Bitcoin (BTC) has been clinging to the 200-day

simple moving average ($84,359), which suggests that the bulls have

kept up the pressure. That improves the prospects of an upside

breakout, signaling the corrective phase may be ending.

Derive founder Nick Forster told Cointelegraph that the current

pullback is a normal correction that Bitcoin experiences during

long-term rallies. He anticipates that Bitcoin’s cycle

peak is yet to come.

A positive sign in favor of bulls is that the US spot Bitcoin

exchange-traded funds (ETFs) have again started to

witness inflows. According to Farside Investors

data, spot

Bitcoin ETFs have recorded $525 million in inflows since March

14.

Crypto market data daily view. Source:

Coin360

However, not everyone is bullish on Bitcoin. CryptoQuant founder

and CEO Ki Young Ju said in a post on X that Bitcoin could remain

in a bearish or sideways trend for the next 6-12 months as the

bull cycle is

over.

Could Bitcoin break out of the 200-day SMA, triggering a rally

in altcoins? Let’s analyze the charts of the top 10

cryptocurrencies to find out.

Bitcoin price analysis

Bitcoin is facing selling at the 200-day SMA, but the bulls have

not given up much ground. That suggests the bulls are not dumping

their positions as they expect a breakout in the near term.

BTC/USDT daily chart. Source:

Cointelegraph/TradingView

The bullish momentum is expected to pick up on a break and close

above the 20-day exponential moving average ($85,441). The BTC/USDT

pair could then climb to the 50-day SMA ($91,904).

This optimistic view will be negated in the near term if the

price turns down sharply from the 20-day EMA and breaks below

$80,000. The pair may then tumble to $76,606. Buyers are expected

to defend the $76,606 to $73,777 zone with all their might.

Ether price analysis

The narrow range trading in Ether (ETH) resolved to the

upside on March 19, indicating that the bulls have overpowered the

bears.

ETH/USDT daily chart. Source:

Cointelegraph/TradingView

Sellers will try to halt the relief rally at the breakdown level

of $2,111, but if the bulls prevail, the ETH/USDT pair could ascend

to the 50-day SMA ($2,468). If this level is also crossed, the pair

could surge to $2,850.

Instead, if the price turns down sharply from $2,111, it will

signal that the bears are trying to flip the level into resistance.

The bears will gain the upper hand if they sink and maintain the

price below $1,800.

XRP price analysis

XRP (XRP) surged above the moving

averages on March 19, opening the doors for a rally to the

resistance line.

XRP/USDT daily chart. Source:

Cointelegraph/TradingView

If the price turns down from the resistance line, the XRP/USDT

pair is likely to find support at the 20-day EMA ($2.36). A bounce

off the 20-day EMA increases the likelihood of a break above the

resistance line. The pair may then climb to $3.

On the other hand, if the price turns down from the resistance

line and breaks below the moving averages, it heightens the risk of

a drop to $2. Sellers will be in control on a close below $2.

BNB price analysis

BNB (BNB) closed above the

50-day SMA ($618) on March 17, but the bulls are struggling to

sustain the higher levels.

BNB/USDT daily chart. Source:

Cointelegraph/TradingView

The pullback is expected to find support at the 20-day EMA

($602). If the price rebounds off the 20-day EMA with strength, it

will suggest a change in sentiment from selling on rallies to

buying on dips. That increases the possibility of a break above

$644. The BNB/USDT pair could then rally to $686.

Conversely, a break and close below the 20-day EMA suggests that

the bulls are booking profits. That may sink the pair to $550.

Solana price analysis

Solana (SOL) rebounded off the $120 to

$110 support zone on March 18, indicating that the bulls are

aggressively defending the zone.

SOL/USDT daily chart. Source:

Cointelegraph/TradingView

If buyers catapult the price above the 20-day EMA ($137), it

will suggest the start of a sustained recovery. The SOL/USDT pair

could rally to the 50-day SMA ($167) and, after that, to $180.

