Bitcoin ETF Inflows Jump To $235 Million – Is The Bull Market Heating Up?

October 09 2024 - 11:30PM

NEWSBTC

Bitcoin’s exchange-traded funds (ETFs) are once again generating

headlines due to an extraordinary increase in inflows. An

investment of $235.2 million in Bitcoin ETFs occurred on October 8,

indicating a substantial increase in investor appetite. This surge,

based on data from Farside Investors, follows a relatively

uneventful beginning to the month, but it indicates a resurgence in

investor confidence in the cryptocurrency market. Related Reading:

Shiba Inu Earns Recognition For Charitable Contributions – Impact

On Price Fidelity And BlackRock Lead The Way This was led by

Fidelity’s Bitcoin ETF (FBTC) with a $103.7 million inflow. iShares

Bitcoin Trust (IBIT), managed by BlackRock, received $97.9 million

of inflows. Bitwise ETF BITB and ARK Invest ETF Arkb also joined

with $13.1 million and $12.6 million respectively. The combined

trading volume of all Bitcoin ETFs steadily grew to over a cool

$1.22 billion up from just the other day. Given the erratic Bitcoin

values, the comeback in ETF inflows is especially remarkable.

Bitcoin was trading at roughly $62,485 at the time of writing,

somewhat declining from its previous high of $66,000 to show some

bearish pressure. Notwithstanding the recent price drop, the strong

demand for Bitcoin ETFs shows that institutional investors are

ready to profit from possible future increases. Bitcoin Edges

Ethereum ETFs Unlike the optimistic sentiment connected with

Bitcoin ETFs, Ethereum’s ETFs tell a different story: Ethereum

exchange-traded funds (ETFs) were on low inflows of $7.4 million on

October 6 and had no new activity on October 7. This stagnation is

quite different from the active movement within Bitcoin ETFs.

Analysts point out that this difference could point to changing

investor tastes or worries on Ethereum’s market dynamics. The lack

of inflows into Ethereum ETFs brings even more questions about

whether, at present, there is any better overall market sentiment

toward altcoins. Investor interest in Ethereum has subsided

somewhat, as indicated, though the phenomenon of Bitcoin draws

enormous volumes of institutional capital. Market Sentiment And

Future Outlook Recent increases in Bitcoin ETF inflows reflect the

direction of a larger market trend resulting from conjecture over

possible Federal Reserve rate reduction. Many investors think this

move will strengthen the market and keep prices on the ascent. If

history has anything to teach us, it is that such financial easing

usually encourages additional investment in risk assets including

cryptocurrency. Related Reading: BlackRock Declares Bitcoin The New

‘Gold Alternative’ – Here’s Why Bloomberg analyst Eric Balchunas

emphasizes that, given the excellent performances of both FBTC and

IBIT, they are going to be very important for the future of Bitcoin

ETFs. They may even touch “stud level” with over $10 billion in

assets under management. And by the end of 2024 in the fourth

quarter, this institutional interest is on the rise which may well

bring us the bull run. Ethereum’s ETFs are presently experiencing

stagnation, despite the fact that Bitcoin ETFs are experiencing a

resurgence that is characterized by significant inflows and

increased trading volumes. Investors are closely monitoring the

market as they prepare for potential changes that may result from

evolving market dynamics and changes in monetary policy. As they

jointly navigate these turbulent waters, the next few weeks will be

critical for both Bitcoin and Ethereum. Featured image from

Zerocap, chart from TradingView

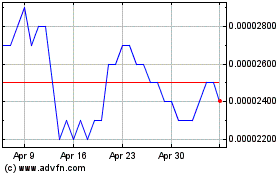

SHIBA INU (COIN:SHIBUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

SHIBA INU (COIN:SHIBUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024