6,400 Ethereum Mystery Move Sparks ETH Rally Talk Pre-ETF Nod

July 12 2024 - 1:30PM

NEWSBTC

As more and more investors choose to keep their Ethereum assets

frozen rather than actively selling them, the Ethereum ecosystem

suddenly finds itself severely short of supplies. The

second-largest cryptocurrency in the world could face serious

challenges going forward depending on the planned behavior of

market players. Related Reading: Analyst Upbeat On USTC, Sees Price

Soaring Over 300% Ethereum Supply Tightens Up The first sign of

this supply gap came earlier this month when an unknown market

player moved a staggering 6,400 Ethereum to the Beacon Chain

depositor wallet. The Beacon Chain, which checks recently added

blocks to the network, is the basis of Ethereum 2.0 This big action

suggests that investors might be inclined to lock down their ETH

holdings instead of aggressive trading. 🚨 6,400 #ETH (20,015,930

USD) transferred from unknown wallet to Beacon

Depositorhttps://t.co/wrOSlw2LaR — Whale Alert (@whale_alert) July

11, 2024 According to cryptocurrency analysts, this is a blatant

sign that a lot of Ethereum users are optimistic about the

network’s long-term prospects. They are effectively removing a

sizeable chunk of the ETH supply from the market by locking up

their coins on the Beacon Chain, which might have a big impact on

the asset’s price dynamics. Following this trend, Glassnode data

shows that Ethereum 2.0 fresh deposits have recently grown. Key to

the next Ethereum 2.0 update, this measure monitors the number of

users staking at least 32 ETH to participate in the rewards system

on the network. The rising staking activity suggests that the

community is rather optimistic about the future of the Ethereum

ETF, which is fast approaching. Bullish Momentum Surge Ahead An

examination of Ethereum’s exchange inflow and outflow data provides

even more evidence in favor of the bullish story. Santiment claims

that the network’s exchange outflow has been greater than its

influx, which suggests a lessening of sell-side pressure. When ETH

is being taken from exchanges more than being deposited, buyers are

certainly in power. Together with the rising amount of locked-up

coins, this dynamic could provide the perfect environment for an

ETH price surge . Related Reading: $36 On The Crosshair: Injective

(INJ) Captures Analyst’s Attention The report also predicts that

Ethereum would be set to surpass Bitcoin in the fourth quarter of

2024, per normal altcoin market cycle pattern. This prediction

acquires further weight from the Bulls and Bears indicator from

IntoTheBlock, which now shows bullish against bearish dominance for

Ether. Market expert Benjamin Cowen believes Ethereum could reach

$3,300 in the next weeks or months and might possibly hit $3,500

should buying demand overcome selling pressure. Featured image from

Pexels, chart from TradingView

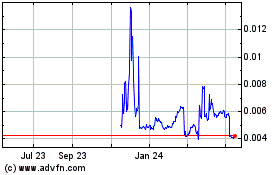

Four (COIN:FOURRUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

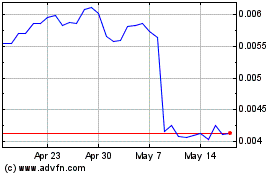

Four (COIN:FOURRUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024