Polygon Soars 13% In Last 7 Days As MATIC Bulls Work To Hit New Highs

November 09 2022 - 2:01AM

NEWSBTC

Polygon (MATIC) has been on an upward trend since it broke out of a

rising wedge pattern last week. Across all time frames examined by

CoinGecko, MATIC has been on the rise, with the monthly time frame

revealing the most increase (41.9%). The crypto has been able to

mount a decent rally, climbing 13% in the last seven days. But,

there’s a lot of higher ground to cover. The token’s current

trading price of $1.05 which is below its opening price of

$1.30, indicates that it was strongly rejected at that level. Since

the MATIC token’s Stoch RSI values have recently been trending down

from the overbought side, this poses a substantial risk to bulls.

Will MATIC be able to maintain its stability or will it eventually

fail? Related Reading: Tron Transaction Volume Balloons To 5.3

Million In Q3, But There’s Still Doubts Ahead Large Correction

Forms For Polygon After starting its climb in late October, the

token is currently in its correction stage after a protracted wick

rejection on the $1.3075 price level. While the Stoch RSI values

are falling, the CMF index is trending higher, giving the bulls a

boost. Rallies like the one MATIC is in are, however, susceptible

to corrections, which often occur after the asset achieves a

rejection. Lower time frames, however, show that MATIC is

stabilizing above the $1.1241 support level. The bull-bear strength

indicator is currently on the bears’ side and is in direct

opposition to the CMF indicator. If MATIC breaches the range of

support at $1.1241, the bulls can stabilize the price around

$0.9367, which still supports MATIC’s path to further highs. As

Polygon becomes increasingly connected with traditional financial

institutions, investors and traders should monitor macroeconomic

developments. Related Reading: SushiSwap Suffers Monthly Drop In

TVL – How Will SUSHI Perform This November? MATIC Performance On

The Crosshair As MATIC reaches new heights and its engagement in

the traditional financial sector becomes more obvious, its

performance in the next days will reflect this development. As

institutions look to Polygon as a gateway to Web3 and DeFi, the

stabilization of the token above the 23.60 Fib retracement line

could be a stimulus for further rally. This could be the beginning

of a new age for Polygon, as the increased institutional interest

in Web3 technology and DeFi will bring in new investors and

traders. But for the time being, MATIC investors and traders should

prepare for the continuing corrective period and avoid becoming

greedy, as this could result in another market decline. This price

fluctuation also disrupted MATIC’s link with Bitcoin, which is

excellent news given that BTC is trading at a loss. We should

anticipate more highs and lows for MATIC in the coming days. MATIC

total market cap at $8.5 billion on the daily chart | Featured

image from Blockchain News, Chart: TradingView.com

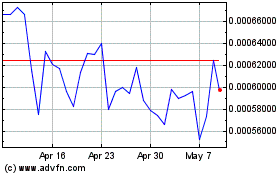

OMI Token (COIN:OMIUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

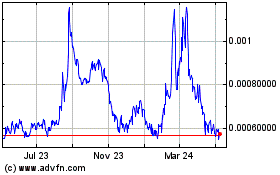

OMI Token (COIN:OMIUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024

Real-Time news about OMI Token (Cryptocurrency): 0 recent articles

More ECOMI News Articles