Montrouge, France, August 1, 2022

DBV Technologies

Reports Second Quarter

2022 Financial Results

- DBV closes Q2 with a cash balance

of $248M following recent ATM and PIPE offerings

- DBV continues to practice budget

discipline measures; cash used in operating activities decreased

more than 40% between the first half of 2021 and 2022

- The U.S. District Court, District

of New Jersey, entered an order granting DBV’s Motion to Dismiss

the Third Amended Class Action Complaint with prejudice

DBV Technologies (Euronext: DBV

– ISIN: FR0010417345 – Nasdaq Stock Market: DBVT), a clinical-stage

biopharmaceutical company, today reported financial results for the

second quarter of 2022. The quarterly financial statements were

approved by the Board of Directors on July 29, 2022.

Financial Highlights

for the Second Quarter

and the Six Months Ended

June 30,

2022:1

Cash and cash equivalents were $248.0 million,

as of June 30, 2022, compared to $77.3 million as of December 31,

2021, and $74.1 million as of March 31, 2022. The net increases of

respectively $173.9 million and $170.7 million for the quarter and

six months ended June 30, 2022, were mostly comprised of a $195.3

million net cash flow received from the ATM Offering in May 2022

for $14.1 million; net of transaction costs and PIPE Offering in

June 2022 for $181.2 million; net of transaction costs as well as a

$27.1 million cash flow received following the reimbursement of the

2019, 2020 and 2021 Research Tax Credit (French Crédit Impôt

Recherche, or CIR) offset by a $(38.9) million cash utilization in

operating activities; and the effect of exchange rates on cash and

cash equivalents for $(12.6) million.

Excluding the effect of second quarter financing

and reimbursement of the Research Tax Credit, the cash used in

operating activities decreased by 42% in U.S. GAAP and 44% in IFRS

between the first half of 2021 and 2022, reflecting the

1The

Company’s interim consolidated financial statements for the six

months ended June 30, 2022, are prepared in accordance with both

generally accepted accounting principles in the U.S. (“U.S. GAAP”)

and International Financial Reporting Standards (“IFRS”) as adopted

by the European Union. Unless otherwise indicated, the financial

figures presented in the Q2 Financial Highlights comply with both

U.S GAAP and IFRS financial statements. Differences between U.S.

GAAP and IFRS consolidated financial statements are mainly due to

discrepancies arising from the application of lease accounting

standards.Company’s continued implementation of budget discipline

measures.

Cash and Cash Equivalents

|

|

|

U.S. GAAP |

|

IFRS |

|

|

|

Six months ended

June 30, |

|

Six months ended

June 30, |

|

|

|

2022 |

|

2021 |

|

2022 |

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

Net (decrease) / increase in cash and cash

equivalents |

$ |

170,670 |

$ |

(70,868) |

$ |

170,671 |

$ |

(70,869) |

|

Net cash flow used in operating activities |

$ |

(11,733) |

|

(66,503) |

|

(8,585) |

|

(64,102) |

|

Net cash flows used in investing activities |

|

(218) |

|

(13) |

|

(218) |

|

(13) |

|

Net cash flows provided by financing activities |

|

195,221 |

|

1,071 |

|

192,075 |

|

(1,336) |

|

Effect of exchange rate changes on cash and cash equivalents |

|

(12,600) |

|

(5,423) |

|

(12,600) |

|

(5,418) |

|

Net cash and cash equivalents at the end of the

period |

$ |

247,971 |

$ |

125,484 |

$ |

247,971 |

$ |

125,484 |

Based on its current assumptions, DBV expects

that its current cash and cash equivalents will support its

operations several months beyond the current projected completion

of VITESSE, the planned Phase 3 clinical study of the modified

Viaskin™ Peanut patch in peanut-allergic children ages 4 years and

older. DBV continues to engage in productive dialogue with the FDA

on the key elements of the VITESSE protocol. As previously

disclosed, the Company will communicate key elements of the VITESSE

trial design and projected timelines once this process has

concluded.

Operating

Income is primarily generated from DBV’s Research Tax

Credit (French Crédit Impôt Recherche, or CIR) and from revenue

recognized by DBV under its collaboration agreement with Nestlé

Health Science. Operating income was $4.1 million for the six

months ended June 30, 2022, compared to $1.5 million for the six

months ended June 30, 2021. The variation in operating income is

primarily attributable to the revision of the revenue recognized

under Nestlé’s collaboration agreement conducted as part of the

existing contract, as the Company updated the measurement of

progress of its Phase II APTITUDE milk-diagnostic tool clinical

study.

