Crossject launches reserved capital increase and warrants issuance

for an aggregate amount of at least €7m

-

CROSSJECT INTENDS TO AMEND THE HEIGHTS CAPITAL MANAGEMENT,

INC. (“HEIGHTS”) BONDS CONVERTIBLE INTO NEW SHARES OR REPAYABLE,

UNDER CERTAIN CONDITIONS

DIJON, FRANCE, December

10, 2024 – 7:15 p.m. (CET) – Crossject (ISIN:

FR0011716265; Euronext: ALCJ), a specialty pharma company

developing medicines harnessing its unique, award-winning

needle-free ZENEO® auto-injector to deliver life-saving medicines

in emergency situations, has been in discussions with investors

regarding a private placement comprising an issue of new ordinary

shares and warrants for a total gross amount of at least EUR 7

million. Crossject (“Crossject” or the

“Company”) has engaged Maxim Group LLC to act as

lead placement agent and Invest Securities to act as co-placement

agent.

The transaction would comprise (i) an issuance

of new ordinary shares (the “New Shares”) via a

capital increase (the “Capital Increase”) reserved

to a specified category of investors (as further described in the

11th resolution of the Annual General Shareholders’

Meeting held on June 27, 2024 (the “General

Meeting”)), and (ii) the concurrent private placement of

warrants (the “Warrants”) giving the right to

subscribe to new ordinary shares (the “Warrants

Issuance” and, together with the Capital Increase, the

“Transaction”).

The proceeds of the Transaction are expected to

result in a total cumulative gross amount of at least

EUR 7 million in immediate new funding for the Company.

The Company could receive further proceeds in the event that the

Warrants are exercised by their holders. The Company reserves the

right to modify any aspect of the Transaction.

The Capital Increase is being carried out

pursuant to the delegation granted by the General Meeting under its

11th resolution, and used by the Management Board by a

decision dated December 10, 2024 and after the prior authorization

of the Supervisory Board on December 10, 2024, and is reserved to

the specific category of investors, defined under 11th

resolution of the General Meeting (mostly entities “investing or

having invested on a regular basis in the pharmaceutical,

biotechnology, medical technology or innovative technology

sectors”).

The Warrants Issuance is being carried out

pursuant to the delegation granted by the General Meeting under its

9th resolution, and used by the Management Board by a

decision dated December 10, 2024 and after the prior authorization

of the Supervisory Board on December 10, 2024, by means of a

private placement governed by 1° of Article L. 411-2 of the French

Monetary and Financial Code (i.e., an offering to certain qualified

investors and/or to a restricted circle of investors acting for

their own account).

The Company expects to announce further details

regarding the Transaction when such details are available in one or

more subsequent press releases.

The Company will make an application for the

admission to trading of the New Shares (which are of the same class

as the existing ordinary shares of the Company) on Euronext Growth

under the same ISIN code FR0011716265. The New Shares are expected

to be admitted to trading on or about December 13, 2024. The

Warrants will be subject to an application for admission to trading

on Euronext Growth under a separate ISIN code to be allocated.

In parallel to the Transaction, the Company has

agreed with Heights Capital Management (“Heights”)

on potential amendments of the terms and conditions of the existing

convertible bonds (the “Amendments”) issued to an

entity advised by Heights (the “Investor”) in

February 2024. The Amendments, detailed below, primarily include

(i) the issuance of a second tranche of approximately €2.5 million,

no longer conditional upon the ZEPIZURE® Emergency Use

Authorization by the FDA, and (ii) an extension of the maturity of

the convertible bonds to December 28, 2027. The Amendments are

conditional upon (i) the completion of the Transaction, in which

Heights will contribute €2 million, (ii) the Transaction raising a

minimum of €7 million in gross proceeds and (iii) Gemmes Venture,

Crossject’s historical cornerstone investor, contributing a minimum

of €2 million in the Transaction.

Reasons for the Transaction and use of

proceeds

Prior to the completion of the Transaction, the

Company expects, based on its cash position and on upcoming

financing from its U.S. sponsor and other no dilutive initiatives,

to have sufficient resources to reach its regulatory manufacturing

milestones for ZEPIZURE® in early 2025, which would be final key

steps toward a filing for an EUA with the FDA soon afterwards.