Contrarily, if the price turns down from the 20-day EMA, it will

signal that the bears remain in control. A break below the support

zone suggests the start of the next leg of the downtrend. There is

minor support at $98, but if the level breaks down, the pair could

plummet to $80.

Cardano price analysis

Cardano (ADA) has been trading between

the uptrend line and the moving averages for the past few days,

indicating indecision about the next directional move.

ADA/USDT daily chart. Source:

Cointelegraph/TradingView

The downsloping moving averages and the RSI just below the

midpoint give a slight edge to the bears. If the price turns down

from the moving averages and breaks below the uptrend line, the

ADA/USDT pair could drop to $0.58 and eventually to $0.50.

On the contrary, a break and close above the moving averages

suggests that the bulls are back in the game. The pair could ascend

to $1.02, where the bears are expected to sell aggressively.

Dogecoin price analysis

Dogecoin (DOGE) is facing selling near

the 20-day EMA ($0.18), indicating that the bears are active at

higher levels.

DOGE/USDT daily chart. Source:

Cointelegraph/TradingView

The bears will try to sink the price below the $0.14 support. If

they manage to do that, it will signal the resumption of the

downtrend. The DOGE/USDT pair could plunge to psychological support

at $0.10.

If buyers do not give up much ground from the current level, it

improves the prospects of a break above the 20-day EMA. If that

happens, the pair could climb to $0.25 and thereafter to $0.29.

Related: Fund

managers dump US stocks at record pace — Can recession fears hurt

Bitcoin?

Chainlink price analysis

Chainlink (LINK) has risen to the

20-day EMA ($14.66), but the bulls are expected to face stiff

resistance from the bears.

LINK/USDT daily chart. Source:

Cointelegraph/TradingView

If the price turns down from the 20-day EMA, the bears will

again try to sink the LINK/USDT pair below the $12 support. If they

manage to do that, the pair could descend to the crucial support at

$10.

Alternatively, a break and close above the 20-day EMA suggests

that the breakdown below the channel was a bear trap. The pair may

climb to the 50-day SMA ($17.22) and later to $19.25.

UNUS SED LEO price analysis

UNUS SED LEO (LEO) has been trading in a

tight range between $10 and $9.60 for the past few days, suggesting

that the bulls are holding on to their positions as they anticipate

a move higher.

LEO/USD daily chart. Source:

Cointelegraph/TradingView

If buyers drive and maintain the price above $10, the LEO/USD

pair will complete a bullish ascending triangle pattern. The pair

may then start an upmove toward the pattern target of $12.04.

Contrary to this assumption, if the price turns down and breaks

below $9.60, it will signal that the bulls have given up. The pair

may then drop to the uptrend line, which is again expected to

attract buyers.

Toncoin price analysis

Toncoin (TON) has been facing resistance

at the 50-day SMA ($3.56), but a positive sign is that the bulls

have not ceded ground to the bears.

TON/USDT daily chart. Source:

Cointelegraph/TradingView

That increases the likelihood of a break and close above the

50-day SMA. If that happens, the TON/USDT pair could climb to $4.50

and then to $5. Sellers are expected to mount a vigorous defense

near $5.

This positive view will be invalidated in the near term if the

price turns down and breaks below the 20-day EMA ($3.26). That will

indicate selling at higher levels. The pair may then slump to

$3.

This article does not

contain investment advice or recommendations. Every investment and

trading move involves risk, and readers should conduct their own

research when making a decision.

...

Continue reading Price analysis 3/19: BTC, ETH, XRP,

BNB, SOL, ADA, DOGE, LINK, LEO, TON

The post

Price analysis 3/19: BTC, ETH, XRP, BNB, SOL, ADA,

DOGE, LINK, LEO, TON appeared first on

CoinTelegraph.

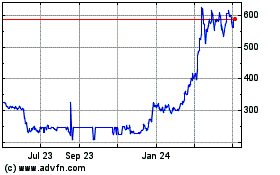

Binance Coin (COIN:BNBUSD)

Historical Stock Chart

From Mar 2025 to Apr 2025

Binance Coin (COIN:BNBUSD)

Historical Stock Chart

From Apr 2024 to Apr 2025