Ethereum Foundation Sells Another 100 ETH, But There’s Still ‘Hopium’ For Holders

January 28 2025 - 12:00AM

NEWSBTC

The Ethereum Foundation (EF) recently sold another 100 Ethereum

(ETH) for 307,893 DAI, a stablecoin pegged to the US dollar. This

marks the third time in 2025 that the EF has sold ETH, raising

concerns among ETH holders about the cryptocurrency’s relatively

lackluster price performance. EF Continues To Sell Ethereum, But

Analysts Offer Hope In a post on X earlier today, on-chain

analytics platform Spot On Chain identified a transaction showing

that the EF had offloaded another 100 ETH. As of January 27, the EF

has sold a total of 300 ETH for approximately $981,200. Related

Reading: Ethereum Poised For A Bullish Q1 2025? Here’s What Experts

Say Naturally, the continued selling pressure from the EF has

contributed to Ethereum’s price struggles. Over the past 24 hours,

the second-largest cryptocurrency by market cap has fallen by 5.7%,

trading at $3,125 at the time of writing. That being said, the EF

still holds a substantial amount of Ethereum. According to data

from Arkham Intelligence, the non-profit organization owns 269,175

ETH, worth more than $800 million at current market prices. While

the EF’s decision to periodically sell ETH has raised concerns

among some of the digital asset’s largest holders, seasoned crypto

trader CoinMamba believes that all may not be lost for ETH just

yet. In a post on X, CoinMamba shared a chart providing ‘some

hopium’ for the next two months. According to the analysis, the

months of February and March have historically delivered strong

returns for ETH holders. The analyst explained that Ethereum has

only posted negative returns in February once, back in 2018, when

the digital asset had already surged by 50% in January of that

year. In February 2024, the cryptocurrency saw a 46.3% increase in

price. Crypto trader Crypto Rover shared their analysis aligning

with the prediction of ETH appreciating in value over the next

couple of months. The trader emphasized that ETH is still in a

‘massive uptrend,’ and there is no reason to panic. Is ETH On The

Cusp Of A Rally? Despite being overshadowed for much of 2024 by the

likes of SUI, Solana (SOL), and XRP, analysts are confident that

ETH has yet to experience a bullish price momentum that could bring

it closer to its current all-time high (ATH) of $4,878, recorded in

November 2021. Related Reading: Ethereum To Outperform Bitcoin In

2025? Report Predicts $8,000 ETH Price For example, recent analysis

by crypto analyst Mister Crypto suggests that ETH has likely

bottomed out and a price rally could be imminent for the smart

contract platform token. Another analyst pointed out that ETH is

completing an inverse head-and-shoulders pattern on the three-day

chart, which is considered a bullish signal for the digital asset.

However, concerns remain regarding Ethereum’s underperformance

relative to Bitcoin (BTC), with the ETH/BTC trading pair hitting

four-year lows. At press time, ETH is trading at $3,125, down 5.7%

over the past 24 hours. Featured image from Unsplash, charts from X

and Tradingview.com

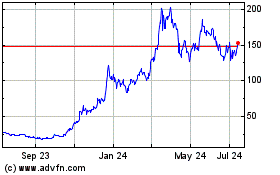

Solana (COIN:SOLUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

Solana (COIN:SOLUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025