With its ambition to directly commercialize

ZEPIZURE® in the United States, Crossject has entered into a new

phase in its development as a specialty pharmaceuticals company.

Crossject has been focusing on the preparation of the EUA marketing

authorization applications for ZEPIZURE®. The Company’s resources

have been concentrated on that latter regulatory goal, while

continuing its investments in its manufacturing facilities and in

the development of its other product candidates.

In this context, the Company intends to use the

net proceeds of the Transaction as follows:

- Approximately 50% will be allocated

to the further development of ZEPIZURE®, including the assumption

of related operating costs that are incurred in complement to the

R&D costs reimbursed by its U.S. sponsor;

- Approximately 20% will be allocated

to ongoing investment activities in its manufacturing facilities,

the priority use of which will be to meet ZEPIZURE® development

needs and initial demand;

- The rest, or approximately 30%,

will be used to finance the R&D for its other projects, ZENEO®

Hydrocortisone and ZENEO® Adrenaline, certain reimbursements to its

financial creditors, as well as for general and administrative

expenses purposes as well as business development expenses.

With a Transaction that would result in a total

gross amount of at least EUR 7 million in immediate new funding for

the Company, prior to any exercise of any Warrant, the Company

expects that its net working capital would be sufficient to meet

its obligations until the end of S1 2025, allowing the Company to

reach its main EUA regulatory milestone for ZEPIZURE. The Company

is exploring dilutive and non-dilutive financing complements in

order to extend its cash runway until the initial payments from its

U.S. sponsor are received, such payments being expected in Q3 2025.

The Company could also receive additional cash proceeds from the

exercise of Warrants to fulfil these additional financing

needs.

Key characteristics of the

Transaction

Capital Increase

The New Shares will be issued through a capital increase without

shareholders’ preferential subscription right reserved to a

specified category of investors (as further described in the

resolution) pursuant to the 11th resolution of the

General Meeting.

In accordance with the terms of the

11th resolution of the General Meeting, the number of

New Shares issued as part of the Capital Increase shall not exceed

9,000,000 New Shares, with a par value of €0.10 per share, which

would represent approximately 17.43% of the outstanding share

capital of the Company upon completion of the Transaction on a

non-diluted basis. The subscription price per share will be

determined in accordance with the 11th resolution of the

General Meeting and will be at least equal to the weighted average

by volume of the share prices over the fifteen (15) trading days

preceding the date the issue price is set; it being specified that

this weighted average may be reduced by a discount of no more than

20%.

Warrants Issuance

The Warrants will be issued pursuant to 9th resolution

of the General Meeting, by means of an offer governed by 1° of

Article L. 411-2 of the French Monetary and Financial Code (i.e.,

offering to qualified investors and/or to a restricted circle of

investors acting for their own account).

The Warrants will be issued at their fair market

value calculated based on the Black Scholes model. The subscription

price and exercise price of the Warrants will be determined in

accordance with the 9th resolution of the General

Meeting, and the amount to be received by the Company (including

the issue price of the Warrants) will be at least equal to the

weighted average by the volumes of the share prices over the thirty

(30) trading days preceding the date the issue price is set; it

being specified that the weighted average may be reduced by a

discount of no more than 20%.

The number of ordinary shares issued upon

exercise of the Warrants shall not exceed 9,000,000 ordinary

shares.

The Warrants will be freely transferable subject

to applicable laws and regulations. Application will be made for

the listing of the Warrants on Euronext Growth promptly after the

issuance date.

The final terms and conditions of the Warrants

will depend on the result of the discussions with investors.

Other characteristics of the

Transaction

The Company’s existing shareholder, Gemmes Venture, which holds a

26.04% stake in the Company on a non-diluted basis has informed the

Company of its intention to subscribe in the Transaction for at

least €2 million. In accordance with the Supervisory Board’s

internal rules, the representative of Gemmes Venture did not

participate in the deliberations of the Supervisory Board relating

to the Transaction.

