Bitcoin MVRV Hits Levels That Lead To Parabolic Bull Run In 2020

February 29 2024 - 8:00AM

NEWSBTC

On-chain data shows the Bitcoin MVRV ratio is currently at the same

high levels as those that led to the parabolic bull run back in

2020. Bitcoin MVRV Ratio Has Shot Up As Latest Rally Has Occurred

As pointed out by CryptoQuant founder and CEO Ki Young Ju in a post

on X, the MVRV ratio has just hit a value of 2.5. The “Market Value

to Realized Value (MVRV) ratio” is a popular on-chain indicator

that keeps track of the ratio between the Bitcoin market cap and

the realized cap. The “realized cap” here refers to a

capitalization model for BTC that assumes that the real value of

any token in circulation is not its current spot price (as the

market cap takes it to be), but rather the value at which the coin

was last transferred on the network. Related Reading: TRON Hits 95

Million Addresses Milestone, Will This Help Price? The previous

transaction for any coin may be considered the last time it changed

hands, which implies that the price at the time would be its

current cost basis. As such, the realized cap adds up the cost

basis of every token in circulation. This means that the realized

cap essentially keeps track of the total amount of capital that the

investors have used to purchase their Bitcoin. Since the MVRV ratio

compares the market cap (that is, the value the investors are

holding right now) against this initial investment, its value can

tell us about the amount of profit or loss the investors as a whole

are currently carrying. Now, here is a chart that shows the trend

in the Bitcoin MVRV ratio over the history of the cryptocurrency:

Looks like the value of the metric has been shooting up in recent

days | Source: @ki_young_ju on X As is visible in the graph, the

Bitcoin MVRV ratio has rapidly climbed up as the asset’s price has

gone through its latest rally. In this surge, the metric has

managed to exceed the 2.5 level. When the ratio is greater than 1,

it means that the market cap is higher than the realized cap right

now, and thus, the overall market is holding its coins at some

profit. A value of 2.5 implies the average wallet is currently

carrying gains of 150%. Related Reading: Cardano (ADA) Among Only

Coins Seeing Loss-Taking: What It Means “In Nov 2020, MVRV was 2.5

at $18K, preceding the all-time high and parabolic bull run,”

explains Ju. Back in that bull run, the peak of the first half of

2021 wasn’t hit until the MVRV ratio crossed the 3.7 mark, just

like the two bull runs preceding it. The top in November 2021,

however, didn’t follow this pattern, as it formed close to the 3.0

level. It now remains to be seen which path Bitcoin would take in

its current rally, if it is at all similar to either of these. BTC

Price Following Bitcoin’s impressive 22% rally over the past week,

the asset’s price is now trading around the $62,800 level, not very

far from setting a new all-time high now. The price of the asset

has gone through rapid growth over the past few days | Source:

BTCUSD on TradingView Featured image from Kanchanara on

Unsplash.com, CryptoQuant.com, chart from TradingView.com

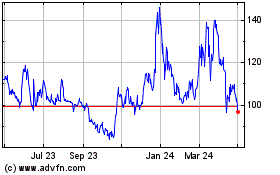

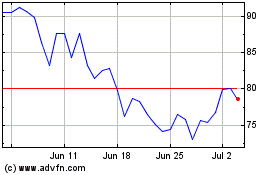

Quant (COIN:QNTUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Quant (COIN:QNTUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024