- 2023 revenues of €11.3 million, in line with the

guidance

- Good gross margin level maintained at 61%

- Positive 2023 EBITDA

- Cash position of €5.3 million at December 31, 2023

Regulatory News:

ALCHIMIE (FR0014000JX7 – ALCHI – PEA-PME eligible), a

channel factory enabling brands, media and companies to create,

design and animate their own themed video channels and stream their

video contents, today announces its consolidated annual results for

the year ended December 31, 2023, as approved by the Board of

Directors on April 18, 2024.

Pauline Grimaldi d’Esdra, CEO of Alchimie, states: “Over

the course of 2023, Alchimie has developed new growth drivers,

transforming its historical model towards SaaS and VPaaS (Video

Platform as a Service) models. The 2023 results are in line with

the guidance, with a gross margin rate of 61% and positive EBITDA.

2024 will be marked by accelerated deployment of our new offerings,

with the aim of fully benefiting from the commercial traction

initiated over the past year. Given this, we confirm that we are

targeting 2024 revenues of close to €8 million, while maintaining a

healthy cost structure”.

Consolidated income statement (IFRS)

In thousands of euros

12.31.2023

12.31.2022

Revenues

11,329

22,070

Cost of sales

(4,441)

(8,844)

Gross margin

6,889

13,226

Technology and development costs

(3,282)

(4,436)

Marketing and sales expenses

(1,469)

(2,833)

General and administrative expenses

(3,562)

(5,946)

Operating income

(1,425)

11

Financial result

(211)

(648)

Consolidated net income

(1,865)

(701)

EBITDA

326

3,061

Cash position end of period

5,346

6,403

Business activity and 2023 financial results

As of December 31, 2023, revenues stood at €11.3 million, in

line with the guidance. The decline in revenues is partly due to

the scheduled termination of service with Orange in January

2023.

In 2023, Alchimie benefited from the solid resilience of its

historical subscriber bases both in France and Germany.

Furthermore, the Company's strategic reorientation to market its

new SaaS and VPaaS, videowall and 42videobricks offerings, got off

to a slower start than expected, generating few revenues in

2023.

Continued rationalization of content licensing costs and

technical costs incurred in the Video segment has enabled Alchimie

to significantly reduce its cost of sales, by -50% compared with

2022, to €4.4 million. The gross margin rate for 2023 thus stands

at 61%, stable compared with 2022.

Operating expenses, down -37%, amount to €8.3 million in 2023.

These reflect the finalization of the Company's restructuring

initiated in 2022 to adapt the cost structure to the Company's

activity. Consequently, in 2023, Alchimie recorded a 26% drop in

technology and development costs, and a 48% decrease in marketing

and sales expenses. In addition, the resizing of support functions

to the Company's needs, as well as the retrocession of part of the

Aubervilliers site and the subleasing of another part, have enabled

Alchimie to reduce its general and administrative costs by around

40%.

All the measures taken have enabled Alchimie to achieve a

positive 2023 EBITDA of €326k, compared with €3.1 million a year

earlier.

Operating income came to a loss of €1.4 million, compared with

€11k in 2022.

After taking into account a financial result of €-211k,

including a positive foreign exchange difference of €46k and

investment income of €68k offset by interest on the HLD Europe

associate current account, and a tax charge of €229k on the German

subsidiary, the consolidated net loss came to €1.9 million,

compared with €701k in 2022.

Financial situation of the Group

Consolidated shareholders' equity was negative at €-2.9 million

at December 31, 2023, impacted by the loss recorded in fiscal year

2023. The cash position at December 31, 2023 was €5.3 million,

compared with €6.4 million at December 31, 2022. This change is

mainly due to the repayment of the associate current account with

HLD Europe.

In terms of financial resources, and given its current cash

position, Alchimie is maintaining tight cost management to preserve

cash, and does not plan to call on the market.

Strategy and outlook 2024

The year 2024 will be marked by the continued deployment of the

videowall and 42videobricks offerings. With a view to

further monetizing its technical assets, Alchimie will intensify

its external communications, using targeted campaigns, to maximize

the visibility of these two growths drivers and will benefit from

the signing of the first contracts.

Concurrently with its commercial development, the Company will

strive to remain among the most innovative players in its sector,

by implementing new functionalities (live broadcasting, events

replay, additional billing options, an improved dashboard, etc.),

to offer customers an ever more comprehensive and intuitive

solution.

Alchimie will also pursue its channel editing activities,

regularly enriching its content catalog. The start of the year saw

the launch of two new SVOD video platforms by the Bauer Group:

www.maximag.tv, a channel featuring a variety of documentaries

(yoga classes, cooking, getaways and travel, etc.), and

www.telecablesat.tv, offering programs around targeted themes

(legends from the world of cinema, history and civilizations, or

major themes in science and technology), a groundbreaking project

made possible thanks to Alchimie's expertise. These two thematic

channels offer users an immersive experience, with the option of

customizing the program to suit their preferences.

Given the outlook, the Company intends to achieve 2024 revenues

of close to €8 million, with sales from new activities not yet

sufficient to offset the decline in revenues generated by the

historical subscriber bases. Despite ongoing efforts to optimize

overheads, Alchimie does not expect to generate positive EBITDA in

2024.

Alchimie is publishing its 2023 full-year financial report

today, available on its website in the Documentation section:

www.alchimie-finance.com.

***

Annual General Meeting: June 7, 2024.

Next financial release: 2023 half-year results 2024, on

October 23, 2024, after market close.

About Alchimie

Alchimie is a unique video streaming platform allowing companies

and creators to build their own video channel, their internal

communication media, and partners. Alchimie also offers

42videobricks, the SaaS access to the technological building blocks

(via API) for operating video and streaming functions. Alchimie has

a catalog of video content from more than 300 prestigious partners

(Arte, France TV distribution, ZDF Entreprises or Zed). For further

information : www.alchimie-finance.com / www.alchimie.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240425131998/en/

Alchimie Pauline Grimaldi d’Esdra CEO

investors@alchimie.com

NewCap Thomas Grojean/Aurélie Manavarere Investor

Relations alchimie@newcap.eu 01 44 71 94 94

NewCap Nicolas Merigeau Media Relations

alchimie@newcap.eu 01 44 71 94 98

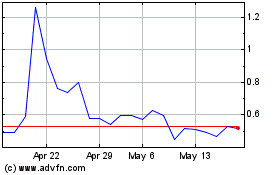

Alchimie (EU:ALCHI)

Historical Stock Chart

From Oct 2024 to Nov 2024

Alchimie (EU:ALCHI)

Historical Stock Chart

From Nov 2023 to Nov 2024