- Sales revenue up 19.3%; order intake

up 18.7%; earnings margin 28.6%1)

- Growth across all product categories

and geographies; the Americas particularly strong

- Guidance for 2019 confirmed

Regulatory News:

Sartorius Stedim Biotech (SSB) (Paris:DIM), a leading partner of

the biopharma industry, reported strong double-digit growth in

sales revenue, order intake and earnings for the first quarter of

2019.

Sales revenue increased against relatively moderate comparables

in the prior-year quarter by 19.3% to 342.9 million euros

(reported: +22.0%); order intake also saw a significant uptick,

rising 18.7% to 381.3 million euros (reported: +21.5%). Underlying

EBITDA1) rose overproportionately relative to sales by 32.5% to

98.1 million euros. The respective margin reached 28.6% (Q1 2018:

26.3%), with a good half of a percentage point of this increase

resulting from a change in accounting rules2), as expected.

Relevant net profit after non-controlling interest3) for the Group

surged by 32.9% to 62.6 million euros, resulting in earnings per

share of 0.68 euros compared with 0.51 euros a year earlier.

“Though we anticipated a good start into the year, we are very

pleased with this strong set of results,” said Dr. Joachim

Kreuzburg, Chairman of the Board. “Expansion was driven by high

demand across the entire portfolio and all regions. Given the

stronger comparables for the next quarters and an increasing

dilutive effect due to the modified setup of our cell culture media

business, we expect that growth rates will normalize over the

course of the year. On this basis we confirm our 2019 full-year

guidance.”

With respect to geographies, the Americas recorded the highest

increase in sales, which were up 26.7% to 124.8 million euros.

Asia|Pacific once again saw significant growth of 16.9% to 77.5

million euros, whereas in the EMEA region, sales totaled 140.6

million euros, equaling a gain of 14.8%. (All growth rates in

constant currencies.)

Key financial indicators

The financial position of the Group remained at very comfortable

levels. Driven by strong earnings, equity of Sartorius Stedim

Biotech grew from 1,044.9 million euros as of the end of fiscal

2018 to 1,055.7 million euros as of March 31, 2019. Mainly due

to a change in accounting standards2), the equity ratio decreased

slightly to 63.6% (December 31, 2018: 66.5%). At 0.3, the ratio of

net debt to underlying EBITDA was below the prior year’s level of

0.4. The ratio of capital expenditures to sales revenue was 9.4%

(March 31, 2018: 9.2%)4).

Positive outlook for 2019

Based on its performance in the first quarter 2019, Sartorius

Stedim Biotech confirms its guidance for fiscal 2019. Consolidated

sales revenue is projected to grow by about 7% to 11%. This

forecast reflects the changes to the sales agreement with the Lonza

group for cell culture media. Without these changes, sales growth

would probably be approximately 3 percentage points higher.

Regarding profitability, management forecasts that the company's

underlying EBITDA margin will increase by slightly more than one

percentage point over the prior-year figure of 28.2%. Of this

figure, approximately half a percentage point is expected to be an

operational increase, whereas the remainder will result from

changes to the IFRS accounting rules2). The ratio of capital

expenditures to sales revenue is projected to be around 11%, down

from the year-earlier figure of 14.6%4).

All figures in this outlook are given in constant currencies. In

spite of countermeasures already taken, a disorderly exit of the

United Kingdom from the EU may have a certain impact on our supply

chain; yet a reliable forecast of possible effects cannot be given

at the present time.

1) Underlying EBITDA = earnings before interest, taxes,

depreciation and amortization, and adjusted for extraordinary items

2) IFRS 16 is required to be applied as of 2019 and regulates

accounting of lease contracts. This leads to a somewhat extended

balance sheet and thus to a slightly lower equity ratio. Further,

this results in reporting longer-term lease payments as

depreciation and, accordingly, in a somewhat higher EBITDA, among

other things. This does not entail any material changes concerning

the Group’s relevant net profit or earnings per share. 3)

Underlying net profit = net profit after non-controlling interest;

adjusted for extraordinary items and non-cash amortization, as well

as based on a normalized financial result and tax rate 4) As of

2019, CAPEX is based on cash flow instead of balance sheet

computation; CAPEX ratio restated: 9.7% for Q1 2018; 14.6% for FY

2018. This press release contains statements about the

future development of the Sartorius Stedim Biotech Group. We cannot

guarantee that the content of these statements will actually apply

because these statements are based upon assumptions and estimates

that harbor certain risks and uncertainties.

