BELGRAVIA CAPITAL INTERNATIONAL INC. (CSE:BLGV) (OTCQB:BLGVF)

(“Belgravia Capital”, “Belgravia”, or the “Company”) is pleased to

announce the commencement of research, development and marketing of

its planned distributed and decentralized blockchain-based

medicinal cannabis quality attestation and provenance public

database. The database will be constructed so retail consumers and

institutional distributors will be able to freely search a

publicly-validated and distributed blockchain dataset for relevant

product characteristics such as proof of cannabinoid, terpenoid and

flavonoid content, as well as proof of strain heritage including

source of genotype and phenotype. Other attested characteristics

include increased safety features such as freedom from heavy metals

(including arsenic, mercury, iron, copper, and zinc), and freedom

from biological contamination metabolites such as endotoxin

lipopolysaccharides, solvents and pesticide residuals.

Recordation of product genesis will allow consumers to identify

where specific strains can be purchased and it is intended that our

platform may provide linkage for actionable purchases which may

enable the company to participate in a revenue sharing model.

The Company intends to establish on a paced

basis an industry consortium to provide independently verified

input data. In that regard Belgravia has executed a letter of

intent on January 2, 2018 with an internationally based vertically

integrated private medicinal cannabis company with license

applications in place, which has access to world recognized strains

and whose business model will include international distribution

consistent with all domestic and international laws.

Belgravia is further negotiating such letters of intent and

definitive agreements with other licensed producers in Canada, and

also in other jurisdictions where medicinal cannabis has been fully

legalized and is fully regulated. Belgravia will only operate in

conjunction with industry players operating fully consistently with

all levels of relevant legal requirements.

Mehdi Azodi, the President and Chief Executive

Officer of Belgravia stated: “We are pleased to be advancing

carefully thought out plans for the development of Blockchain

distributed databases as a service to retail consumers, and as a

value-added technology for the industry. Bootstrapping such

specific blockchain applications will require our integrating

cannabis agronomic and medical researchers, software developers,

distributed and centralized blockchain experts,

business-to-business participants, and governments, merchants, and

customers. We are developing a team with specialization in

these areas.”

Mr. Azodi continued: “The blockchain development

will involve a permissioned network of input nodes representing

licensed producers, analytical laboratories, and government

regulators, as well as an open distributed network of nodes for

consumers and other interested parties. While consumers will

be fully pseudonymous, inputters will be trusted and auditable

industry or government service providers. We believe that consumers

will appreciate the protection of their identities, which will be

provided by using private address keys. For inputters, the

identities will be public for two reasons: first, all input data

will be traceable backwards to a cloud-based database of

hash-indexed and hash-provable and therefore immutable documents;

further, reputation is important and in a pseudonymous environment,

where identities can be switched effortlessly, reputation systems

are not workable if identities can be switched effortlessly.

Inputter identification and off chain databases also provide

protection to inputters from spurious assertions. The Blockchains

are append-only and immutable ledgers and this will provide greater

confidence to consumers than is presently possible. As blockchain

utilization develops, we also intend to integrate the power of

cloud computing, which will be attractive to the international

community of medicinal cannabis consumers. Cloud computing

provides a retail oriented attractive alternative model for

enabling ubiquitous convenient and on-demand network access to a

shared pool of configurable computing resources. In

principle, a P2P storage system will allow for the international

retail community to provide their storage resources as dedicated

and supportive to medicinal cannabis consumers. They could provide

such resources for reasons of personal satisfaction of supporting

greater visibility and confidence in the industry, or in exchange

for industry specific digital coins. Such coins or tokens are

becoming recognized as affiliation instruments in addition to

providing exchangeable monetary value.”

Equity FundingFunding of

blockchain developments and other initiatives will be from working

capital including a note receivable, expected warrant exercises,

and an additional equity funding. As previously announced on

October 17, 2017 the Company, in addition to USD $1.4 million

already received, has a receivable promissory note of USD $1.4

Million (approximately CAD $1.75 million) from Cartesian Capital

Group-controlled Intercontinental Potash Corp (USA).