Heights has informed the Company of its

intention to subscribe in the Transaction for €2 million under

certain conditions (see below).

The Transaction will not require the publication

of a prospectus pursuant to Regulation (UE) 2017/1129 of the

European Parliament and of the Council of 14 June 2017 (the

“Prospectus Regulation”).

Amendments, subject to conditions, to

the first tranche of convertible bonds and issue of a second

tranche

In a press release dated February 27, 2024, the

Company announced that it had obtained financing from the Investor,

comprising a first tranche of 70 amortizable bonds convertible into

new shares (the “OCAs”) for an aggregate principal

amount of €7 million, and an optional second tranche for a maximum

principal amount of €5 million, subject to the satisfaction of

certain conditions precedent, in particular the obtention of

authorization from the US FDA of an Emergency Use Authorization for

its lead product candidate ZEPIZURE®, with the view to delivering

the first units to the Strategic National Stockpile in connection

with the collaboration between Crossject and its U.S. sponsor. The

first tranche of OCAs was issued on February 28, 2024.

Heights (the “Investor”) intends to subscribe

for €2 million in the Transaction announced today, under the

conditions that:

- the amount

raised in the Transaction is a minimum of €7 million,

- Gemmes Venture

subscribes for a minimum of €2 million in the Transaction.

Subject to these conditions and the Transaction

being definitively completed, the Company would convene an

Extraordinary General Meeting to be held no later than January 31,

2025 to vote on the following resolutions:

-

A resolution amending the terms and conditions of the OCAs issued

on February 28, 2024 in order to:

-

extend the maturity date of the OCAs from February 28, 2027 to

December 28, 2027;

-

reduce the bi-monthly amortization schedule from €6,000 to €4,500

per bond;

-

amend the OCAs holder’s right to request early repayment of up to

two amortization schedule instalments (no longer subordinated to

the case of payment by the Company of the last amortization

schedule instalment in stocks);

-

amend the current conversion price of the OCAs, which will be equal

to the lower of (i) the subscription price per New Share in the

Capital Increase (for the avoidance of doubt, excluding the

Warrants) plus 20% of the subscription price per Warrant in the

Warrant Issuance and (ii) 110% of the Market Value1 on

the new tranche issue date (which may not be less than € 1);

and

-

amend the period during which the conversion price may be adjusted

in the event of the issue of securities for a gross amount of at

least € 5 million (extended to February 28, 2027 inclusive).

In the event this resolution is not passed at

the Extraordinary General Meeting to be held no later than January

31, 2025, the Company has undertaken to convene a second

Extraordinary General Meeting to vote on this resolution, with such

meeting to be held on or prior to March 31, 2025.

- A resolution to allow the issue of

a new tranche of OCAs, which would upon issue be fungible with the

first tranche of OCAs, it being specified that such issue would not

be conditional on obtaining FDA approval. The new tranche of OCAs

would amount to a principal amount of approximately € 2.5

million.

Subject to the Extraordinary General Meeting

voting in favor of these resolutions2 (in which Heights

will not participate), the Amendments to the first tranche of OCAs

and the issue of the second tranche of OCAs would take place within

10 calendar days of the said Meeting.

The Amendments to the first tranche of OCAs and

the issue of the second tranche of OCAs will not require the

publication of a prospectus pursuant to the Prospectus

Regulation.

Information available to the public and

risk factors

Risks related to the

Transaction

Readers are invited to consider the following risks: (i)

shareholders that do not participate in the Transaction will see

their interest in the Company's share capital diluted following the

Transaction and the issue of the new shares, or in the event of a

new capital increase to finance the Company’s growth, (ii) the

potential sale by the Company's main shareholders of a significant

number of shares in the Company, could have an unfavorable impact

on the Company's share price, (iii) the market price for the

Company's shares may fluctuate and fall below the subscription

price of the shares issued pursuant to the Capital Increase and of

the exercise price of the Warrants, and (iv) the volatility and

liquidity of the Company's shares may fluctuate significantly.

General risks

Detailed information regarding the Company, including its business,

financial information, results, prospects and related risk factors

are contained in the Company’s 2023 Annual Report and 2024

Half-Year Report available on the website of the Company

(www.crossject.com).

