36% Explosion! ENS Coin Steals The Spotlight In The Crypto Market

July 02 2024 - 11:30AM

NEWSBTC

The ENS token (Ethereum Name Service) has recently taken center

stage in the crypto community, sustaining a 36% rise in in the last

week. This steady surge has sparked widespread interest, with some

analysts predicting a prolonged bullish trend, while others advise

caution. Related Reading: Dogwifhat (WIF) Jumps 21% As Analysts See

$4.5 Price Tag ENS: Price Explosion & Renewed Investor Interest

ENS, the native token of the Ethereum Name Service, which

translates human-readable domain names into machine-readable wallet

addresses, surged by over 2% in the past day. This propelled the

token as one of the highest gainers today. ENS briefly surpassed

the $33 mark. It is currently trading at $31.89, data from

Coingecko shows. This excitement wasn’t limited to spot markets;

the derivatives sector also saw a ripple effect. Open interest,

which reflects the total value of outstanding futures contracts,

reached record highs exceeding $160 million, suggesting a dramatic

increase in investor participation and speculation around ENS.

Furthermore, the funding rate, which indicates the cost of holding

futures contracts, shifted from negative to positive territory.

This transition points to rising demand for long positions, where

investors bet on the price increasing. A positive funding rate

indicates a growing pool of optimistic traders expecting further

price hikes for ENS. Technical Analysis: Bullish Signals Daily

technical analysis of ENS reveals a recent price rally following a

period of mixed trends. The most significant development occurred

on June 30th, with a substantial price jump pushing the token to

$33.21. This bullish momentum has continued, with the RSI (Relative

Strength Index) hovering near 70, indicating a strong uptrend.

While a high RSI can suggest potential overbought conditions, it

also reflects significant buying pressure. However, some analysts

caution against interpreting this short-term rally as a guaranteed

path to sustained growth. The cryptocurrency market is notoriously

volatile, and historical price movements don’t necessarily predict

future performance. Related Reading: Ethereum Suffers 3rd Straight

Weekly Outflows, Becomes 2024’s Worst Performer Long-Term Prospects

& Potential Risks Several factors could be contributing to the

recent surge in price and activity. The upcoming ENSv2 upgrade,

which aims to improve efficiency and scalability, might be fueling

investor excitement. Additionally, the growing adoption of

decentralized applications (dApps) within the Ethereum ecosystem

could be driving demand for user-friendly domain names facilitated

by ENS. Despite the current optimism, potential risks remain. The

overall health of the cryptocurrency market can significantly

impact individual tokens like ENS. A broader market correction

could lead to a pullback in ENS price. Additionally, the success of

ENS depends on the continued adoption and growth of the Ethereum

network and the dApps built upon it. Featured image from SpaceRef,

chart from TradingView

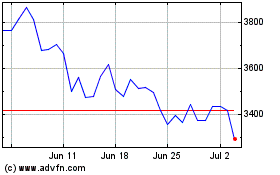

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Jun 2024 to Jul 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Jul 2023 to Jul 2024