AFYREN NEOXY: first products commercialized but adjustments

in operations needed to reach continuous production

- Ambition to reach continuous production by end 2024 is

maintained, subject to adjustments to the separation-purification

stage

- First tons of biobased acids and fertilizers commercialized to

customers

- Further development of partnerships and commercial pipeline to

prepare for the future

- First sustainability report published and good execution of the

ESG roadmap

A solid financial base, supporting the start-up of AFYREN

NEOXY

- Stable loss reflecting good control of operating expenses

- Cash position of €43 million at 30 June 2024, with cash burn of

€6 million, including transitional support for the start-up of

AFYREN NEOXY's continuous production

Regulatory News:

AFYREN (Paris:ALAFY), a greentech company that offers

manufacturers natural, low-carbon ingredients produced using unique

fermentation technology based on a completely circular model, today

announced financial results for the half-year ended June 30, 2024,

and approved by the Board of Directors on September 27, 2024.

Nicolas SORDET, CEO of AFYREN, said: "This summer saw

many temperature records fall. Faced with this reality, repeating

year after year, AFYREN is proud to offer a concrete response to

the challenges of decarbonizing industry. The strategic priority

given to the continuous start-up of our AFYREN NEOXY plant should

not overshadow the many successes achieved in other areas, whether

in R&D, partnerships, our ESG roadmap or the commercial

pipeline."

RECENT highlights

AFYREN NEOXY: tangible progress made with

the first tons of biobased acids and fertilizer commercialized to

customers, while continuous production is envisaged after the

adjustments currently being made to the separation-purification

stage

Following the on-time delivery of the AFYREN NEOXY plant and its

successful industrial commissioning, several quarters of tests and

trials were necessary for the teams to master the critical stages

of a pioneering process second to none, worldwide.

During this period, the upstream fermentation-concentration

process was confirmed. Adjustment work is now focusing on the

downstream stages of the process.

Role

Objective

Status

Fermentation &

Concentration

Enable transformation of feedstock into

Acids

Replicating the pilot's performance on an

industrial scale

Confirmed

Concentrate reaction medium

Achieve expected performances

Confirmed

Separation & Purification

Extract Acids and produce Fertilizer

Improve the reliability of industrial

equipment and process management

Several long cycles successfully

executed

Reliability work in progress to enable

more stable continuous operation

Purification of Acids

Produce in line with standard market

specifications

Largely validated by the production of

industrial volumes at the quality required by customers

Ongoing replacement of a piece of

equipment damaged by a corrosion incident

These recent advances have enabled:

- the production and commercialization of over a hundred tons of

fertilizer since April 2024;

- the production of several dozen tons of acids and

commercialization to three customers, meeting the quality standards

of the human food, cosmetics, and life sciences markets.

AFYREN NEOXY will record its first acids sales in the second

half of 2024.

Adjustment in operations required to achieve continuous

production. These relate to the separation-purification, in

particular with the ongoing replacement of a piece of equipment

damaged by a corrosion incident, with the ambition to resume full

production cycles at the end of November 2024. Achieving the

objective of continuous production by the end of 2024 therefore

depends on replacing this equipment without delay and more

generally, the ongoing improvement in the reliability of

separation-purification.

The objective of reaching break-even1 of the plant in the course

of 2025 is confirmed.

AFYREN NEOXY: a financing plan for the

start-up of operations currently being structured

Today, as anticipated, additional financing requirements,

including operating costs related to the start-up as well as the

necessary investments, are covered for now by a shareholder loan

from AFYREN to its subsidiary AFYREN NEOXY. To date, this financing

facility amounts to €7.8 million.

A more comprehensive financing package, including debt

financing, is currently being structured.

AFYREN would participate in this plan as a 51% shareholder in

AFYREN NEOXY by mobilizing part of its available cash. It would

cover start-up delays and the ramp-up period, right through to

financial equilibrium.

Strategic partnerships and commercial

progresses

In parallel with the launch of AFYREN NEOXY, a strategic

priority for the Group, AFYREN is continuing to make progress on

securing raw materials and commercial outlets for its products.

In the first half of 2024 AFYREN and SUEZ announced that they

would be continuing their collaboration on a new way of recovering

biowaste. The aim of this collaboration is to use this waste from

SUEZ's collection and treatment activities in the AFYREN process to

manufacture molecules that can be used to replace petroleum-based

molecules. This initiative opens up an attractive recycling option

and a concrete, circular solution to the challenges of

decarbonization. It marks a significant step forward in the

collaboration between the two companies, initiated in 2020 as part

of the AFTER-BIOCHEM consortium.

