Biophytis Announces Publication of its 2018 Annual Report

May 22 2019 - 2:55PM

Biophytis SA (Euronext Growth Paris: ALBPS), a clinical-stage

biotechnology company focused on the development of therapeutics

for age-related diseases, today announced the publication of its

2018 Annual Report (Document de référence), which has been filed

with the French Autorité des Marchés Financiers (the “AMF”) under

n°19-0509. The 2018 Annual Report is available on the Company’s

website (www.biophytis.com) and on the website of the AMF

(www.amf-france.org).

The 2018 Annual Report has been filed

concurrently with the public filing of a registration statement on

Form F-1 with the U.S. Securities and Exchange Commission, which is

being separately announced today.

First Quarter 2019

FinancialsThe Company also provided first quarter 2019

interim condensed consolidated financial statements, which are

available in their entirety on the Company’s website

(www.biophytis.com) and summarized below:

- Cash and Cash Equivalents. Cash and cash

equivalents as of March 31, 2019 were €11.2 million, a decrease of

€3.2 million as compared to €14.4 million as of December 31, 2018.

During the three months ended March 31, 2019, cash used in

operating activities and investing activities were €5.0 million and

€0.0 million, respectively, which was partially offset by cash

provided by financing activities of €1.8 million.

- Research and Development Expenses. Net

research and development expenses were €2.3 million for the three

months ended March 31, 2019, an increase of €0.3 million as

compared to €2.0 million for the corresponding period in 2018.

- General and Administrative Expenses. General

and administrative expenses were €1.2 million for the three months

ended 2019, an increase of €0.3 million as compared to €0.9 million

for the corresponding period in 2018.

- Net Loss. Net loss was €3.7 million for the

three months ended 2019, as compared to €2.9 million for the

corresponding period in 2018. Net loss per share (based on

weighted-average number of shares outstanding over the period) was

€0.28 for the three months ended March 31, 2019 and €0.22 for the

corresponding period in 2018.

Considering current cash resources and existing

financing lines, the company has the financial means to operate for

the next 12 months.

Intellectual Property Agreement with

Stanislas VeilletUnder French intellectual property law,

Mr. Veillet, our CEO, who is a corporate officer (mandataire

social) but not an employee of the Company, is entitled to certain

rights with respect to inventions he has developed with the Company

and for which the Company has submitted patent applications in

which he is listed as a co-inventor as well as other inventions

that the Company expects may give rise to patent applications in

the future, for which he is likely to be included as a co-inventor.

These rights are distinct from the statutory rights that usually

apply to employee inventors under French law. In order to define a

framework within which any intellectual property resulting from Mr.

Veillet’s research and development activities is properly assigned

to the Company, the parties have entered into an agreement, which

was approved by the board of directors of the Company and provides

for the following payments to Mr. Veillet for his

contributions:

- a first lump sum cash payment of €90 thousand to be paid within

30 days of the filing of a patent application based on the assigned

rights;

- a second lump sum cash payment of €90 thousand to be paid

within 30 days of publication of a patent application based on the

assigned rights; and

- a 6.5% royalty payment with respect to any license income

and/or any net sales by us of products manufactured with the

patents filed on the basis of the assigned rights.

These three payments will be capped at €2.1 million on a

platform per platform basis.

In the event that a third-party pharmaceutical

and/or biotech company acquires 100% of our capital and voting

rights, payments will be accelerated, so that the cap (€2.1 million

per platform), less any amount previously paid in respect of a

platform, will become immediately payable.

A payment of €450 thousands will be made to the

Company’s CEO within 30 days of execution of the agreement, as

certain patent applications covered by the agreement had already

been filed and therefore triggered payment of the first lump

sum.

About BiophytisBiophytis is a

clinical-stage biotechnology company focused on the development of

therapeutics that slow the degenerative processes and improve

functional outcomes for patients suffering from age-related

diseases. Our therapeutic approach is aimed at targeting and

activating key biological resilience pathways that can protect

against and counteract the effects of the multiple biological and

environmental stresses that lead to age-related diseases. Our lead

drug candidate, Sarconeos (BIO101), is an orally administered small

molecule in development for the treatment of neuromuscular

diseases, including sarcopenia and Duchenne muscular dystrophy

(DMD). Our second drug candidate, Macuneos (BIO201), is an orally

administered small molecule in development for the treatment of

retinal diseases, including dry age-related macular degeneration

(AMD) and Stargardt disease. Biophytis is headquartered in Paris,

France, and has offices in Cambridge, Massachusetts. The Company’s

ordinary shares are listed on Euronext Growth Paris (Ticker: ALBPS

- ISIN: FR0012816825). For more information please visit

www.biophytis.com.

DisclaimerThis press release

contains forward-looking statements. Forward-looking statements

include all statements that are not historical facts. In some

cases, you can identify these forward-looking statements by the use

of words such as "outlook," "believes," "expects," "potential,"

"continues," "may," "will," "should," "could," "seeks," "predicts,"

"intends," "trends," "plans," "estimates," "anticipates" or the

negative version of these words or other comparable words. These

forward-looking statements include any statements relating to

future payments to be made to Stanislas Veillet under the

Intellectual Property Agreement. Such forward-looking statements

are subject to various risks and uncertainties including, without

limitation, risks inherent in the development and/or

commercialization of potential products, the outcome of its

studies, uncertainty in the results of pre-clinical and clinical

trials or regulatory approvals, need and ability to obtain future

capital, and maintenance of intellectual property rights.

Accordingly, there are or will be important factors that could

cause actual outcomes or results to differ materially from those

indicated in these statements. These factors include but are not

limited to those described under "Risk Factors" in Biophytis’

registration statement relating to the initial public offering.

These factors should not be construed as exhaustive and should be

read in conjunction with the other cautionary statements that are

included in the registration statement. We undertake no obligation

to publicly update or review any forward-looking statement, whether

as a result of new information, future developments or otherwise,

except as required by law.

Biophytis Investor Relations

ContactDaniel Schneiderman, CFO

dan.schneiderman@biophytis.comTel: +1 (857) 220-9720

U.S. Media ContactLifeSci

Public Relations Cherilyn Cecchini,

M.D.ccecchini@lifescipublicrelations.comTel: +1 (646) 876-5196

Europe Media ContactCitigate

Dewe RogersonAntoine Denry

antoine.denry@citigatedewerogerson.comTel: +33 (0) 1 53 32 84

78

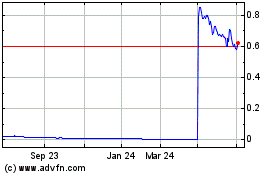

Biophytis (EU:ALBPS)

Historical Stock Chart

From Nov 2024 to Dec 2024

Biophytis (EU:ALBPS)

Historical Stock Chart

From Dec 2023 to Dec 2024