Chainlink Signals Deeper Losses: Can Bulls Stage A Comeback?

September 18 2024 - 9:30AM

NEWSBTC

Chainlink is facing increasing bearish pressure as its price

continues to edge lower, signalling a potential move toward the

further downside. After a period of consolidation, the bears

have regained control, pushing Chainlink closer toward the $9.28

support level. However, bulls may not be ready to give up

just yet. With market sentiment fluctuating, the possibility of a

bullish comeback looms on the horizon. By examining key technical

indicators and market sentiment, we seek to determine if LINK is

poised for a deeper decline or if bullish forces could reverse the

current trend and drive the price upward. At the time of writing,

Chainlink was trading around $10.59, marking a 0.10% decline over

the past day. The cryptocurrency’s market capitalization stood at

approximately $6.4 billion, while trading volume exceeded $206

million, showing increases of 0.10% and 15.36%, respectively.

Current Market Sentiment: Bearish Pressure Mounts On Chainlink On

the 4-hour chart, following a successful drop below the $11 mark,

LINK has continued to experience negative momentum, dropping toward

the 100-day Simple Moving Average (SMA). As the cryptocurrency

approaches the 100-day SMA, it could either find temporary support

or risk further declines if the bearish momentum continues to

intensify. Also, the Relative Strength Index (RSI) on the 4-hour

chart, has dropped below the 50% threshold, now sitting at 42%.

With the RSI attempting to move deeper into the oversold territory,

it shows that bears are gaining control, and an extended decrease

could be on the horizon if buying interest does not pick up soon.

Related Reading: Is Chainlink (LINK) $12 Breakout Imminent? Data

Reveals A Rising Open Interest On the daily chart, Chainlink is

currently making a bearish movement, toward the $7.14 trading below

the 100-day Simple Moving Average. This movement underscores strong

selling pressure and negative market sentiment, signaling a

heightened risk of further losses. Lastly, the 1-day RSI reflects

increasing pessimistic pressure on LINK, as the indicator has

fallen to 47% after briefly crossing above the 50% threshold. This

drop highlights mounting selling activity and signals a stronger

potential for additional downward movement. Will LINK See A

Recovery Or Further Decline? As the cryptocurrency approaches the

$9.28 support level, which could spark a potential rebound,

technical indicators like the RSI still point to strong selling

pressure. If LINK fails to hold this level, a break below could

result in persistent declines, potentially testing the $7.14

support level and even lower thresholds. Related Reading: Chainlink

(LINK) Could Drop To $8 If It Loses Current Support: On-Chain Data

Reveals However, should Chainlink manage to hold above this crucial

support level, it could set the stage for a potential upward move

toward the $11.10 resistance. A successful breakout through this

resistance could ignite a significant rally, paving the way for the

price to aim for the next key resistance at $12.44. If bullish

momentum continues to build, Chainlink may even reach higher

levels, extending the rally beyond current resistance points.

Featured image from Medium, chart from Tradingview.com

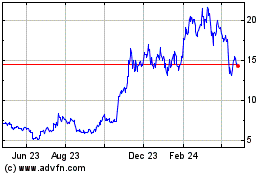

ChainLink Token (COIN:LINKUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

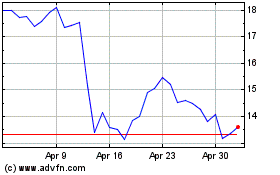

ChainLink Token (COIN:LINKUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024