In Asia, AFYREN is progressing with the structuring of its

commercial activities, within the framework of the planned

partnership with Mitr Phol, a leading Thai group in the production

of cane sugar and its derivatives, via the creation of AFYREN

SERVICES (THAILAND) CO. LTD, a wholly owned subsidiary of

AFYREN.

More recently, AFYREN announced the signature of a new

multi-year commercial contract with a US-based manufacturer of

nutraceutical products, a high-value and fast-growing market. As

part of the contract, AFYREN will supply the customer with its

biobased acids, produced using its unique natural fermentation

process and used as preservatives or flavorings for food

supplements. Initially based on limited volumes, this contract may

evolve towards larger quantities.

Tangible progress on the

ESG2 roadmap

Integral to AFYREN's value proposition and supported by

ambitious corporate governance, ESG is at the heart of AFYREN's

strategy.

Recent achievements include:

- Signing of the global Responsible Care® charter attesting to

the commitment of all AFYREN sites;

- Success of the second HR survey (AFYREN Global People Survey),

with 98% participation;

- Improvement of the Gaia non-financial rating: in March 2024,

AFYREN recorded a further improvement in its EthiFinance

non-financial rating to 83/100 (Platinum Level), highlighting a

level of ESG maturity superior to that of comparable

companies3;

- Publication of AFYREN's first sustainability report,

voluntarily drawn up in the spirit of the ESRS (Environmental,

Social, and Governance Reporting Standards). This document is

available for consultation and download in a dedicated section of

the company's website.

A solid financial

base

A stable loss thanks to disciplined cost

management

Simplified P&L (in thousands of

euros)

06/2024

06/2023

Var.

Revenue

1,364

1,956

-30%

licensing and development of industrial

know-how

709

708

-

other services provided

656

1,247

-47%

Operating loss

(3,590)

(3,097)

+16%

Net financial result

978

503

+94%

Share in loss of equity-accounted company

(net of tax)

(2,710)

(2,529)

+7%

Net loss

(5,322)

(5,123)

+4%

The Company's revenues amounted to €1.36 million in the first

half of 2024, a 30% decline compared with €1.96 million in the

first half of 2023, in line with a reduced scope of services

provided to its subsidiary AFYREN NEOXY, given the increased

activity of local teams.

Revenues are essentially made up of:

- income from patent and know-how licenses granted to AFYREN

NEOXY since December 2018 for a total of €0.7 million in the first

half of 2024 (€1.4 million on an annual basis) unchanged from the

first half of 2023;

- various contracts for provision and other service provision

(technical, commercial, administrative, etc.) signed with AFYREN

NEOXY for a total of €0.7 million in the first half of 2024, down

due to the reduction in administrative services linked to specific

projects and, more generally, local teams taking up an increased

workload.

Net operating expenses4 amounted to €5.0 million in the first

half of 2024, down slightly from €5.1 million in the first half of

2023.

These expenses include:

- purchases and external expenses, up €0.1 million, including

expenses related to the development of the Group's next

plants;

- personnel expenses, down €0.2 million, due to lower costs for

share-based payments. The average number of full-time equivalents

(FTEs) was 46, compared with 40 at 30 June 2023 (excluding AFYREN

NEOXY).

In addition, research and development spending recognised as

expenses amounted to €0.9 million in the first half of 2024, stable

compared with the same period in 2023.

Current operating income came to €(3.6) million, with lower

expenses partially offsetting lower revenues.

Net financial income was positive in the first half of 2024:

financial income from cash investments totalled €1.0 million in the

first half of 2024, compared with €0.7 million in the first half of

2023. Financial expenses were lower in 2024 than in the first half

of 2023, which included interest linked to IFRS restatements (on

convertible bonds and licence agreements).

AFYREN NEOXY's share of net income was €(2.7) million in the

first half of 2024, compared with €(2.5) million in the first half

of 2023. This result is mainly related to the plant's operating

expenses, with no meaningful revenues.

Group net income was €(5.3) million at the end of June 2024,

compared with €(5.1) million at the end of June 2023, reflecting

good cost control pending the positive contribution from production

at the AFYREN NEOXY plant.

