Bitcoin Price Crash Incoming? Why A Fall To $63,000 Is Possible If This Resistance Holds

March 07 2025 - 6:00PM

NEWSBTC

The recent Bitcoin price crash below $90,000 came as a shock to the

broader crypto community, especially amid expectations of a

continued bull market rally. Despite the volatility and ongoing

declines, a crypto analyst projects an even greater crash,

suggesting that Bitcoin could fall as low as $63,000 if a certain

resistance level holds. TradingView crypto analyst Alixjey

has declared that the Bitcoin price must break past $99,500 to

continue moving higher. He highlights that if this resistance holds

and Bitcoin fails to break it, the pioneer cryptocurrency will

likely face a steeper price decline to new lows of $63,000. The

last time Bitcoin was around the $60,000 range was during its

massive price rally in 2024 after the launch of Spot Bitcoin ETFs.

Considering that Bitcoin has risen as high as $104,000 at one point

this year, a crash toward $60,000 would be a devastating blow to

investors and its market. Bitcoin Price Crash Imminent

The TradingView analyst shared a chart suggesting that Bitcoin

could rise as high as $106,000 or drop toward the $60,000 to

$65,000 range if it fails to break resistance. This price drop is

highlighted as a strong buying and accumulation opportunity for

long-term investors, as it presents a low entry point into the

market. Related Reading: Bitcoin 77% Correction To $25,000, Will

History Repeat Itself During its price highs, many retail

investors were likely unable to buy Bitcoin due to its increasing

cost. Most accumulations were from whales who had purchased

millions of dollars worth of Bitcoin in one swoop. Alixjey

has also labeled his projected $60,000 – $65,000 downturn as the

last chance to re-enter the Bitcoin market, emphasizing that it was

a prime HODLing point for potential profits in Q3 and Q4 of 2025.

This implies that the analyst anticipates a price rebound in

Bitcoin later in the year. Moving on, the TradingView expert

highlighted two liquidity levels in the 4-hour timeframe that are

likely to be cleared soon. He also acknowledged that he was solely

bearish on Bitcoin’s price outlook, indicating that his projected

short-term pullback will not be invalidated unless the

cryptocurrency crosses the resistance between $94,000 and $98,000.

Other factors that could contribute to Bitcoin’s already heightened

volatility are the Non-Farm Payroll (NFP) data. AlixJey predicts

that once released, this data could lead to high volatility in both

stocks and crypto. He urges investors and traders to be cautious,

as major economic reports often influence market movements.

Analyst Sees Upside Potential After BTC Crashes Due to Bitcoin’s

recent declines, many analysts have shared bearish projections of

the cryptocurrency, expecting a severe price correction before a

potential recovery. One such analyst is Herbert Sim, the Chief

Marketing Officer (CMO) of AICean. Related Reading: Bitcoin Price

Suffers Bearish Deviation After Filling CME Gap, Is This Good Or

Bad? Sim projects that Bitcoin will crash to new lows, especially

with the recent approval of a crypto reserve in the United States

(US). He expects a crash to $40,000 but highlights that it will be

short-lived, spanning from weeks, months, and possibly years.

However, the AICean CMO suggested that investors who can HODL for

the long-term are likely to see more profits once BTC rebounds from

bearish trends. Featured image from Adobe Stock, chart from

Tradingview.com

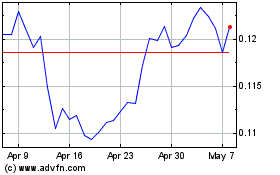

TRON (COIN:TRXUSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

TRON (COIN:TRXUSD)

Historical Stock Chart

From Mar 2024 to Mar 2025