PoW Tokens Take A Hit: Ravencoin and Ethereum Classic Crash Over 20%

September 23 2022 - 1:11PM

NEWSBTC

Ravencoin (RVN) and Ethereum Classic (ETC) were operated as a safe

haven for miners seeking shelter from “The Merge” fallout. The

event that completed Ethereum’s transition to Proof-of-Stake (PoS),

“The Merge” locked out miners from the ecosystem. Related Reading:

Displaced ETH Miners Seek Refuge In Ethereum Classic, Ravencoin

Leading into the event, Ravencoin, Ethereum Classic, and other

Proof-of-Work (PoW) cryptocurrencies were recording double-digit

gains. The new participants onboarding the networks drove their

hashrate to new highs, and their price followed as demand for PoW

tokens followed. However, as more miners flocked into these

networks, it became more difficult to obtain rewards. In that

sense, and with “The Merge” out of the way, miners might be seeking

new alternatives to carry on with their operations and maximize

their gains. At the time of writing, Ravecoin and Ethereum Classic

traded at $0.03 and $28, respectively. The cryptocurrencies record

a 30% loss for RVN and a 22% loss for ETC over the past week. The

tokens gave back a large portion of the gains obtained in previous

weeks. Ravencoin (RVN) And Ethereum Classic (ETC) Might Be Losing

Market Share As the price of Ravencoin and Ethereum Classic trend

to the downside, their hashrate trend lower which hinted at the

current bearish price action. Miners that were prompting the value

of these cryptocurrencies seem to be existing or diversifying their

participation across multiple networks. Data from CoinWars shows a

decrease in the hashrate for Ethereum Classic and Ravencoin. The

former has seen a steadier decline in hashrate since September

17th, two days after “The Merge”. As seen below, ETC’s hashrate

reached a high of 210 terahash/s (TH/s) and an all-time high of 220

TH/s before trending lower. Over the same period, ETC’s price

recorded massive losses, as mentioned. Ravencoin hashrate saw

sideways movement after an aggressive push to the upside. The

network saw an all-time high of 20 TH/s before starting a descend

into its current levels at around 15 TH/s. Both cryptocurrencies

might experience losses if their network’s hashrate sustains their

current momentum. Where Are Ravencoin And Ethereum Classic’s

Hashrates Fleeing? As computer power leaves Ravencoin and other PoW

cryptocurrencies, it must be finding new networks to increase the

miners’ chances of obtaining rewards. Data from Coingecko indicates

that a couple of PoW tokens have benefited from this crash in price

and hashrate from RVN and ETC. Related Reading: Ravencoin (RVN)

Records 90% Increase, Community Warns About Price Speculation The

best-performing token seems to be CLO from Callisto Network. This

project has seen a surge in trading volume and hashrate that has

supported a 30% rally over the past 7 days. In the coming months,

traders might benefit from frontrunning these spikes and crashes in

PoW tokens hashrate. #CallistoNetwork is the most profitable

#ETHASH coin on Whattomine ⛏ Network #hashrate and trading volumes

are growing, don’t wait and start mining $CLO now! P.S. ZPoW is

coming, so make sure you aren’t late 😏 ➡️ https://t.co/Wj0zgNANzu

pic.twitter.com/hIs6jqNBtI — Callisto Network Official

(@CallistoSupport) September 22, 2022

Ravencoin (COIN:RVNUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

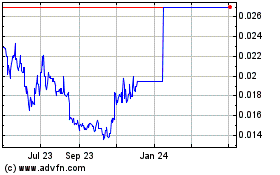

Ravencoin (COIN:RVNUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024

Real-Time news about Ravencoin (Cryptocurrency): 0 recent articles

More Ravencoin News Articles