Operating

Expenses

|

|

|

U.S. GAAP |

|

U.S. GAAP |

|

IFRS |

|

|

|

Three months

ended June 30, |

|

Six months

ended June

30, |

|

Six months

ended June

30, |

|

($ in thousands) |

|

2022 |

|

2021 |

|

2022 |

|

2021 |

|

2022 |

|

2021 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

$ |

(18,611) |

$ |

(20,179) |

$ |

(30,834) |

$ |

(42,343) |

$ |

(30,694) |

$ |

(42,185) |

|

Sales and marketing |

|

(1,037) |

|

(1,198) |

|

(1,500) |

|

(1,927) |

|

(1,476) |

|

(1,905) |

|

General and administrative |

|

(5,704) |

|

(8,269) |

|

(12,334) |

|

(17,951) |

|

(12,166) |

|

(17,939) |

|

Total operating

expenses |

$ |

(25,352) |

$ |

(29,646) |

$ |

(44,669) |

$ |

(62,221) |

$ |

(44,336) |

$ |

(62,029) |

Operating

Expenses for the three months ended June 30, 2022, were

$(25.4) million, compared to $(29.6) million for the three months

ended June 30, 2021, each under U.S. GAAP or -14%. For the six

months ended June 30, 2022, operating expenses were $(44.7) million

under U.S. GAAP and $(44.3) million under IFRS, compared to $(62.2)

million and $(62.0) million under U.S. GAAP and IFRS respectively,

for the six months ended June 30, 2021. DBV has continued to

practice financial diligence and implemented further cost

containment strategies.

Employee-related costs decreased by $3.8

million, from $15.9 million for the six months ended June 30, 2021,

to $12.1 million for the six months ended June 30, 2022 – a 23.8%

decrease, compared to a 21% decrease of the average number of

headcounts between the two periods (88 and 111 full-time equivalent

employees for the six months ended June 30, 2022 and 2021,

respectively). As of June 30, 2022, DBV had 86 employees.

Net Loss and Net Loss

Per Share

|

|

|

U.S. GAAP |

|

U.S. GAAP |

|

|

IFRS |

|

|

|

Three months

ended June

30, |

|

Six months

ended June

30, |

|

|

Six months

ended June

30, |

|

|

|

2022 |

|

2021 |

|

2022 |

|

2021 |

|

|

2022 |

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) ($ in thousands) |

$ |

(23,039) |

$ |

(30,654) |

$ |

(39,746) |

$ |

(60,103) |

|

$ |

(39,522) |

$ |

(60,240) |

|

Basic / diluted net loss per share ($/share) |

$ |

(0.35) |

$ |

(0.56) |

$ |

(0.66) |

$ |

(1.09) |

|

$ |

(0.65) |

$ |

(1.10) |

For the three months ended June 30, 2022, net

loss was $(23.0) million compared to a net loss of $(30.7) million

for the comparable period in 2021.

On a per share basis, net loss (based on the

weighted average number of shares outstanding over the period) was

$(0.35) and $(0.56) for the three months ended June 30, 2022 and

2021, respectively.

For the six months ended June 30, 2022, net loss

was $(39.7) million and $(39.5) million under U.S. GAAP and IFRS,

respectively. Net loss per share was $(0.66) under U.S. GAAP and

$(0.65) under IFRS.

Monthly

Information

Regarding the

Total

Number of

Voting

Rights and

Total

Number of

Shares of the Company as of June 30,

2022:

(Article 223-16 of the General Regulations of

the Autorité des Marchés Financiers)

|

Date |

Total number of shares |

Total number of voting rights |

|

06/30/2022 |

94,022,679 |

Total gross of voting rights: 94,022,679 |

|

Total net* of voting rights: 93,916,392 |

* Total net = total number of voting rights

attached to shares – shares without voting rights

The PIPE financing DBV completed in June

included the sale of prefunded warrants to purchase up to

28,276,331 ordinary shares. The pre-funded warrants are not

included in the number of shares outstanding. If all 28,276,331

pre-funded warrants were exercised, the total number of DBV shares

outstanding would be 122,299,010.

