Ethereum Shanghai Update Gives Native Tokens A Boost In Price

March 29 2023 - 2:00PM

NEWSBTC

After several postponements, a date has finally been set for the

Ethereum Shanghai upgrade, which will allow for the withdrawal of

staked ETH on several platforms. According to the Ethereum

Foundation’s latest note, the Shanghai upgrade is set to be

activated by 6:30 pm UTC on April 12, 2023. This latest update on

the Shanghai upgrade has given native tokens of staking projects

such as Lido DAO (LDO), Frax Shares (FXS), and Rocket Pool (RPL) a

bullish momentum. Over the past 24 hours, these tokens have surged

by over 10%, respectively. LDO, FXS, And RPL Surge More Than 10%

Though the majority of altcoins in the market have since been in an

upward trend after the dip yesterday, the latest rally from LDO,

FXS, and RPL seems to be attributed to the latest date set for the

Shanghai launch. Related Reading: LDO Leads Top

Cryptocurrencies, Rises 20% In The Last Day In the past 24 hours,

these tokens have surged even more than Ethereum itself which has

only moved 4.1% over the same period. Lido’s LDO has seen the

second-largest gain among these listed native tokens for staking

projects. Over the past 24 hours, LDO has made a significant move

up by 12.8%. The token has risen from a low of $2.05 seen on March

28 to trade as high as $2.49 as of today. LDO’s daily trading

volume has also surged over the same period, indicating increasing

buying pressure as the Shanghai launch draws near. Emerging as the

highest gainer among the listed tokens, Frax’s FXS has surged by

more than 18% in the last 24 hours. The token has moved from a low

of $7.42 seen yesterday to trade just below $9 at the time of

writing. Despite the token low recognition compared to LDO among

the crypto community, FXS has an all-time high value of $42.80.

However, just like several altcoins in the market, the token is

currently down 79% from its peak. Rocket Pool’s RPL has the lowest

gain among the listed tokens. At the time of writing, RPL is up

around 10% and the token has spiked from a low of $40 to $45.53. As

opposed to the majority of crypto in the market, RPL is only down

29% from its high of $59.46, seen in November 2021. A Run Down On

Ethereum Native Tokens Staking projects such as Lido, Frax Shares,

and Rocket Pool entered the spotlight when Ethereum transitioned

into a proof-of-stake (PoS) mechanism. Basically, the transition

caused a drastic change in the way in which Ethereum is being

mined. To be a miner or validator on the Ethereum network, one will

have to deposit or stake a total of or more than 32 ETH, while that

figure happens to be a large amount when converted to real word

currency such as the united states dollar, not everyone could

afford that. Related Reading: Ethereum Staking Provider Lido

Finance (LDO) Climbs 10%, Is It Too Late To Get In? As a result,

many turned to liquid staking projects like Lido Finance which

allows for the contribution to be a staking validator on the

Ethereum network without the need to deposit the required 32 ETH.

Platforms such as Lido Finance, Frax Shares, and Rocket Pool give

users the opportunity to stake lesser than 32 ETH and earn a yield

on it. In exchange for the staked ETH, the user receives a

staked version of ETH such as Lido’s stETH and Frax’s frxETH, which

is like a receipt of their staked ETH. Featured image from

Unsplash, Chart from TradingView

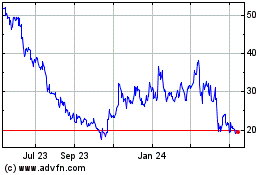

Rocket Pool (COIN:RPLUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

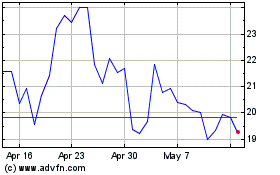

Rocket Pool (COIN:RPLUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024