Follow Sartorius Stedim Biotech on Twitter @Sartorius_Group and

on LinkedIn.

Conference call

Joachim Kreuzburg, CEO and Chairman of the Board of the

Sartorius Stedim Biotech Group, will discuss the company’s results

with analysts and investors on Thursday, April 18, 2019, at 3.30

p.m. Central European Summer Time (CEST), in a teleconference. You

may register at:

http://services.choruscall.de/DiamondPassRegistration/register?confirmationNumber=6266464&linkSecurityString=2e6e97fe0

Alternatively, you can dial in without prior registration at +49

(0) 69 566 03 7000

The presentation will be available on April 18, 2019, starting

at 3:15 p.m. CEST, on our website at:

https://www.sartorius.com/en/company/investor-relations/sartorius-stedim-biotech-sa-investor-relations/presentations

Press images

https://www.sartorius.com/en/company/newsroom/downloads-publications

Financial calendar

July 19, 2019 Publication of first-half figures (January to June

2019)

October 22, 2019 Publication of nine-month results (January to

September 2019)

Key performance indicators for the

first quarter of 2019

in millions of €unless otherwise

specified

3 months 2019

3 months2018

∆ in %reported

∆ in % cc1)

Sales revenue 342.9 281.1

22.0 19.3 EMEA2)

140.6 122.5

14.8 14.8 Americas2)

124.8 93.8 33.0

26.7 Asia | Pacific2) 77.5

64.8 19.6

16.9 Order intake3) 381.3

313.8 21.5 18.7

EBITDA4) 98.1 74.0

32.5 EBITDA margin4) in %

28.6 26.3

Net profit5)

62.6 47.1

32.9 Earnings per share5) in €

0.68 0.51

32.9 1) In constant currencies

2) According to customers’ location 3) All customer orders which

were legally concluded during the respective reporting period 4)

Underlying EBITDA = earnings before interest, taxes, depreciation

and amortization, and adjusted for extraordinary items 5)

Underlying net profit = net profit after non-controlling interest;

adjusted for extraordinary items and non-cash amortization, as well

as based on a normalized financial result and tax rate

Reconciliation

in millions of €

3 months2019

3 months2018

EBIT (operating result) 80.1

57.6 Extraordinary items 2.6

3.6 Depreciation and amortization

15.4 12.8 Underlying EBITDA

98.1 74.0 in millions of

€

3 months2019

3 months2018

EBIT (operating result) 80.1

57.6 Extraordinary effects 2.6

3.6 Amortization | IFRS 3 3.4

4.2 Normalized financial result1)

-1.0 -1.1 Normalized income tax

(2019: 26%; 2018: 26%)2) -22.1

-16.7 Underlying net result 63.0

47.5 Non-controlling interest

-0.4 -0.5 Underlying net result after

non-controlling interest 62.6

47.1 Underlying earnings per share (in €)

0.68 0.51 1) Financial result

excluding fair value adjustments of hedging instruments, as well as

currency effects from foreign currency loans 2) Income tax

considering the average group tax rate, based on the underlying

profit before tax

A profile of Sartorius Stedim Biotech

Sartorius Stedim Biotech is a leading international partner of

the biopharmaceutical industry. As a total solutions provider, the

company helps its customers to manufacture biotech medications

safely, rapidly and economically. Headquartered in Aubagne, France,

Sartorius Stedim Biotech is quoted on the Eurolist of Euronext

Paris. With its own manufacturing and R&D sites in Europe,

North America and Asia and an international network of sales

companies, Sartorius Stedim Biotech has a global reach. The Group

has been annually growing by double digits on average and has been

regularly expanding its portfolio by acquisitions of complementary

technologies. In 2018, the company earned sales revenue of €1,212.2

million and currently employs some 5,800 people.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190417006063/en/

Petra Kirchhoff; Head of Corporate Communications and Investor

RelationsPhone: +49(0)551.308.1686;

petra.kirchhoff@sartorius.com

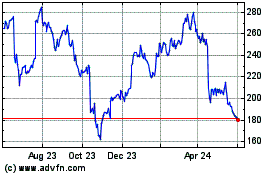

Sartorius Stedim Biotech (EU:DIM)

Historical Stock Chart

From Jan 2025 to Feb 2025

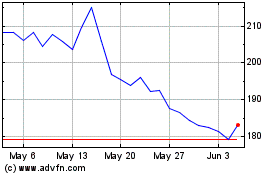

Sartorius Stedim Biotech (EU:DIM)

Historical Stock Chart

From Feb 2024 to Feb 2025