Worldcoin Drops 6% Amid Alameda Research 1.5 Million Token Sale, Will WLD Price Hold?

October 10 2024 - 7:00AM

NEWSBTC

Worldcoin, the crypto project co-founded by OpenAI’s CEO Sam

Altman, recently saw its token’s price drop over 6% following

Alameda Research’s continued sales. Some analysts believe WLD’s

price could continue to move sideways before recovering its bullish

momentum. Related Reading: Experts Discuss What Made Solana

Memecoins The Cycle’s Top Narrative Alameda Goes On A Worldcoin

Sell-off On-chain data analysis firm SpotOnChain revealed that

Alameda Research has sent part of its WLD holdings to crypto

exchanges for the past two months. The report shared that, since

early August, FTX’s sister company has transferred 1.56 million WLD

tokens to Binance. The firm has sent around 143,770 WLD tokens,

worth around $2.51 million, every week since August 9, selling the

tokens in 10 batches at an average price of $1.6. The news came two

days after US Bankruptcy Judge John Dorsey approved FTX’s

repayment plan. The approval allows the crypto exchange to pay

customers between $14.7 billion and $16.5 billion in recovered

crypto assets. Alameda received around $8 billion of FTX users’

misappropriated funds, allegedly used for the fund’s trading

operations. Some suggest that the sell-off is linked to FTX’s

repayment plan, which is expected to start soon and could signify

further selling pressure from the companies. Per SpotOnChain’s

report, Alameda’s wallet holds 23.44 million WLD tokens worth

around $43 million. At its current selling rate, it could take over

three years to completely unload Alameda’s Worldcoin holdings.

Additionally, other altcoins could face selling pressure from the

company. The wallet holds $98.8 million in other cryptocurrencies,

including 100.9 million Stargate Finance (STG), 1.78 million Mantle

(MNT), and 98.86 million BitDAO (BIT), now MNT. The company’s BIT

holdings, valued at $68 million, could start being sold in

November, as the 3-year no-sale commitment with BitDAO ends. WLD

Price Reacts To The News Following the sell-off report, Worldcoin

saw a 6% dip in the daily timeframe. The token’s price dropped from

the $1.98 mark to the $1.77 support zone in the last 24 hours,

representing a 4.5% decline in WLD’s biweekly performance. The

cryptocurrency registered a remarkable 31% weekly surge in late

September after Worldcoin announced its expansion to three new

countries. As reported by NewsBTC, the crypto project revealed it

was bringing its World ID services to Guatemala, Poland, and

Malaysia. The news, alongside the crypto market’s recovery,

propelled the token’s price above the $2 mark, which was

momentarily held. Since then, the token has struggled to reclaim

the key support zone, hovering between $1.58-$2.03 levels for the

past week. Related Reading: Bitcoin Whales Are Going Through A

‘Generational’ Shift, CryptoQuant CEO Reveals Crypto analyst Yuiry

from BikoTrading noted that WLD’s price retested the $1.5 crucial

level after October 1’s drop, bouncing around 33% from this level.

As the token continues trying to retest the $2 resistance level,

the analyst expects it to move within its new $1.8-1.98 range for a

few days before breaking above it. As of this writing, WLD is

trading at $1.8, an 8.7% and 27.4% increase in the weekly and

monthly timeframes. Featured Image from Unsplash.com, Chart from

TradingView.com

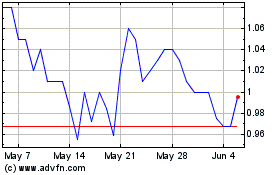

BitDAO (COIN:BITUSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

BitDAO (COIN:BITUSD)

Historical Stock Chart

From Mar 2024 to Mar 2025