Investors are encouraged to read the risk

factors included in the 2023 Annual Report.

In addition, the financing agreement of the OCA

to be concluded with the Investor would include repayment

clauses:

Crossject will submit a resolution to a vote at an Extraordinary

General Meeting (which must be held no later than January 31, 2025,

or, failing that, March 31, 2025. Should these resolutions not be

passed, the Investor shall be entitled to require Crossject to

repurchase all or part of the OCAs at a price equal to the greater

of the following amounts: (i) 102% of the principal amount

outstanding and (ii) 120% of parity, in each case together with

accrued but unpaid interest thereon. This put option will be

exercisable within 30 days from the date of the announcement of the

votes of the second general meeting.

This press release does not constitute a

prospectus under the Prospectus Regulation (as defined below) or an

offer of securities to the public.

*****

About Crossject

Crossject SA (Euronext: ALCJ;

www.crossject.com) is an emerging specialty pharma company. It is

in advanced regulatory development for ZEPIZURE®, an epileptic

rescue therapy, for which it has a $60 million contract with the

U.S. Biomedical Advanced Research and Development Authority

(BARDA). ZEPIZURE® is based on the Company’s award-winning

needle-free autoinjector ZENEO®, designed to enable patients and

untrained caregivers to easily and instantly deliver emergency

medication via intramuscular injection on bare skin or even through

clothing. The Company’s other products in development include

rescue therapies for allergic shocks, adrenal insufficiencies,

opioid overdose and asthma attacks.

Contacts

Investors

Natasha Drapeau

Cohesion Bureau

+41 76 823 75 27

natasha.drapeau@cohesionbureau.com |

Media

Sophie Baumont

Cohesion Bureau

+33 6 27 74 74 49

Sophie.baumont@cohesionbureau.com |

Forward Looking Statements

This press release may contain certain

forward-looking statements. Although the Company believes its

expectations are based on reasonable assumptions, all statements

other than statements of historical fact included in this press

release about future events are subject to, without limitation, (i)

change without notice, (ii) factors beyond the Company’s control,

(iii) clinical trial results, (iv) regulatory requirements, (v)

increased manufacturing costs, (vi) market access, (vii)

competition and (viii) potential claims on its products or

intellectual property. These statements may include, without

limitation, any statements preceded by, followed by or including

words such as “target,” “believe,” “expect,” “aim,” “intend,”

“may,” “anticipate,” “estimate,” “plan,” “objective,” “project,”

“will,” “can have,” “likely,” “should,” “would,” “could” and other

words and terms of similar meaning or the negative thereof.

Forward-looking statements are subject to inherent risks and

uncertainties beyond the Company’s control that could cause the

Company’s actual results, performance or achievements to be

materially different from the expected results, performance or

achievements expressed or implied by such forward-looking

statements. A description of these risks, contingencies and

uncertainties can be found in the Company’s 2023 Annual Report.

Furthermore, these forward-looking statements, forecasts and

estimates are made only as of the date of this press release.

Readers are cautioned not to place undue reliance on these

forward-looking statements. The Company disclaims any obligation to

update any forward-looking statements, forecasts or estimates to

reflect any subsequent changes that the Company becomes aware of,

except as required by law.

This press release has been prepared in French

and English. In the event of any differences between the texts, the

French language version shall prevail.

DISCLAIMER

This press release and the information

contained herein do not constitute either an offer to sell or

purchase, or the solicitation of an offer to sell or purchase,

securities of Crossject.

No communication or information in respect

of the offering by the Company of its shares may be distributed to

the public in any jurisdiction where registration or approval is

required. No steps have been taken or will be taken in any

jurisdiction where such steps would be required. The offering or

subscription of shares may be subject to specific legal or

regulatory restrictions in certain jurisdictions. The Company takes

no responsibility for any violation of any such restrictions by any

person.

This announcement does not, and shall not,

in any circumstances, constitute a public offering, a sale offer

nor an invitation to the public in connection with any offer. The

distribution of this document may be restricted by law in certain

jurisdictions. Persons into whose possession this document comes

are required to inform themselves about and to observe any such

restrictions.

