

In 2019, McPhy recorded a +43% increase in revenue to €11.4

million, versus €8 million in 2018. This growth was driven by the

taking and completion of a number of orders for electrolyzers and

hydrogen production and distribution stations in France and

abroad.

In 2019, McPhy recorded a +43% increase in revenue to €11.4

million, versus €8 million in 2018. This growth was driven by the

taking and completion of a number of orders for electrolyzers and

hydrogen production and distribution stations in France and

abroad.

The increase in other operating income was associated with the

cancellation of the €3.5 million debt as part of the Pushy

project following the notification by BPI Financement in July

2019.

Purchases consumed and external costs evolved in line with

activity, but only saw a limited increase given the cost reduction

measures implemented to ensure a continual improvement in

competitiveness. Moreover, the Company continued its research and

innovation efforts.

To ensure the success of its industrialization phase, the Group

strengthened its teams. The net recruitment of 12 people over the

year thus took the total number of staff to 98 at December 31,

2019.The increase in depreciation, amortization and provisions was

primarily due to the mandatory effective date, on January 1, 2019,

in accordance with the IFRS 16 (leasing contracts) for €0.6 million

and the depreciation of 50% of the accrued receivables for the

Hebei contract (project in China) for €0.6 million.

At December 31, 2019, McPhy had a cash position of €13 million,

notably following the success of the capital increase by private

placement of almost €7 million carried out last November.

As a reminder, McPhy’s Extraordinary Shareholders’ Meeting of

January 16, 2020 approved the resolution concerning the issuance of

14,773,307 BSA stock warrants (“BSA”) enabling all shareholders

(with the exception of Fonds Ecotechnologies and EDF Pulse

Croissance Holding, who have agreed not to exercise any warrants

allocated to them) to participate in the operation and benefit from

the same subscription conditions. The stock warrants can be

exercised from January 17, 2020 until May 18, 2020, i.e. two days

before the Company’s Annual General Meeting called to approve its

annual accounts for the year to December 31, 2019. The exercise of

the stock warrants could strengthen the Company’s shareholders’

equity by a maximum of €2.8 million.

2019 highlights

- €13 million in orders booked in France and abroad,

reflecting excellent sales momentum over the year

- Order for 7 stations taken from SIEGE 27 and SDEC Energie for

the roll-out of hydrogen mobility as part of the “EAS-HyMob”

project in Normandy

- Order from Atawey for a 40 kg per day 30-bar electrolyzer

for a first hydrogen station in Chambéry, as part of the

Auvergne-Rhône-Alpes region’s “Zero Emission Valley” project

- Order for 2 MW of high-pressure electrolysis in Germany for the

Energy market for a Power-to-Power application

- Record order for McPhy’s PIEL range, with 11 electrolyzers for

the Bangladesh Meteorological Department

- Order for a McFilling 200-350 station in Germany for refueling

hydrogen buses, following a first order for a McLyzer 400-30

electrolyzer at the start of 2019

- April 2019: launch of “Augmented McFilling”, McPhy’s

new smart hydrogen station architecture for heavy-duty

vehicles

-

- “Augmented McFilling”, an innovative architecture for

heavy-duty vehicles, able to address the massive hydrogen needs

inherent to the necessary decarbonization of heavy-duty transport

and long-distance vehicles (trains, trucks and buses), combining

compression, storage, cooling and vehicle delivery functions

- Managed by McPhy’s smart supervision software, which makes the

station dynamically reconfigurable for an infinite number of usage

scenarios and real-time adaptation to clients’ requirements with no

capacity limits

- June 2019: inauguration in the Hauts-de-France Region

of the first refueling station for hydrogen buses in

France

-

- In Houdain, northern France, a Artois-Gohelle Transport

Authority (SMT-AG) project led by ENGIE GNvert, which has entrusted

to McPhy the construction of a station with a daily capacity of 200

kg fueled by 0.5 MW of electrolysis

- A genuine innovation in France, this 100% hydrogen bus line and

its refueling station are precursors of the “zero emission

mobility” revolution that is becoming increasingly widespread in

France, in Europe and on a global scale

- The entire clean hydrogen production, storage and distribution

chain is equipped with McPhy technology

Confirmation of the transition to hydrogen production on

an industrial scale

As previously announced, McPhy has been chosen by Nouryon and

Gasunie, two leading industrial groups, to equip the first

zero-carbon hydrogen production plant on a large scale in Europe,

thus strengthening its leadership position on its market.

Designed, manufactured and integrated by McPhy, the 20 MW

zero-carbon hydrogen production platform uses the Company’s

innovative “Augmented McLyzer” electrolysis technology. Each year,

3,000 tons of clean hydrogen will thus be generated by

electrolysis from green electricity. This hydrogen will be used to

produce bio methanol used in industrial processes and will

contribute to reducing CO2 emissions by up to 27,000 tons a year,

the equivalent of the annual emissions of 4,000 French

households.

McPhy will be involved in the pre-engineering phase from this

year, and subsequently in the detailed engineering, production and

commissioning of the electrolysis platform.