A solid cash position of €43 million

thanks to limited cash consumption

Simplified balance sheet (in thousands

of euros)

06/2024

12/2023

Non-current financial assets

16,671

19,479

of which equity-accounted securities

11,475

14,185

Current assets

47,246

50,948

of which cash and cash equivalents

43,402

49,559

Total assets

63,917

70,427

Equity

56,734

61,799

Non-current provisions

3,477

4,213

of which loans and financial debts

2,390

3,176

Current liabilities

3,706

4,414

of which loans and financial debts

1,585

1,611

Total liabilities

63,917

70,427

At 30 June 2024, Group has a cash position of €43.4 million.

Cash outflows totaled €6.2 million in the first six months of 2024,

of which €2.5 million related to short-term financing of the

subsidiary AFYREN NEOXY by means of a shareholder loan, and €0.7

million related to debt repayments.

At the end of June 2024, AFYREN had a solid balance sheet and

shareholders' equity of €56.7 million, with the decrease compared

with the end of 2023 attributable to the net loss for the period.

Total financial debt was limited to €4.0 million5 at the end of

June 2024, compared with €4.8 million at the end of 2023, with the

decrease mainly due to the normal repayment of debt.

Outlook and financial

OBJECTIVES

As of the date of this press release, AFYREN aims at starting up

continuous production at AFYREN NEOXY, the first industrial-scale

production unit using its technology.

Experience feedback from AFYREN NEOXY is a prerequisite for

launching more advanced engineering studies on two projects: a

plant in Thailand targeting the Asian market and the extension of

the French plant to meet demand in Europe.

AFYREN aims for:

- three production units with an installed capacity of around

70,000 tons of acids in 2028, including at least two in continuous

production (including the existing AFYREN NEOXY plant). These three

units will also produce a high added-value fertilizer to ensure the

circularity of the model;

With all three units running at full capacity, AFYREN aims

for:

- cumulated production revenue of more than €150 million;

- a target recurring EBITDA margin at Group level of around

30%6.

2024 HALF-YEAR FINANCIAL REPORT

AVAILABILITY

The Company will make its 2024 half-year financial report in

French available to the public today. An English version will

follow shortly.

About AFYREN

AFYREN is a French greentech company launched in 2012 to meet

the challenge of decarbonizing industrial supplies. Its natural,

innovative and proprietary fermentation technology valorizes local

biomass from non-food agricultural co-products, replacing

petro-sourced ingredients usually used in many product

formulations. AFYREN's 100% biobased, low-carbon and sustainable

solutions can meet decarbonization challenges in a wide variety of

strategic sectors: human and animal nutrition, flavors and

fragrances, life sciences and materials, and lubricants and

technical fluids. AFYREN's plug-and-play, circular technology

combines sustainability and competitiveness, with no need for

manufacturers to change their processes.

The Group's first French plant, AFYREN NEOXY, a joint venture

with Bpifrance's SPI fund, is located in the Grand-Est region of

France, in Saint Avold, serving mainly the European market.

AFYREN is also pursuing a project in Thailand with a world

leader in the sugar industry, and is developing its presence in the

Americas, following up on distribution agreements it has already

signed.

At the end of 2023, the AFYREN Group employed about 120 people

in Lyon, Clermont-Ferrand and Carling Saint-Avold. The company

invests 20% of its annual budget in R&D to further develop its

sustainable solutions.

AFYREN has been listed on the Euronext Growth® exchange in Paris

since 2021 (ISIN code: FR0014005AC9, mnemonic: ALAFY).

Find out more: afyren.com

Appendix

1. Income statement

(in thousands of euros)

06/2024

06/2023

Revenue

1 364

1 956

Other income

242

226

Purchases and external expenses

(1 675)

(1 538)

Payroll costs

(3 029)

(3 249)

Depreciation of fixed assets and rights of

use

(405)

(406)

Other expenses

(88)

(86)

Current operating income

(3 590)

(3 097)

Non-current operating income

-

-

Operating income

(3 590)

(3 097)

Financial income

1 051

746

Financial expenses

(73)

(243)

Net financial income

978

503

Share in income of equity-accounted

company (net of tax)

(2 710)

(2 529)

Income before tax

(5 322)

(5 123)

Income tax

0

-

Net income for the year

(5 322)

(5 123)

Earnings per share

Basic earnings per share (in euros)

(0,20)

(0,20)

Diluted earnings per share (in euros)

(0,20)

(0,20)

2. Balance sheet

(in thousands of euros)