Class Action

Complaint:

As previously disclosed, a class action

complaint was filed in January 2019 in the U.S. District Court,

District of New Jersey, alleging that the Company and certain

current and former executive officers violated certain U.S. federal

securities laws. Plaintiffs filed a Third Amended Complaint on

September 30, 2021. On July 29, 2022, the Court entered an order

granting the Company’s Motion to Dismiss the Plaintiff’s Third

Amended Complaint with prejudice. The Court indicated that the

Third Amended Complaint was deficient in a number of ways, failing

to allege a violation of the Securities Exchange Act of 1934, and

ordered the matter closed. Per court procedural rules, the

Plaintiffs have 30 days to appeal the dismissal of the Third

Amended Complaint. The Company believes that the allegations

contained in the complaint are without merit and will continue to

defend the case vigorously.

CONDENSED STATEMENT OF CONSOLIDATED

FINANCIAL POSITION (unaudited)($ in

thousands)

|

|

|

U.S. GAAP2 |

|

|

IFRS3 |

|

|

|

June 30, |

|

December 31, |

|

|

June 30, |

|

December 31, |

|

|

|

|

2022 |

|

2021 |

|

|

2022 |

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets |

$ |

284,978 |

$ |

146,723 |

|

$ |

284,922 |

$ |

146,323 |

|

|

of which cash and cash equivalents |

|

247,971 |

|

77,301 |

|

|

247,971 |

|

77,301 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities |

|

40,562 |

|

47,449 |

|

|

40,501 |

|

47,293 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders’

equity |

$ |

244,416 |

$ |

99,274 |

|

$ |

244,421 |

$ |

99,030 |

|

|

of which net result |

|

(39,746) |

|

(97,809) |

|

|

(39,522) |

|

(98,052) |

|

|

|

|

|

|

|

|

|

|

|

|

|

CONDENSED STATEMENT OF CONSOLIDATED

OPERATIONS AND COMPREHENSIVE LOSS (unaudited)($ in

thousands, except per share data)

|

|

|

U.S. GAAP2 |

|

U.S. GAAP2 |

|

|

IFRS3 |

|

|

|

Three months

ended June

30, |

|

Six months

ended June

30, |

|

|

Six months

ended June 30, |

|

|

|

2022 |

|

2021 |

|

2022 |

|

2021 |

|

|

2022 |

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

1,529 |

$ |

(1,488) |

$ |

4,074 |

$ |

1,453 |

|

$ |

4,074 |

$ |

1,453 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses

: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

(18,611) |

|

(20,179) |

|

(30,834) |

|

(42,343) |

|

|

(30,694) |

|

(42,185) |

|

Sales & marketing |

|

(1,037) |

|

(1,198) |

|

(1,500) |

|

(1,927) |

|

|

(1,476) |

|

(1,905) |

|

General & administrative |

|

(5,704) |

|

(8,269) |

|

(12,334) |

|

(17,951) |

|

|

(12,166) |

|

(17,939) |

|

Total operating

expenses |

|

(25,352) |

|

(29,646) |

|

(44,669) |

|

(62,221) |

|

|

(44,336) |

|

(62,029) |

|

Financial income (expenses) |

|

784 |

|

46 |

|

936 |

|

261 |

|

|

827 |

|

(68) |

|

Income tax |

|

- |

|

434 |

|

(87) |

|

404 |

|

|

(87) |

|

404 |

|

Net

(loss) |

$ |

(23,039) |

$ |

(30,654) |

$ |

(39,746) |

$ |

(60,103) |

|

$ |

(39,522) |

$ |

(60,240) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic/diluted net loss per share attributable to

shareholders |

$ |

(0.35) |

$ |

(0.56) |

$ |

(0.66) |

$ |

(1.09) |

|

$ |

(0.65) |

$ |

(1.10) |

2Unaudited

financial statements prepared in accordance with generally accepted

accounting principles in the U.S. ("U.S. GAAP").3Unaudited

financial statements prepared in accordance with International

Financial Reporting Standards (“IFRS”) as adopted by the European

Union.CONDENSED STATEMENT OF CONSOLIDATED CASH FLOW

(unaudited)