This major project marks a change in McPhy’s size, confirming

its transition to an industrial scale with the aim of reducing

zero-carbon hydrogen production costs and thus boosting the

emergence of efficient and competitive hydrogen ecosystems with the

highest quality and safety levels.

Update on the Covid-19 outbreak and its

potential impact on the Group’s activity

Given the uncertainty regarding the future chain

of events, it is currently difficult to quantify the impacts of the

Covid-19 epidemic on the Group’s activity in 2020, notably in terms

of revenue, results and delays for the completion of some projects.

In accordance with domestic and international governmental

recommendations, McPhy has implemented all necessary safety

measures to limit its employees and partners’ travel and exposure

to the virus.

In China, at this stage, McPhy’s exposure to the

coronavirus epidemic is limited to a Power-to-Gas application

project in Hebei province, a project that is currently affected by

delays in its execution. As a reminder, in June 2017 McPhy

delivered 4 MW hydrogen production equipment enabling the

transformation into zero-carbon hydrogen and storage of excess

energy produced by a 200 MW wind farm.

In Italy, McPhy has a subsidiary based in San

Miniato (Tuscany) devoted to the assembly of electrolyzers and the

production of high capacity batteries. The Group is closely

monitoring the evolution of the outbreak and its expansion and has

particularly noted the decree communicated by the Italian

government extending the containment measures to the entire

country.

In this context of uncertainty and volatility,

McPhy is currently assessing the potential impact of the outbreak

on its activity.

Upcoming events

- Annual General Meeting, on May 20, 2020

- Publication of 2020 first-half results, on July 28, 2020 (after

market)

About McPhy

|

In the framework of the energy transition, and as a leading

supplier of hydrogen production and distribution equipment, McPhy

contributes to the roll-out of zero-carbon hydrogen throughout the

world. Thanks to its wide range of products and services dedicated

to the industrial, mobility and energy markets, McPhy provides

turnkey solutions to its clients adapted to their applications in

industrial raw material supply, fuel cell electric car refueling or

renewable energy surplus storage and valorization. As a designer,

manufacturer and integrator of hydrogen equipment since 2008, McPhy

has three development, engineering and production units based in

Europe (France, Italy, Germany). The company’s international

subsidiaries ensure a global sales coverage of McPhy’s innovative

hydrogen solutions. McPhy is listed on NYSE Euronext Paris (Segment

C, ISIN code: FR0011742329; ticker: MCPHY). |

|

NewCap |

|

|

Investor Relations Théodora Xu | Emmanuel HuynhT.

+33 (0)1 44 71 20 42mcphy@newcap.eu |

Media Relations Nicolas MerigeauT. +33 (0)1 44 71

94 98mcphy@newcap.eu |

Balance sheet8

|

Assets (€ millions) |

2019 |

2018 |

| Goodwill |

2.5 |

2.5 |

| Other

fixed assets |

3.0 |

2.6 |

| Other

non-current assets |

0.3 |

0.4 |

| Non-current

assets |

5.8 |

5.5 |

|

Inventories |

1.9 |

2.2 |

| Trade and

other receivables |

7.7 |

6.6 |

| Current

tax assets |

0.7 |

0.7 |

| Financial

assets |

- |

- |

| Cash and

cash equivalents |

13.0 |

14.9 |

| Current assets |

23.4 |

24.4 |

| |

|

|

| Total assets |

29.2 |

29.9 |

|

Liabilities (€ millions) |

2019 |

2018 |

| Share capital |

2.1 |

1.8 |

| Issue

premium |

30.9 |

31.2 |

| Treasury

shares |

(0.1) |

(0.1) |

| Retained

earnings |

(16.3) |

(17.2) |

| Shareholders’

Equity |

16.6 |

15.7 |

|

Provisions – over 1 year |

0.8 |

0.6 |

| Financial

debt & borrowings – over 1 year |

1.8 |

5.2 |

| Other

non-current liabilities |

0.6 |

0.5 |

| Non-current

liabilities |

3.1 |

6.2 |

|

Provisions – under 1 year |

0.6 |

0.8 |

| Financial

debt & borrowings – under 1 year |

1.1 |

0.8 |

| Trade and

other payables |

4.9 |

4.2 |

| Other

current liabilities |

3.0 |

2.3 |

| Current

liabilities |

9.5 |

8.0 |

| |

|

|

| Total Shareholders’ Equity and

liabilities |

29.2 |

29.9 |

8Audit procedures have been carried out and the audit

certification report is currently being prepared.

- PR_McPhy_2019 annual results_ENG_vF

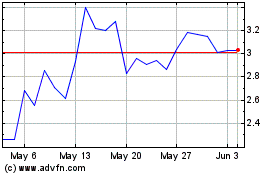

Mcphy Energy (EU:MCPHY)

Historical Stock Chart

From Oct 2024 to Nov 2024

Mcphy Energy (EU:MCPHY)

Historical Stock Chart

From Nov 2023 to Nov 2024