This amount is due January 8, 2018. In addition to working

capital, there are outstanding 20,236,666 warrants exercisable at

CAD $0.08 maturing on March 1, 2018. If fully exercised,

these in-the-money warrants will provide an additional CAD

$1,618,933.

Further, the Company intends to raise additional

funds and has price protection for equity securities by way of a

unit offering at CAD $0.05 a unit, which was obtained on December

1, 2017. The Company intends to raise up to CAD

$4,000,000 by issuing units at a price of CAD $0.05 per unit, each

unit consisting of one common share and one common share purchase

warrant, each warrant entitling the holder to purchase an

additional common share at CAD $0.18 per warrant for a period of

one year from the date of issue. The Company expects such

financing to be completed no later than January 10, 2018. It is

also expected that additional funds up to USD $12.2M will be

received from Cartesian Capital Group controlled Intercontinental

Potash Corp. (USA) from New Mexico water sales. Those

anticipated revenues are in connection with the Water Royalty, as

more particularly described in the Company’s press release of

October 17, 2017.

About Belgravia

CapitalBelgravia Capital International is focused on the

provision of clearly value-added services to the international

legal Cannabis industry. This includes the production of

specialized organic fertilizers for Cannabis Sativa plants, and the

organization and development of blockchain technology software for

seed to sale tracking and quality attestation of intermediate and

consumer products. The wholly-owned subsidiary of Belgravia, ICP

Organics, is a research and development company incorporating

agronomic and health perspectives in the Cannabis space. Belgravia

is also developing a royalty-streaming subsidiary.

Belgravia Capital intends to establish joint

research and development partnerships with Licensed Producers

operating under ACMPR regulations in Canada and in other

jurisdictions where medicinal cannabis is fully legal.

Belgravia Capital may invest in various private and public

companies in diversified sectors on an opportunistic basis. For

more information, please visit www.belgraviacapital.ca.

Forward-Looking

Statements Certain information set forth in this news

release may contain forward-looking statements that involve

substantial known and unknown risks and uncertainties and other

factors which may cause the actual results, performance or

achievements of the Company to be materially different from any

future results, performance or achievements expressed or implied by

such forward-looking statements. Forward-looking statements include

statements that use forward-looking terminology such as “may”,

“will”, “expect”, “anticipate”, “believe”, “continue”, “potential”

or the negative thereof or other variations thereof or comparable

terminology. Such forward-looking statements include, without

limitation, statements regarding planned investment activities

& related returns, trends in the markets for fertilizers and

medicinal or recreational use of cannabis, the timing or assurance

of the legalization of recreational cannabis, the timing for

completion of research and development activities, the potential

value of royalties from water and other resources, and other

statements that are not historical facts. These forward-looking

statements are subject to numerous risks and uncertainties, certain

of which are beyond the control of the Company, including, but not

limited to, changes in market trends, the completion, results and

timing of research undertaken by the Company, risks associated with

resource assets, the impact of general economic conditions,

commodity prices, industry conditions, dependence upon regulatory,

environmental, and governmental approvals, the uncertainty of

obtaining additional financing, and risks associated with cannabis

use for medicinal or recreational purposes. Readers are cautioned

that the assumptions used in the preparation of such information,

although considered reasonable at the time of preparation, may

prove to be imprecise and, as such, undue reliance should not be

placed on forward-looking statements.

For More Information, Please

Contact:Mehdi Azodi, President & CEOBelgravia Capital

(416) 779-3268 mazodi@blgv.ca

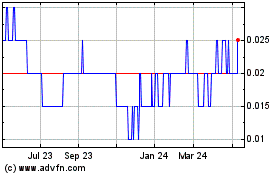

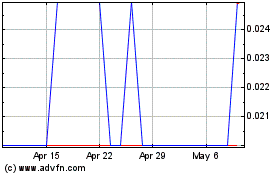

Belgravia Hartford Capital (CSE:BLGV)

Historical Stock Chart

From Oct 2024 to Nov 2024

Belgravia Hartford Capital (CSE:BLGV)

Historical Stock Chart

From Nov 2023 to Nov 2024