($ in thousands)

|

|

|

U.S. GAAP4 |

|

|

IFRS5 |

|

|

|

Six months

ended June

30, |

|

|

Six months

ended June

30, |

|

|

|

2022 |

|

2021 |

|

|

2022 |

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

|

Net cash flow used in operating activities |

$ |

(11,733) |

$ |

(66,503) |

|

$ |

(8,585) |

$ |

(64,102) |

|

Net cash flows used in investing activities |

|

(218) |

|

(13) |

|

|

(218) |

|

(13) |

|

Net cash flows provided by (used in) financing

activities |

|

195,222 |

|

1,071 |

|

|

192,075 |

|

(1,336) |

|

Effect of exchange rate changes on cash and cash

equivalents |

|

(12,600) |

|

(5,423) |

|

|

(12,600) |

|

(5,418) |

|

Net (decrease) / increase in cash and cash

equivalents |

|

170,670 |

|

(70,868) |

|

|

170,670 |

|

(70,869) |

|

Net cash and cash equivalents at the beginning of the

period |

|

77,301 |

|

196,352 |

|

|

77,301 |

|

196,352 |

|

Net cash and cash equivalents at the end of the

period |

$ |

247,971 |

$ |

125,484 |

|

$ |

247,971 |

$ |

125,484 |

About DBV TechnologiesDBV

Technologies is developing Viaskin™, an investigational proprietary

technology platform with broad potential applications in

immunotherapy. Viaskin is based on epicutaneous immunotherapy, or

EPIT™, and is DBV Technologies’ method of delivering biologically

active compounds to the immune system through intact skin. With

this new class of non-invasive product candidates, the Company is

dedicated to safely transforming the care of food allergic

patients. DBV Technologies’ food allergies programs include ongoing

clinical trials of Viaskin Peanut. DBV Technologies has global

headquarters in Montrouge, France, and North American operations in

Basking Ridge, NJ. The Company’s ordinary shares are traded on

segment B of Euronext Paris (Ticker: DBV, ISIN code: FR0010417345)

and the Company’s ADSs (each representing one-half of one ordinary

share) are traded on the Nasdaq Global Select Market (Ticker:

DBVT).

4Unaudited

financial statements prepared in accordance with generally accepted

accounting principles in the U.S. ("U.S. GAAP").5Unaudited

financial statements prepared in accordance with International

Financial Reporting Standards (“IFRS”) as adopted by the European

Union.

Forward Looking StatementsThis

press release may contain forward-looking statements and estimates,

including statements regarding DBV’s forecast of its cash runway,

designs of DBV’s anticipated clinical trials, DBV’s planned

regulatory and clinical efforts including timing and results of

communications with regulatory agencies, the ability of any of

DBV’s product candidates, if approved, to improve the lives of

patients with food allergies, and the outcome of any litigation.

These forward-looking statements and estimates are not promises or

guarantees and involve substantial risks and uncertainties. At this

stage, DBV’s product candidates have not been authorized for sale

in any country. Among the factors that could cause actual results

to differ materially from those described or projected herein

include uncertainties associated generally with research and

development, clinical trials and related regulatory reviews and

approvals, including the impact of the COVID-19 pandemic, and DBV’s

ability to successfully execute on its budget discipline measures.

A further list and description of risks and uncertainties that

could cause actual results to differ materially from those set

forth in the forward-looking statements in this press release can

be found in DBV’s regulatory filings with the French Autorité des

Marchés Financiers (“AMF”), DBV’s filings and reports with the U.S.

Securities and Exchange Commission (“SEC”), including in DBV’s

Annual Report on Form 10-K for the year ended December 31, 2021,

filed with the SEC on March 9, 2022, and future filings and reports

made with the AMF and SEC by DBV. Existing and prospective

investors are cautioned not to place undue reliance on these

forward-looking statements and estimates, which speak only as of

the date hereof. Other than as required by applicable law, DBV

Technologies undertakes no obligation to update or revise the

information contained in this Press Release.

Investor

Contact Anne PollakDBV Technologies+1

857-529-2363anne.pollak@dbv-technologies.com

Media

ContactAngela MarcucciDBV

Technologies+1 646-842-2393

angela.marcucci@dbv-technologies.com

Viaskin and EPIT are trademarks of DBV

Technologies.

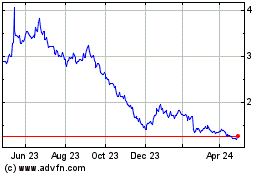

DBV Technologies (EU:DBV)

Historical Stock Chart

From Oct 2024 to Nov 2024

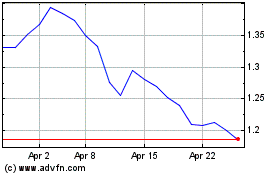

DBV Technologies (EU:DBV)

Historical Stock Chart

From Nov 2023 to Nov 2024