Brunel continues strong growth path in Q1 2023 through leading

position in attractive markets

Amsterdam, 5 May 2023 – Brunel International

N.V. (Brunel; BRNL), a global provider of flexible workforce

solutions and expertise, today announced its first quarter (Q1)

2023 results.Key

points

- Revenue of EUR 317 million, up 15%

(19% like-for-like)

- Gross profit of EUR 68.8 million,

up 11% (15% like-for-like)

- EBIT of EUR 15.8 million, up 1% (6%

like-for-like)

Jilko Andringa, CEO of Brunel International

N.V.: “We continued to demonstrate strong

organic revenue growth across all regions and in all strategic

markets. The expected development of our chosen focus markets

continues to be very positive and that’s why we continue to invest

accordingly in our organization. We were able to mostly offset

inflation-related salary increases as well as higher cost

associated with continued growth-related investments. As a result,

our like-for-like EBIT increased by 6%.

Trends in our markets remain robust as continued investments in

the digital and energy transition require many more specialists,

now and in the foreseeable future. By combining recruitment

expertise with global mobility services, we are in a unique

position to provide great value to our clients and simultaneously

take advantage of the favorable environment in which we

operate.

Supporting our clients in the energy transition and in their

drive to become more sustainable, is an important element of our

ESG strategy. Next to that we continue to execute our plans to

lower our own footprint. With our support of certified green

projects, we are proud to be a carbon neutral company.

In Q1 we also adapted new tooling to improve further on our

‘excellence in execution’. Our account managers and recruiters are

now using market leading AI tools to attract, search, select and

retain top talent for our clients.

Brunel is getting stronger and stronger, with all regions

maturing and contributing to our strategic profitability goal. We

remain ahead of our plan with a sustained focus on multi year, high

single digit growth and profitability enhancement across our

regions, aimed at achieving a higher than 6% EBIT in 2025.”

ESG Update In Q1 2023, Brunel

Foundation, hosted by our Global partner OffshoreWind4Kids,

supported the First LEGO league regional and national finals in

Eindhoven and Delft in the Netherlands. Almost 600 children,

ranging from 9 to 15 years old, got insights about how to measure

wind power generated by building wind turbines with a built-in

display. This workshop perfectly matched the theme of this year’s

challenge: SUPERPOWERED. For this edition, the First

LEGO League teams were challenged to learn more about energy

sources, energy distribution, storage and usage. Together all

participating children collaborated and innovated for a better

future with green energy.

We believe that involving children at an early age in fun

activities related to renewable energy is a great way to create

awareness for the environment in general and to inspire them to

join the industry later in life. The numbers in our Global Trash ‘n

Trace Challenge with Litterati grew to 415,000 pieces of litter

picked and registered in our challenge.

