Ethereum (ETH) Bulls Brace For Quick Drop As Charts Predict 10% Downswing

March 21 2023 - 1:28AM

NEWSBTC

Ethereum (ETH) price has shown signs of a potential downturn as it

reached an exhaustion of bullish momentum, signaling a possible

drop in the near future. According to analysts, ETH has produced a

clear sell signal, indicating a shift in the cryptocurrency’s

trend. The world’s second-largest cryptocurrency by market

capitalization has been on a bullish run for the past few weeks,

with its price surging by more than 34% in just a matter of days,

according CoinMarketCap data. The digital asset has been benefiting

from a strong market sentiment, as well as the growing interest in

decentralized finance (DeFi) and non-fungible tokens

(NFTs). However, experts are suggesting that this could be an

opportunity for long-term investors to accumulate and take

advantage of the potential dip. Related Reading: Ethereum

Unsettling Investors As Downward Price Potential Grows Ethereum

Price To Face Immediate Resistance Like Bitcoin, Ethereum has been

experiencing a bullish trend and traded above $1,800 earlier today,

although it has since fallen to $1,759 at the time of writing.

Other cryptocurrencies such as Litecoin (LTC), Dogecoin (DOGE),

Solana (SOL), and Ripple (XRP) have also seen significant gains.

ETH trying to breach multi-year resistance. Chart: TradingView

TradingView data shows the ETH/USD pair is positively biased, its

upward momentum is not as strong as Bitcoin’s. Ethereum is

currently struggling to break through the $1,800 level and may face

resistance at $1,900 if it does. Despite Ethereum’s price reaching

higher highs since March 14, the Relative Strength Index (RSI) and

Awesome Oscillator have produced lower highs, indicating a

divergence. Divergence can lead to declining momentum and a

potential reversal in price. In the context of cryptocurrency

prices, divergence refers to a situation where the price of a

particular cryptocurrency moves in a different direction than that

of a related asset or benchmark. ETH total market cap now at $214

billion on the daily chart at TradingView.com For example, if the

price of Bitcoin is rising, but the price of Ethereum is falling,

this could be considered a divergence between the two

cryptocurrencies. This phenomenon can occur due to a variety of

factors, such as differences in market sentiment, news events, or

technical factors affecting each cryptocurrency. Traders and

investors may use divergence as a signal to adjust their trading

strategies, as it can indicate a shift in market dynamics or

potential opportunities for profit. Related Reading: Bitcoin Price

Barrels Past $28,000 – Can BTC Keep Pushing This Week? Bullish

Thesis At Stake Although Ethereum’s price has been on an upward

trend, it is possible that it may experience a 10% drop and fall to

either the psychological level of $1,600 or the monthly level of

$1,677. This potential drop should be approached with caution,

as it could signal a shift in market sentiment. Specifically, if

the price drops below the $1,600 level and continues to experience

selling pressure, it could lead to the $1,422 level becoming a

resistance level and invalidate the optimistic outlook for

Ethereum. -Featured image from EthereumPrice

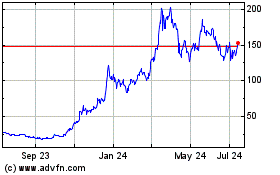

Solana (COIN:SOLUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

Solana (COIN:SOLUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025