With respect to the Member States of the

European Economic Area (including France) (the “Member States”), no

action has been or will be undertaken to make an offer to the

public of the securities referred to herein requiring a publication

of a prospectus in any Member State. As a result, the securities of

the Company may not and will not be offered in any Member State

except in accordance with the exemptions set forth in Article 1(4)

of the Prospectus Regulation, or under any other circumstances

which do not require the publication by the Company of a prospectus

pursuant to Article 1 of the Prospectus Regulation and/or to

applicable regulations of that relevant Member State.

For the purposes of the provision above, the

expression “offer to the public” in relation to any shares of the

Company in any Member State means the communication in any form and

by any means of sufficient information on the terms of the offer

and any securities to be offered so as to enable an investor to

decide to purchase any securities, as the same may be varied in

that Member State. The expression “Prospectus Regulation” means

Regulation (EU) 2017/1129, as amended from time to time, and

includes any relevant implementing measure in the Member

State.

This document does not constitute an offer

to the public in France and the securities referred to in this

document can only be offered or sold in France pursuant to Article

L. 411-2 of the French Monetary and Financial Code (Code monétaire

et financier). In addition, in accordance with the authorisation

granted by the Annual General Shareholders’ Meeting dated June 27,

2024, only the persons pertaining to the categories specified in

the 9th and

11th resolutions

of such meeting may subscribe to the offering.

This document does not constitute an offer

of securities for sale nor the solicitation of an offer to purchase

securities in the United States or any other jurisdiction where

such offer may be restricted. Securities may not be offered or sold

in the United States absent registration under the U.S. Securities

Act of 1933, as amended (the “Securities

Act”) or an exemption from registration under the

Securities Act. The securities of the Company have not been and

will not be registered under the Securities Act, and the Company

does not intend to make a public offering of its securities in the

United States.

The distribution of this document (which

term shall include any form of communication) is restricted

pursuant to Section 21 (Restrictions on "financial promotion") of

Financial Services and Markets Act 2000

(“FMSA”). This document is only

being distributed to and directed at persons who (i) are outside

the United Kingdom, (ii) have professional experience in matters

relating to investments and who fall within the definition of

investment professionals in Article 19(5) of the Financial Services

and Markets Act 2000 (Financial Promotion) Order 2005 (as amended)

(the “Financial Promotion

Order”), (iii) are persons falling within Article

49(2)(a) to (d) (high net worth companies, unincorporated

associations, etc.) of the Financial Promotion Order or (iv) are

persons to whom this communication may otherwise lawfully be

communicated (all such persons referred to in (i), (ii), (iii) and

(iv) above together being referred to as “Relevant

Persons”). This document must not be acted on or

relied on in the United Kingdom by persons who are not Relevant

Persons. Any investment or investment activity to which this

document relates is available only to Relevant Persons, and will be

engaged in only with such persons in the United Kingdom.

This document may not be distributed,

directly, in or into the United States of America, Canada,

Australia or Japan.

1 Corresponding to the lowest daily

Volume-Weighted Average Price for the stocks comprised in the

Market Price Observation Period in respect of such market price

relevant date, where “Market Price Observation Period” means, in

respect of any market price relevant date (a) (if such market price

relevant date is a trading day) the period of six (6) consecutive

trading days ending on (and including) such market price relevant

date or (b) (if such market price relevant date is not a trading

day) the period of five (5) consecutive trading days ending on (and

including) the trading day immediately preceding such market price

relevant date

2 Gemmes Venture, Crossject's

reference shareholder, will undertake to vote in favor of these

resolutions.

- 20241210 - Crossject - PR launch vDEF ENG

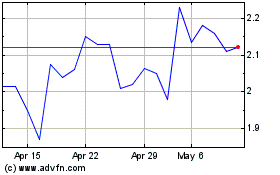

Crossject (EU:ALCJ)

Historical Stock Chart

From Dec 2024 to Jan 2025

Crossject (EU:ALCJ)

Historical Stock Chart

From Jan 2024 to Jan 2025