Group performance

|

Brunel International (unaudited) |

|

|

|

P&L amounts in EUR million |

|

|

|

|

| |

Q1 2023 |

Q1 2022 |

Δ% |

|

| Revenue |

316.9 |

274.6 |

15% |

a |

| Gross

Profit |

68.8 |

61.8 |

11% |

|

| Gross

margin |

21.7% |

22.5% |

|

|

| Operating

costs |

52.3 |

46.2 |

13% |

b |

| Operating

result |

16.5 |

15.6 |

6% |

|

| Earn out

related share based payments* |

0.7 |

1.1 |

-36% |

|

| EBIT |

15.8 |

15.6 |

1% |

c |

| EBIT % |

5.0% |

5.7% |

|

|

| |

|

|

|

|

| Average

directs |

11,000 |

11,233 |

-2% |

|

| Average

indirects |

1,529 |

1,436 |

6% |

|

| Ratio direct /

Indirect |

7.2 |

7.8 |

|

|

| |

|

|

|

|

| a

19 % like-for-like |

|

|

| b

20 % like-for-like |

|

|

| c

6 % like-for-like |

|

|

|

Like-for-like is measured excluding the impact of currencies,

acquisitions and divestments |

|

|

|

*Relates to the acquisition related expenses for Taylor

Hopkinson |

|

|

The average number of directs reflects our

specialists working at clients (the average for Q1 2022 still

included the average for Russia of 941).Headline

performance by regionP&L amounts in EUR million

|

Revenue |

Q1 2023 |

Q1 2022 |

Δ% |

| |

|

|

|

| DACH region |

64.9 |

58.4 |

11% |

| The

Netherlands |

53.4 |

48.9 |

9% |

| Australasia |

43.5 |

34.0 |

28% |

| Middle East &

India |

37.8 |

30.8 |

23% |

| Americas |

44.0 |

32.5 |

35% |

| Asia |

44.2 |

33.0 |

34% |

| Rest of

world |

29.1 |

37.0 |

-21% |

| |

|

|

|

|

Total |

316.9 |

274.6 |

15% |

|

EBIT |

Q1 2023 |

Q1 2022 |

Δ% |

| |

|

|

|

| DACH region |

8.3 |

6.9 |

20% |

| The

Netherlands |

4.8 |

5.2 |

-8% |

| Australasia |

0.9 |

0.2 |

350% |

| Middle East &

India |

3.0 |

3.0 |

0% |

| Americas |

0.4 |

0.4 |

0% |

| Asia |

2.0 |

1.9 |

5% |

| Rest of

world |

-0.1 |

0.9 |

-111% |

| Unallocated |

-3.5 |

-2.9 |

-21% |

| |

|

|

|

|

Total |

15.8 |

15.6 |

1% |

In Q1 2023 the Group’s

revenue increased by 15% or EUR 42.3 million

y-o-y, with the largest growth in Americas, Asia, Australasia and

Middle East & India. Like-for-like revenue increased by 19%.

Following very strong growth in the Asia region for the past

consecutive quarters, we commenced separate reporting on the region

as of 2023. In Q1 2022, Rest of World still included our activities

in Russia (EUR 10 million revenue and EUR 1 million EBIT).

Gross margin for the group

decreased slightly, mainly as a result in the continued change in

mix between the regions.

Unallocated costs were higher due to the

implementation of new digital tools.

EBIT increased by 1% to EUR

15.8 million. Excluding Russia and impact of currencies, the

increase was 6% or EUR 1.0 million.

Performance by region

|

DACH region (unaudited) |

|

|

P&L amounts in EUR million |

|

|

|

| |

Q1 2023 |

Q1 2022 |

Δ% |

|

| Revenue |

64.9 |

58.4 |

11% |

|

| Gross Profit |

24.0 |

21.1 |

14% |

|

| Gross margin |

37.0% |

36.1% |

|

|

| Operating

costs |

15.7 |

14.2 |

11% |

|

| EBIT |

8.3 |

6.9 |

20% |

|

| EBIT % |

12.8% |

11.8% |

|

|

| |

|

|

|

|

| Average

directs |

2,085 |

1,985 |

5% |

|

| Average

indirects |

428 |

388 |

10% |

|

| Ratio direct /

Indirect |

4.9 |

5.1 |

|

|

The DACH

region includes Germany, Switzerland, Austria and

Czech Republic.

Revenue per working day in DACH increased by

9.5%, as a result of a higher number of specialists working at our

clients, and increased rates. Gross margin adjusted for working

days is 36.1% in Q1 2023 (Q1 2022; 36.1%), and remains robust.

Working days Germany:

|

|

Q1 |

Q2 |

Q3 |

Q4 |

FY |

|

2023 |

65 |

60 |

65 |

61 |

251 |

|

2022 |

64 |

60 |

66 |

62 |

252 |

Headcount as of 31 March 2023 was 2,078 (2022:

1,996).

|

The Netherlands (unaudited) |

|

|

P&L amounts in EUR million |

|

|

|

| |

Q1 2023 |

Q1 2022 |

Δ% |

|

| Revenue |

53.4 |

48.9 |

9% |

|

| Gross Profit |

15.0 |

14.9 |

1% |

|

| Gross margin |

28.1% |

30.5% |

|

|

| Operating

costs |

10.2 |

9.7 |

5% |

|

| EBIT |

4.8 |

5.2 |

-8% |

|

| EBIT % |

9.0% |

10.6% |

|

|

| |

|

|

|

|

| Average

directs |

1,701 |

1,677 |

1% |

|

| Average

indirects |

273 |

276 |

-1% |

|

| Ratio direct /

Indirect |

6.2 |

6.1 |

|

|

Revenue per working day in The

Netherlands increased by 7.6%. The increase is mainly the

result of higher headcount and higher rates, partially offset by

the lower productivity due to higher bench. The business lines

Finance & risk and Legal are the main driver of the growth.

