LUNC Price Records 440% Profit In 30 Days, Worst Time To Short?

September 08 2022 - 1:25PM

NEWSBTC

Coming back from the crypto underworld, the LUNC price has

experienced a massive bull-run over the past 30 days. The native

token for the Terra Classic network, LUNC has been the subject of a

lot of controversy as it lost over 99% of its value in a single

year. Related Reading: Bitcoin Price Trades Below $19,500 While

Chainlink Surpasses The $7 Mark At the time of writing, LUNC price

trades at $0.0005 with a 23% profit in the last 24 hours and a 140%

profit over the past week. Data from Coingecko records a total of

over 400% profits in two weeks alone, but is this price action

sustainable? LUNC Price Shorts Pile In, Will They Get Rekt? As LUNC

price trends to the upside, the funding rates across the

derivatives sector turned negative. This metric indicates the

number of traders taking longs or shorts and the percentage that a

side pays the others. If funding rates are negative, most market

participants are short or betting on the price to crash, the

opposite is true when funding rates are positive. According to a

pseudonym user, the funding rates for the LUNC/USDT pair reached

-0.48% at some point during today’s trading session. In other

words, short positions piled up on LUNC price bullish momentum. As

a result, these positions could be liquidated if the cryptocurrency

continues to trade to the upside and fuel the bull run much

further. In the past 12 hours, the LUNC/USDT trading has

experienced a spike in Open Interest (OI). Data from the OI Bot

claims the cryptocurrency saw an increase of around 30% on this

metric with positions adding millions of dollars in a short span of

time. Huge Open interest variation spotted on : $LUNC OI increased

by 16.63% these last 5 minutes! More than 2,939,702$ added.⬆️⬆️ —

OIB – Crypto Open Interest Variations Bot (@OIAlertBot) September

8, 2022 What’s Behind The LUNC Price Rally? The LUNC price

action has been supported by a new community proposal to implement

a burn mechanism for the cryptocurrency. The proposal was submitted

on late July 2022 and approved a few weeks later. Some people seem

to be betting on LUNC making a comeback based on this new mechanism

that will “Burn” 1.2% of the cryptocurrency’s supply while

re-enabling the staking mechanism. The proposal claims: The Terra

v1 governance community (which includes validators) must decide the

appropriate trusted distribution path for the code for these two

proposals. This proposes the following code, the following

distribution path, as well as a preventative security measure.

Related Reading: Terra Classic Jumps Double-Digits, Is It Time To

Buy? Time will tell if the burning mechanism will be enough to

drive LUNC price back to its former glory or if this rally will be

short-lived before the cryptocurrency returns to its former lows.

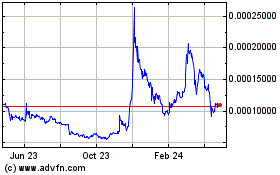

Terra Luna Classic (COIN:LUNCUSD)

Historical Stock Chart

From Aug 2024 to Sep 2024

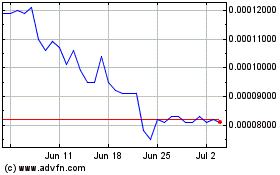

Terra Luna Classic (COIN:LUNCUSD)

Historical Stock Chart

From Sep 2023 to Sep 2024