06/2024

12/2023

Intangible assets

3 146

3 333

Property, plant and equipment

285

338

Rights of use

328

441

Equity-accounted securities

11 475

14 185

Non-current financial assets

1 437

1 182

Non-current assets

16 671

19 479

Trade receivables

352

466

Current financial assets

100

99

Other current assets

3 392

824

Cash and cash equivalents

43 402

49 559

Current assets

47 246

50 948

Total assets

63 917

70 427

Share capital

522

520

Issue premiums

85 391

85 264

Reserves

(9 815)

(4 679)

Retained earnings

(14 042)

(9 720)

Net income for the year

(5 322)

(9 586)

Equity attributable to the owners of

the Company

56 734

61 799

Non-current borrowings and financial

liabilities

2 269

2 952

Non-current lease liabilities

121

224

Defined benefit liabilities

61

61

Non-current provisions

14

14

Non-current deferred income (customer

contract liabilities)

0

0

Non-current deferred income (grant)

1 012

962

Non-current liabilities

3 477

4 213

Current borrowings and financial

liabilities

1 391

1 402

Current lease liabilities

193

208

Trade payables

282

388

Current deferred income (customer contract

liabilities)

637

1 321

Other current liabilities

1 202

1 095

Current liabilities

3 706

4 414

Total liabilities

7 183

8 628

Total equity and liabilities

63 917

70 427

3. Cash flow statement

(simplified)

(in thousands of euros)

06/2024

06/2023

Net income for the year

(5 322)

(5 123)

Total elimination of expenses and

income with no cash impact

2 574

3 074

Total cash flow

(2 748)

(2 049)

Total changes in working

capital

(635)

(258)

Net cash from operating

activities

(3 383)

(2 307)

Acquisition of PPE and intangible assets,

net of disposals

(52)

(231)

Capitalised development expenses

(19)

(76)

Investment grants (incl. CIR offsetting

capitalised expenses)

49

(15)

Subscription to AFYREN NEOXY capital

increase

-

(2 000)

Current account contribution to AFYREN

NEOXY

(2 500)

-

Interest received

838

665

Net variation in non-current financial

assets

(50)

(1 501)

Variation in current financial assets

(liquidity contract)

(1)

(400)

Net cash used in investing

activities

(1 735)

(3 557)

Capital increase

129

93

Purchase / sales of treasury share

(306)

(202)

Proceeds from new borrowings and financial

liabilities

-

1 001

Repayment of borrowings and financial

liabilities

(702)

(818)

Repayment of convertible bonds

-

(3 567)

Payment of lease liabilities

(110)

(110)

Interest paid on borrowings and financial

liabilities

(38)

(27)

Interest paid on bonds

-

(178)

Interest paid on lease liabilities

(10)

(9)

Net cash used in financing

activities

(1 039)

(3 816)

Net change in cash and cash

equivalents

(6 157)

(9 681)

Cash and cash equivalents as of January

1st

49 559

62 333

Cash and cash equivalents as of Dec

31

43 402

52 652

__________________________________________ 1Current EBITDA from

production: corresponding to current operating income adjusted for

depreciation, amortization and net impairment of property, plant

and equipment and intangible assets and the royalties for the

remuneration of a technology licence granted by AFYREN.

2Environmental, social and governance criteria 3In terms of

employee numbers and sector 4Net of other income, mainly operating

grants including in particular the research tax credit 5Including

rental liabilities, which represent 121 thousand euros at the end

of June 2024 for the non-current portion and 193 thousand euros for

the current portion 6Current EBITDA margin is defined at Company

level.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240929852092/en/

AFYREN Director for ESG, Communications and Public

Affairs Caroline Petigny caroline.petigny@afyren.com

Investor Relations Mark Reinhard

investisseurs@afyren.com

NewCap Investor Relations Théo Martin / Mathilde

Bohin Tel: 01 44 71 94 94 afyren@newcap.eu

NewCap Media Relations Nicolas Mérigeau / Gaëlle

Fromaigeat Tel: 01 44 71 94 98 afyren@newcap.eu

International Media relations Bogert-Magnier

Communications James Connell +33 6 2152 1755

jim@bogert-magnier.com

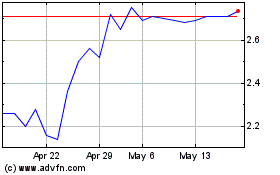

Afyren (EU:ALAFY)

Historical Stock Chart

From Dec 2024 to Jan 2025

Afyren (EU:ALAFY)

Historical Stock Chart

From Jan 2024 to Jan 2025