Gross margin adjusted for working days is 27.3% in Q1 2023 (Q1

2022: 30.5%). As expected, the indexation of rates to cover for

higher salaries has been hindered by timing-effects, putting

pressure on margins in Q1 which is expected to soften in the course

of this year.

Working days The Netherlands:

|

|

Q1 |

Q2 |

Q3 |

Q4 |

FY |

|

2023 |

65 |

61 |

65 |

63 |

254 |

|

2022 |

64 |

61 |

66 |

64 |

255 |

Headcount as of 31 March 2023 was 1,735 (2022:

1,679).

|

Australasia (unaudited) |

|

|

P&L amounts in EUR million |

|

|

|

| |

Q1 2023 |

Q1 2022 |

Δ% |

|

| Revenue |

43.5 |

34.0 |

28% |

a |

| Gross Profit |

4.6 |

3.1 |

48% |

|

| Gross margin |

10.6% |

9.1% |

|

|

| Operating

costs |

3.7 |

2.9 |

28% |

b |

| EBIT |

0.9 |

0.2 |

350% |

c |

| EBIT % |

2.1% |

0.6% |

|

|

| |

|

|

|

|

| Average

directs |

1,495 |

1,256 |

19% |

|

| Average

indirects |

118 |

101 |

16% |

|

| Ratio direct /

Indirect |

12.7 |

12.4 |

|

|

| |

|

|

|

|

| a 30

% like-for-like |

|

| b 26

% like-for-like |

|

| c 467

% like-for-like |

|

|

Like-for-like is measured excluding the impact of currencies,

acquisitions and divestments |

|

Australasia includes Australia

and Papua New Guinea.

Growth in the region continues to be driven by

conventional energy and mining clients. Gross margin increased by

1.5 ppt as a result of margin discipline and the additional

services offered to clients.

|

Middle East & India (unaudited) |

|

|

P&L amounts in EUR million |

|

|

|

| |

Q1 2023 |

Q1 2022 |

Δ% |

|

| Revenue |

37.8 |

30.8 |

23% |

a |

| Gross Profit |

5.6 |

5.2 |

8% |

|

| Gross margin |

14.8% |

16.9% |

|

|

| Operating

costs |

2.6 |

2.2 |

18% |

b |

| EBIT |

3.0 |

3.0 |

0% |

c |

| EBIT % |

7.9% |

9.7% |

|

|

| |

|

|

|

|

| Average

directs |

2,196 |

2,179 |

1% |

|

| Average

indirects |

160 |

130 |

24% |

|

| Ratio direct /

Indirect |

13.7 |

16.8 |

|

|

| |

|

|

|

|

| a 20

% like-for-like |

|

| b 16

% like-for-like |

|

| c -3

% like-for-like |

|

|

Like-for-like is measured excluding the impact of currencies,

acquisitions and divestments |

|

Middle East & India

includes Qatar, Kuwait, Dubai, Saudi Arabia, Iraq and India.

All countries contributed to the strong revenue

increase, mainly driven by new projects with both existing and new

clients, Gross margin dropped due to change in client mix, and the

absence of higher margin ‘shut down’ projects in Q1 2023.

|

Americas (unaudited) |

|

|

P&L amounts in EUR million |

|

|

|

| |

Q1 2023 |

Q1 2022 |

Δ% |

|

| Revenue |

44.0 |

32.5 |

35% |

a |

| Gross Profit |

5.5 |

4.2 |

31% |

|

| Gross margin |

12.5% |

12.9% |

|

|

| Operating

costs |

5.1 |

3.8 |

34% |

b |

| EBIT |

0.4 |

0.4 |

0% |

c |

| EBIT % |

0.9% |

1.2% |

|

|

| |

|

|

|

|

| Average

directs |

1,021 |

861 |

19% |

|

| Average

indirects |

150 |

115 |

31% |

|

| Ratio direct /

Indirect |

6.8 |

7.5 |

|

|

| |

|

|

|

|

| a 33

% like-for-like |

|

| b 31

% like-for-like |

|

| c 8 %

like-for-like |

|

|

Like-for-like is measured excluding the impact of currencies,

acquisitions and divestments |

|

Americas saw continued strong

growth in its main markets, USA and Brazil. The growth is mainly

driven by conventional energy and mining clients, with a number of

bigger projects in Canada completed in Q1 2023. Operating costs

increased due to investments in staff to support future growth.

|

Asia (unaudited) |

|

|

P&L amounts in EUR million |

|

|

|

| |

Q1 2023 |

Q1 2022 |

Δ% |

|

| Revenue |

44.2 |

33.0 |

34% |

a |

| Gross Profit |

6.6 |

4.9 |

35% |

|

| Gross margin |

14.9% |

14.8% |

|

|

| Operating

costs |

4.6 |

3.0 |

53% |

b |

| EBIT |

2.0 |

1.9 |

5% |

c |

| EBIT % |

4.5% |

5.8% |

|

|

| |

|

|

|

|

| Average

directs |

1,459 |

1,371 |

6% |

|

| Average

indirects |

146 |

135 |

8% |

|

| Ratio direct /

Indirect |

10.0 |

10.1 |

|

|

| |

|

|

|

|

| a 35

% like-for-like |

|

| b 56

% like-for-like |

|

| c 6 %

like-for-like |

|

|

Like-for-like is measured excluding the impact of currencies,

acquisitions and divestments |

|

Asia includes, Singapore,

China, Hong Kong, South Korea, Taiwan, Japan, Indonesia, Thailand,

Malaysia.

Due to the high level of activity at energy and

mining clients, strong growth was achieved in almost all countries

in this region. Operating costs increased as a result of

investments in staff to support future growth.

|

Rest of world (unaudited) |

|

|

|

P&L amounts in EUR million |

|

|

|

|

| |

Q1 2023 |

Q1 2022 |

Δ% |

|

| Revenue |

29.1 |

37.0 |

-21% |

a |

| Gross

Profit |

7.5 |

8.4 |

-11% |

|

| Gross

margin |

25.8% |

22.7% |

|

|

| Operating

costs |

6.9 |

7.5 |

-8% |

b |

| Operating

result |

0.6 |

0.9 |

-33% |

|

| Earn out

related share based payments* |

0.7 |

1.1 |

-36% |

|

| EBIT |

-0.1 |

0.9 |

-111% |

|

| EBIT % |

-0.3% |

2.4% |

|

|

| |

|

|

|

|

| Average

directs |

1,042 |

1,906 |

-45% |

|

| Average

indirects |

191 |

231 |

-17% |

|

| Ratio direct /

Indirect |

5.5 |

8.3 |

|

|

| |

|

|

|

|

| a

16 % like-for-like |

|

|

| b

36 % like-for-like |

|

|

|

Like-for-like is measured excluding the impact of currencies,

acquisitions and divestments |

|

|

*Relates to the acquisition related expenses for Taylor

Hopkinson |

|

Rest of World includes Taylor

Hopkinson, Belgium and our other energy activities in Europe. In Q1

2022, this region also still included Russia which activities were

divested in Q2 2022.

On a like-for-like basis (excl. Russia) revenue

was up 16% and EBIT was stable versus Q1 2022. Taylor Hopkinson

performed in line with Q1 2022. Their offshore wind activities are

slightly impacted by seasonality, with a typically lower activity

level in Q1 which has recently started to pick up strongly

again.

OutlookWe expect the current

favourable trends to continue throughout Q2 2023, with the normal

seasonality.

- Press Release Q1 2023.pdf

Source: Brunel International NV

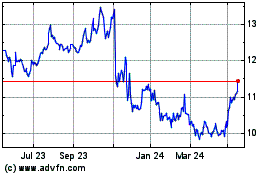

Brunel International NV (EU:BRNL)

Historical Stock Chart

From Oct 2024 to Nov 2024

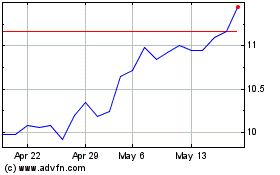

Brunel International NV (EU:BRNL)

Historical Stock Chart

From Nov 2023 to Nov 2024